Hi All,

I wanted to share a very simple yet rarely discussed subject of how losses (if not recovered

or at least brought back to breakeven) effect our bottom line results.

I am basically making a case study of how crucial and important is to keep the losses

as SMALL as possible and how BREAKEVEN days are little statistical “miracles”.

Consider the following simple scenario:

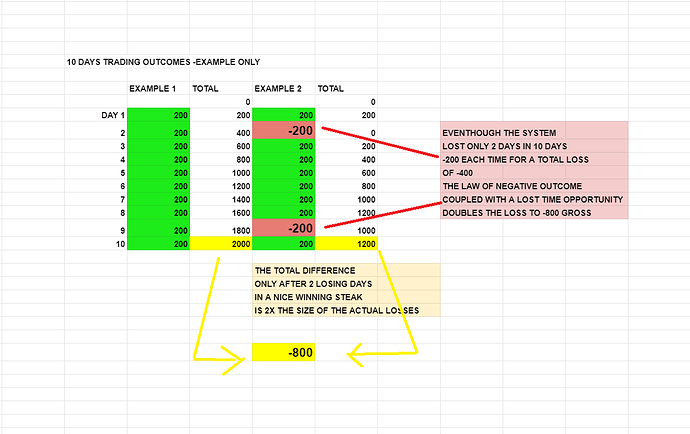

A trader trades for 10 days.

A trader attempts to make +$200 per day and stop trading.

A trader attempts to loose no more then -$200 at which point a trader stops trading for the day.

After 10 Days, we are analyzing 2 scenarios:

A trader made 10 straight winning days

For a total outcome = +$2,000

2)

A trader lost only 2 times in a 10 day sequence for a TOTAL loss of -$400 (2 x -$200)

For a total outcome = +$1200

What’s worth mentioning is that although a trader lost only -$400 dollars in reality

the 2 examples show a difference of -$800 or 2x the actual loss at the end of the 10 days?

Why?

It is what I call Time/Loss Opportunity phenomenon.

If you have only 10 days to trade/measure results, then each day that a trader does not

meat the goal, that slot is lost in time and also if one was hoping to make +$200 but

instead one lost -$200, the difference in absolute value at the end of 10 days testing period is -$400 (the difference between the peak of +$200 and the dip of -$200).

Although simple, this reality causes many traders to overlook the damaging effect

of losses on the bottom line end results. Traders tend to literally ignore their losses and keep focusing on the next trade instead of figuring out how to either trade less, trade better and focus on the process

and the real numbers behind their method instead of just keep throwing trades at the wall and

hope that “something” will stick.

Solution: Focus really hard on not losing first, breakeven second and winning small but consistently third. This way one could stabilize the returns not just in a way of numbers but also in stabilizing

the psychology behind the trading. Seeing smaller but consistent wins truly makes a big difference

in a way a trader takes traders, focuses and hopefully enjoys the whole process.

This subject brings me to memories of traders I came in contact with in my career who rarely analyzed

their outcomes and just kept focusing on the next trade, in effect generating more hope, kept

the traders’ juice up but in reality it only kept bringing more losses from period to period, generated

more trading costs, more grieve.

The crazy part is that trading can be simple and to improve the bottom line, one had to simply trade less, trade better, accept less, enjoy breakeven days like gifts and most likely have smaller then

expected but nonetheless green periods.

Hope it helps guys,

Happy Trading

p11