How to Identify Potential Breakouts

This question came up in a webinar about how to identify which way the market could move on a breakout from a range.

Keep in mind this is a demo account.

While we can’t know for sure, there are things to look for to potentially improve the probability of knowing.

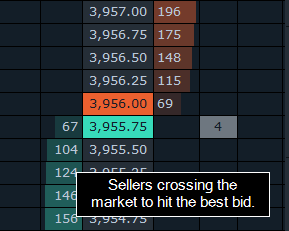

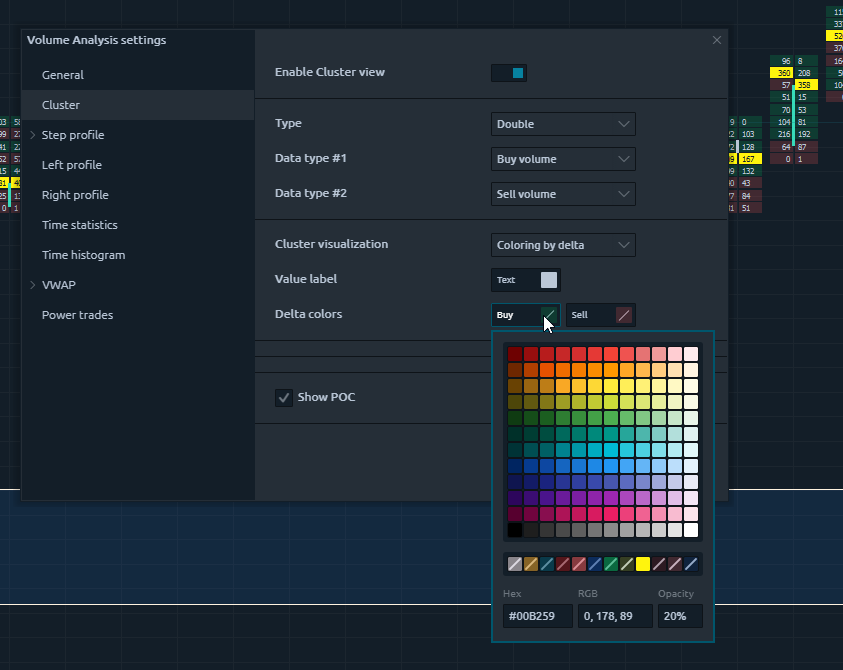

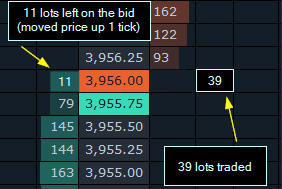

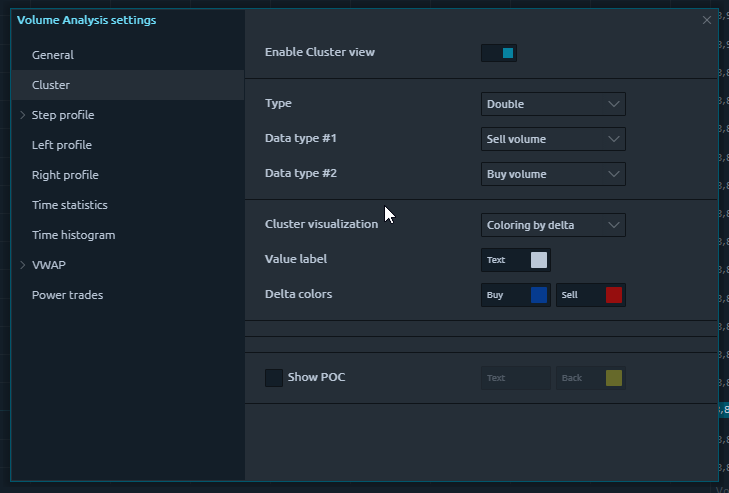

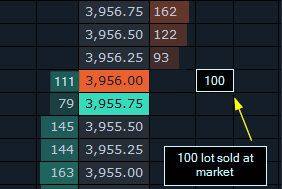

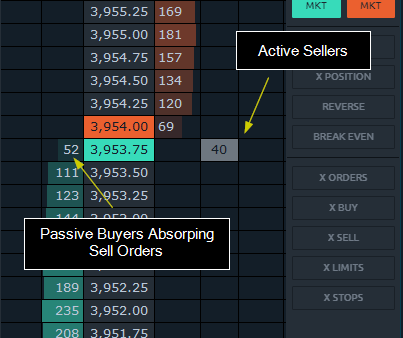

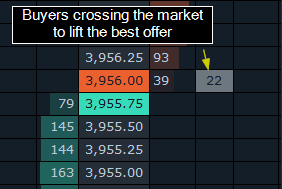

During a range, there are buyers and sellers that will be taking short and long-term positions. We want to be able to see how the orders are coming into the market, the velocity and direction of them as well.

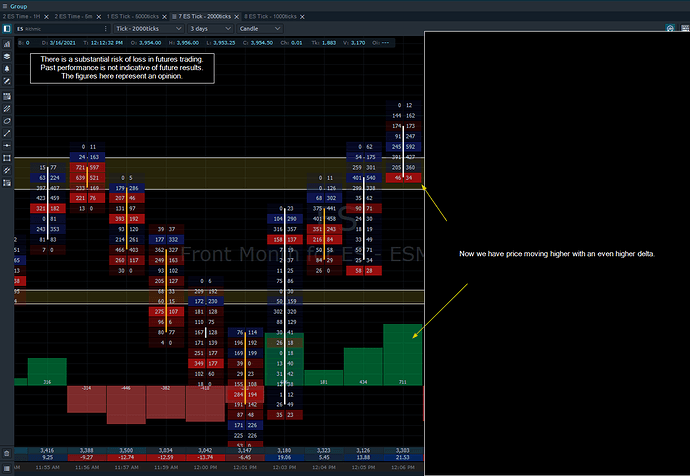

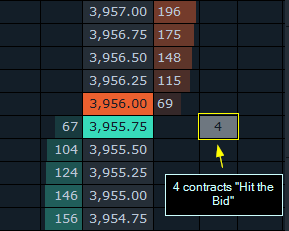

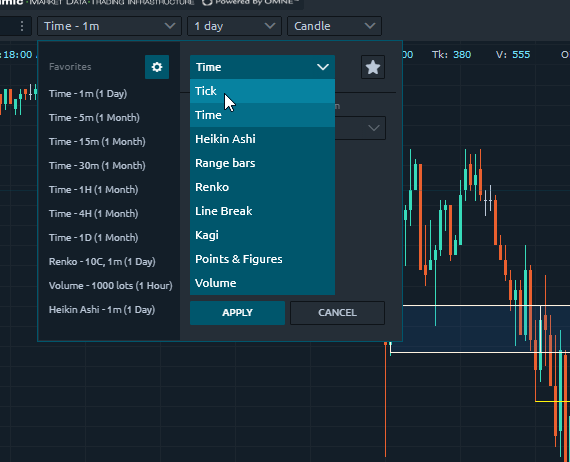

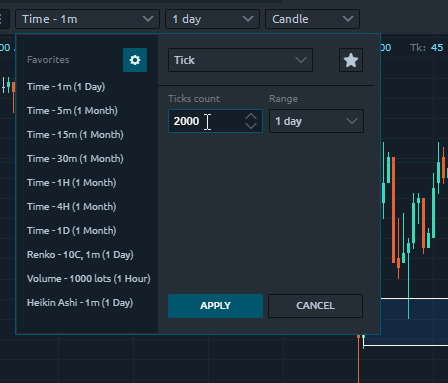

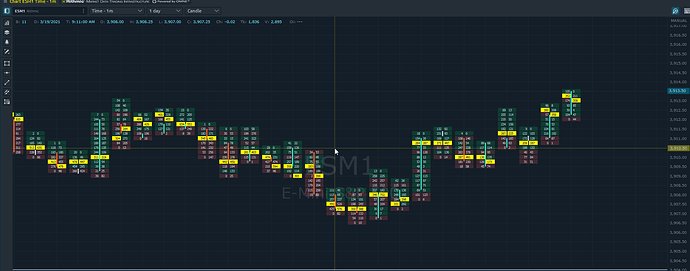

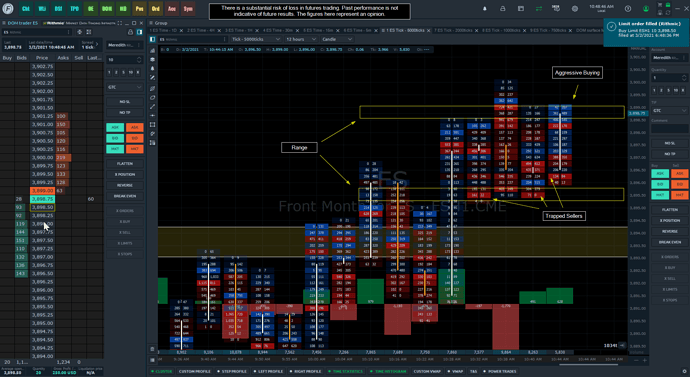

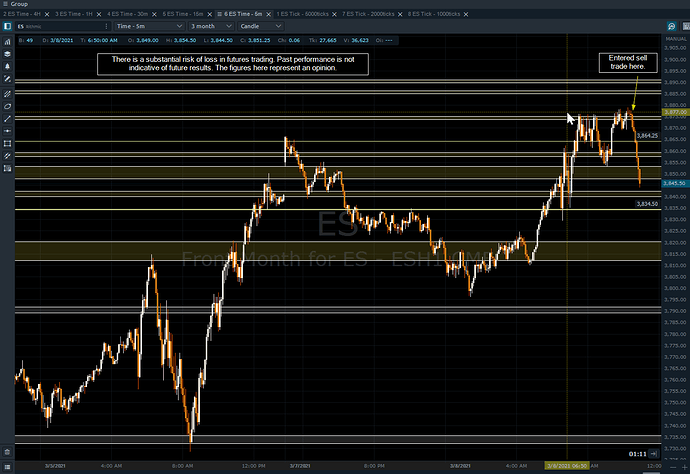

This way we can get an idea of where the bias is and how influential it may be. Let’s look at a Footprint chart of a range:

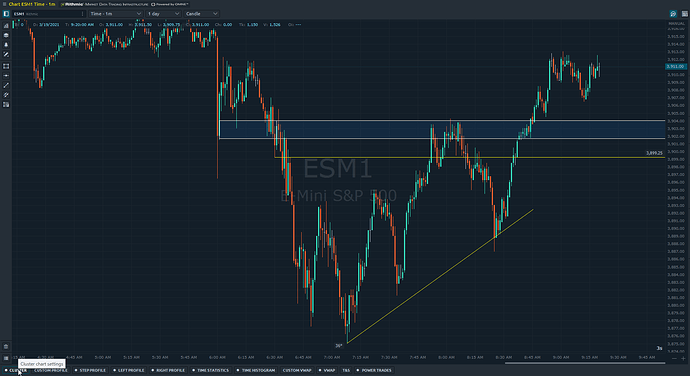

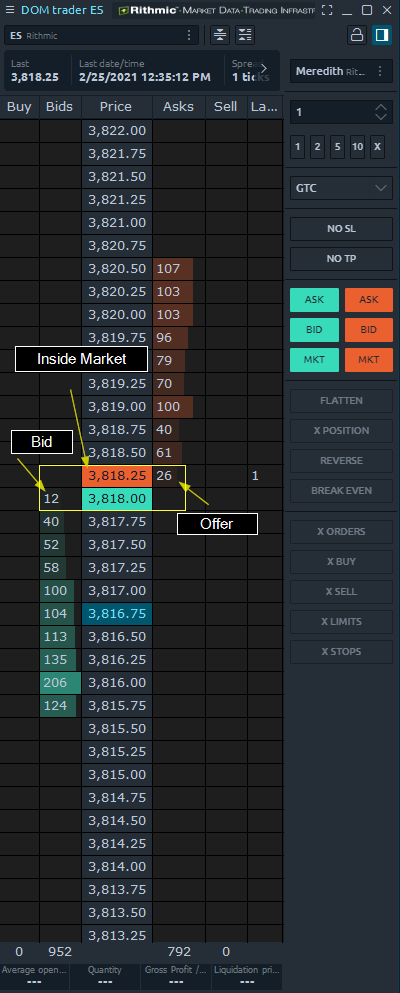

In this scenario I got long when I saw a swarm of buyers come in, I verified this with the Footprint chart with the strong shades of blue at the top of the range.

What would a buyer want to see in order to confirm his idea? What would a seller want to see?

As mentioned, we cannot predict what will happen, however, we can use the information to validate or disprove our position.

Since the market moves based on what the majority are doing (assuming that outweighs what the minority are doing), and they succeed, it’s hard to fade that move. In this case, I liked what I saw and the order flow confirmed there were more aggressive buyers than sellers. Furthermore, it was trading near the top of the range so previous tension in the market had the potential to force sellers to puke if price exceeded their risk.

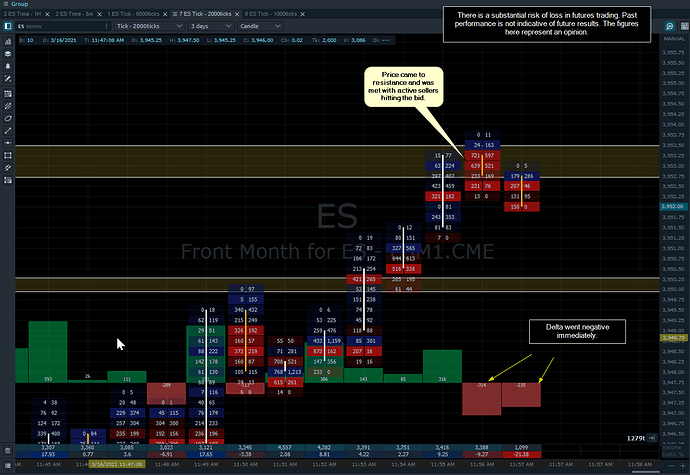

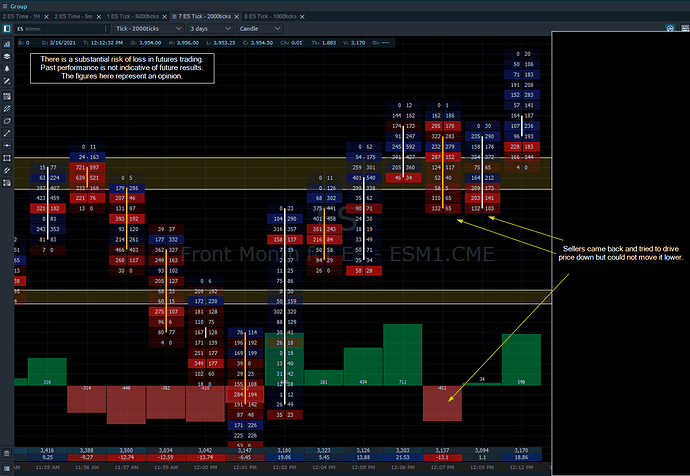

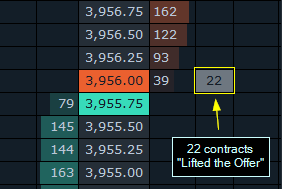

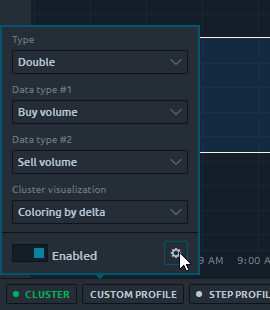

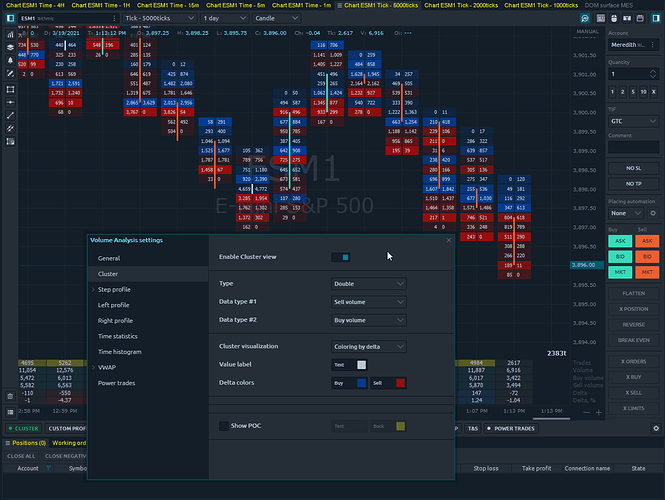

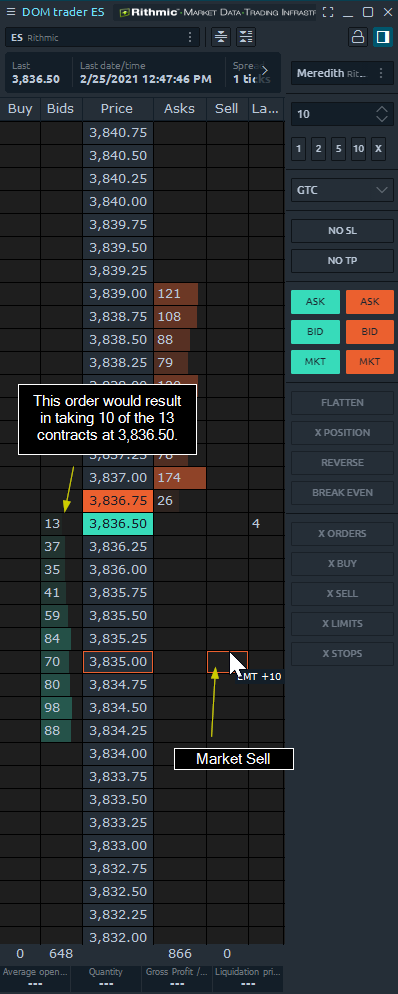

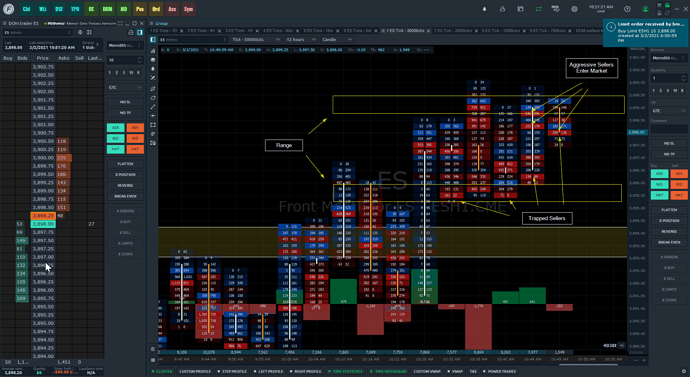

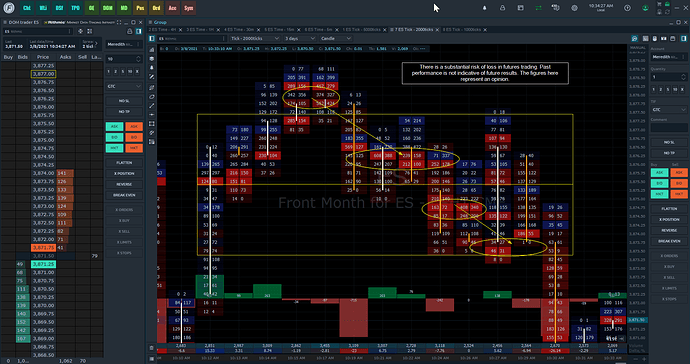

This is the next picture:

I included trapped sellers again, the reason being that assuming a portion of those contracts may be holding with their stop set above the range. They are trapped if price continues to move against them.

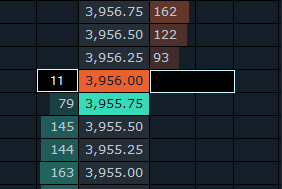

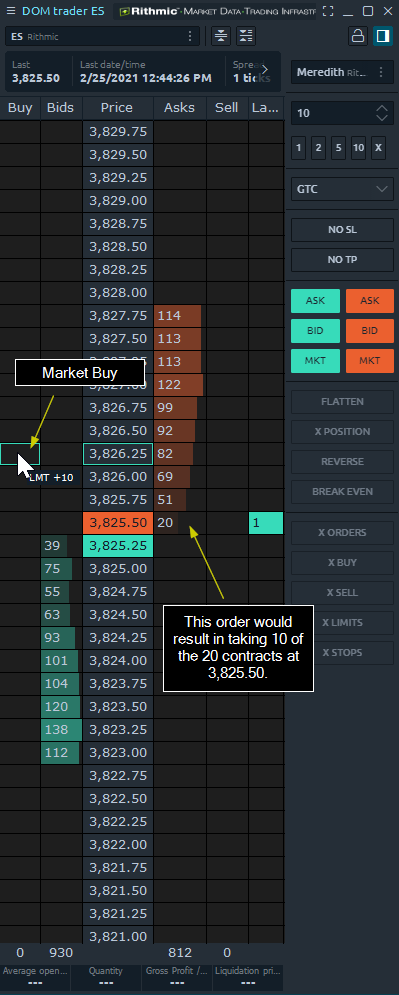

The big thing that changed is aggressive sellers came into the market turning the strong blue to neutral and even darker red in some areas. This bar also created a negative delta.

Not what I want to see as a buyer. What do you do?

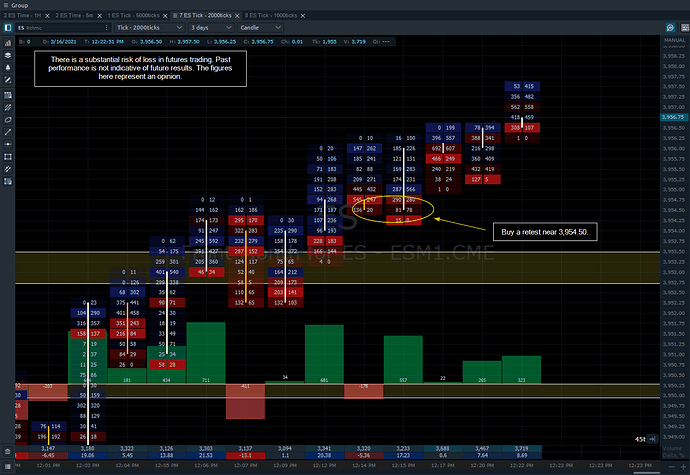

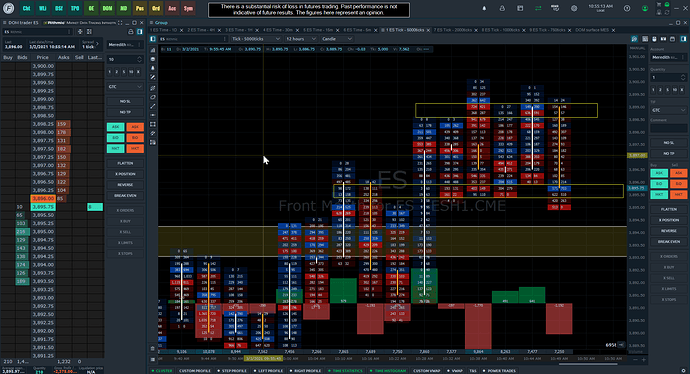

So, what do we do as a buyer? The answer to that is it depends.

It depends on your strategy, your intention, and your original idea.

There is no right answer.

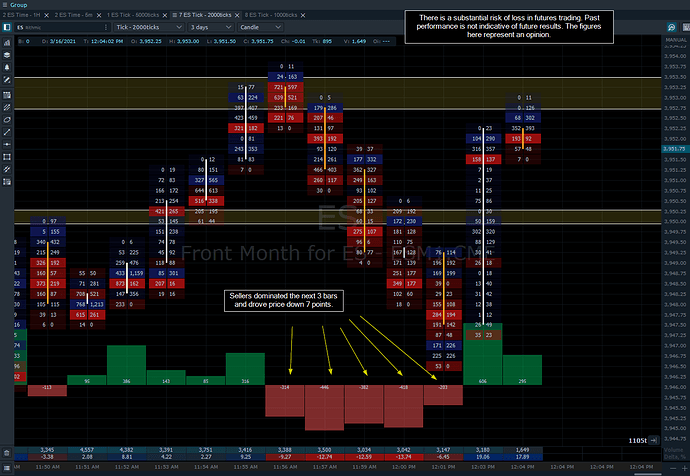

This has more importance than face value. For me, I had to exit. My idea was THIS was the breakout and I’m hopping on.

NOT that it would retest support. Only I know that. I could easily justify holding the trade by using strong support, or say there were still a lot of aggressive buyers.

But that isn’t true to my idea and that trade. If you don’t see happen what you thought would, it may not be the best trade if you hold it. For me, that’s when I get rolled over and it’s not fun.

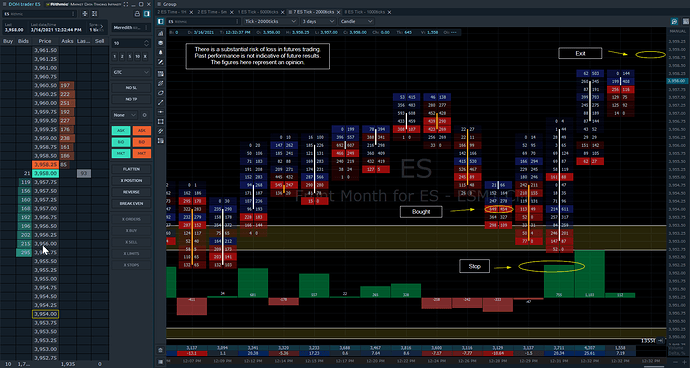

So, I exited and bought 96 evens.

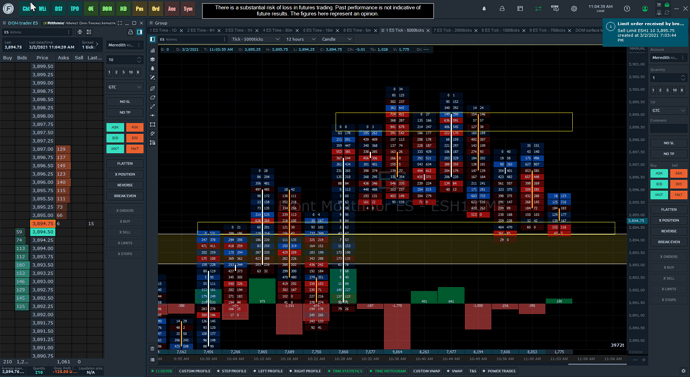

Then, it didn’t develop and I partially exited and entered to move my average position to 94 three quarters.

After this, the market bounced a tad, then sold off and I scratched the trade.

There are two points to this:

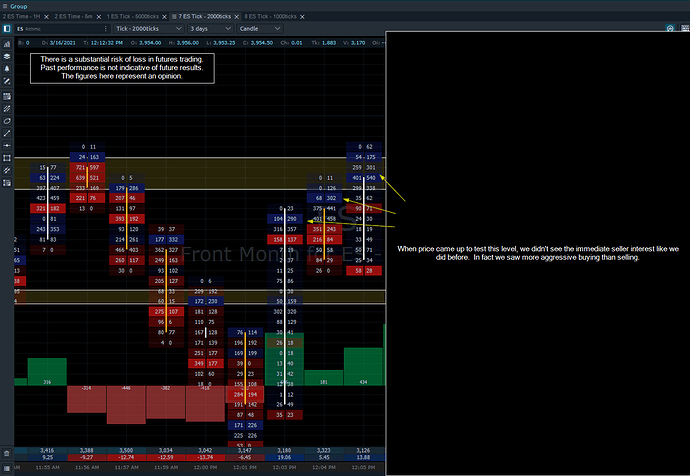

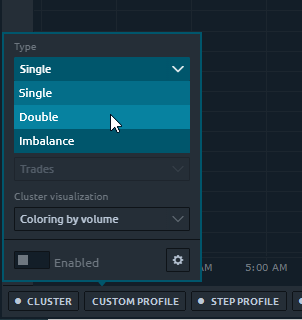

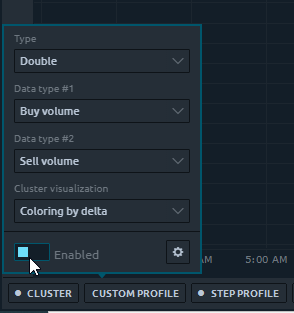

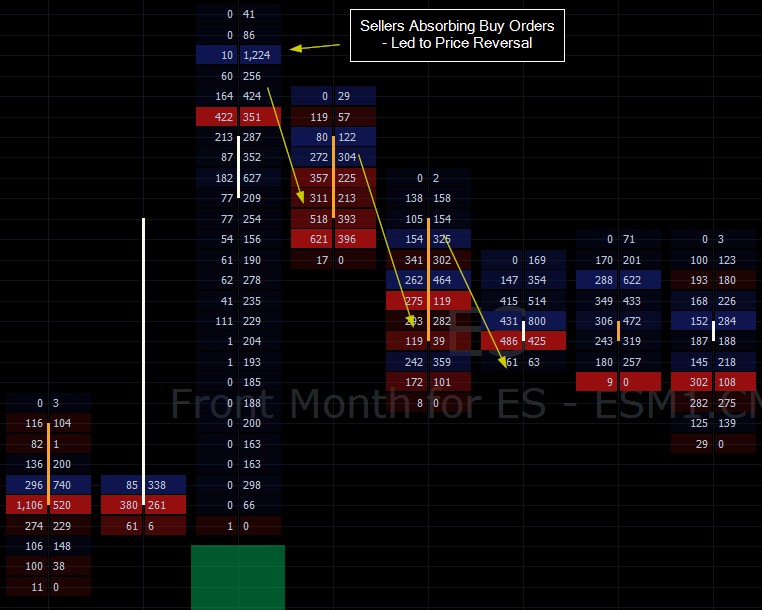

1. The Footrpint chart shows us what most traders don’t see, live and historical order flow.

2. Your idea may very well be right, but it might only be “right” for a few seconds. The markets are ever-changing, and not adapting can create larger losses.

If you think about it, the Footprint chart is like a microscope into the market. No other chart can show us what the majority are doing. Not to mention, if that sentiment changes we can also identify that.

Let me know if you have any questions or any good additions to the Footprint chart that you typically watch!

There is a substantial risk of loss in futures trading. Past performance is not indicative of future results. The figures here represent an opinion. The placement of contingent orders by you or broker, or trading advisor, such as a “stop-loss” or “stop-limit” order, will not necessarily limit your losses to the intended amounts, since market conditions may make it impossible to execute such orders. Please conduct your own due diligence if Futures are an appropriate instrument for you.

t

t