@Project11

Thank you so much for following up on this thread, I’m sure many traders down the line will find this information very helpful.

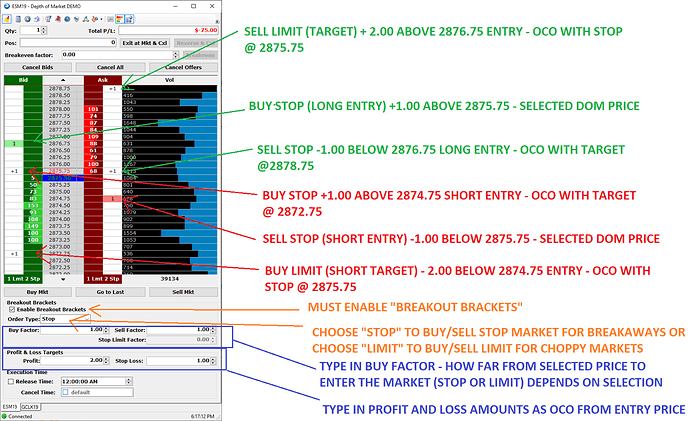

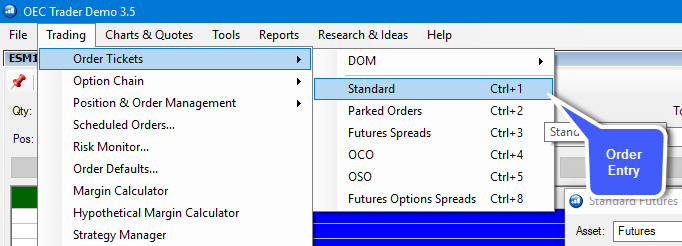

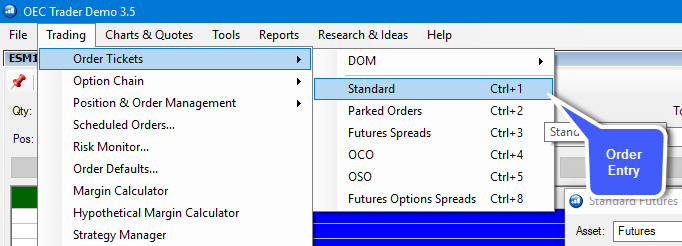

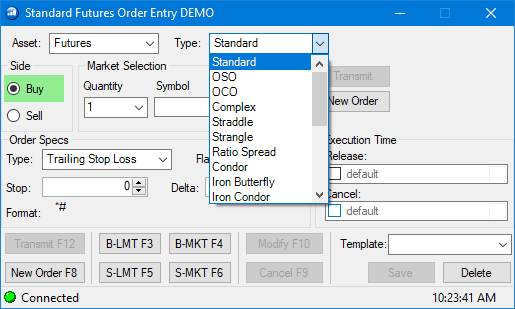

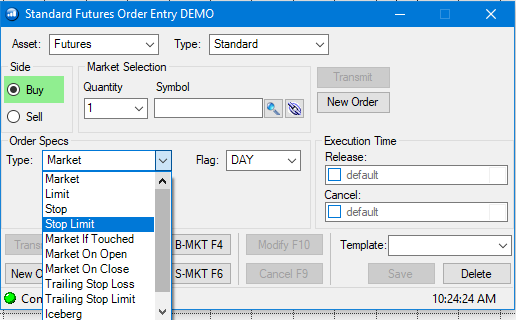

I’d also like to mention that for anyone interested, you can also place Advanced Order Types (OSO, OCO, Complex, Straddle, Strangle, etc) along with Advanced Order Specs (Trailing Stop, Trailing Limit, Brackets, Iceberg, etc) within the Order Ticket window. This can be opened by navigating to Trading > Order Tickets > Standard you can also use the Ctrl + 1 shortcut on your keyboard.

I felt this was worth mentioning because it provides an alternative solution for those traders who do not actually place orders through the DOM. The order entry window allows users to place more additional order types (like those mentioned above) and also allows for advanced tactics such as delayed execution/cancel times.

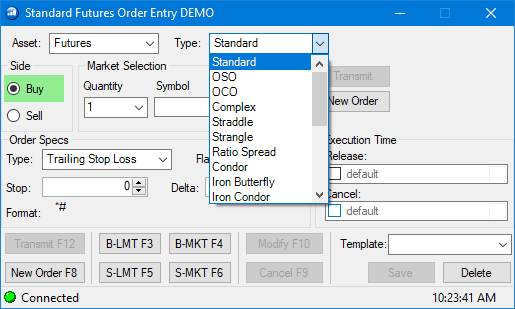

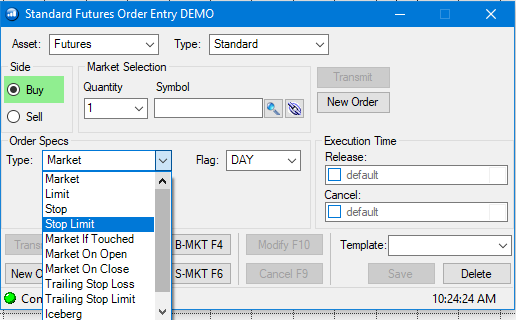

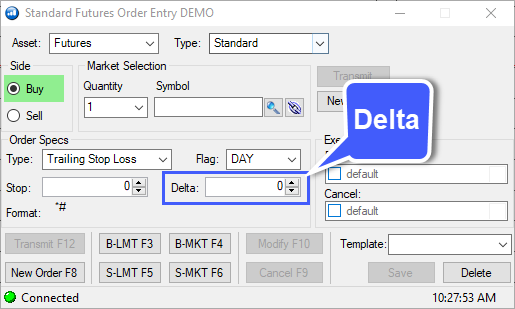

Feel free to look at the Order Entry windows below to take a look at the order types and specs that can be configured.

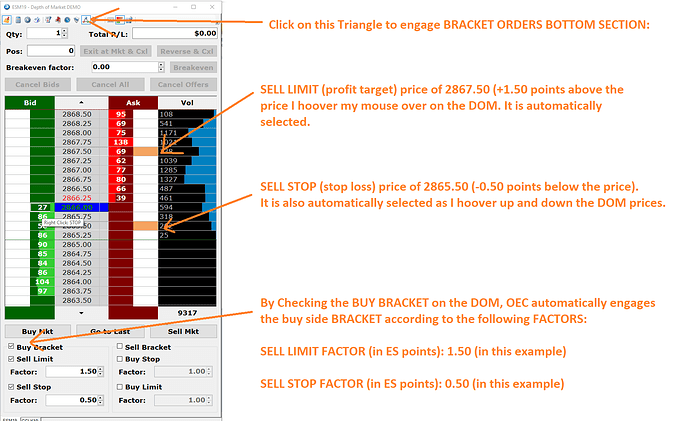

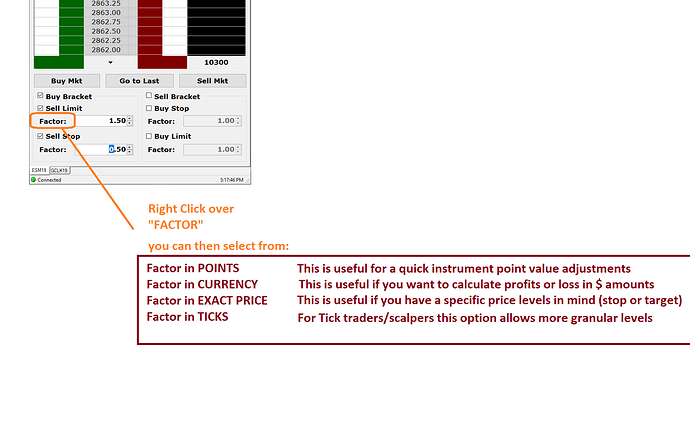

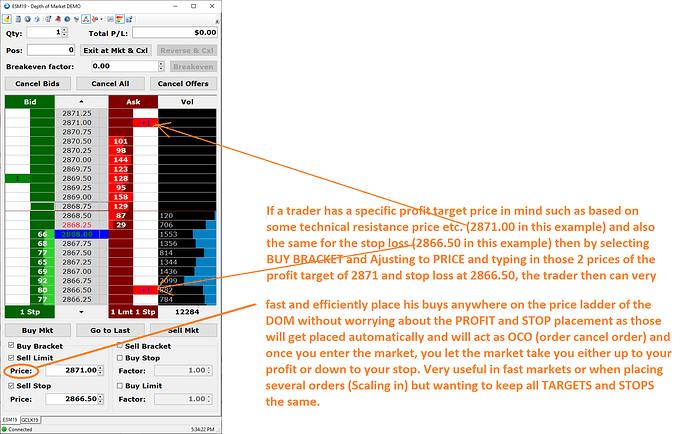

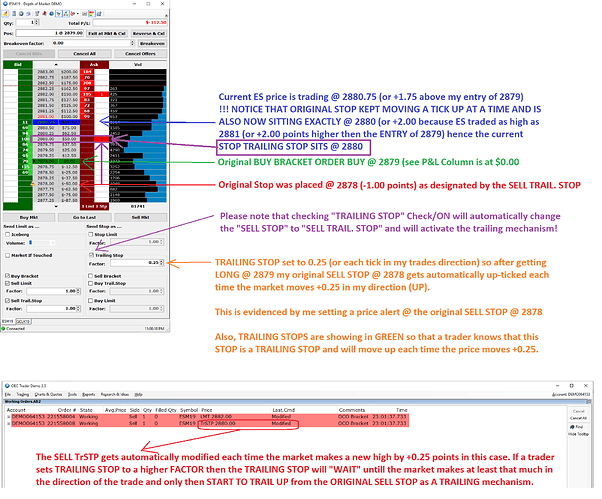

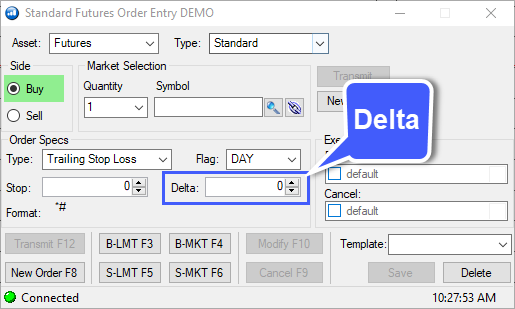

I also wanted to mention the order entry window for a specific reason, Delta. You’ll notice that if you configure a trailing order under a standard order type, you’ll be presented with a Delta field as shown below. This has caused issues for traders in the past because there’s no clear definition of what Delta means. You’ll notice that if you switch your order type to an OCO or OSO, the Delta field will disappear and instead you’ll be presented with a Factor field as it is shown in the DOM.

After reaching out to Gain Capital, we’ve determined that Delta is apparently just another word for factor. Factor refers to an incremental numeric unit used as a specific value to increase of decrease the stop order by, i.e., .50 in the first box increases the stop value by the factor of .50; The same concept works the second factor box in that it affects the Limit.

According to Gain customer support, " All delta is, is the factor. So, when the market moves by factor(delta) the TRL STP moves."

If you plan on trading through the order ticket, you can use trailing orders with OCO and OSO types as well. Under these order types, factor is displayed clearly (not delta) as mentioned briefly above.

So as you can see, Gain Trader (OEC) offers quite a few alternatives to placing bracket, trailing, and OCO orders on the platform. It is ultimately up to the trader which method they’d like to use, but with the information provided by @Project11, this gives a clear starting point for traders to approach this topic with.

If anyone has additional input to this topic, feel free to post a reply. We’d love to hear what you have to say about this. Once again, thank you @Project11 for your contribution, this was extremely informative and helpful!

Jake

Optimus Futures Support