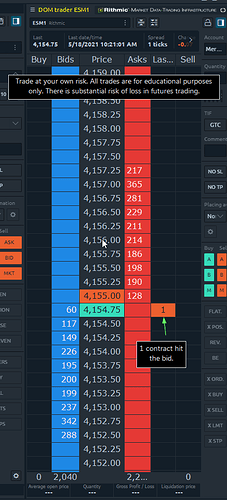

Today I was watching the market and removed the “Last Contract” column that shows the size of the last order to hit the market:

What I noticed is it forced me to just focus on the amounts bid and offered.

Normally, here is what I watch on the DOM:

- Size of bid and ask.

- How they change when price is coming closer and go away from them.

- How fast the bids and offers pile onto a new price after it is taken.

- Size of market orders trading.

- Frequency of market orders coming into the bid or offer.

- Interest in price based on the velocity of orders hitting it.

That’s a lot to take in, and I obviously don’t do any calculations in my head or crazy math. It’s just observing the market participants and their behavior.

Back to taking away the market orders.

Since the market orders are a significant factor in watching the DOM, without having it I had to watch something else. So now all my energy and focus is being put into just the bids and offers. Watching them flow back and forth and how the totals changed, even up to 3 ticks off the market, based on how close price got to them.

It almost feels like how a school of fish reacts to a whale getting his dinner. Some fish on the outer edges might not have to move at all to avoid being eaten. For other fish, it doesn’t matter how fast they try to get out of the way, they get eaten up and never thought of again.

We’ve been there, where someone pukes a huge huge order and nothing trades at the offer. Those prices (fish) are gone.

Nonetheless, it was interesting to watch and focus on something other than the market orders (whales). Instead, I was watching just the passive market participants (fish) and intently focusing on how they reacted and moved in correlation to price.

Putting the market orders back in the DOM… Now I know there’s something to be noted when looking at the bids and offers so I can remember to watch it more often.

There is a substantial risk of loss in futures trading. Past performance is not indicative of future results. The figures here represent an opinion. The placement of contingent orders by you or broker, or trading advisor, such as a “stop-loss” or “stop-limit” order, will not necessarily limit your losses to the intended amounts, since market conditions may make it impossible to execute such orders. Please conduct your own due diligence if Futures are an appropriate instrument for you.