I have been trying Rithmic datafeed in conjuction with Sierra Chart in the last two weeks.

The datafeed is very stable and I like it, in particular I noticed that there were several occasions in which my account with CTS got stucked, and I could not trade, while rithmic was always working fine.

There are however, a couple of things that I have observed and that I cannot explain.

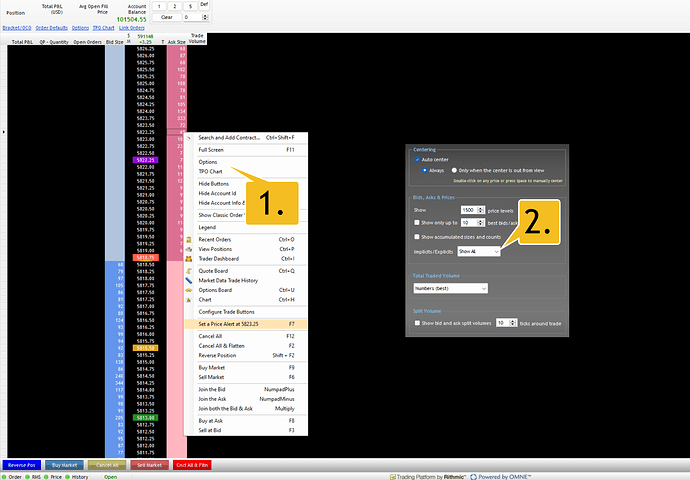

I use SierraChart’s DOM, that I customized to look like Jigsaw, the main differences are:

- stacking of bid/offer: in CTS there are many more big orders, for instance in /ES you will see many big order stackin up in offer/bid side 300 or 200 lots, while in Rithmic you will see maximum some 100 lot orders.

- Market order (inside columns in Jigsaw): it seems strange but in CTS you see many more orders that in Rithmic you just don’t see, I cannot explain this honestly.

It seems as though in Rithmic everything is “scaled down”, I guess orders are “grouped” differently.

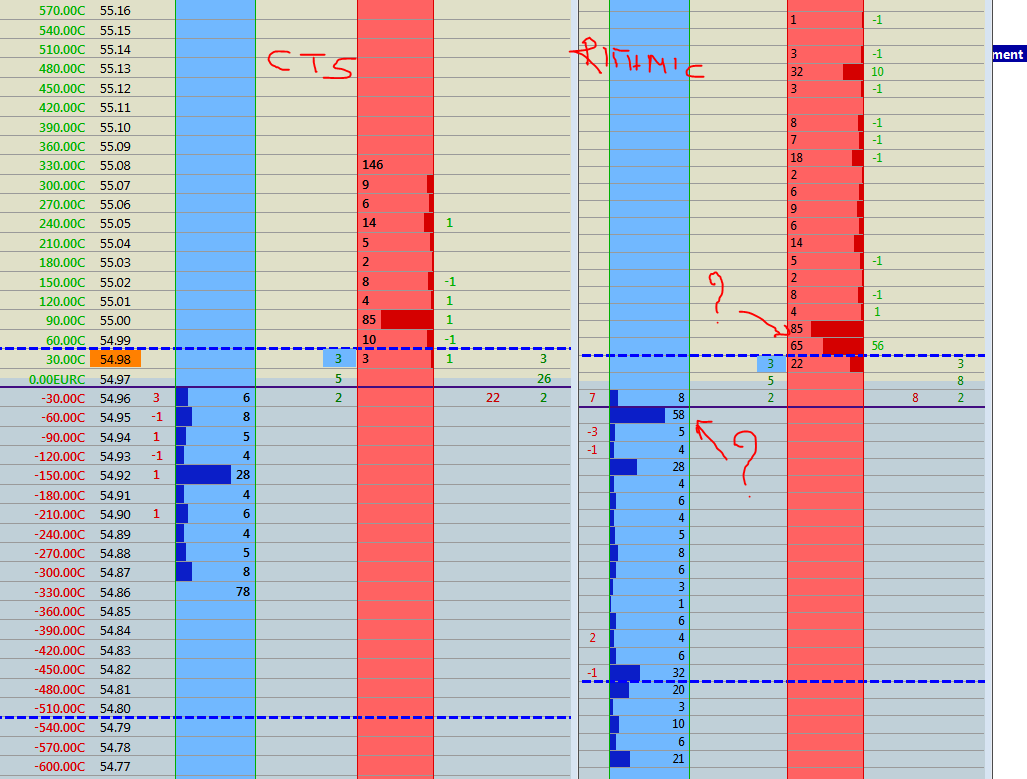

The biggest difference however is the one that I noticed on the overnight market on February 14th. At around 7pm CT, I was trading Crude (/CL) and I noticed that also the ladder was different.

This makes copletely no sense to me, since the numbers that I see on the ladder are limit order that should be on the exchange.

I send you in attachment a picture.

-red colums=offers

-blue columns=bid

-inside numbers on the left of the red column are recent buy market orders hittin the offer

-external column on the right of the red-column= stacking of sell limit order

-external colums on the left of the blue column=stacking of buy limit orders

The strange thing to me are the differences in limit orders, look above the blue line! On Rithmic there is a 65 limit order @54.99 on the offer that on CTS is absent.

At 54.95 there is a limit buy order of 58 contracts in rithmic and it does not appear on CTS.

I hope you can help me to understand this.

Best regards