Originally published at: https://optimusfutures.com/tradeblog/archives/futures-hedging-strategies/%20

This article on Futures Hedging Strategies is the opinion of Optimus Futures.

- Many experienced investors and traders use the futures market to hedge their stock portfolios against market downswings.

- Futures can give you the advantage of weathering downturns in a manner that is efficient and cost-effective.

- Hedging futures strategies are scalable, meaning you can hedge a portion to 100% of your stock market exposures.

Futures trading may be popular among active traders who want the freedom to go in and out of positions for short-term gains without having to maintain a $25,000 balance in their accounts (an SEC pattern day trading requirement).Futures trading is also a way for active traders to use leverage in the hopes of making much more with much less (it can go the other way too, losing much more with very little capital).But aside from short-term speculation, experienced investors and traders often use futures to protect their stock portfolios against sharp market downturns . As futures can be used aggressively in pursuit of profit, it can also be used for the defensive purposes of establishing a solid hedge.Futures hedging strategies are scalable. For instance, there are various futures hedging strategies that can be used to absorb the negative short-term shocks of major reports or events, such as the FOMC decision, GDP report, an unexpected geopolitical event, or a forecasted financial crisis.Although futures hedging strategies can be customized to absorb these steep yet sharp momentary disruptions, they can also be scaled to protect portfolios during longer-term declines as in the case of bear markets and recessions.

Ultimately, it is a matter of knowing how to set up an effective hedge, how much of your portfolio to protect, and when to execute your strategy.

Before we get into more detail about the “how-to’s” of constructing a futures hedging strategy, let’s take a look at a recent scenario.

The Coronavirus Crash of 2020

On January 21, you started hearing about the news of a new virus–COVID-19–that seems to be spreading somewhat rapidly in China and in other Asian countries. You come across this CDC report:

“The Centers for Disease Control and Prevention (CDC) today confirmed the first case of 2019 Novel Coronavirus (2019-nCoV) in the United States…The patient recently returned from Wuhan, China, where an outbreak of pneumonia caused by this novel coronavirus has been ongoing since December 2019.”

Another report from the World Health Organization:

“As of 20 January 2020, 282 confirmed cases of 2019-nCoV have been reported from four countries including China (278 cases), Thailand (2 cases), Japan (1 case) and the Republic of Korea (1 case)…Of the 278 confirmed cases, 51 cases are severely ill1 , 12 are in critical condition.”

By mid-February, the news of viral spread is starting to make you nervous. You cannot even begin to imagine how this might affect the US, its economy, and most importantly, your investment in the markets. Because you know well that markets hate uncertainty, you decide to prepare a futures hedging strategy just in case COVID-19 begins infecting the markets.

Your main concern is your 401(k) portfolio, which consists mainly of a single ETF, the SPDR Dow Jones Industrial Average ETF (DIA) of which you own 100 shares. For every cent the DIA moves, your entire portfolio of 100 shares moves $1.

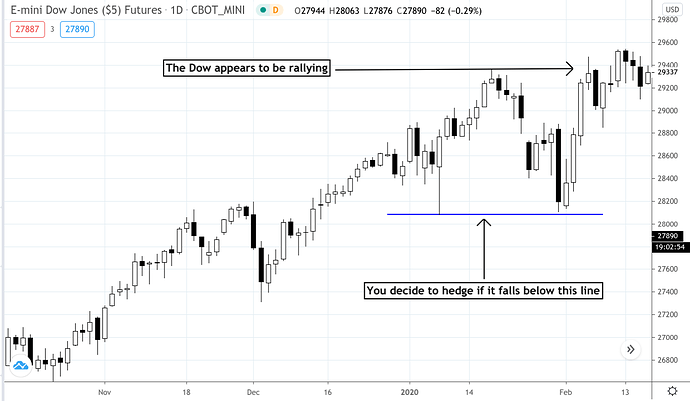

So far, the Dow appears to be rallying, no sign of worries. But if the Dow falls below the blue line, representing critical resistance, you figure its best to hedge.

So, you place a sell stop order for two contracts of the Micro E-mini Dow Jones Industrial Average Index futures (MYM), going “short” the futures to hedge your DIA exposure.

Why two contracts? For every cent that the DIA moves, your portfolio of 100 shares moves a dollar. For every equivalent “tick” the MYM moves, each contract moves $0.50 (fifty cents). So, you buy two contracts to match your DIA dollar for dollar–a 100% hedge.

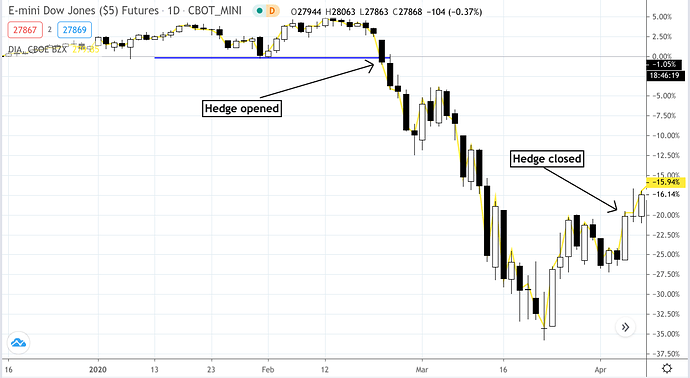

In a matter of days, the broader saw a massive crash, just as you had anticipated.

The yellow line represents the DIA (giving you an idea of how correlated both instruments are). You’re losing money on your DIA position. But for every dollar lost in your 401(k), you’re covered 100% by your futures hedge.

It’s almost like having insurance on your equities portfolio.

On April 6, you decide to lift your hedge on news that the economy might be recovering. True or not, closing out your futures position is what you decide to do.

Let’s look at the outcome for each asset class starting on February 24, when you opened your hedge at the end of the day.

On February 24, the DIA was trading at $279.56. On April 6, the DIA was down to $226.53.

- Result: your ETF was down $53.03. At one hundred shares, it had depreciated by -$5,303 .

Your “short” hedge was opened on the same day when the MYM was trading at $27,968. You closed your hedge on April 6 at the price of $22,488.

- Result: a gain of $2,740 per contract. With two contracts, your total gain was $5,480 .

The net result of your hedge: $5,480 (MYM) – $5,303 (DIA) = $177. You actually came out of your hedge with a gain (which doesn’t always happen).

Remember, your initial goal was just to hedge your DIA losses.

A simple example, the scenario above illustrates just one way to get a futures hedging strategy to work for you.

When Should You Use Futures Hedging Strategies?

If your stock portfolio is based on a long-term investment strategy, which it likely is, then you are probably most concerned with protecting its value against prolonged periods of uncertainty such as a bear market or recession.

Timing your hedge based on market turning points is similar to timing the markets: most investors can’t do it successfully , especially if you’re using fundamental analysis alone (technical analysis may give you a tactical edge, but even that is no guarantee that your timing will be right on).

So instead of attempting to time the perfect hedge, look for critical price levels. Understanding basic technical principles–like support and resistance, basic chart patterns, technically-determined trends, and oversold/overbought levels–may help you set up your hedge.

These technical approaches can be used to fine-tune your entries, even while your overarching strategy may be fundamentally-driven.

If you base your hedge on a strictly fundamental reading of the markets without any knowledge of technical analysis, you may be at greater risk of placing a hedge at the wrong price or at the wrong time (from a technical point of view).

So, brush up on your technical analysis skills, or take some time to learn the basics. If anything, it can give you more tools to use in your trading and investing approaches.

ALSO READ | Conduct a DIY Technical Trading Audit with These 10 Questions

How Do I Place a Hedge Using Futures?

First, try to figure out which futures instrument to which your portfolio is most correlated. For instance, if your portfolio is broadly diversified across all eleven market sectors, then it might be correlated with the S&P 500. If your portfolio is concentrated on tech, then check to see how correlated it might be with the Nasdaq Composite.

If you’re hedging a precious metals portfolio, or significant precious metals exposure in your overall portfolio (whether your metals consist of physical, ETF, or ETN assets) then you might want to use a combination of gold and silver futures.

Next, you’ll want to compare your dollar-per-tick value with that of a correlated futures instrument. As in the example above, where 100 shares of DIA moved exactly $1 per point, we saw that two contracts of the Micro E-mini Dow (MYM) moved $1 per point as well.

If you can’t find the equivalence of the point values between instruments (stocks and futures), then you can’t tell whether you are under-hedging or over-hedging your exposure. Let’s talk about that next.

How Much of My Exposure Should I Hedge?

Should you hedge 100% of your stock exposure? Good question. What if you fully hedge your portfolio and the market goes up instead of down? This means that your stocks will appreciate in value but your hedge will lose an equivalent amount, leaving your net position at zero, or with a slight loss.

Even worse, if your hedge losses accumulate to a large amount, then you may be forced to sell your stocks to cover your losses, which is counter to what you’re trying to accomplish with a hedge. Apparently, hedging–which aims to reduce risks–has its own inherent risks.

On the flip side of that scenario, your 100% hedge might be to your maximum benefit if the market tumbles, as you can now close your hedge with even more cash to build your positions.

As you know, your choice to invest is a willingness to risk a certain tolerable degree of loss. There is no riskless investment, even with a futures hedging strategy. So, why not hedge a fraction of your portfolio instead?

Depending on the dollar-per-tick value of your futures instrument, you may find it okay to hedge only 50% of your stock exposure. The amount is up to you and dependent on the size of your portfolio (if you have a small portfolio, then maybe a futures hedge might not be worth it).

What you do not want to do is to “overhedge” which is essentially hedging 100% of your portfolio plus additional exposure, making your hedge a speculative bet in the opposite direction.

The Bottom Line

Hedging is as much an art as it is a science. To hedge well, you have to know your correlations, understand how to match your stock portfolio with the right futures instruments, know when to enter and exit, and understand how much of your portfolio to protect, considering that your forecast may be correct or way off. This takes lots of study and practice.

If you need assistance, talk to your broker or financial advisor. But eventually, you may want to learn how to do this yourself. And with enough practice, you may acquire the flexibility and tactical proficiency to make the best out of a falling market.

There is a substantial risk of loss in futures trading. Past performance is not indicative of future results. The placement of contingent orders by you or broker, or trading advisor, such as a “stop-loss” or “stop-limit” order, will not necessarily limit your losses to the intended amounts, since market conditions may make it impossible to execute such orders