@AndyHuan I apologize, but your original diagram was closer to what we think is right. This[quote=“AndyHuan, post:5, topic:1961, full:true”]

Dear Mod-MottZ

One last time confirmation with you again.

As I revised what I study or know as below, can you please correct me again?

Please advice.

Thank you.

[/quote]

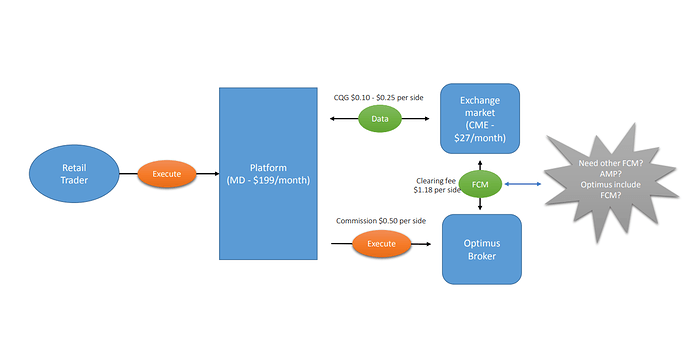

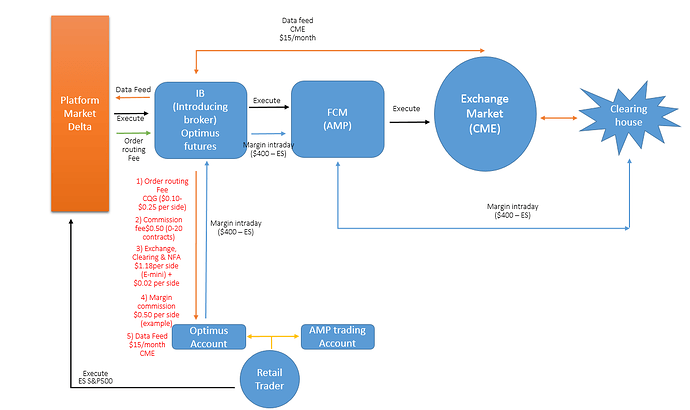

Hello @AndyHuan we feel that the first diagram was closer to what we think is right. Your second diagram implies that Optimus Futures intercepts orders and that is not correct. We use DMA (Direct Market Access) where the trades go directly to the exchange. However, there is another component where the risk side of the FCM does authorize whether the trade can go through. This is set when you establish an account.

Further, we are not sure what the arrow means from the exchange to the clearinghouse. If you say that your trades are reflected in the account that you carry with the FCM, then this is correct. The trades get executed ONLY on the exchange level. Maybe you come from the FX world where trades could get executed and carried by a broker, but with a regulated futures contract, execution can only happen within an exchange.

Further, there is only ONE fee attached to an FCM clearing and that is set once the account is carried.

We have attached a diagram that demonstrates what we consider to have the right flow of things while keeps things generic.

We hope this helps and you can see a bigger image here: Futures Trading Infographic | Understanding the Trading Landscape

At this point, we feel that we need to close the thread because our diagram should answer all questions as far as clearing. When you establish the account with Optimus Futures, we assure you that the flow execution, orders, FCMs and IB make become much clearer. We encourage you to ask many questions about the functionalities of the MarketDelta platform. Tihs is why we also built this forum. You can ask about order placement, certain button functionalities, etc.

Thank you and we look forward to our future communication.

Matt Z

Optimus Futures Support