Hi all,

After participating a little while on Optimus’ forum and after noticing how hard @Mod-MattZ and his team works to provide the best technology, feeds and trading infrastructure I decided to go ahead and try to post my views of the markets and share some of the trading technology products I use daily in order to discover an edge in the markets.

I just wanted to say that anything I post related to the markets is of my own opinion and biases and should NOT be construed in ANY way as financial advice nor a solicitation to buy/sell or sell short any futures or options contracts. I am a trader who makes a living at this and feel that we could all benefit from picking up a strictly trading-related dialogue and as such learn from one another.

I hope this feed grows and that a few traders could join in the conversation because with the immense market’s liquidity there are countless of opportunities daily to find potentially strong risk/reward trades and providing one has a strong day-to-day semi mechanical approach I personally believe that Trading for a Living is a craft and an art that can be mastered with enough time, practical guidance and practice.

I will just start by creating a simple

3 SECTION FORMAT:

-

VIEW OF TODAY’S MARKET CONDITION

In this section I would review the market type we are/were in;

a. CHOPPY,

b. MOMENTUM,

c. BREAKAWAY,

d. FUNDAMENTAL such as FOMC or Major News Events could override technical setupsThis analysis would lay down the foundation for selecting potentially the useful strategy/approach to trade the markets we have in front of us for the day, instead of trying to force an approach that is not

best suited for the current market’ environment. -

DAYTRADING SET-UPs

Here, I would go over the best trades I could find through the day and analyze the set-ups,

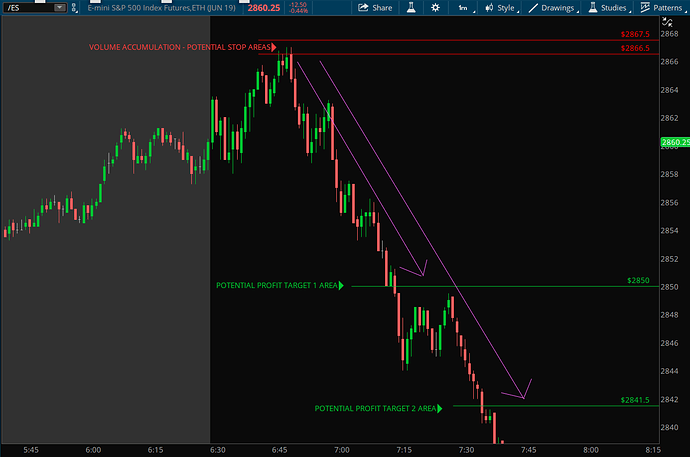

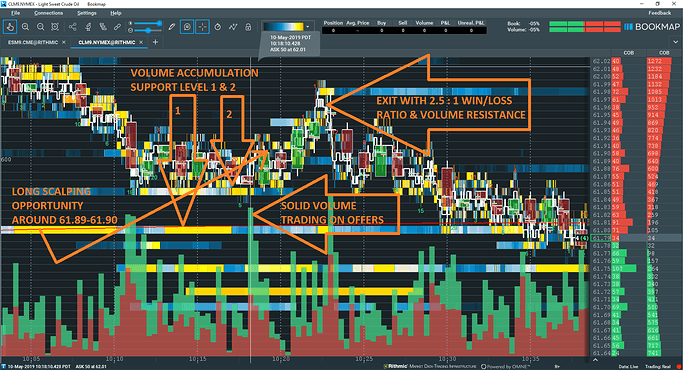

from the technical, risk/reward perspective and how they fit in with the overall market condition2.1 SHORT TERM SCALPING Setups

(3min - 30min time frames)

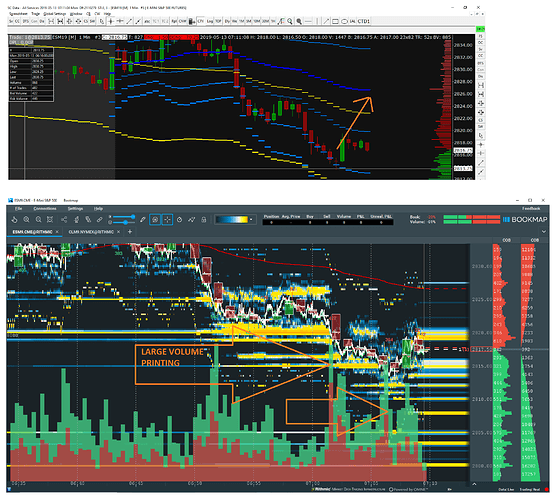

These potential trade ideas are generally suitable for traders who feel that their edge comes from being in-&-out of the markets faster and who don’t like to turn small profitable trades into loses. This comes with higher trading activity, potentially more commissions and is not suitable for every trader. I personally have started trading as a scalper in the equities markets in the mid 90’s and have since came a full circle. So I still like scalping but there is also the second very valid daytrading approach below:2.2 INTRADAY MOMENTUM Setups

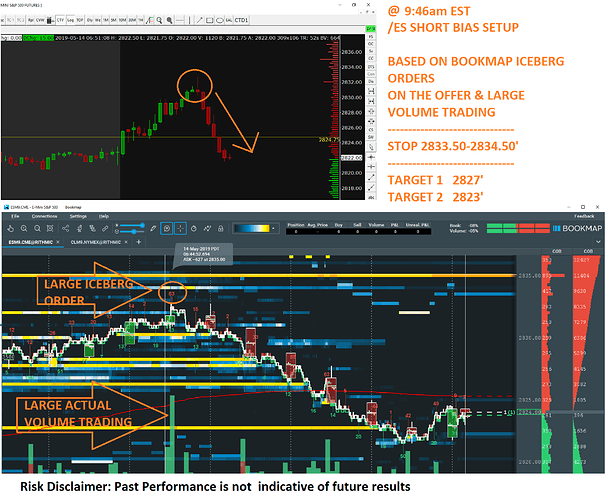

(30min - 4 Hours time frames)

With these types of trades, one must be able to more or less accurately call the day’s sentiment and be able to gauge the supply and demand forces shifts in the underlying market one is trading, being able to be patient with an entry which almost NEVER is perfect and once the trade hopefully starts working (but always staying insured by a smart protective stop loss) these type of trades could workout in trader’s favor if one is able to sit on their hands and withstand the market’s ebbs & flows on the way up or down to the trade’s targets. This my friends is one of the hardest thing to do in trading and it doesn’t get much easier even after 20 years

-

RISK MANAGEMENT & PSYCHOLOGY

Here I would share something from the psychology department, as it is so crucial to keep our head straight and keep perspective while trading and I will never stop preaching the importance of money management, risk control and all those “boring” yet crucial subjects which if embraced could save us from those costly, painful and totally avoidable mistakes.

Yes, we all make them and I personally blew up a few accounts and lost money in my career.

Yes, it hurts, but today I feel it was absolutely necessary to learn some of the most valuable lessons.

INSTRUMENTS I LIKE TRADING:

Each instrument has its own dynamics and there are differences in how they move and trade

so it pays off to learn their personalities.

The Markets I like trading and would consider analyzing and discussing are;

ES - Emini S&P500,

CL - CrudeOil Futures,

GC - Gold Futures

6E - EuroFX Futures

For technology products - I like to use:

GAIN/OEC Trader - for options execution and some futures, datafeed, IWeb access, iMobile access, DDE Excel auto-functionality for analysis and some auto-execution

SierraChart - for futures execution, charts, DOMs, VolumeProfiles, OrderFlow Analysis, Historical charts and tick data

Bookmap - for OrderFlow analysis, Volume Analysis, Visual Liquidity Pools, up-to-second Support & Resistance areas

OptimusNews - The product helps me to stay on top and be aware of any major fundamental reports coming up across any markets & currencies which at times can override and skew even the most solid technical set-up, it also allows me to understand the overall market flavor and not rely on CNBC or other busy news feeds.

I hope I can bring value to the forum and would hope to pick up a conversation with other like-minded traders. Please be patient as I am a trader first and hopefully I can figure out a format that I could share some of my insights and with time maybe come up with a beat and a format that could help other traders.

I will try to post at least 2 times a week at first and see how it goes.

Any words, comments, suggestions or feedback would be much appreciated so that I could create a format that makes sense and is helpful as I don’t need to post if it doesn’t help traders.

I am content with my trading and sharing is only a way to grow myself.

Best Regards,

- Project11

Risk Disclaimer:

Trading futures and options involves substantial risk of loss and is not suitable for all investors.

You must be aware of the risks and be willing to accept them in order to invest in the futures markets.

This post is for educational and informational purpose only and this is neither a solicitation nor an offer to buy/sell futures. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this post. You are subject to lose all or more of your original investment. Don’t trade with money you can’t afford to lose or money that, if lost, would affect your current lifestyle.

The past performance of any trading system or methodology is not necessarily indicative of future results.