Here are the things I learned and did on my day off of trading that will help me next time.

Tuesday 5/11/2021

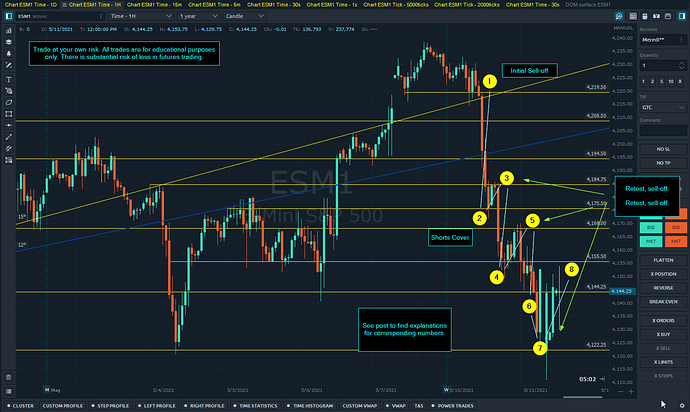

Yesterday, the ES Mini’s sold off from a range with support at 4220.00. This also formed a head and shoulders pattern.

I did not catch the first part of the move but was able to scalp on both sides about 15 minutes after the initial move.

Before we get into the learning side and rules, here’s the market structure with the sell-off.

Explanations:

- This is the initial sell-off level. It also is a head and shoulders pattern.

- Shorts cover their positions to take profit and price comes up to 4184.75.

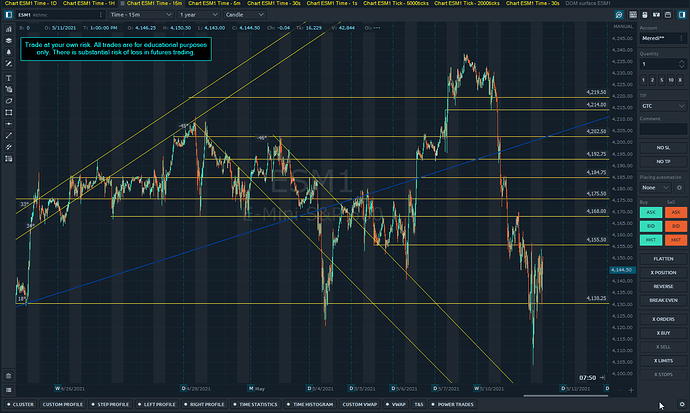

- This is significant resistance and support from 4/26. (See chart below).

- Price moves further down to previous support.

- Retest of previous support and resistance. (See chart below).

- Sells off to form a tall range.

- Low of the day.

- Retest previous support.

The 15-minute chart shows these levels with more touchpoints going back further.

This was a clean move with signals that it was priming to sell off at some point. Albeit happened sooner than I thought it would.

Now, the story.

After this move yesterday, I got frustrated and went into “rage-trade” mode. I broke my foundational rules and did everything wrong at that point. Therefore I did not trade today, and that was a huge huge bummer with all the movement.

What’s really frustrating is that after the selloff yesterday, I was up including commission costs. I kept trading when I knew I shouldn’t and one losing trade turned into another, then another, and another.

I did watch the market and traded demo this morning. I could see the market clearly, without bias and emotion. I was able to see it much better because I knew I wasn’t going to trade.

So, the only thing that changed was my mentality regarding trading real vs. demo.

Here’s the contrast I noticed specifically from the past two days:

Live Trading:

-

I picked out the head and shoulders before the open yesterday, then quickly forgot about it and didn’t refer to it.

Solution: Set a timer for every 15 minutes on my desk with my trade plan written out. This will remind to me stop, look and review.

Things to confirm and remind myself during this time:

- What is the market structure?

- Where are support and resistance?

- Trade with purpose and confidence.

- Find the best spot to enter and watch order flow. If you miss it, there’s another one coming.

- Identify entry, exit, and stop. Once you execute the trade let it develop or stop out.

- I can see the market without bias. I can process the information clearly and effectively.

-

I wasn’t seeing the market as clearly as I should have. It felt clouded and blurry like I was guessing. There were one or two trades that I was sure of and they made sense.

Solution: Remember that when I’m trading, I’m processing information to speculate where price will go in the short term. Keep it simple and think logically from a birds-eye view.

Things to do and help with this:

- Stay hydrated and eat healthy food throughout the session.

- Stand up every 5-10 minutes and stretch, rest eyes, etc.

-

I got emotional about money and self-sabotaged my trading.

Solution: Set reminders to reinforce positive thinking about money rather than negative. Affirmations for making good decisions, remembering my place in the market and goals.

Demo Trading:

- I could see the market with clarity and precision. I knew where it was going and executed trades accordingly.

Things to Remember:

- When I trade without even thinking about money, I put my attention into the market and not my account size. This allows me to process more information, look at the market without bias and properly assess risk/reward.

- I am fully capable of identifying profitable trades and recognizing the patterns in the market. The area that I can improve on is how to separate trading from money.

- I let trades develop and didn’t get scared before the move happened.

Things to Remember:

- Set your entry, exit and stop loss and once the trade is executed, don’t touch the DOM.

- I can do this, actually only do this, when I’m not trading to make up losses or make a certain amount of money.

Here are my new set of rules for the time being:

- Trade one size only - No scaling in or out, two mouse clicks per trade and that’s it.

- I know when I’m wrong. It is generally 3-4 ticks of heat and/or a change in order flow. Get out then.

- When a trade is profitable but the situation changes and isn’t in my favor, I dump the position. No FOMO, there is always another opportunity.

- My style of trading is to capture 4 ticks on average. In some cases, that need to be pre-planned, I will let the trade go further based on my chart analysis. But mainly looking for the 4-6, sometimes 8 tick winners.

- I will only trade when I am level-headed and seeing the market clearly.

- I will only take trades that meet my setup requirements. That may be one trade all day or 5 per hour. This will be monitored by myself and my partner on a daily basis by reviewing trade data. If I have a loser that is bigger than my standard loss and it wasn’t caused by factors outside of my control (slippage, latency, etc), I will sit out again. This will also be measured by average tick gain/loss per trade.

- Be out of the market by 12:45 Pacific time. There is no need to trade anything past that point. If I didn’t make my ticks by that time, I should be trading at all.

For trade execution.

I will memorize a straightforward, detailed checklist for executing all my trades:

- Check market structure (range, trending, random).

- Check support and resistance levels for this trade.

- Confirm order flow is in favor of the trade.

Bigger picture lessons

These are more ideology-based lessons that I think are essential for the long term.

-

I can self-sabotage quickly if kept unchecked. There are signals that I’m aware of, and capable of noticing and changing. These are things that can snowball quickly and will be written out as reminders.

-

The market will always be there, no matter what. There will be moves that I’m, and many that I’m not. This applies to having winners covered, only to have it go another 5 points in my favor.

-

I chose to have a losing trade that broke all my rules. I was the only person that chose that. No one forced me or talked me into the trade. My bad. In light of that, I can just as easily choose the opposite of that. To NOT be in the trade, to sometimes flip my position and way of thinking about the market if I’m seeing it from a biased point of view.

What blows my mind about this is something that I can apply to every choice in my life:

The decision to place or hold a trade when you know it’s the right choice vs. the wrong choice takes the same amount of energy, and we are all equally capable of making either decision.

-

This means that I didn’t hold the trade overnight or too long because it was ‘hard’ to exit or I couldn’t see the right decision. It was because, to me, having a large loser meant more than just having a big loss.

-

It meant failing and letting myself and my partner down, which ties into self-worth (snowball effect).

-

It meant not being good at something.

-

It felt easier to lose now than lose when the stakes are bigger when I could be more let down.

Those are the real things that make the seemingly easy decisions, the obviously right decisions, so incredibly hard.

What can I change going forward?

Aside from the list of rules and ideas above, I know there are some really simple fixes to catch bad habits from forming while cultivating good ones.

Have everything written out on my desk rather than online notes.

Reward myself with something I enjoy when I follow my rules for the day.

Go over my trade history every day and find easy wins to implement the next day.

If you guys have anything to add that helps you or that you find challenging I’d love to hear it!

There is a substantial risk of loss in futures trading. Past performance is not indicative of future results. The figures here represent an opinion. The placement of contingent orders by you or broker, or trading advisor, such as a “stop-loss” or “stop-limit” order, will not necessarily limit your losses to the intended amounts, since market conditions may make it impossible to execute such orders. Please conduct your own due diligence if Futures are an appropriate instrument for you.