I wanted to share my journey over last 6 months of transitioning from trading equities to Futures in hopes of helping other traders with any possible challenges I have faced myself and general thoughts.

As a side note, I trade Mostly the ES/ESMircos. Intraday- no overnights in the main portfolio for cash-flow.

First and foremost while platforms, feeds, commissions are important, it is not what matters most at first imho.

Number one factor is capital preservation and risk management while you are learning “the trade”. CME’s latest tool - Micros is something really worth starting with before going with full contracts. Paper trading is great for setting up strategies, testing, platforms, feeds setup, etc. after that one should be in real environment quickly with real money in order to make any headway.

Choosing a platform and feeds should be in concert with our trading style, psychology and approach.

I am very visual, too many numbers confuse me and yet i enjoy spotting patterns and looking at the flow of the market, its structure.

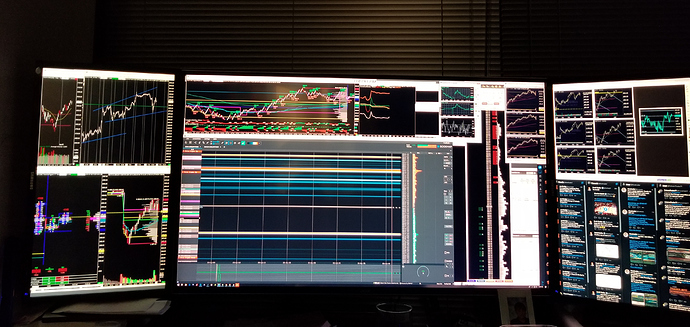

After trying few diferent tools, I ended up with Bookmap, SierraCharts, R Trader Pro and this setup has been working perfectly for me for few months now. I did migrate from TradeStation when trading Stocks, so SierraCharts was a simple choice for me.

When I first started with Optimus I had multiple feeds (3) to accomplish what i wanted, thanks to Matt and his team, especially Jake I ended up with One feed and 3 software packages working seamlessly together.

While I like the R Trader Pro for its order entry/exit using shortkeys and bracket orders (when I enter a trade, I have a stop and target auto entered which i modify visually), its great to see my orders/stops/targets represented in Bookmap as well live and if i choose in SierraCharts. I can quickly adjust my orders according to market conditions.

Having orders with predefined stops and targets also gives me peace of mind in case my internet goes down or something else happens locally as all orders are kept on Rithmic servers.

One of the strategies that works great (if one wants to trade ES) is to start with MicroES. Starting with 3 contracts, few $k in the account gives one ability to trade in 3rds (that is my strategy) without risking much. If successful, one can increase the size to 6, 12 and more contracts until ready to move to full 3 contracts ES. This preserves the capital while progressively increasing size with confidence and ease, minimizing the “Skin in the Game” emotions so we can focus on market structure, setups and trading.

Money comes by itself as a byproduct of skill, discipline and solid strategy.

While the MicroES commisions structure is more expensive comparing to full ES contracts, it is a very inexpensive way to pay for your live education in the markets which is priceless without dangers of burning out the capital. One final note, journal EVERYTHING all trades, point strengths and weakness, yes its a pain but really worth it.

Here are the final notes on my approach:

Software: SierraCharts, Bookmap, RTrader Pro

Data: Rithmic

Hardware: AMD Ryzen 5 1600x Six Core Processor 3.6 GHz

32GB of RAM

Graphics Card: NVIDIA GeForce RTX 2060

3 Monitors

Charts Setup:

Left Monitor Large time frame : Daily 30/15 min.

Center-execution/main charts for intraday trading

Right Monitor: Relevant markets, tweetdeck/news

I have also found through years of trading if someone is in this only for the money, this will probably not work in most cases. (just a side note)

Happy Trading!