What’s New? | Release Notes | Current Version: 1.96.1

Attention Optimus Futures community members and Optimus Flow users,

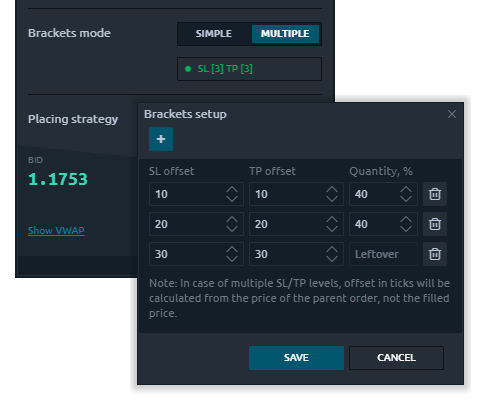

As of last night, we have launched our latest major update, Version: 1.96.1. This update has added breakeven stop loss orders, drawing synchronization, further DOM customization, automated order entry in the form of scheduled and time split orders, bugfixes and more.

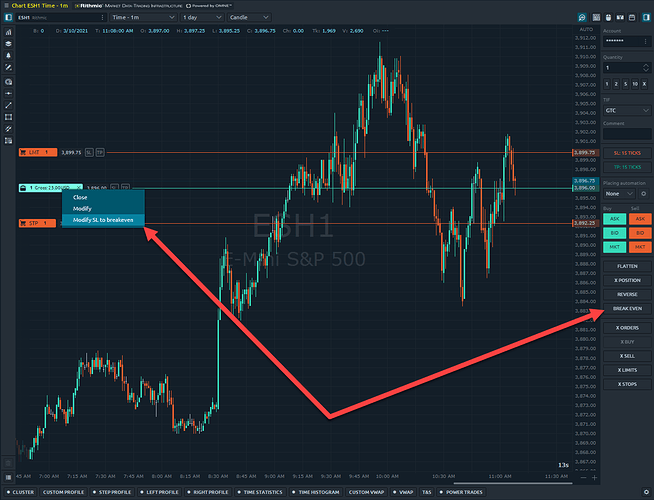

Breakeven Stop Loss Orders

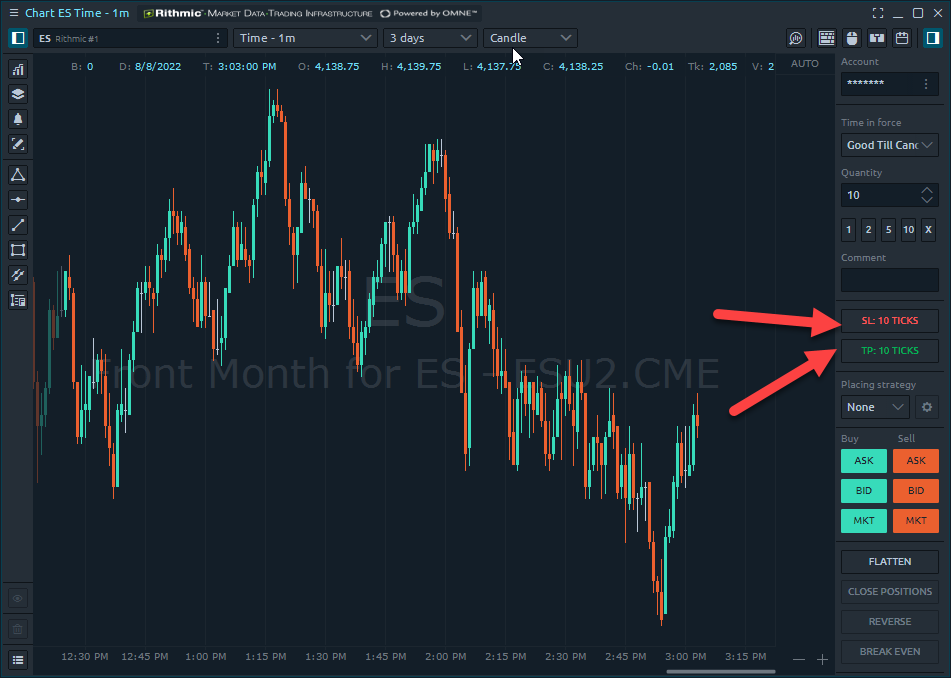

Users can now place a breakeven stop order. Replace or set a stop order for an open position to Breakeven with one click. When you click the button, all orders will be cancelled and stop order will be set to the position’s open price.

With this new addition, we’ve Added Breakeven to the list of trading hotkeys in the Chart, TPO Chart, DOM Trader, DOM Surface panels.

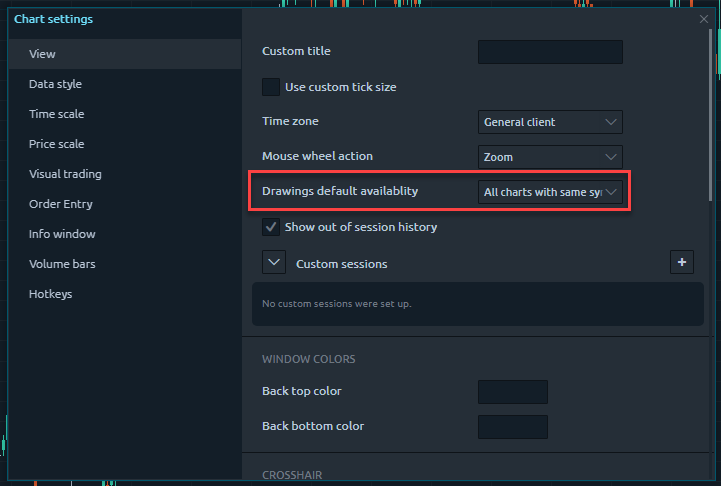

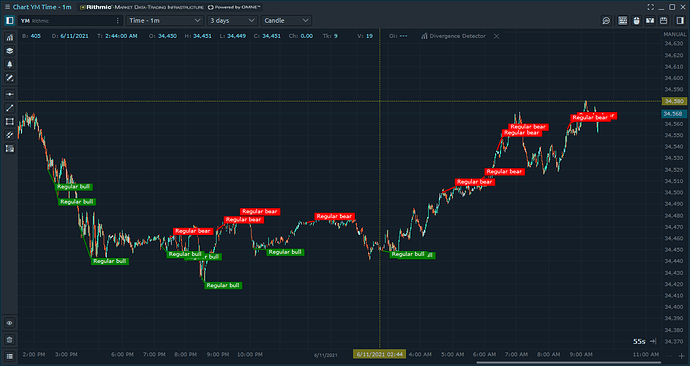

Drawing Synchronization

This new addition allows for synchronization between different charts with the same symbol. For example, if you enable this feature and draw a trend line on a chart for the ES any other chart with the ES symbol applied will also draw this trend line in the same exact location regardless of the chart type or aggregation settings.

In order to enable this feature, go to chart panel settings and set ‘Drawings default availability’ to ‘All chart with same symbol’.

For any users with existing drawings who would like this feature enabled, open a context menu of any drawing. Set ‘Availability’ to ‘All charts with same symbol’.

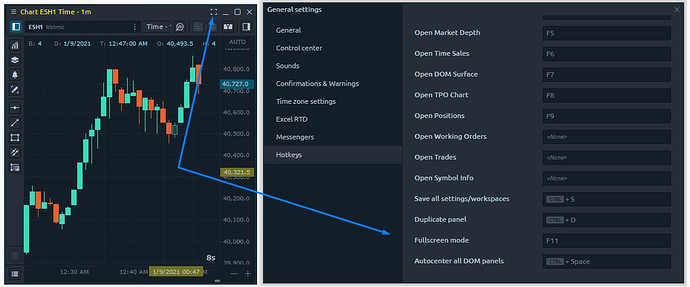

FullScreen Mode

Added the FullScreen Mode with the ability to manage the functionality of the panel without limitations — trading operations, adding indicators and drawing tools. Use hotkey or button on header of the panel to activate Fullscreen mode.

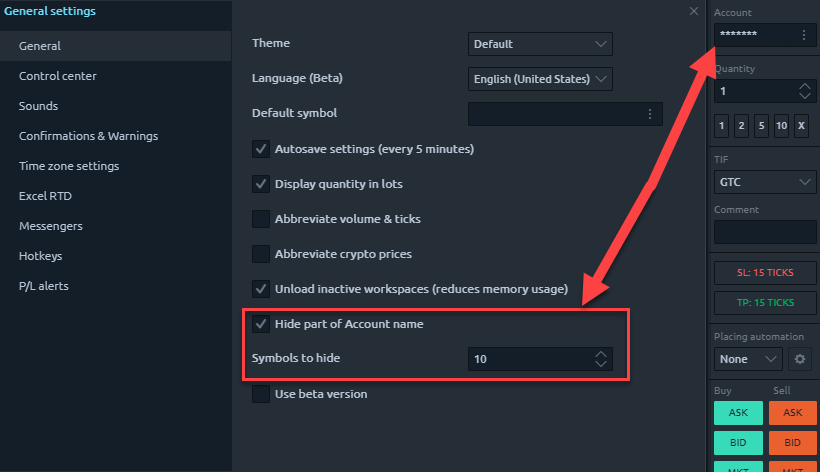

Trading Account Privacy

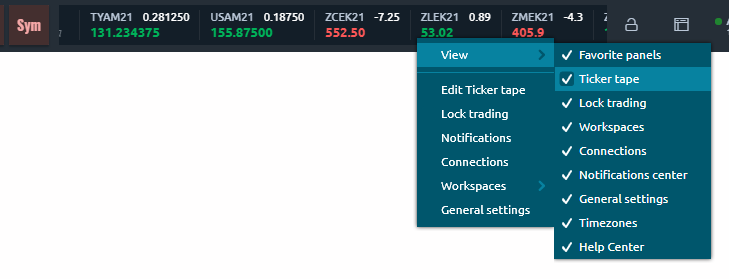

Keep the trading account privacy during screen sharing by using a new general setting — Hide Account name.

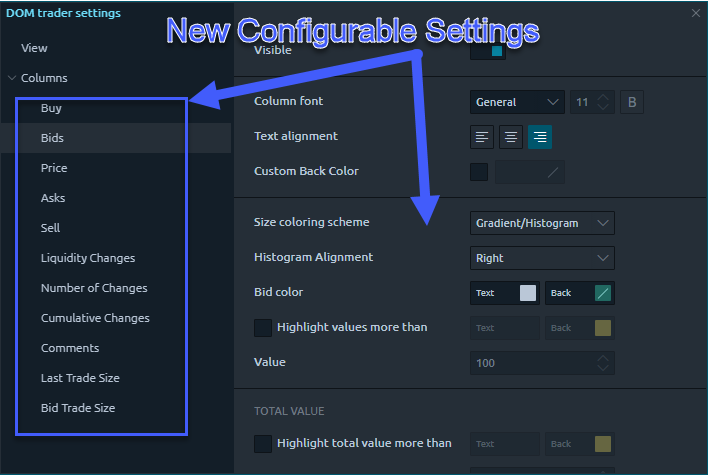

DOM Customization

-

With the latest version of Optimus Flow, you can make even more customizations of the DOM Trader panel, based on our community feedback:

-

· Highlighting Imbalance, Bid/Ask values — go to DOM trader panel settings → Columns → Imbalance and set filter for Bid/Ask or for Total value.

-

· Highlighting total values for Imbalance

-

· Reduce the price value by hiding the required number of digits

-

· Possibility to specify custom colors for any columns — go to the panel settings and specify colors for background, text, positive/negative value, etc.

-

· Possibility to specify a custom font for each column, total values, header.

-

· Possibility to adjust text alignment in columns

-

· Customization of visibility for all columns.

-

· New coloring schemes for Bid/Ask columns — now you can select Solid coloring mode for rows or you can disable any coloring here by selecting None mode.

-

· Possibility to adjust histogram alignment in Bid/Ask columns

In this version, we have also improved trading through the panel:

-

· Mouse-down trading. Reduced the time for placing orders through the panel. Instead of a full mouse click, orders are placed by the mouse down action.

-

· Trading via Bid/Ask. Placing orders through the Bid / Ask columns. Further management of existing orders is performed through the Buy / Sell columns.

-

· Refresh rate. Added the ability to control the rate (ms) of market data update. This determines how often the panel refresh changes in depth of market (depends on data provider). With a value of 1, all changes to the level2 data will be processed immediately. We recommend using value 100. Note, the smaller the value, the more system resources required.

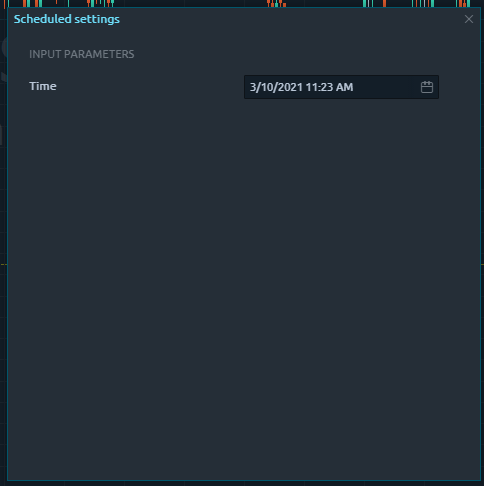

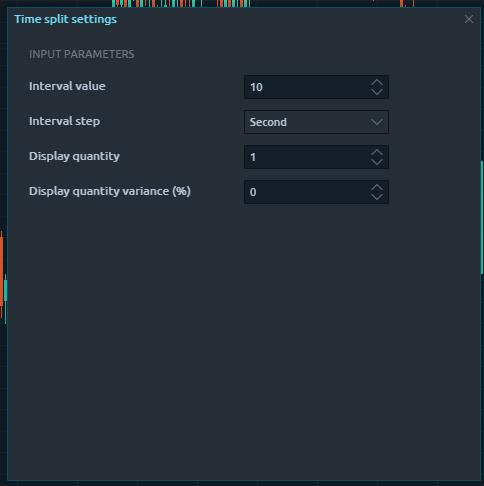

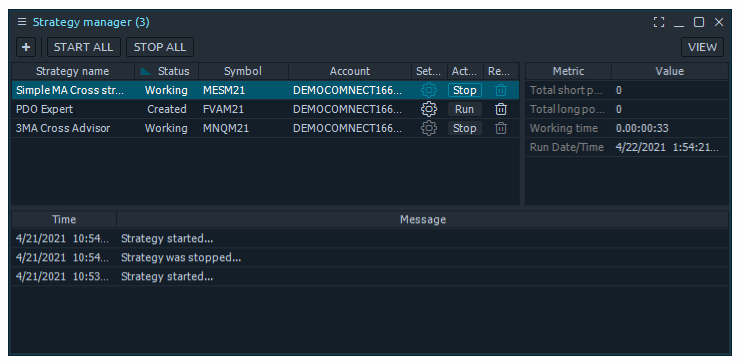

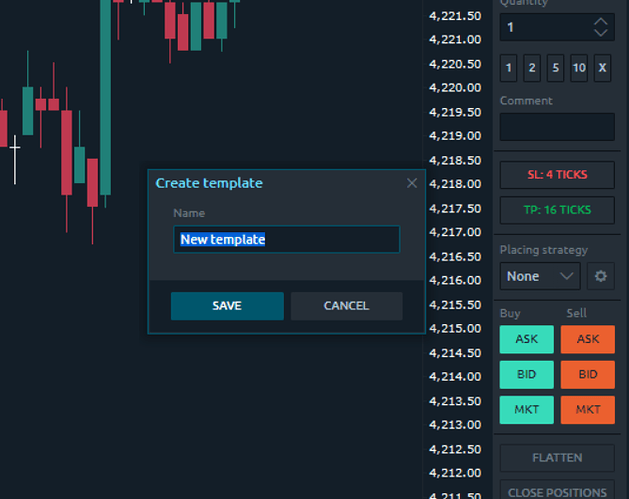

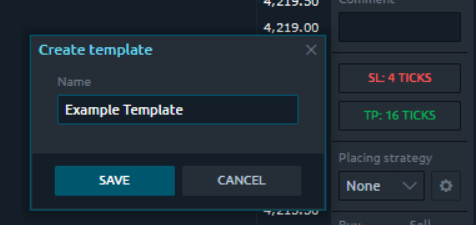

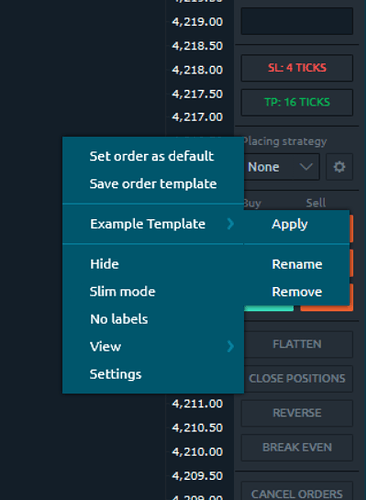

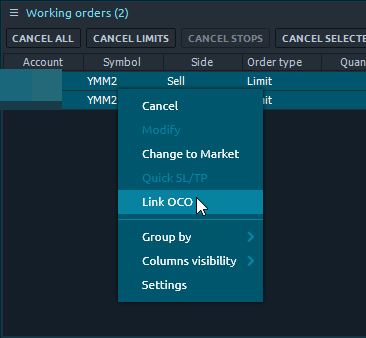

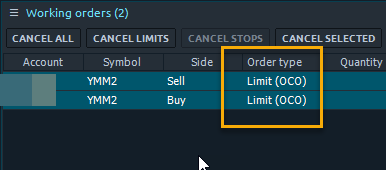

Automated Orders

Users now have the ability to use order placing strategies that can implement advanced trading algorithms such as splitting order by time or volume, Iceberg, local SL/TP, Traling, etc. In near future we will add more predefined strategies as well as provide a possibility to create your own.

-

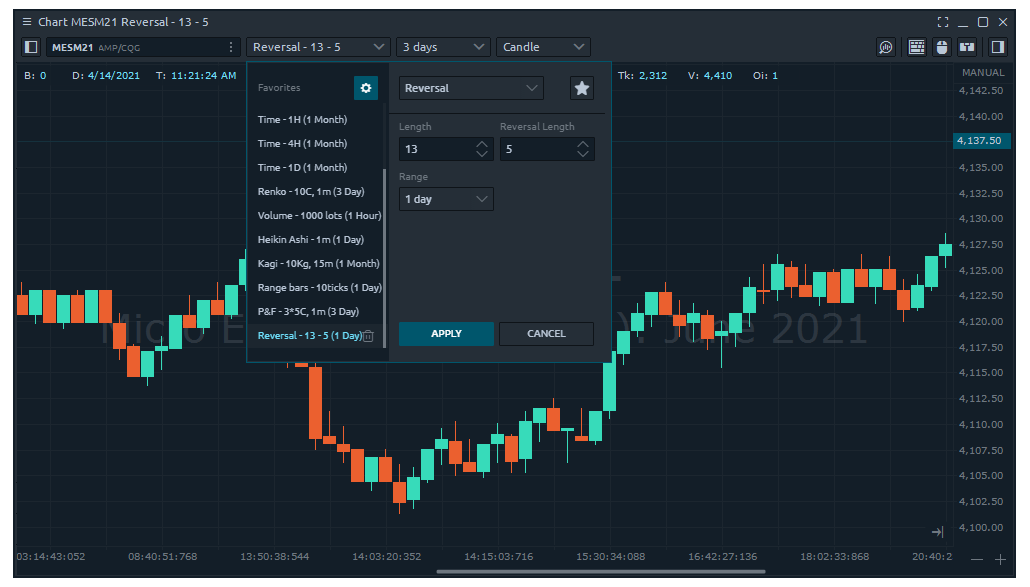

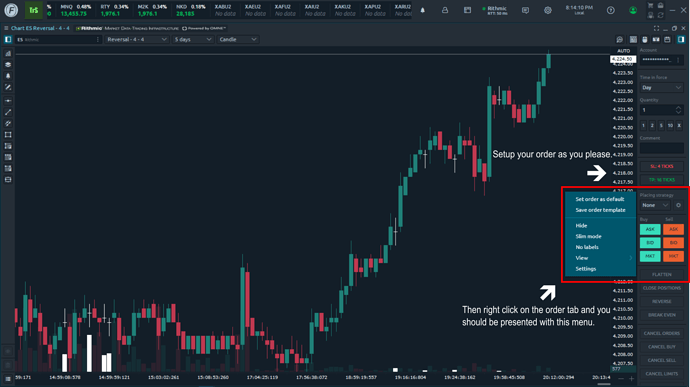

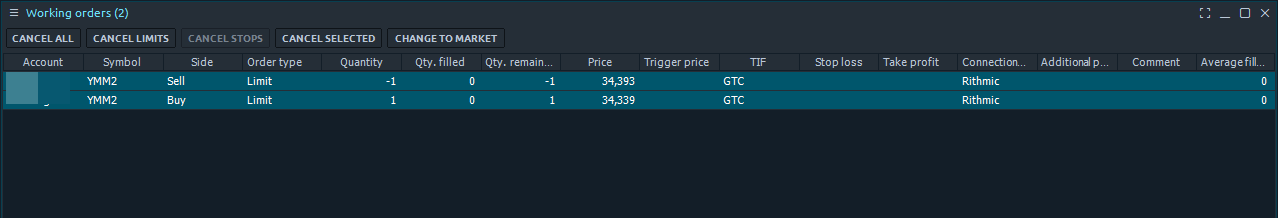

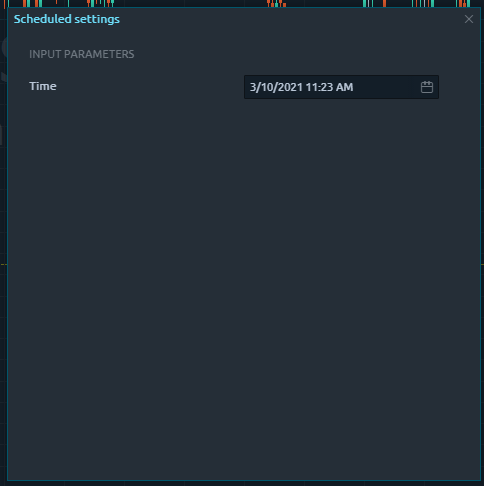

· Order placing strategy “Scheduled” This strategy will send your order at a specified time.

-

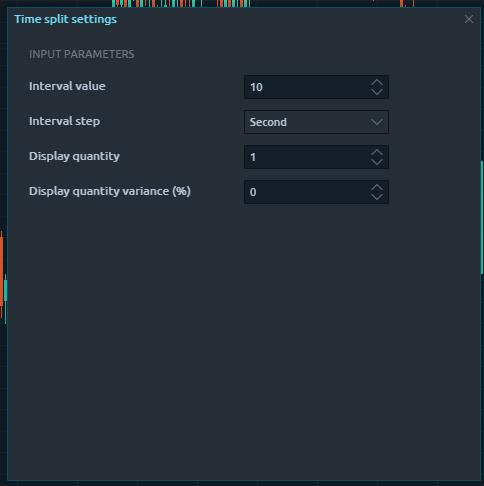

· Order placing strategy “Time Split” This strategy will divide the size of your order on equal parts and send them in a few steps according to specified Display Quantity and via selected time Interval.

Example of Scheduled Orders:

Time Split Configurable Settings

Bug Fixes and Misc. Fixes

-

[Drawings] Issue with favorites drawings list saving.

-

[DOM Surface] Incorrect aggregation which occurred after the accumulation of large amounts of data.

-

[Trading Simulator, Market Replay] Minor issues with execution on futures market data.

-

[Trading Simulator, Market Replay] Incorrect price for Market orders.

-

[Chart] POC Level is not drawn on profile aggregation.

-

[Chart] Horizontal Line tool with applied dash/dot style can degrade chart performance.

-

[DOM Surface] Incorrect default text color for Bid price indicator.

-

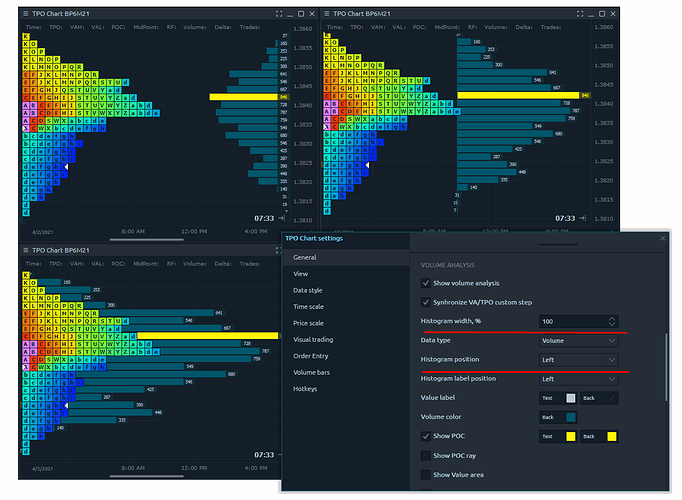

[TPO Chart] Some settings did not save.

-

[DOM Trader] Incorrect prices during placing Buy at Bid/Ask, Sell at Bid/Ask.

-

[DOM Trader] High/Low did not display with custom tick size.

-

[General] Application interface was broken on Intel 11th Core Iris Xe Integration graphic cards.

-

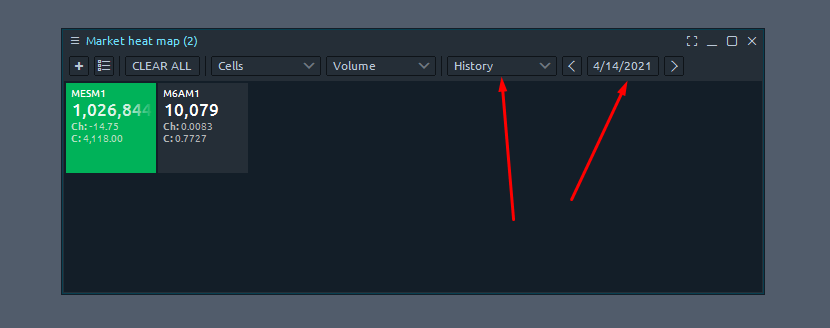

[Chart] Periodical issue with applying history.

-

[Backtesting] Incorrect settings for ‘Period’ type.

-

[Chart trading] Resolved a visual issue when trading from the chart.

-

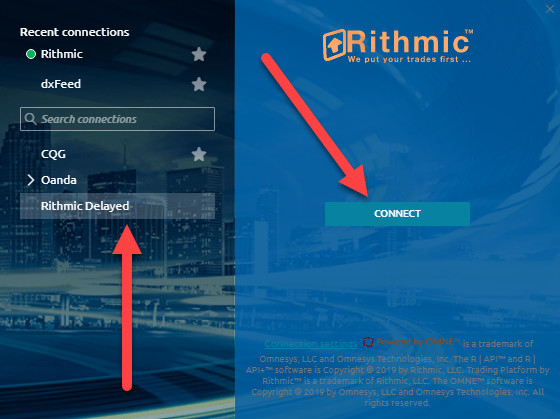

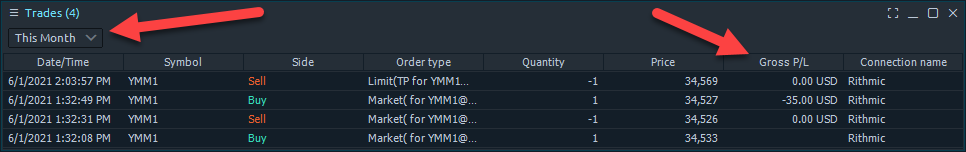

[Rithmic] Wrong PnL calculation in ticks for continuous contracts.

-

[License] Periodical logouts from licenses.

-

[Chart] Incorrect Renko wicks calculations.

We hope you enjoy the new features and updates we’ve added along with Version 1.96.1 If you have any suggestions, comments, questions, or concerns about this update or other features you want us to add in the future, please let us know!

Thanks for your time,

Jake

Optimus Futures

Disclaimer:

The risk of loss in trading commodity interests can be substantial. You should, therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The placement of contingent orders by you or broker, or trading advisor, such as a “stop-loss” or “stop-limit” order, will not necessarily limit your losses to the intended amounts, since market conditions may make it impossible to execute such orders. Stop Orders are Market Orders.