Fakeout leading to buyers puking.

It’s hard to determine when a level will break or when participants will puke their positions. It’s a lot of, “if this then that” scenario. With any order flow data, it’s still very important to take into consideration the most likely situation.

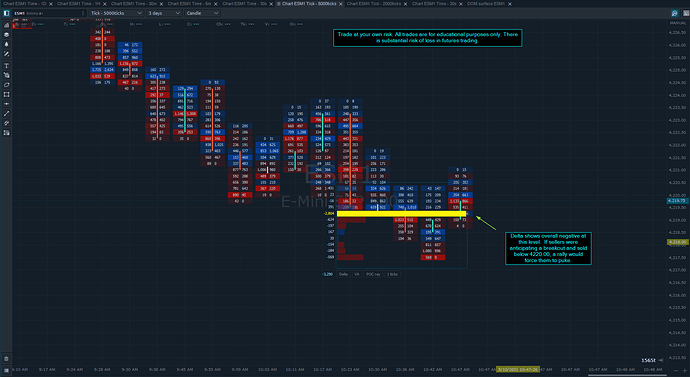

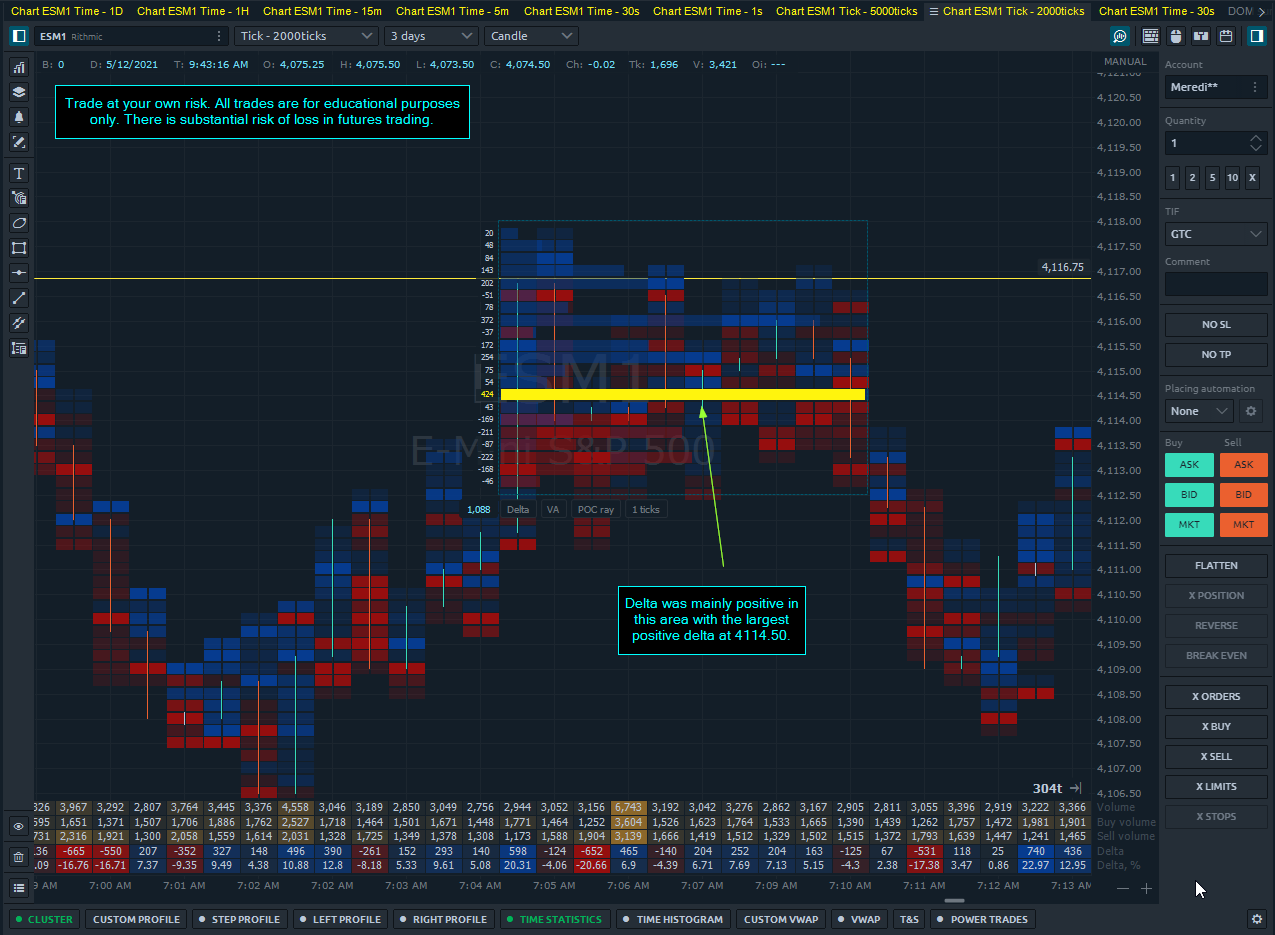

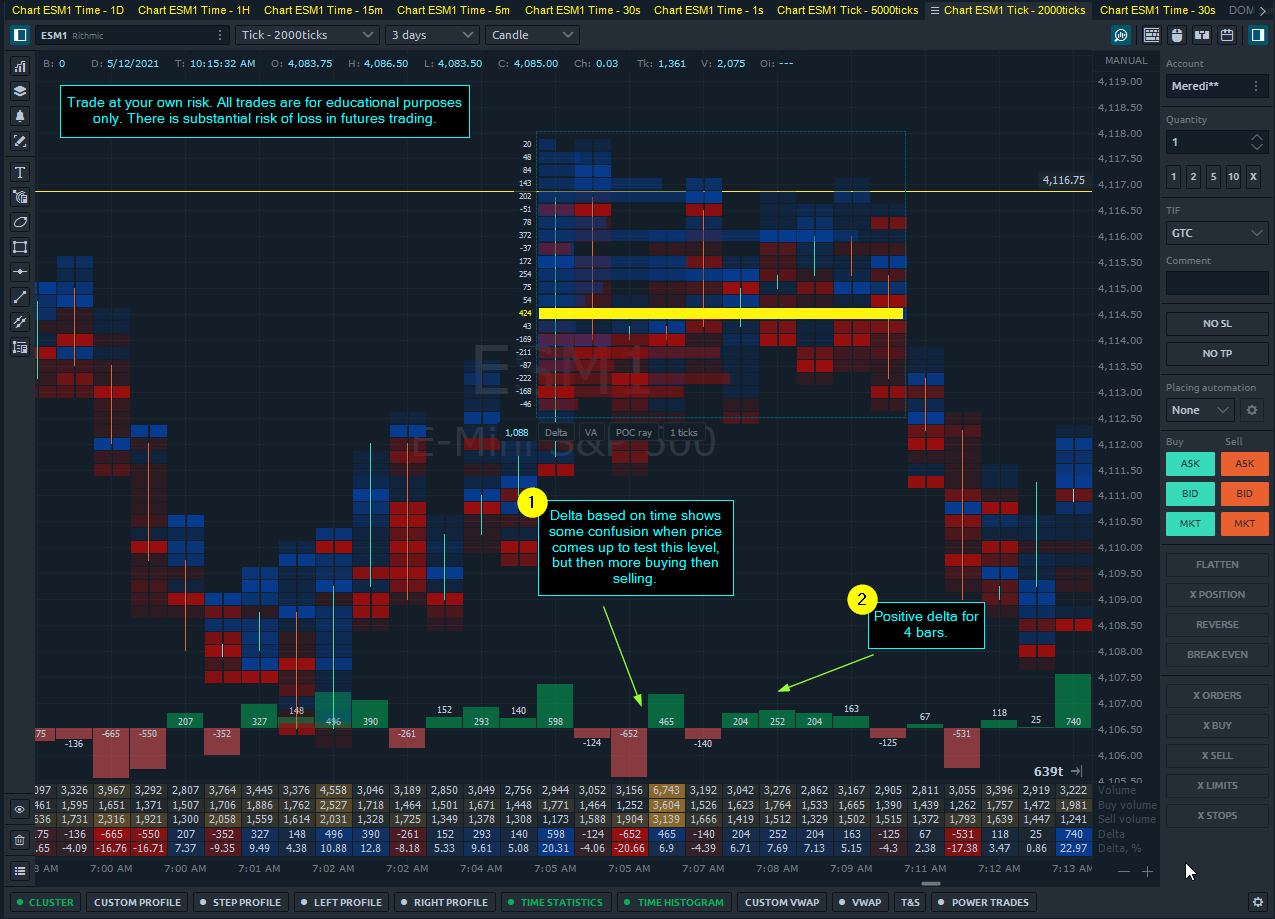

In this case, there was a pattern forming that appeared to be a fake breakout to the downside. Sellers gained momentum below support, yet price held just below support without continuation.

Price started to travel back above support, potentially forcing sellers to buy. The moment buyers started to lift offers, sellers came in and the bids backed off, driving price down.

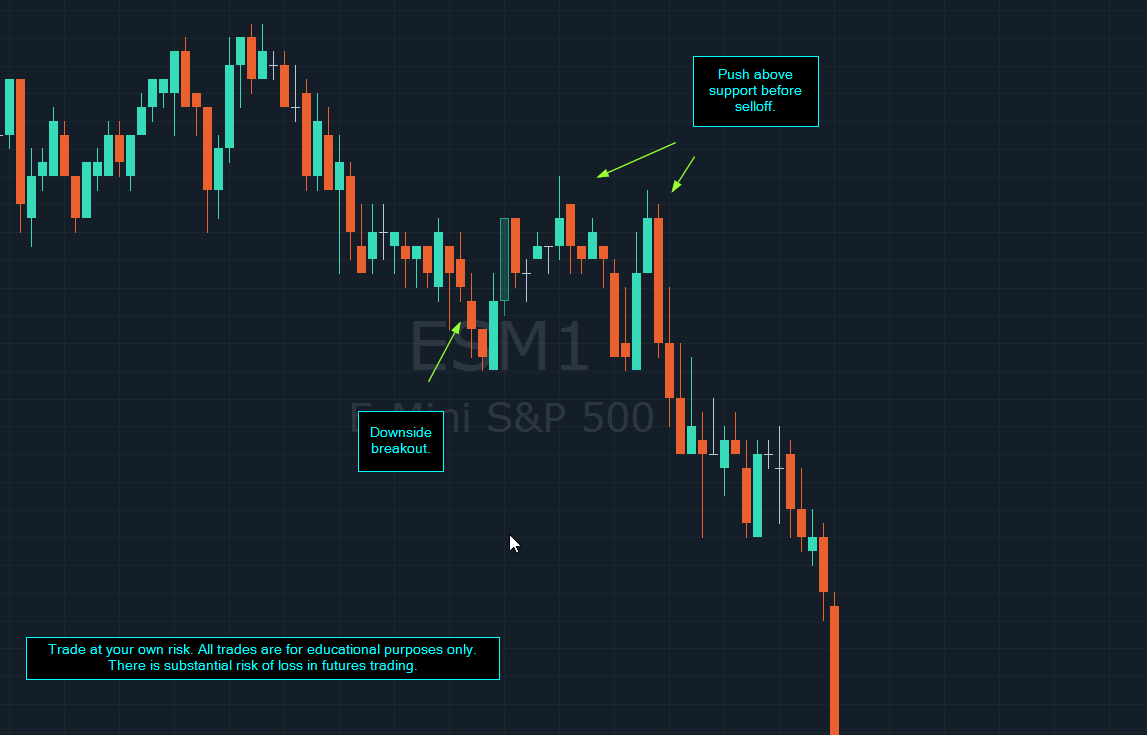

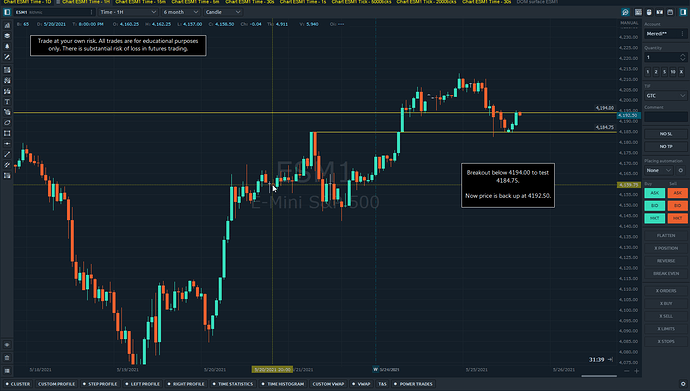

Here it is on a 30 second chart:

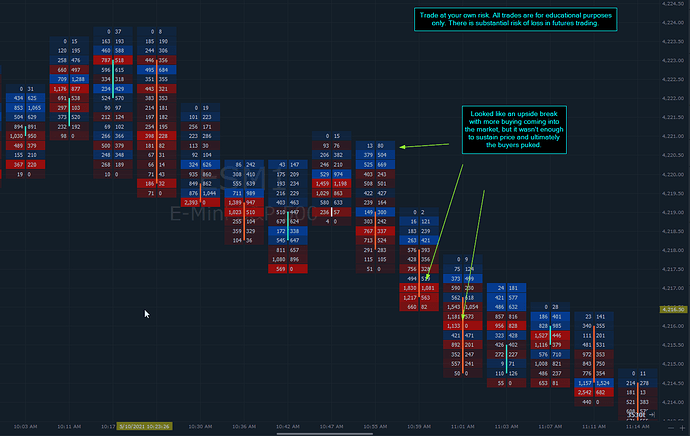

As we all know, there’s no way to tell. I didn’t trade this, but I did think it was a short-trap and it would go back into the range and rally. The market felt strong and it seemed that buyers were dominating early trade.

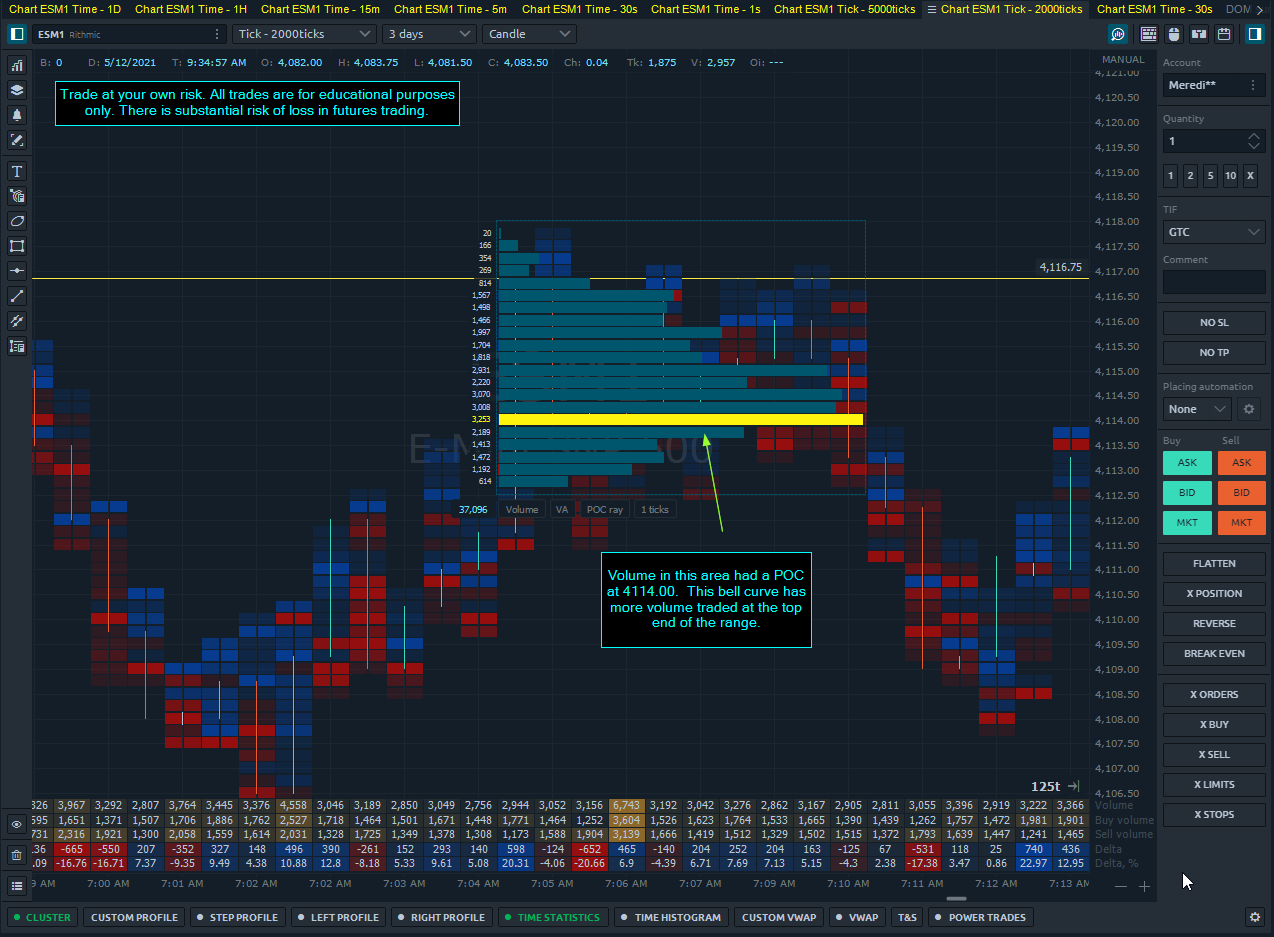

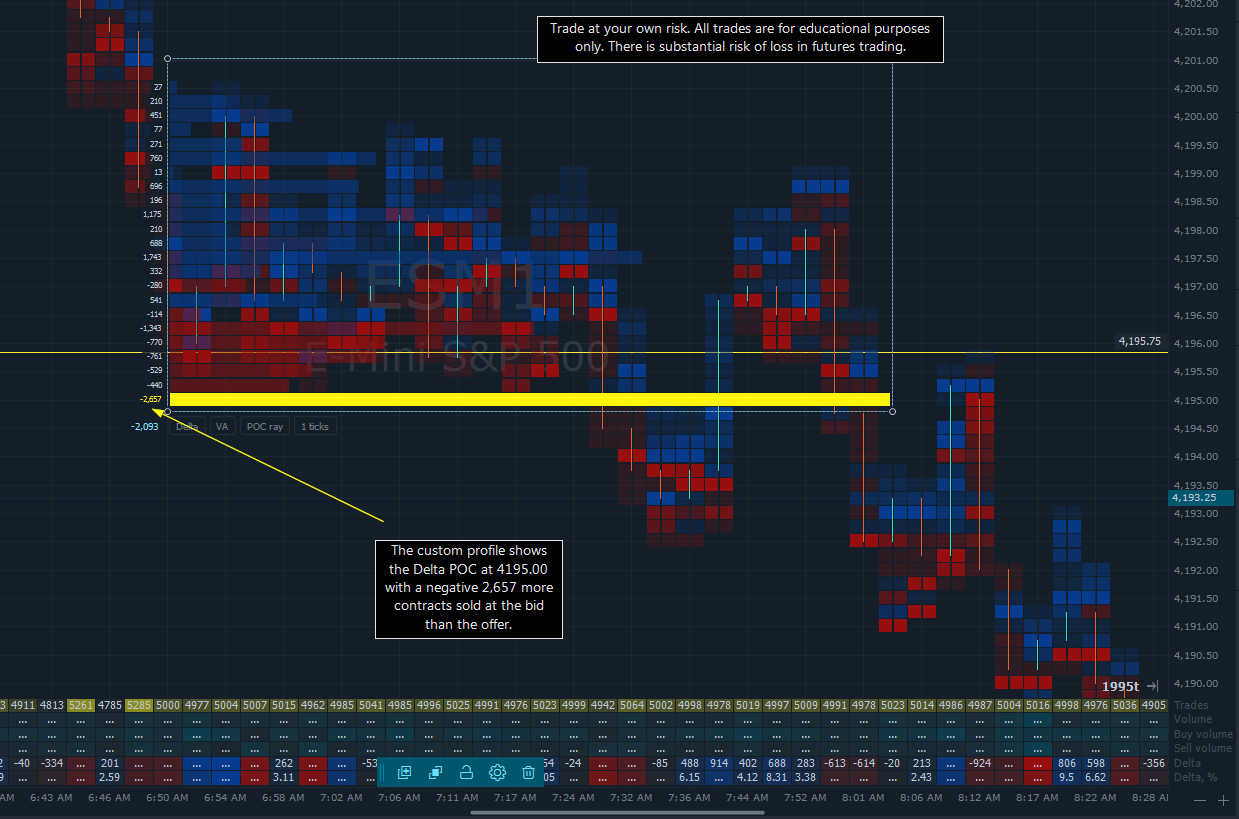

Once the buyers couldn’t push it back into the range, I should have shifted gears and gone to the short side. I also forgot that I spotted this at the open:

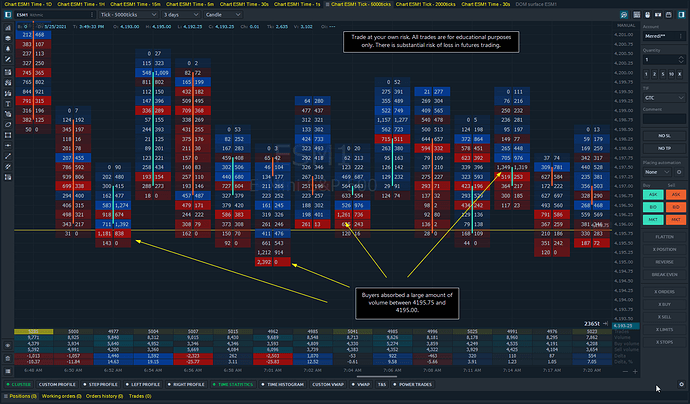

It very well could have gone up from here, but if I was quick to react I could have seen the short potential.

Not only would we have new traders entering the market on the pattern, but there would also have been existing long traders needing to puke their positions. This ignited the sell-off today.

There is a substantial risk of loss in futures trading. Past performance is not indicative of future results. The figures here represent an opinion. The placement of contingent orders by you or broker, or trading advisor, such as a “stop-loss” or “stop-limit” order, will not necessarily limit your losses to the intended amounts, since market conditions may make it impossible to execute such orders. Please conduct your own due diligence if Futures are an appropriate instrument for you.