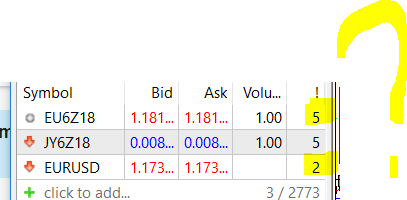

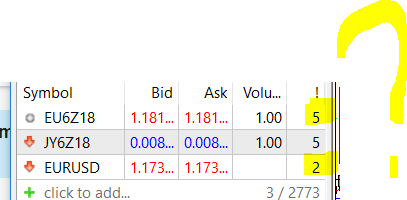

Why is the spread lower on the FX pair over the Futures?

Why is the spread lower on the FX pair over the Futures?

It looks like you have posted the same image twice, we do not see FX pair you speak of. Would you mind reuploading that image? Or did you only mean to post this image once? We need further clarification before we are able to assist you.

Thanks,

Jake

Optimus Futures Support

They are both the same image I posted twice.

It is the two yellow. EU6 is futures and EURUSD is FX.

Seems to be the case for JPY (Futures) and JPYUSD (FX). I would expect futures to be spreadless

@jubael_haque Thank you for the question.

The FX market is an OTC market where there is a specific market maker or broker that decides on the spread, etc. Since we do not know which broker you use for your cash transaction, we do not know how they regulate and provide these spreads. Further, we do not know if you place market orders what liquidity you are provided with.

The Futures contract is regulated by the exchange, where buyers and sellers are matched without the exchange or us as broker taking any side in the contract.

The spread you provided is on the large contract, which is .00005 on 125,000 EU which is $6.25

The “2” spread could be .0002 on the typical cash contract of $100 which is $20.

In this case, the Futures contract is way lower.

Thank you,

Matt Z

Optimus Futures

I see,

Thanks for clearing it up. I will discuss with AMP.

Take care Matt!

Spreads from the futures exchange are not related to the FCM itself. They are provided by the exchange.

Thanks,

Matt Z

Optimus Futures

Upon contacting some industry professional, I need to correct a few errors. MT4/MT5 indicate the last decimal of the spread, so 5 was correct as far as 6.25 spread, but it varies upon hours of the day and could be higher as well due to news announcements, surprise moves, and other announcements that may make markets less liquid.

Essentially, the figure of 2 is not .0002 rather .00002 which makes it $2 spread, not $20.

Retail customers do not get such spreads unless forex brokers tack on commissions or do deas that are in the millions. These are “ideal” demo spreads.

There could be arguments back and forth of Forex VS. Futures so you need to know what you are getting into. ECN, Non-ECN, Dealing Desk vs., Non-Dealing Desk, etc.

When you trade on the exchange you see depth, exchange regulation; buyers match with sellers, the speed of execution, etc. Each has to decide what is more critical for him/her.

Matt Z

Optimus Futures

Thanks for looking into this Matt. It could be just that. However my last broker I literally had zero spread for futures. They were a futures brokers, my data was CME, platform was CQG IC. I have never seen a single spread in any of the futures instruments and found it so strange.

You are very welcome.

Yes, indeed that is strange. Every instrument has a bid/offer and the spread depends on the liquidity of the instrument. Well, at least now you have better visibility to the spread.

Thanks,

Matt Z

Optimus Futures