Originally published at: Futures Trading Basics | What You Need to Know About Futures Markets

This article on futures trading basics is the opinion of Optimus Futures.

As a futures trader, you know quite well that by trading any market, you are certainly not operating in a vacuum. In fact, you probably have more company than you think. But how large might this environment be, who are the other futures market participants, and what roles might these other participants play?

This is what we’re going to cover in this piece. Before you jump into futures trading, it helps to know the role of each futures market participant, not only to understand the various “nodal points” in a given trade, but also to glean information that might even serve to your advantage.

For instance, if the futures market experiences a negative event, like a tech glitch or a downed server, it helps to know the origination point of such an event and the role of the participant (or participant class) responsible for fixing it.

If you hear that speculators, commercials, and institutions hold conflicting positions on a given market, it helps to understand the roles they play in the market, and how showing their “hand” might indicate the direction of a given commodity (i.e. by reading the Commitment of Traders report).

So, let’s delve into this, starting with you, or rather, the role you play in this market.

The Speculator as a Futures Market Participant

As a retail trader, you fall into the category of “speculator.” You might be a scalper, day trader, swing trader, or longer term position trader, but your role (and don’t take this the wrong way) is that of the “smaller player.”

Ironically, the smaller players outnumber the bigger ones by far, by a number of accounts. And the most important role that speculators play in the markets is that of making the trading environment more liquid and efficient. The more a market is traded by scalpers, day traders, and swing traders, the narrower the bids and asks are, making a given commodity class easier to buy and sell.

Speculators willingly engage risk in pursuit of profit.

Case in point of highly illiquid markets are rice, dairy, cocoa, and lumber to name just a few. You’ve likely never met a day trader specializing in rough rice or lumber. But, they exist. And it didn’t end well for either of them (try day trading the rough rice market, and you’ll see what we mean).

The bottom line is that speculators help make markets more liquid and efficient. And if a speculator happens to be a skilled trader, then he or she can do this and walk away with handsome profits.

The Hedger as a Futures Market Participant

Strangely, this is a very basic distinction that many retail traders often do not get. When new traders fill out applications for a futures trading account, it is not uncommon for them to ask their broker whether they should check the “speculator” box or the “hedger” box.

The distinction between speculator and hedger status goes as far back as the earliest days of futures trading. But, many new traders don’t understand the most basic history of the markets they’re trading.

Well, let’s clear up this confusion now. A hedger is also what’s referred to as a “commercial,” or rather, a commercial futures market participant . Hedgers are either commercial manufacturers (small to large) who need to buy a commodity (say, corn) in order to produce goods (like corn flakes cereal), or they are producers (like farmers) who need to sell their goods (corn, soybeans, wheat, etc.). In terms of size, hedgers can occupy a small or large category.

Hedgers trade in order to avoid risk by using futures to “lock in” a price to buy or sell a commodity.

For example, a farmer who has corn to sell is afraid that corn prices might sink, reducing his profit margin. So, he goes short corn futures at an amount that’s equivalent to what he has to sell so that he can “lock in” the current selling price. On the other side of the trade, a speculator may think that corn prices will increase, so she buys the contract that the farmer sells.

If corn prices sink, the farmer saves his profit margin; the speculator, on the other hand, loses money. If corn prices rise, the farmer may miss out on a windfall but still locks in his profit margin; the speculator, on the other hand, makes a profit.

The bottom line is this: hedgers aim to avoid risk by locking-in a given price , whereas speculators aim to engage risk to seek profit. Next, let’s talk about another futures market participant that typically occupies the larger end of the participant scale.

Institutional Traders as Futures Market Participants

Institutional traders are like speculators, but the difference between them and your average speculator is that they have much larger capital resources. Think “large fund manager” and you’ll pretty much get the picture. The average speculator may trade a few to a handful of futures contracts, whereas the institutional traders can buy futures contracts well into the hundreds or thousands.

Institutional traders who are well capitalized often buy or sell at such high volume, they can actually move the market.

Why is this important to know? Well, think about it: institutional traders who are managing other people’s money may be implementing longer-term strategies. This means they tend to look at the futures market on a more “fundamental” basis since their market forecast aims toward a lengthier time period. And when they deploy their managed money, they’re likely deploying lots of it by loading up on or dumping a huge number of contracts.

What might this mean for the smaller short-term speculator? You might not want to be on the other end of an institutional trader’s position , because you’ll likely lose. If anything, especially if your trading horizon is near-term, you want to be on the same side as most institutional traders, because they’re the ones with enough capital to influence the market price.

Optimus Flow’s Power Trade feature allows traders to detect execution of a large number of orders in a very short time. Learn More Here.

Now that we’ve covered all of the participants on the “trading” spectrum, let’s cover the participants on the dealing or assistance end of things, starting with the biggest “player” of them all, the exchanges.

Commodity Exchanges, the Biggest Futures Market Participant of Them All

When we think “commodity futures exchange,” we think in terms of a place where people trade and the institution that manages that place. In the US, the biggest exchange conglomerate is the CME Group, which stands for the Chicago Mercantile Exchange Group.

The CME is comprised of four exchanges:

- CME (Chicago Mercantile Exchange)

- CBOT (Chicago Board of Trade)

- NYMEX (New York Mercantile Exchange)

- COMEX (New York Commodities Exchange)

Between these four exchanges, the CME group provides access to most of the world’s most commonly traded commodities (some commodities such as certain international indices or regionally-traded commodities may not be accessible through the CME group).

As in the past, a few of these exchanges still have trading pits (remember those?), though most trading these days takes place virtually. The main function of a futures exchange is to organize, standardize, and promote futures trading activity.

They also establish their own margins for trading, and they self-regulate the market process to ensure that the integrity of the market remains efficient and trustworthy. The exchanges also have first-hand access to the trading data (because that’s where people trade) and often account for the zillions of bits of digital transactional data created in the process.

In order to trade futures on an exchange, you have to be an “exchange member.” Okay, “hold on,” you’re probably thinking, “I trade but I’m not a member of any of these exchanges.” In fact, membership can be rather costly. So, how are you trading without being an actual member?

As in the olden days, a member has to vouch for you, allowing you to trade without membership. And who might that member be? Well, your clearing firm, or FCM, short for “Futures Commission Merchant.” Without them, you would have no access to trading commodity futures.

You’re probably not dealing with your FCM directly, instead, going through an Introducing Broker (IB). So, let’s talk about FCMs and IBs next.

The FCM and Introducing Broker as Futures Market Participants

Here is a common misconception that every trader should know (but doesn’t always…meaning, you haven’t done your homework): your futures brokerage– unless it is an FCM –isn’t holding the cash for your trading account.

Why begin with this example? Because many traders, surprisingly, don’t know the difference between an Introducing Broker (IB) and an FCM. Let’s start at the beginning.

An FCM is typically a company (or person) that enables you to trade the futures market. They accept buy or sell orders in exchange for a commission. If you are using an independent broker, then the FCM is the last “commission merchant” to submit your order to the exchange (these days, orders are done digitally or virtually).

The FCM also has the responsibility of setting the margin for the instruments you trade, ensuring asset delivery for expired contracts, and setting aside your trading funds in a segregated account at a bank of their choosing.

So, with all of these hefty responsibilities, why even go through an Introducing Broker? It’s because of these responsibilities that many traders want to work with IBs.

IBs typically have the time to help customers on a one-on-one basis, some even provide technical support.

FCMs, in contrast, can be so large that they need assistance on the customer end; so they hire IBs. When FCMs do give personalized service, it’s likely to the bigger accounts–many of them commercials or institutional funds–that do significantly larger volume.

Sometimes, larger manufacturers, farmers, or fund managers like working with IBs for the personalized service they provide. It’s up to you, but who wouldn’t want high-quality one-on-one assistance?

Check out this podcast to learn more about the difference between an FCM (Futures Commission Merchant) and a futures broker. Find out which arrangement best suits your needs when it comes to opening a live trading account.

The Data Provider as Futures Market Participant

With millions of futures contracts being exchanged across all commodity classes on a daily basis, you can imagine that the sheer amount of data in real time would be nothing short of awesome and overwhelming.

No single computer can possibly digest all of that transactional data at once. Doing so would likely kill your computer (metaphorically speaking). So, there are companies that specialize in extracting, filtering, and providing data: data providers.

Here’s a little-known “secret” in the world of digital futures trading. Notice how some data providers say their data is “unfiltered”? First of all, if your computer were to receive unfiltered data in real time and all the time, your computer would be overburdened. Too much data.

So, to make it work, all data–even unfiltered data–is to a certain degree filtered. Some data providers provide different levels of data products, and the quality of their product depends on the quality of their data customization (how they filter their data).

And when it comes to trading, the data you receive is your only access to the “reality” of the market–which consists of real-time bids and asks. So choose your data provider wisely!

Also Read | Can Fast Execution Improve Your Futures Trading Performance?

Trading Platform Providers as Futures Market Participants

Last but not least, let’s talk about your trading platform. Your trading platform is like your vehicle into the virtual markets. Is your platform a “participant”? It’s as much a participant as your car is when you take it out for a drive. So, yes, it is.

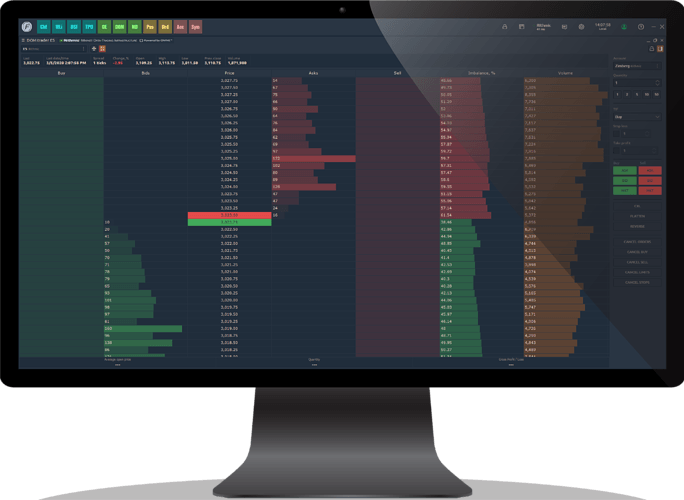

The quality of your experience is partly due to the capabilities of your platform, as your charts, analytical tools, and order placement is only as good as the platform you use. For instance, some platforms don’t even have charts, but they have speed. Some platforms with lots of bells and whistles have a clunky user dashboard; some even have latency issues.

Some platforms have lots of analytical tools, charting capabilities, and fast order routing speed, like Optimus Flow. So, when you’re shopping for a platform, make sure your platform is in line with your workflow preferences and trading needs.

How All Participants Can Affect Futures Contract Pricing

All participants play some role in the commissions and fees that go into trading futures. Let’s pick them apart one by one.

Margin is ultimately set by the exchanges. Exchange margins are on the higher end, as they typically concern traders who hold positions for a longer period of time–namely, commercials and institutional traders. To provide competitive margins for intraday traders, FCMs typically provide lower “day trading margins.”

You’ll notice that different FCMs offer different margins. Not only is this a way for FCMs to compete, but it may also be an indication as to the quality and speed of their risk management software and staff. How’s that? If a given market undergoes a “flash crash,” an FCM should assist to liquidate their clients’ positions fast, otherwise, the FCM itself may risk insolvency.

Having said that, it is the responsibility of the trader to liquidate their position, and he or she is responsible for any negative balances. FCM’s don’t control certain market conditions as gaps, flash crashes, etc. The trading technology can also malfunction during certain periods (we have seen that during negative oil prices).

To protect yourself in the best possible way, please consider the size you trade and ensure you have access to all your support resources (broker, email, phone, etc). However, please keep in mind that your actions will not necessarily limit your losses to the intended amounts, since market conditions may make it impossible to execute such orders

IB’s don’t have margin-setting power unless the FCM lets them. In the case of Optimus Futures, our FCM’s cooperate with us and allow it for certain accounts.

Click Here to View Day Trading Margins by FCM

Commissions are charged by IB’s and FCM’s. Exchange fees are generally set and are often the highest piece of the entire commission schedule. When commissions are competitive, such a reduction takes place on the IB level.

Platform and data fees can also vary per trade. Again, if a company believes it is providing quality data or a premium platform, and if you agree that such services are helping your trading, then the extra fees can make sense.

With so much competition out there, nobody is forcing you to pay a premium for your data or platform. How much of this you’re willing to compromise is up to you.

Find Out Exactly How Much You Pay In Commissions To Trade Futures

Traders naturally change the cost of a given commodity. That is their role, isn’t it? To make a buck as a buyer, you want the commodity price to rise. It’s the reverse for short-sellers. But this year, we saw something of an anomaly: negative oil prices. How can a commodity go below zero? What happened this year stems from a much larger geopolitical conflict.

When the US became one of the largest oil producers in the world, particularly in light of the US shale industry, its output plunged oil prices across the globe. Reasonably, this hurt prospects for other oil producers across the globe. To simplify things a bit, given the US’ relationship with certain OPEC allies, namely Saudi Arabia, and our uneasy relations with Russia (a nation sanctioned by the US), a price war broke out between the two which threatened the stability of US oil producers holding large levels of debt.

In short, it nearly crashed the entire US shale industry (and it still might). With oil futures prices sinking to below zero, many producers were paying buyers to buy oil from them, a strange and rare event. It just comes to show, amid extreme economic or geopolitical uncertainty, don’t assume anything, even the saying that commodity markets can’t go to zero, because apparently, they can.

The Bottom Line

Now you should have a good understanding of each category of futures market participants and the distinct roles they play. If all of this is too much to digest in one sitting, here’s an infographic that can help you visualize the entire thing.

Last but not least, know that all of this information plays a part in understanding the big picture context of futures trading. If you want to learn more, check our comprehensive guide to futures trading in 2020.

We certainly hope this has been informative. Trade wisely!

There is a substantial risk of loss in futures trading. Past performance is not indicative of future results.