Hello @Icbto09,

Thank you for your question!

At this time, Optimus Flow has two built-in PNL risk management features that are exclusively native to Optimus Flow and not available on Quantower at this time.

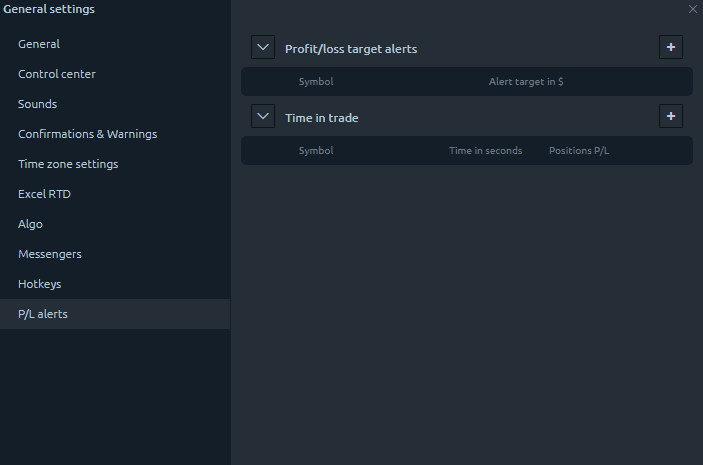

To access these features, open the general settings of the platform and navigate to the P/L Alerts tab:

As you can see we currently have two options:

- Profit/Loss Target Alerts

- Time in Trade

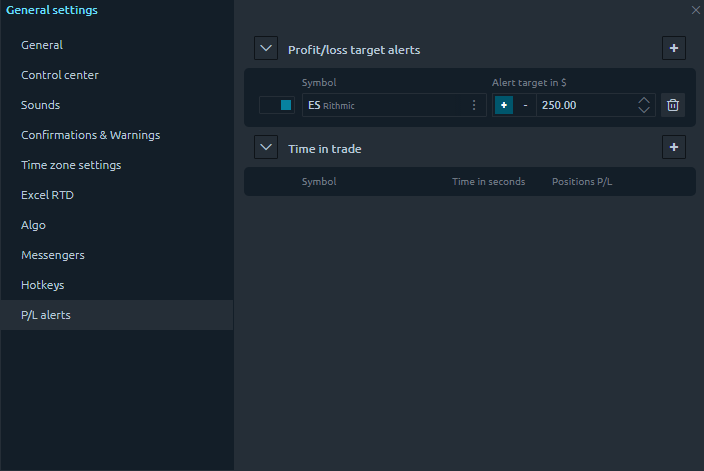

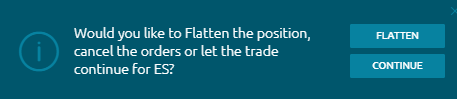

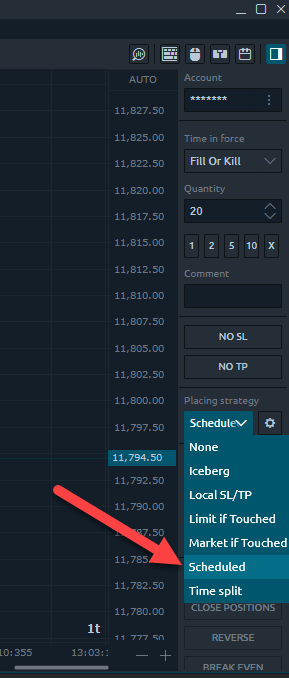

The current options found here are fairly self-explanatory. Once the configured criteria is hit, an alert will trigger within the platform giving you the option to liquidate any open positions or orders for the said product the alert is configured for. In the example below, i have an alert configured to trigger when an ES trade is +$250 in profit:

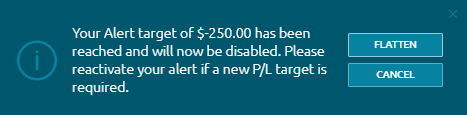

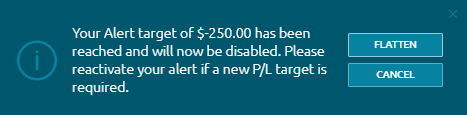

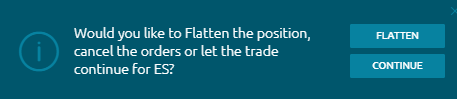

Once the criteria has been triggered, the alert is then automatically disabled and the user is prompted to flatten their current trades:

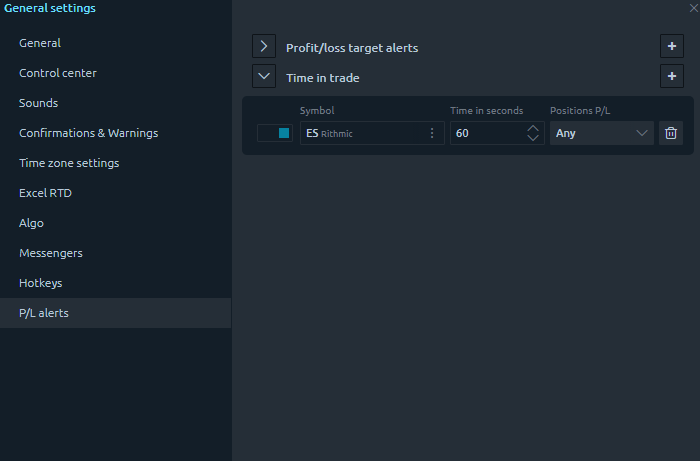

The time in trade option works similarly, but instead of being entirely based on profit or loss, this Alert is based on the time of the trade (you can also filter it to trigger based on whether or not a position is currently positive or negative):

In the example above, my trade lasted for one minute (Position P/L configured to any - so regardless of the PNL of the trade after 60 seconds was up the alert was triggered) and then the alert was triggered:

Please keep in mind these are NOT native CME orders and we strongly encourage you to stay in front of your machine while these alerts are active. Please remember that these are only alerts, liquidation does not occur UNLESS a user clicks the “flatten” button when prompted. Please remember that depending on market conditions and slippage, it is possible for the alert to trigger after the potential loss or gain is triggered. This means your losses could potentially exceed what you have set as your loss.

These are the current options we have built into the platform. On the data feed level server-side level, if a user is configured for the Optimus connect or Rithmic data feeds, these feeds also include server side loss limits that can be configured.

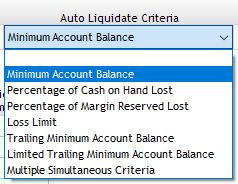

By default, on both Optimus connect and Rithmic we set all new users to a 60% cash on hand loss as auto-liquidation criteria. This means that if you are in a position and 60% of your account balance is lost in a session, your positions will be liquidated to potentially prevent your account from going below $0 and negative. For example, if you start the session with $1,000 and lose $600 throughout the same session, positions will be liquidated and orders will be canceled by Optimus connect or Rithmic to potentially prevent further losses - these are account-wide settings that would affect all open orders and positions regardless of the product being traded at the time.

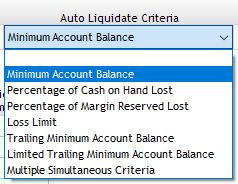

Rithmic also has the other following options as auto-liquidation criteria that a user can choose from (by default we set the percentage of cash on hand lost as mentioned above):

I hope this helps! If there is demand among our user base for a local daily loss limit that can be configured directly within Optimus Flow, similar to our PNL or time in trade alerts, we can consider implementing this at some point down the line as a new P/L alert!

Thanks again for your question,

Jake

Optimus Futures Support