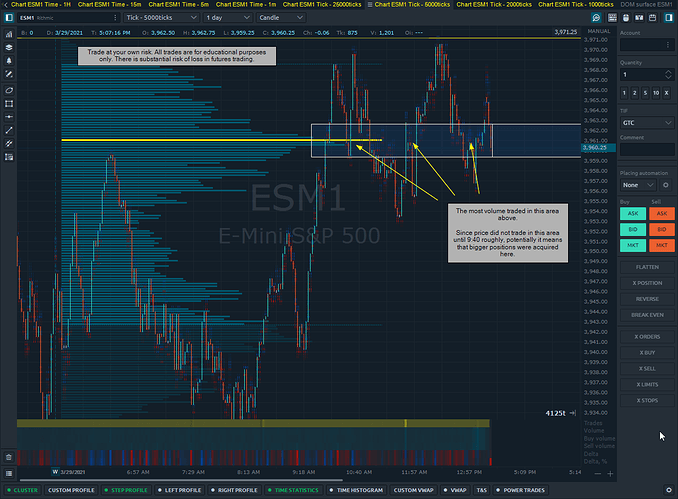

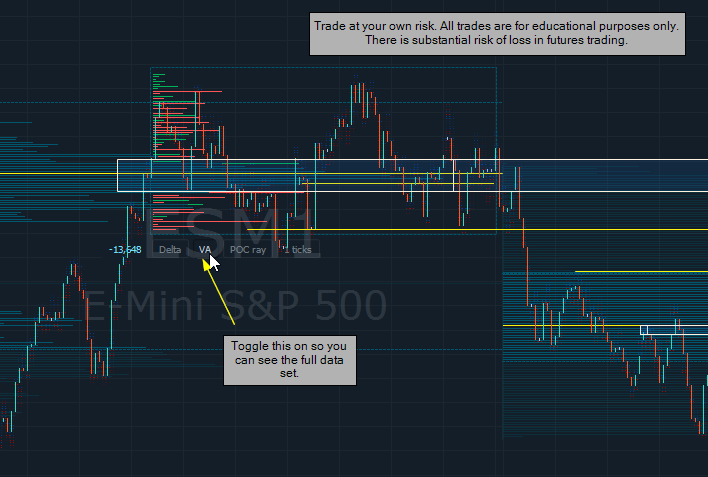

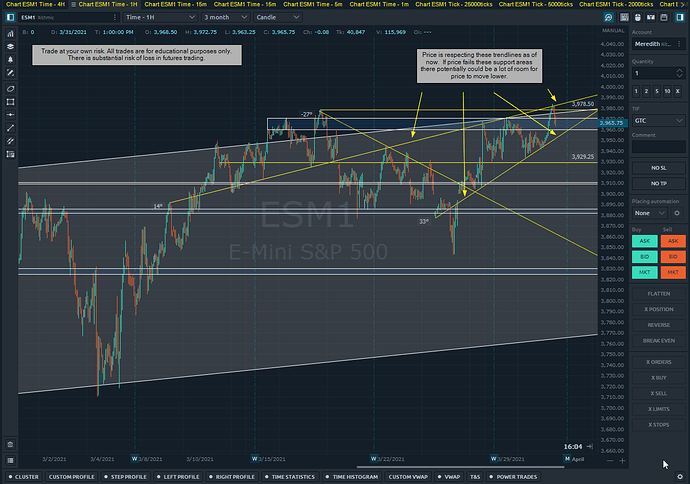

How I’m using the DOM Surface to validate trade ideas and levels.

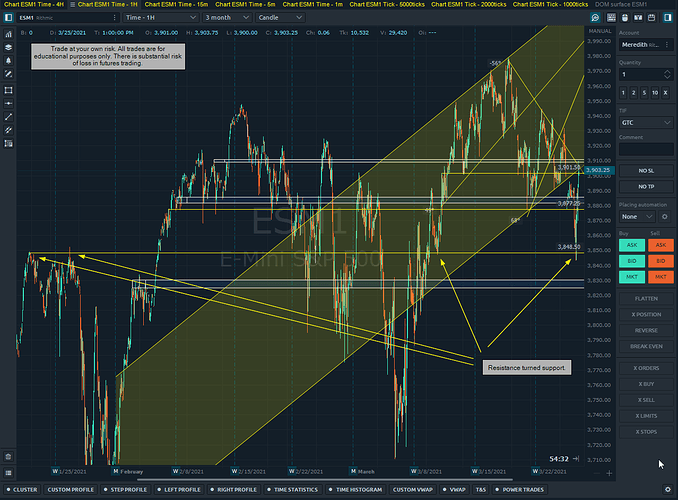

I recently started focusing on the DOM Surface more when looking at my levels to help formulate my entries and exits.

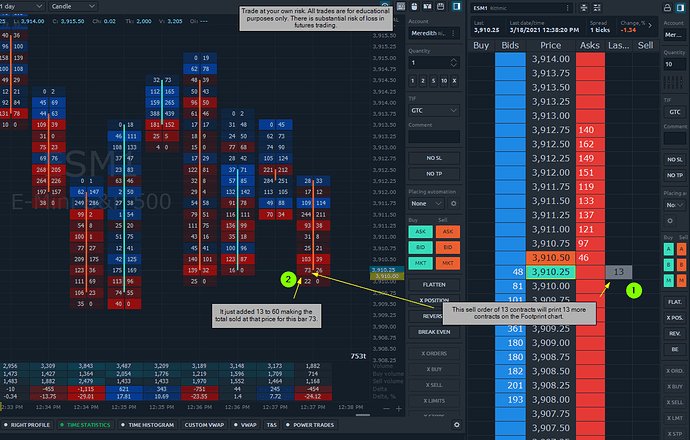

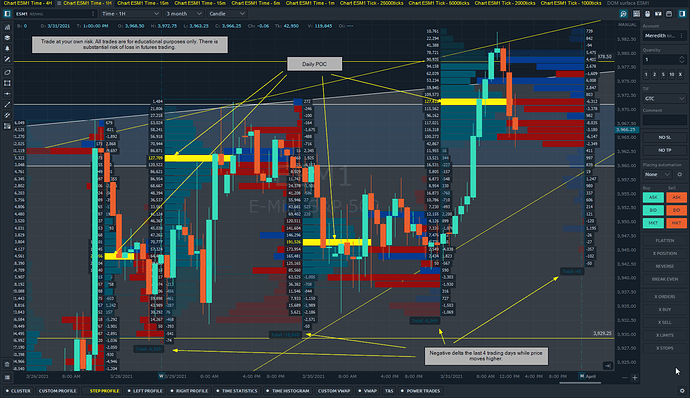

As mentioned on the webinar last week, my Footprint chart only shows the “Market Orders” that print on the market. This doesn’t show the amount of excess contracts (if there are any) on the bids and offers.

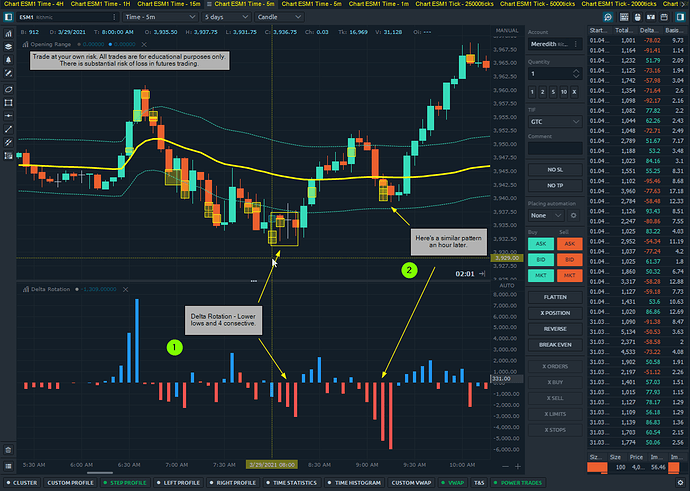

This is a big piece of order flow trading and it needs to be addressed accordingly. The way I address this is by just looking at the DOM and the orders coming in and out of the market.

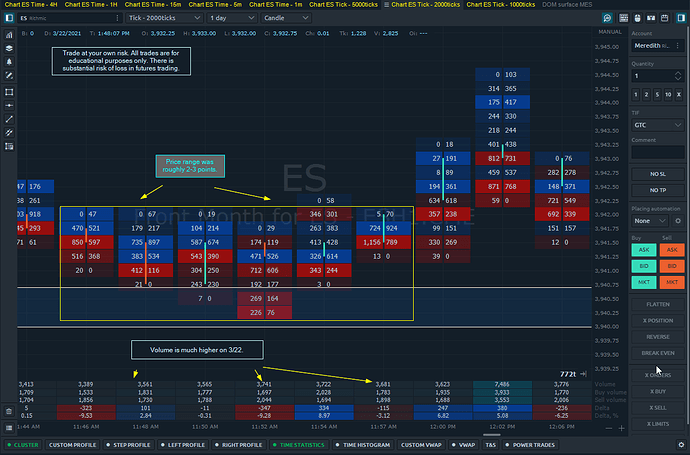

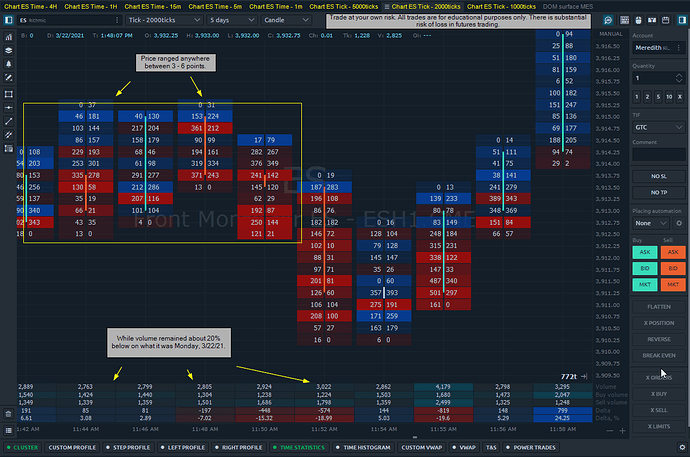

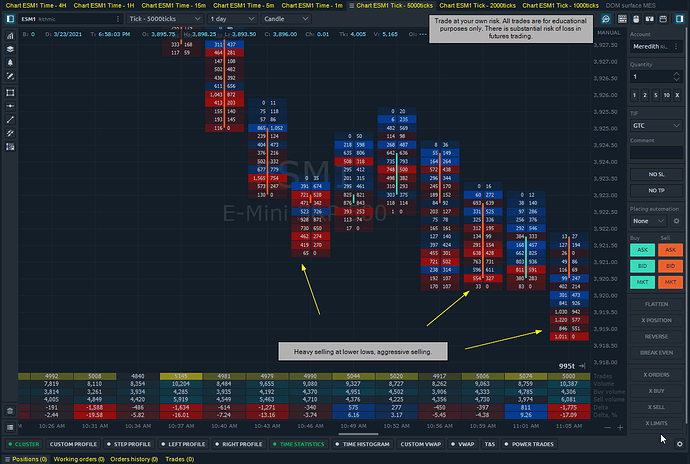

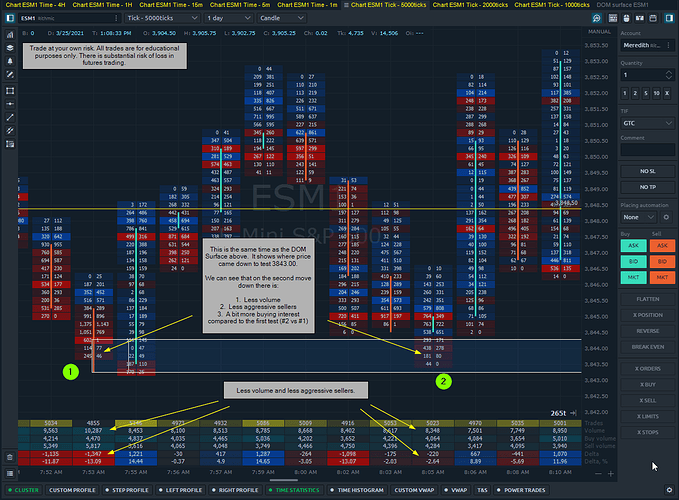

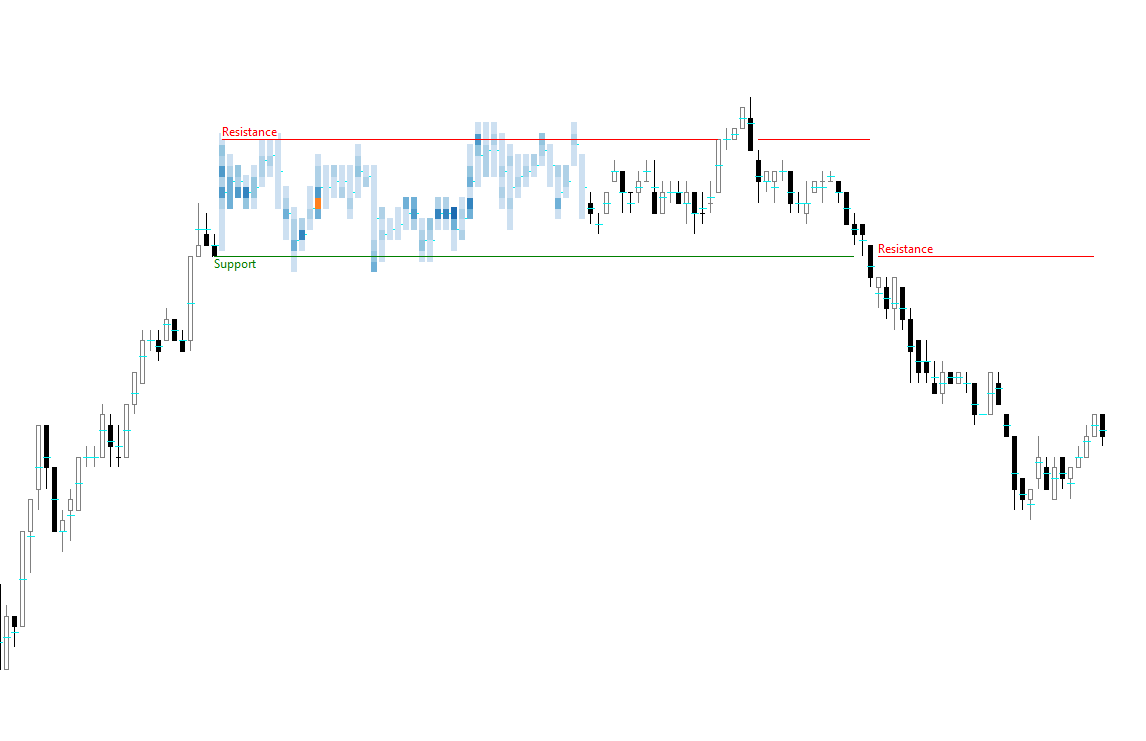

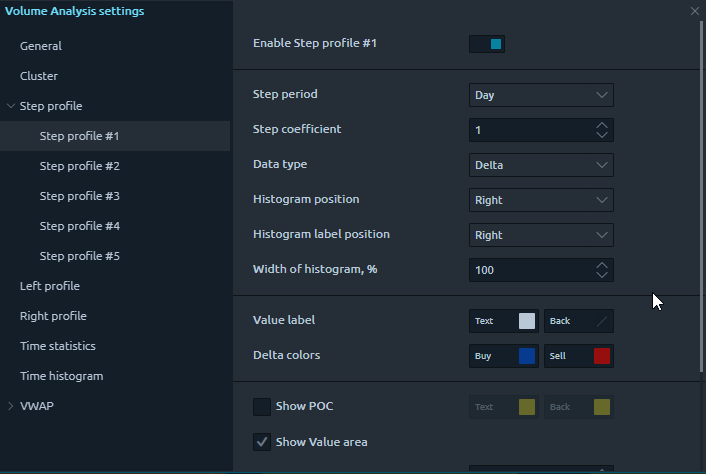

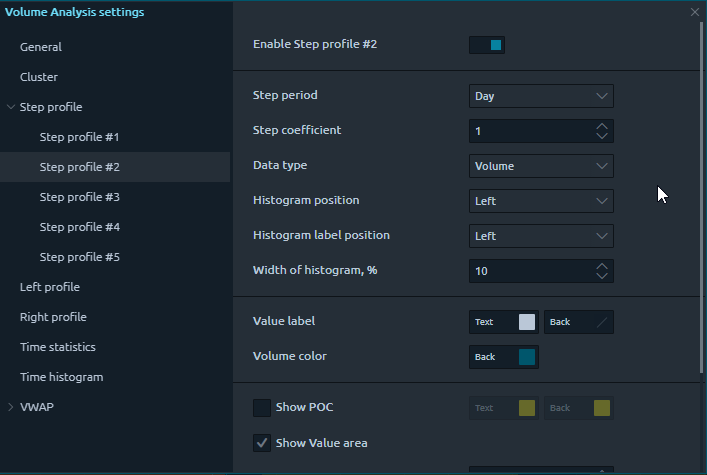

The Footprint chart, the way I have it setup, shows the market orders coming in:

What this doesn’t show is how many contracts may be added to the bid or removed, which occurs all the time especially with algo trading.

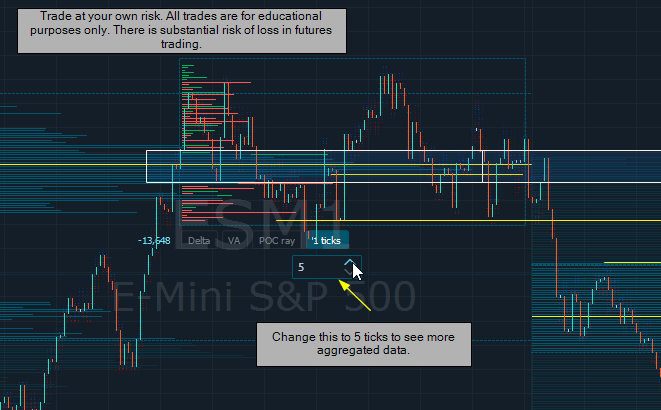

Why would knowing this information be important? Well first it gives us an idea of what the “Passive Buyers” are doing and where their sentiment is.

If we saw a 13 lot sell at market then someone reload on the bid for another 400 contracts, I would want to know that. Alternatively, it would be telling us important information if people started removing their bids.

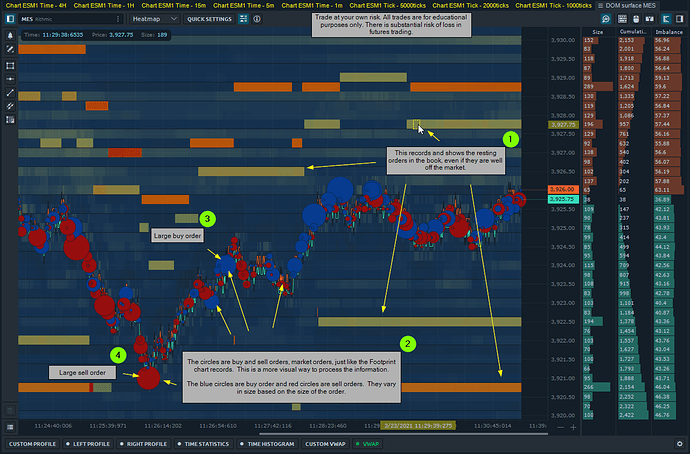

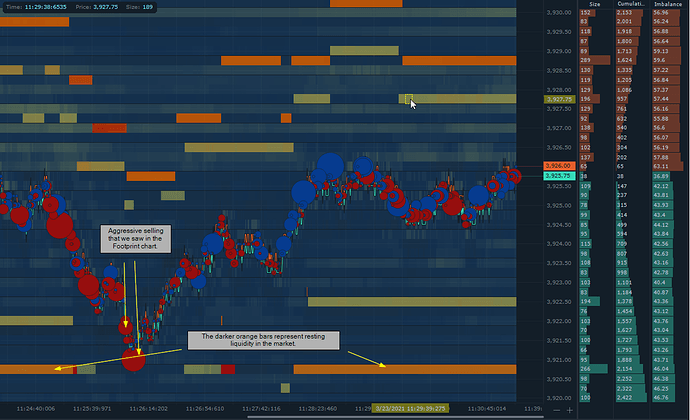

This chart can be edited to your liking, with the ability to change the size of the circles and also change the minimum trade required to trigger one.

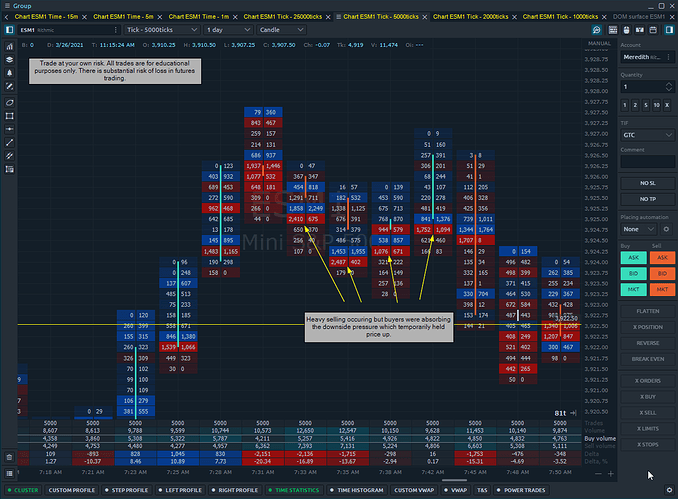

It is easy to think we can use this chart as something to lean on in terms of support and resistance, however, it’s very important to not get caught up with this on it’s own. Just like trading with blinders on, it’s easy to get sucked in.

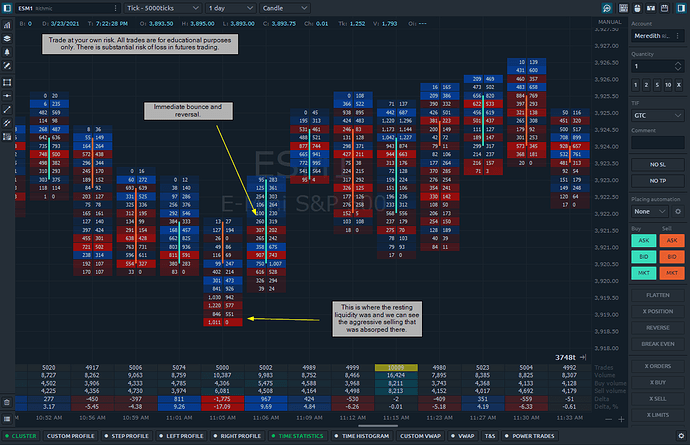

We have to use this together with our overall strategy and plan while utilizing the Footprint chart to validate our ideas.

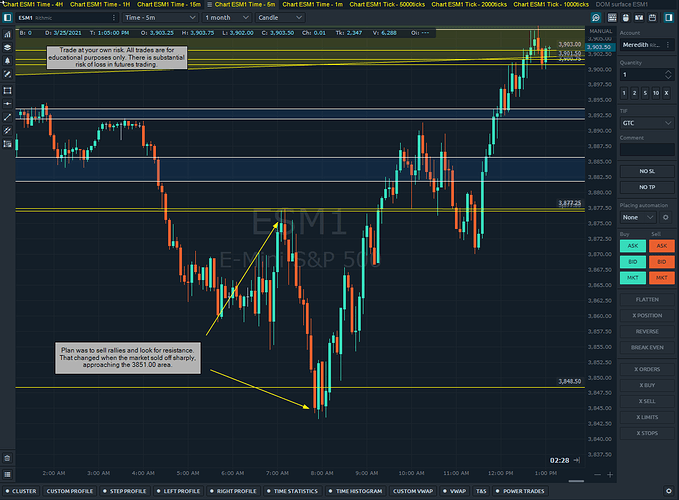

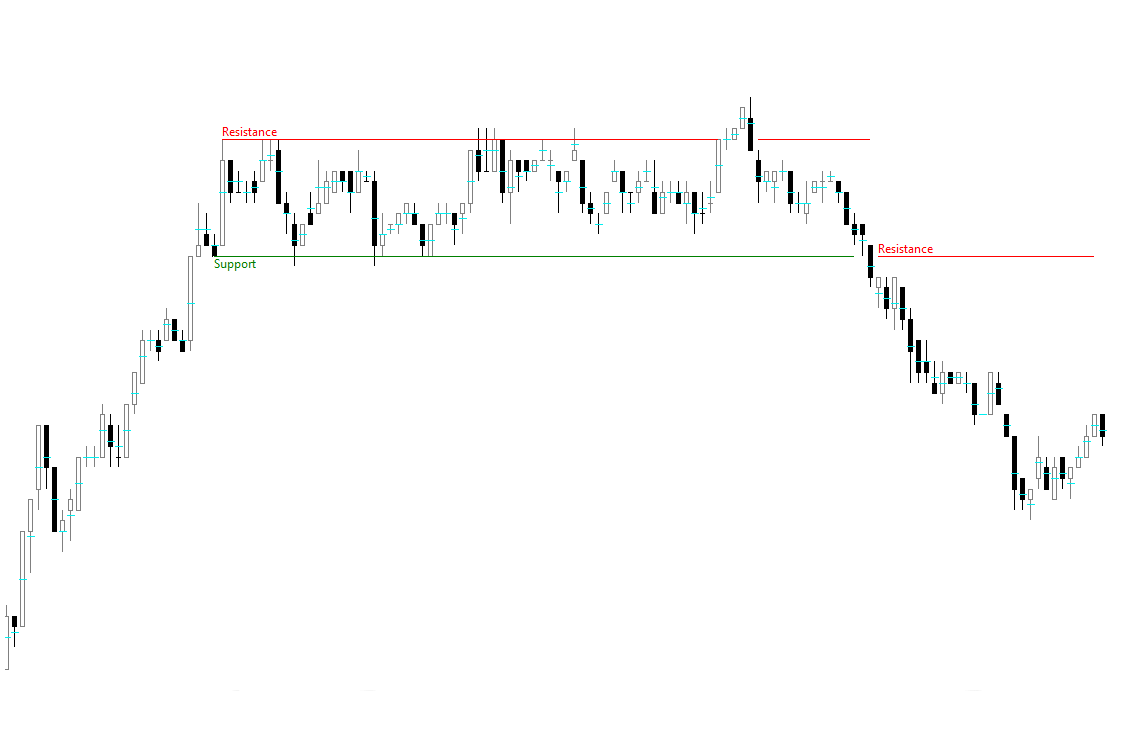

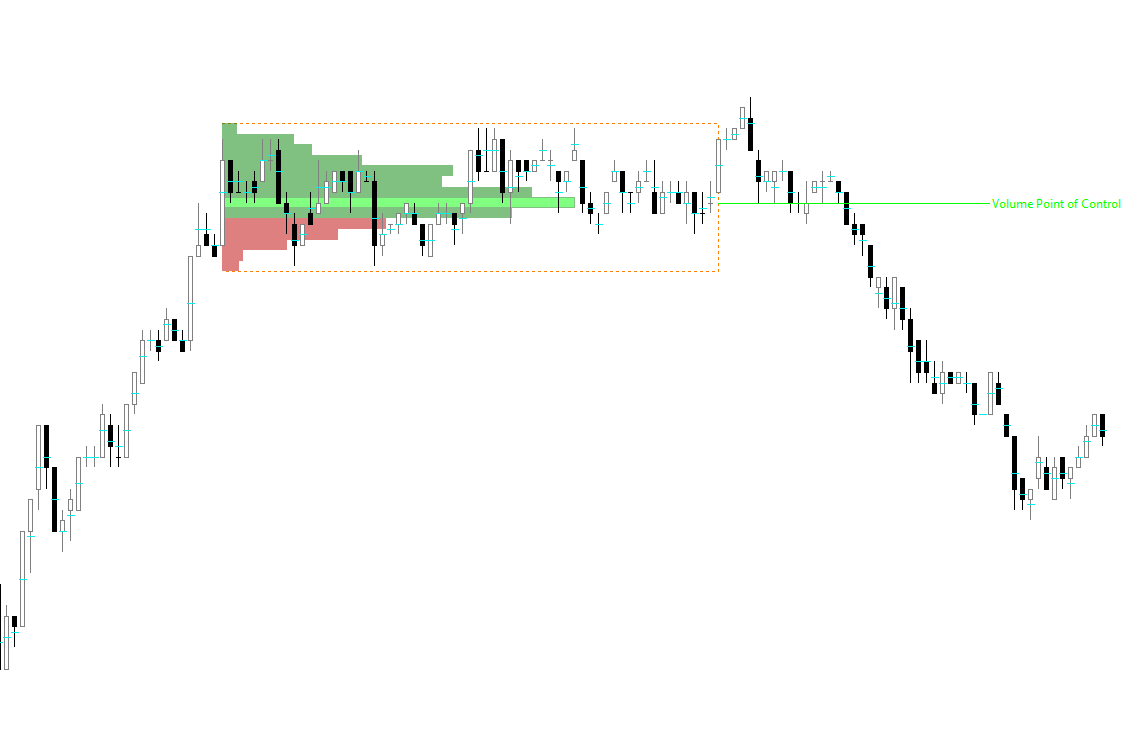

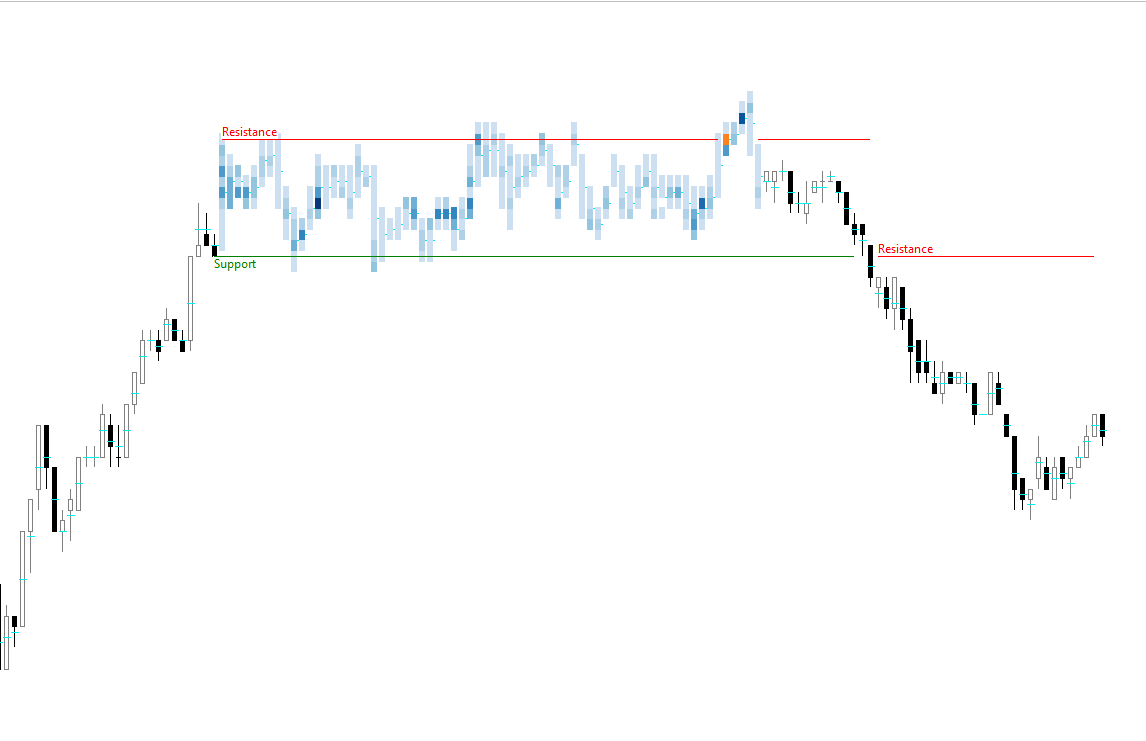

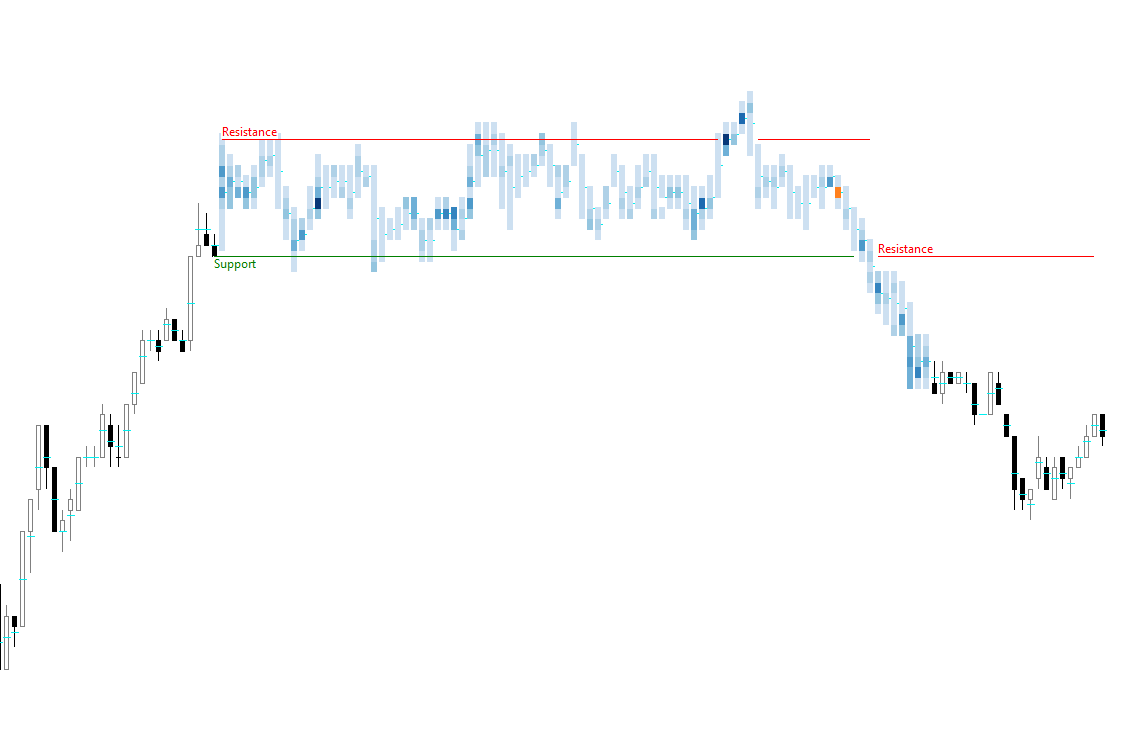

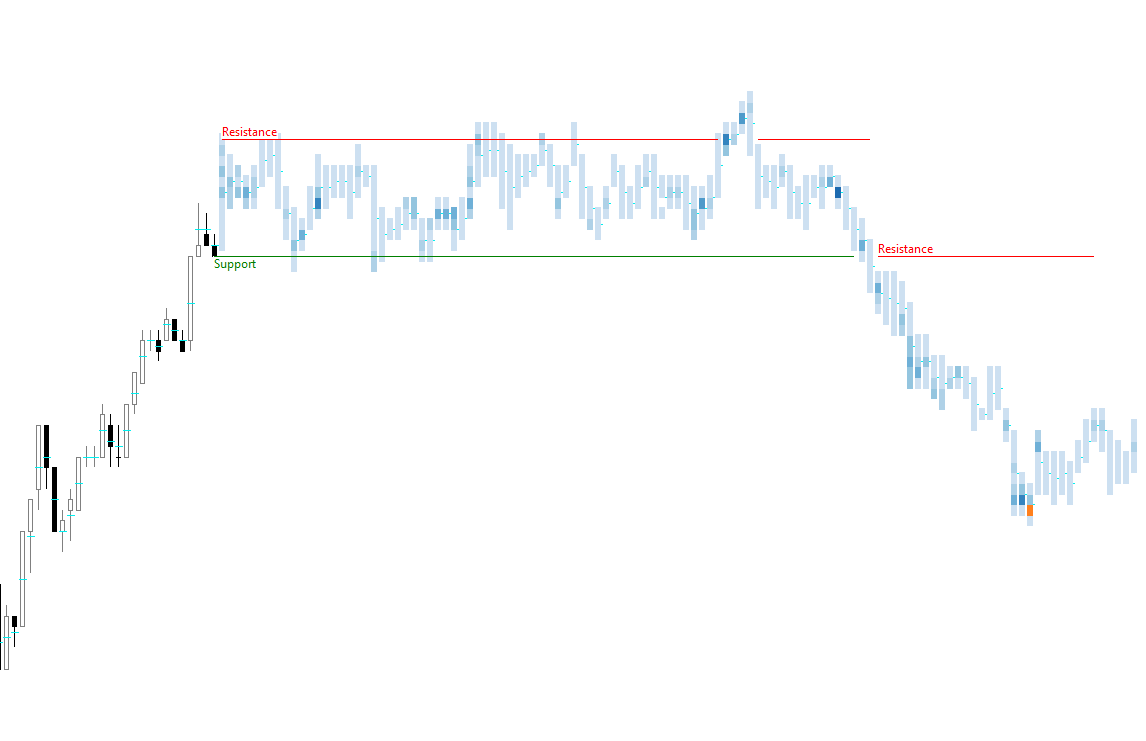

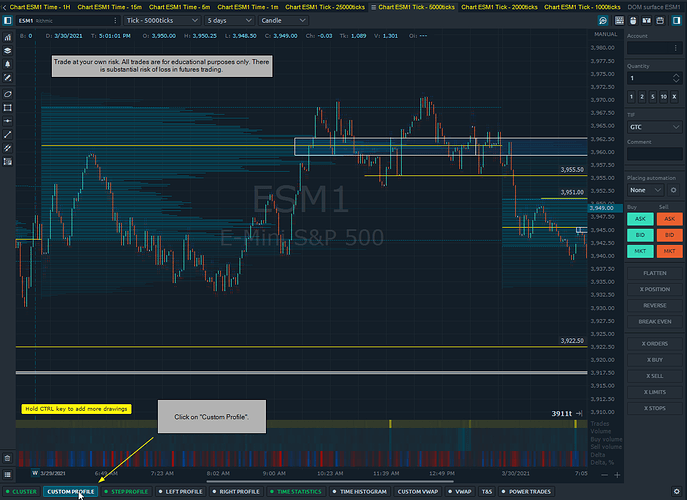

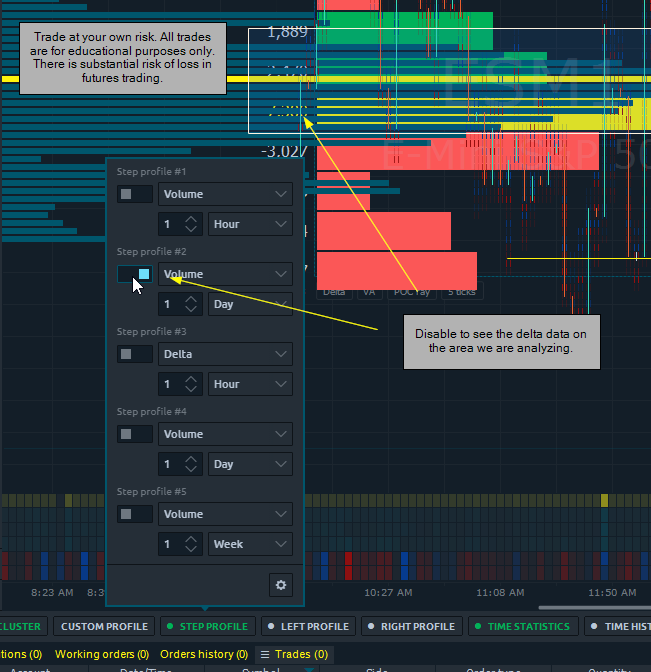

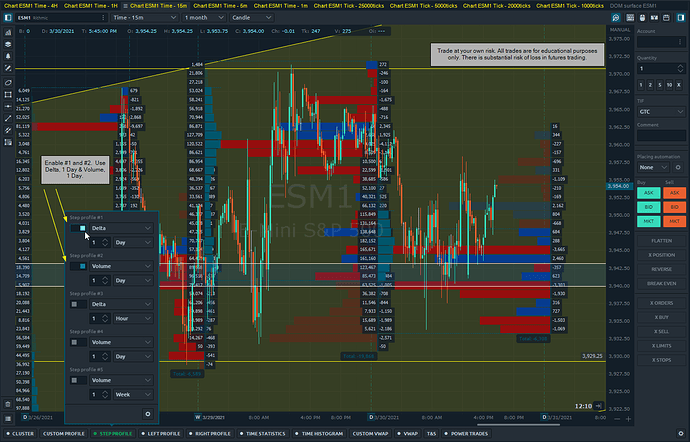

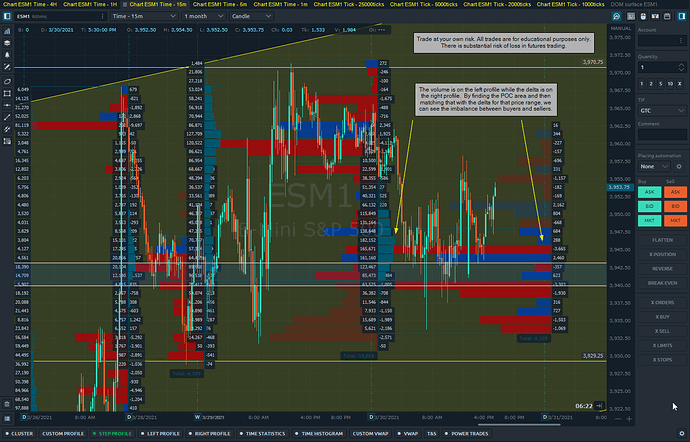

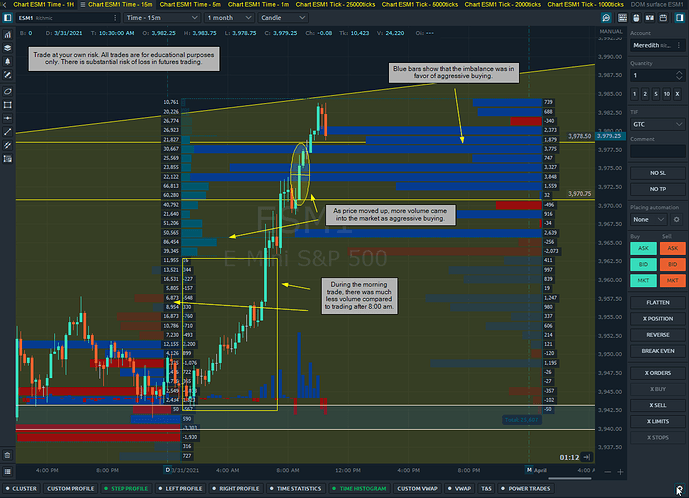

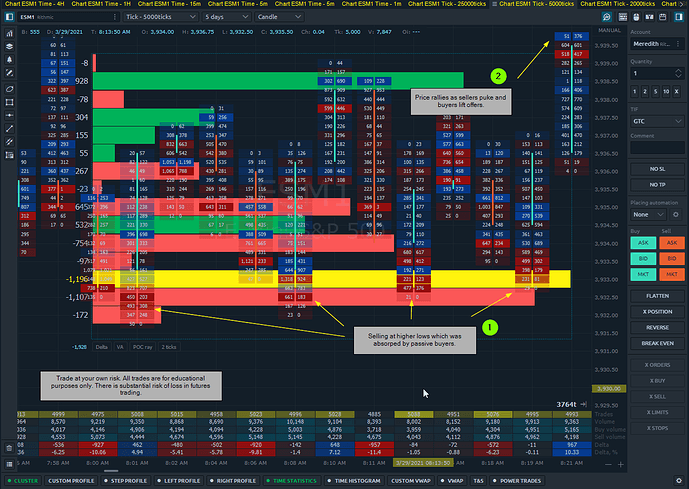

Let’s take this example from today, price came down to 3920.50 area and bounced right off, here’s the Footprint chart first:

We can see lower lows with aggressive selling, the sellers are obviously in charge here.

In order for this market to turn, at a minimum it would need for the buyers to take over.

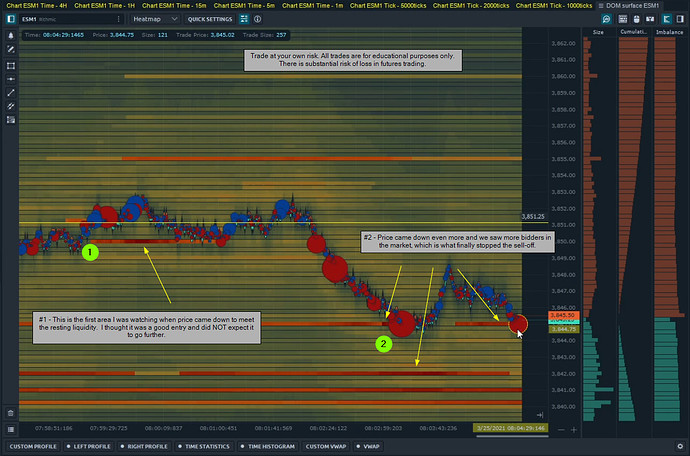

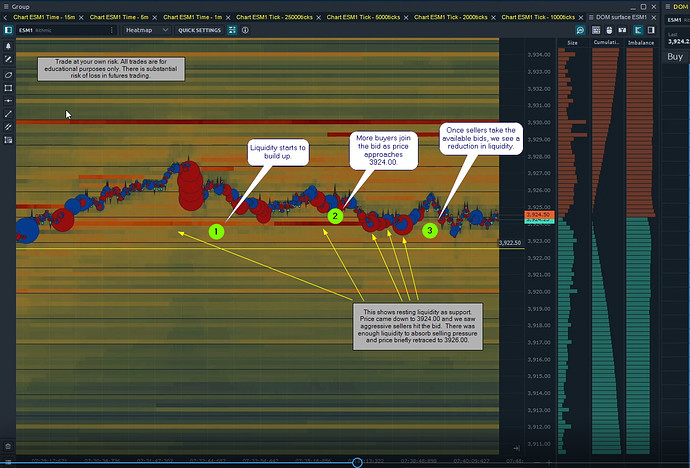

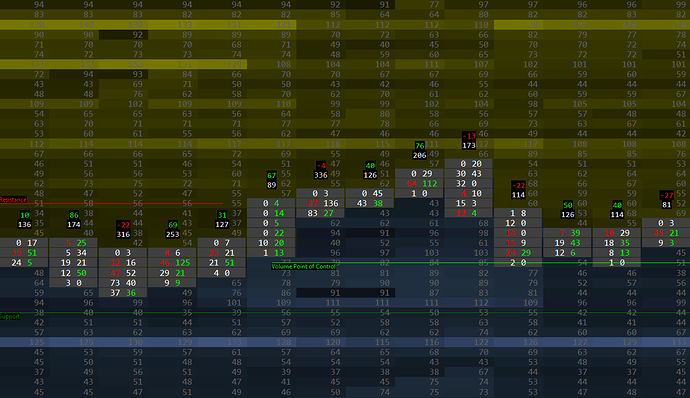

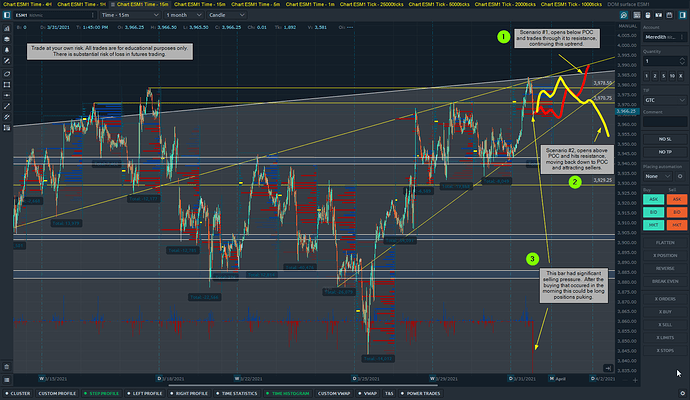

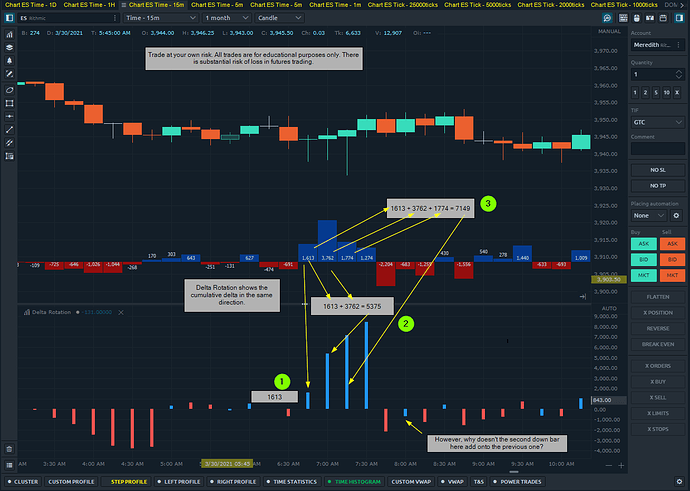

Now, let’s look at the DOM Surface that showed resting orders in this area:

Note: the below chart is actually of the MES (micro es mini) but it does correspond with the es mini dom surface.

The orange line on the bottom shows that there was resting liquidity before the market reached that area. As this chart moves it records where large orders were in the book. As you can see this is an easy to read visualization of where potential buyers and sellers are wanting to enter the market.

In this case, that area matched up with my charts and ALSO trading plan for the day. I did make this trade but my execution was very very sloppy.

Price immediately bounced off that area and went to 3,926.50.

The bonus here is that on a trade like this, we can see the passive buyers soaking up the selling and lean on them a bit.

There is a substantial risk of loss in futures trading. Past performance is not indicative of future results. The figures here represent an opinion. The placement of contingent orders by you or broker, or trading advisor, such as a “stop-loss” or “stop-limit” order, will not necessarily limit your losses to the intended amounts, since market conditions may make it impossible to execute such orders. Please conduct your own due diligence if Futures are an appropriate instrument for you.

make a post about it.

make a post about it.