Originally published at: https://optimusfutures.com/tradeblog/archives/futures-trading-skills/%20

The following article on 10 Futures Trading Skills You Need to Master is the opinion of Optimus Futures.

As you head on your path towards becoming a better trader, you’ll notice a subtle difference between your beginning stages and your more intermediate stages. As a beginner, you felt like there was an entire world of knowledge to discover. As an intermediate trader, you realized that a) every hill of knowledge you climbed only led to an even greater hill, and b) not all hills were worth climbing (meaning there was a lot to unlearn ).

But to cross that beginner-to-intermediate boundary, there are a number of futures trading skills that you absolutely need to master. Although this is relatively subjective territory, we’ve identified ten skills that are likely to be on your list. We’ll cover each one, starting with the most obvious.

1: Have Your Chart Reading Skills Down Pat

Unless you’re a futures investor or long-term position trader, you’ll need some serious chart reading skills. This doesn’t mean that you have to understand every single chart type, from candlesticks, point & figure, to three-line breaks and kagi charts. It also doesn’t mean you have to understand the more esoteric charting approaches like elliott wave or gann theory.

What it does mean is that you have to know:

- Which chart provides the most relevant information according to your trading style;

- Why it matches your trading style; and

- How to shift, enhance, or simplify your charts when the market situation calls for it.

As a day or swing trader, you will likely rely on your charts when making trading decisions. There are plenty of different charts, and each type shows a different aspect of the markets. Each chart type has its advantages and limitations. So, choose wisely! Example:

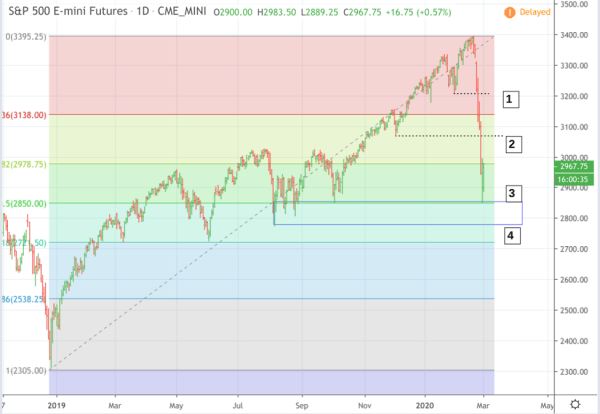

There are countless ways to interpret this chart, depending on your trading approach.

- Are you considering this price movement a bearish downtrend as it broke below its 200-day moving average [1]?

- Or are you paying attention to the longer-term trend at [2] which indicates it might be a bullish uptrend? Perhaps you are paying closer attention to the support levels at [3].

- As a swing trader, you might have noticed the bearish triple top at [4].

- Or perhaps you incorrectly speculated on the bullish diamond bottom at [5]?

There are many ways to read a chart. And for short-term traders, chart reading is a mandatory skill (particularly for day traders–it’s a day trading skill you can’t operate without). And in order to weigh one reading against another, you have to know how to view a chart from several different angles.

2: If You Can’t Read Price Action, You’re at a Major Disadvantage

Think about it: relying on lagging indicators (such as moving averages) naturally has a built-in latency that can affect your timely decision making. Predictive models, such as fibonacci projections or time series or Elliott Wave projections and others can easily be disrupted by sudden price movements that reflect real-time shifts in supply and demand.

The closest you’ll get to understanding real-time markets is the context surrounding real-time price action . Current conditions can easily change throughout the day, and such changes may affect the market in the short-, intermediate-, or long-term. The trick is assessing which one of the three is the most likely outcome. And to do that, you’ll need the ability to make forecasts that are adaptable to real-time market changes and to be able to foresee different potential outcomes that are on the horizon.

Unless you can understand what’s happening in front of you, your forecasts–based on lagging or predictive models–may be relatively useless.

Example:

The break below the swing low at [1] indicates a downtrend from a short-term perspective. The break below [2] potentially indicates a downtrend from a medium-term perspective. The bounce at [3] might have been expected considering the strong historical support. Plus, from a longer-term perspective, the price level at [4] marks a 50% Fibonacci retracement, rendering the “downtrends” mere pullbacks in the course of an uptrend. Which view is right? You won’t know until it happens. But as far as how you might adjust–you’ll need to read the price action .

Tactically, you could have traded these scenarios, such as using each level as a price target for short positions while buying call options on the 2800 strike price–that is, if you were positive that the markets would bounce from 2800. This is not trading advice, but it does illustrate one potential way in which you might have traded the move based on the short- to longer-term price indications.

3: Know How to Identify Trend Direction and Reversals

This is a lot trickier than it seems, How so? You can’t really “predict” trend continuations or reversals with any reliable degree of accuracy. However, you can anticipate them enough to adapt to multiple outcomes.

First, get past the basic errors, namely, confusing trends of different time lengths. Know which trend time frame you are trading and use at least one trend evaluation means based on real-time price data. Remember that trends can only be confirmed by looking back. But anticipating their continuations and turns must happen in real-time.

Example:

From a price action perspective, we know that an uptrend = higher highs and higher lows; a downtrend = lower lows and lower highs.

The movements [1], [2], and [3] indicate an uptrend. The break below at [4] indicates a downtrend. These principles are simple enough to follow. The tricky thing is that a trend is comprised of multiple (and sometimes conflicting) micro and macro trends.

In other words, you’ll have to decide which trends to pay attention to and which ones to ignore.

4: Risk Management is a Strategy, Not Just a (Stop Loss) Tactic

If you’ve worked in the industry for some time, you’ll have noticed that around 90% of the traders who’ve blown up their accounts used stop losses. The reason for the blowup: they didn’t use them strategically. In fact, they had no risk management strategy other than using a stop loss. That didn’t do them any good, apparently.

For instance, what use are stop losses if you keep shifting your %R (risk) from 2% to around 20% with no rhyme or reason other than to accommodate the demands of the trade?

Here’s another one: some traders place stop losses based on a dollar amount, say $200. This is because, in their initial estimate, $200 represented a certain percentage risk. That’s like 2 points on the ES. The problem is, some markets (in certain markets like the ES) can blow through that level in just seconds. So many of these traders end up taking many small losses, enough to seriously hemorrhage their accounts.

The solution here is to determine a monthly loss limit, weekly loss limit, and daily loss limit. It all has to be aligned. If you reach your loss limit in any one of those contexts, just stop trading. Period.

ALSO READ | How To Manage Stop Loss Orders More Effectively In Your Trading

The placement of contingent orders by you or broker, or trading advisor, such as a “stop-loss” or “stop-limit” order, will not necessarily limit your losses to the intended amounts, since market conditions may make it impossible to execute such orders.

5: Follow Fundamentals That Affect the Markets you Trade

If you don’t follow the fundamentals affecting the markets you trade, then you’re trading with a major strategic handicap. You’ll never know what hit you when it hits you until afterwards. Not a smart thing to do.

Here’s a perfect example of what can happen if you don’t pay attention to the fundamentals.

Since the YM had been steadily trending upward during the overnight session, you decided to buy a pullback at [1]. Of course, the reason it’s been trending up is because traders were expecting positive blowout numbers for the December jobs report at 8:30 am. As someone who doesn’t follow fundamentals, not only didn’t you know about it, you wouldn’t have understood its implications.

The numbers were a miss and you got stopped out at [2]. So, you watch the news, realize that the jobs numbers were a big miss, and you decide to join the shorts at [3]. The problem is that although the job numbers may have been bad, the Federal Reserve position was also known to be accommodative, meaning the Fed’s position outweighed any negative implications of the jobs report. So the markets turned back up only to stop you out again at [4].

In short, know your fundamentals! Technicals are tactical, but fundamentals make up a key strategic component to any trade.

6: Understand When and When Not to Trust Trading Psychology

Here it is in a nutshell, and you don’t have to go out and buy a book on this. Knowing behavioral “theory” isn’t necessary if you just follow a few principles in “practice.”

- Natural fear isn’t necessarily a bad thing; being overly optimistic and blowing up your accounts as a result is much worse.

- If you trade with an excessive amount of risk capital (meaning you haven’t thought through your money management strategy or you just can’t afford to trade), then you’ll always be obsessively fearful. Being obsessively fearful is not good.

- If you can’t trust your system no matter how hard you try, then you probably haven’t fully evaluated your system (or it’s just a bad system and intuitively you just know it ).

- If you have a solid trading strategy and sound risk management principles in play and you still can’t trade according to plan, then just quit trading –no amount of self-help advice can help you until you finally get it together and do it right.

- Don’t use “psychology” as an excuse for making poor decisions or for being irresponsible. If you can’t work harder at making smarter decisions, learning from your mistakes, and taking responsibility for your actions, then Vegas is only a plane trip away.

- Good trading should feel relatively uneventful. It’s just what happens when you’re prepared with a solid strategy and risk management plan. In contrast, most forms of gambling should always be thrilling, as your odds of winning are often too slim to take seriously.

The rest of the “feel good” or “work on your trading self-esteem” stuff is just babble. What counts is your bottom line. You do, or you don’t. You learn, or you don’t. Nothing else should come in between you and the markets but knowledge, discipline, smart decisions, and careful actions.

7: Learn From Your Mistakes, Don’t Double Down on Them

Doubling down is what happens when you have a losing position and you multiply it on your way down. The goal is to break even or come out with a profit when the market turns back in your favor. It’s also called “good money chasing bad money.” If you hold a large or leveraged position, this can often result in account death. In fact, any type of doubling down can result in getting wiped out.

In contrast, a longer-term investor who “builds” a position on the way down as part of an accumulation strategy typically doesn’t “double” a position but incrementally adds to a position.

Take a look at the example below – October to December 2018, when the markets underwent a massive correction:

If a swing trader entered at [1] and kept doubling his position (literally, one contract and then two and then four, etc.) at each swing low at [2] and [3], he might have blown up long before he reached [4].

In contrast, a position trader who entered a 25% of a position at [1] and kept adding 25% all the way down to the last low of this correction would have been rewarded once the correction reversed itself, as shown in the chart below:

8: Understand Order Flow Trading

Order flow trading is a method that attempts to anticipate price movement based on the current orders that are visible on both the buy and sell side. Order flow is the mechanism that moves prices up and down. It is the balance or imbalance of buyers and sellers (bids and asks). It’s the onslaught of market sell orders that overwhelm the buy limit orders, or the market buys that overpower the limit order sellers.

Courtesy of the Optimus Flow Trading Platform.

There’s so much to understand with regard to order flow, and we’re not going to pretend that we can cover all of the basics here in this small section. Check out our order flow tutorial to get a better sense of how it works and what technologies to use to take advantage of it. If you can observe and exploit the mechanisms that move price, you potentially have an advantage over traders who can’t see it at all. And when it comes to institutional trading practices, order flow transparency is virtually required (though not always used, depending on the strategy).

9: Handle Your Platform As Skillfully As You Would a Vehicle

Imagine driving a car and not knowing where half of the controls are. Perhaps you can’t find the turn signals or the wipers. You don’t know how to engage the emergency brake, or the air conditioning or heater. Your speed gauge is in kilometers per hour and you don’t know how to switch it back to MPH. Chances are, you probably wouldn’t continue driving until you’ve figured out how to fully control your car.

As commonsensical as this may sound, many traders go live without fully understanding critical dashboard functions–say, order entry windows, DOM, or chart functions. When there’s money at stake, don’t enter the markets without fully understanding the vehicle by which you engage market risk. Contact your broker and ask for a full one-on-one technical support session. And on that note, here’s one last futures trading skill–more of a soft skill than an actual trading skill–that you should never overlook.

10: Develop a Strong Relationship With Your Broker

Your broker can help you along with your day-to-day trading concerns, whether it’s solving a problem, or finding ways to enhance your efforts. Remember, your broker wants you to succeed. The more successful you are, the more you trade. And the more you trade, the more you and your broker are able to benefit financially. It’s a win-win. Of course, it never hurts to have a broker who supports you and is willing to provide you with all of the information you need. In fact, it can help a lot. Remember, your relationship with your broker is a business relationship. Good business is built on trust and rapport. And both can be achieved only by establishing a strong and healthy relationship. Enough said.

The Bottom Line

The futures trading skills that we just discussed cover a wide range. Hopefully, you’ve picked up a few helpful insights. If you have any questions, feel free to contact us. Some of the areas we covered entail a greater degree of study. And to that, we have a whole library of articles and tutorials that might be helpful. If not, then call us and we’ll connect you to an expert who can help. That’s our job. And we’ll do our best to provide you with everything you need in order to enable you to achieve the level of trading success you envision for yourself.

Please be advised that trading futures and options involves substantial risk of loss and is not suitable for all investors. Past performance is not necessarily indicative of future results. This matter is intended as a solicitation to trade.