2021-03-05T01:13:00Z

Thank you for participating in today’s support and resistance webinar.

Here are the keynotes about support and resistance in any asset class:

Support and resistance are the most widely used terms used in technical analysis. These levels can be handy and alert you to trends in a particular asset’s price. Support and resistance are easy to understand but hard to master. Support is a level that an asset’s price bounces off from if a downtrend begins. As an asset’s price falls, it will fall to support then bounce back up sharply; this is called a bounce or a pullback. But, support and resistance are not a precise science. It is a subjective interpretation while each trader may find different areas, or we call them in trading lingo, the zones.

On strong trending days:

Look for support in a bullish market trend

Look for Resistance in a bear market trend

Why? While on strong days you have fluctuations back and forth, you should look for support on uptrends. You should look for resistance on downtrends.

This in my opinion should increase your odds of winning trades.

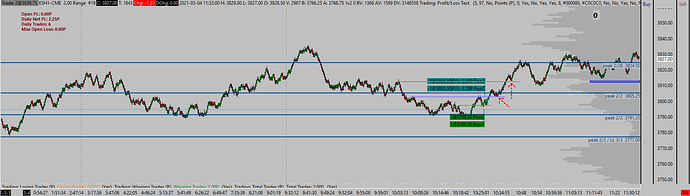

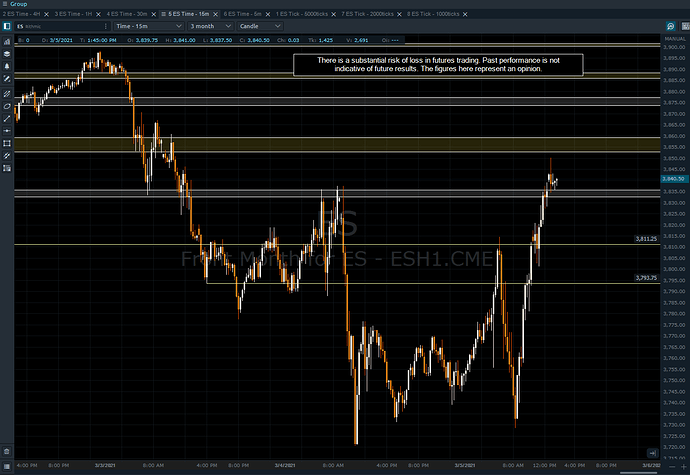

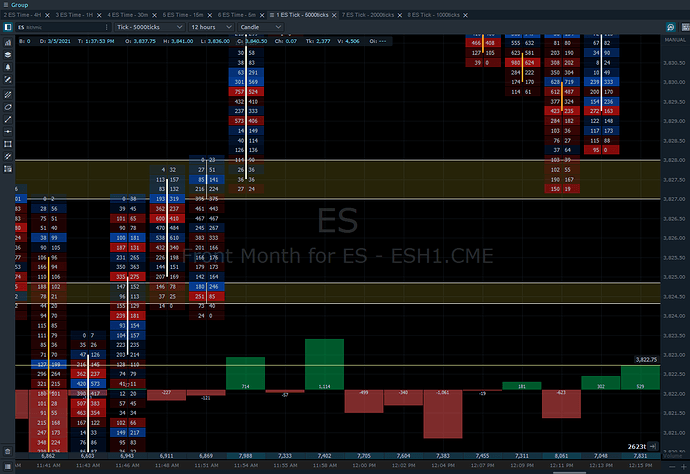

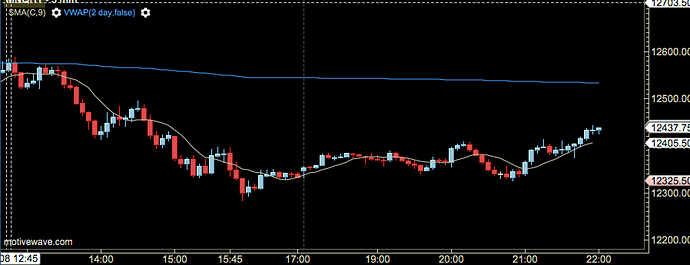

As a day trader, you should use at least three time frames for reference.

Look at two time frames that are higher than the one you are trading from.

Look for support and resistance within these time frames and see whether they occur within the same levels as your shorter time frames. If they do appear, they become “stronger” support or resistance.

As above, support and resistance are not a precise science. No method is. There is always a level of noise you need to accept when you trade. While trading support and resistance, you will see that very often, with a specific channel, there are false breakouts, and then the price resumes to the channel.

Be patient and see how the price behaves around support and resistance, and see whether the support holds or not. It is better to trade a few points of support or resistance because it could verify whether the support or resistance held or not.

Don’t treat support or resistance as a predictive tool rather as a tool that would add probability. Above all, DO NOT try and guess whether specific support and resistance would hold. This is one of the biggest mistakes that traders commit when it comes to support and resistance: A tendency to be impulsive and try and guess whether support or resistance would hold. They would place an order ahead of support or resistance being touched. Remember trading is not a business of prediction it is an odds game while you react to what the market is doing precisely. Exercise patience.

Junior levels versus Observed Levels: These are my terms of distinguishing between those support levels that appear for the first time versus repeated times.

Junior levels could at times serve as reliable support or resistance. The observed levels, often called touchpoints (especially those that repeat many times), are viewable to the entire market and may not hold as traders anticipate.

Let me know if you have any questions.

Best,

Matt Z

Optimus Futures

There is a substantial risk of loss in futures trading. Past performance is not indicative of future results.