Great webinar today Matt and thanks for having me!

- I do trade different sizes for different trades.

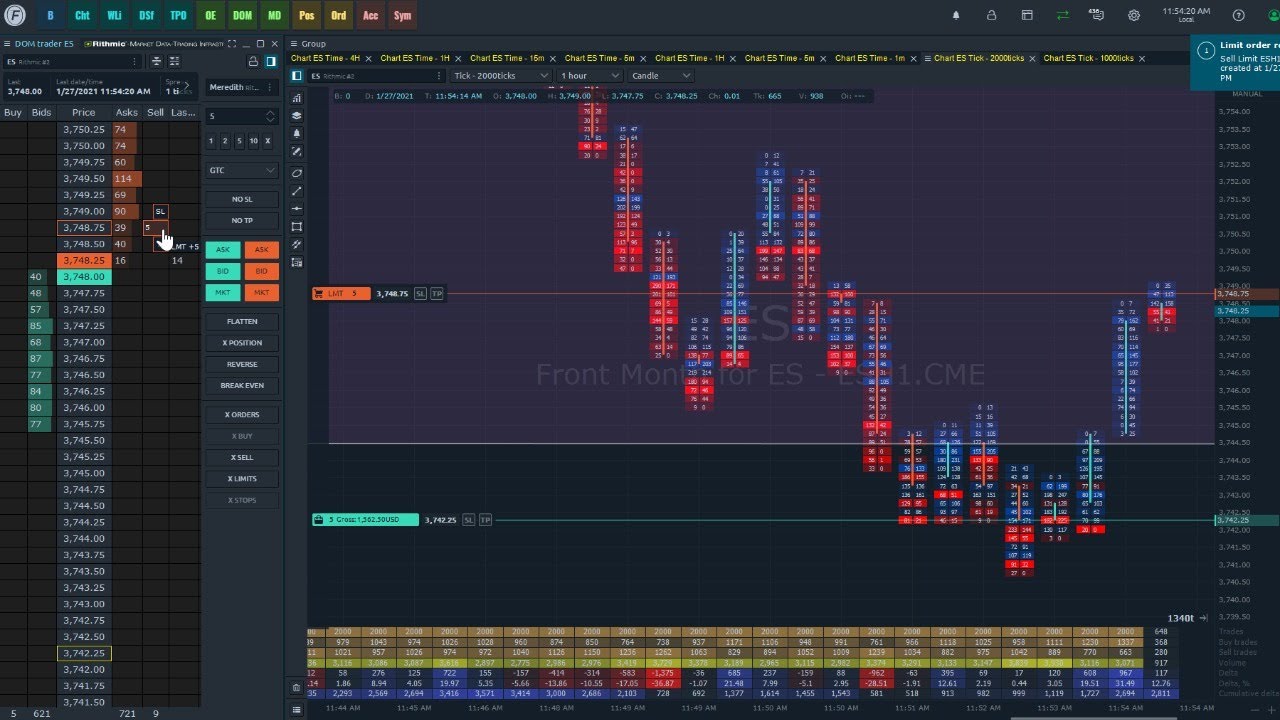

- If the market is trading in a range and I’m getting short, sometimes I’ll scale into the trade if my entry isn’t precise and scalp around that if possible to make up for lost ticks.

- In general I have a click set to “x” lots and I will only click 3 times for a position in either direction.

This helps with a few things, let’s say it’s even micro lots. When you’re not trading you are not participating, which is much needed throughout the session. But when you get into a trade, even a micro lot, your mentality changes and you see different things and pay attention to “managing the trade”.

Furthermore, if you have the flexibility to scale in vs a trader who only has a 1 lot and one click, it could drastically change the outcome of the trade and mentality on the trader.

Example: Two traders want to get long at 3820. They both buy at that price, the non scaling trader buys his only lot. The scaling trader buys 5 micro lots, so half of a 1 lot. The price goes down to a solid support range, but it’s already down to 3818. The single lot trader is down a full two points, $100.

The scaling trader is only down $50, but now he sees support is holding and decides to add his other 5 micros. Now his average price is 3819 while the 1 lot trader is still long at 3820. Price only has to go up half for the scaling trader to break even but a full two points for the 1 lot trader.

To make matters worse, let’s say they were both right just different entries, the market eventually moves to 3830, 10 point move.

However, because price traded down so close to the support line, the 1 lot trader experienced more fear as he was risking more and let’s say he puked his position. He sees the market rally and now he is caught in the mind battle of being “right” but wrong and has a loss.

That’s just one example of the many things that can happen, but those small things built up over time can seriously affect the mindset of anyone.

- Size definitely puts more pressure on me, which to an extent is good, but when it violates your systems and rules that’s when it can turn bad.

One thing to help with this very much is ALWAYS tracking your trades and analyzing the data. MyFxBook is free and does a good job or Matt has recommended EdgeWonk for trade tracking.

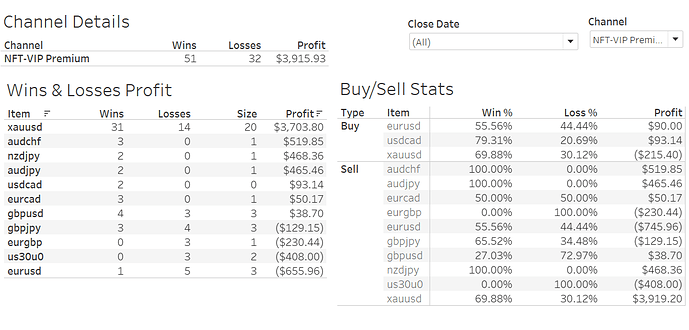

When you properly sort through your data you may come up with something like this:

Here’s sample data I took from a trade account and filtered through it in order to really dive into what trades had better odds, what made the most, the least, etc.

By always monitoring this YOUR personal track record will become a database of information that can provide invaluable information you may not be able to see on the surface.