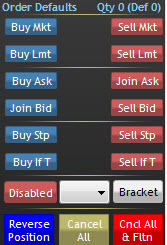

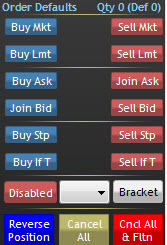

I have recently started trading futures on a R|Trader platform and I want to understand the nature of all the orders. In the past I have used long only strategies, and due to the long term trades, I hit MKT. Now, I have switched to shorter strategies and need to understand the nature of order. Here is my DOM

Can you explain what is the difference between: 1) Buy Ask and Join Ask 2) Join Bid and Sell Bid

If there is additional info you need to share with me, please do. I need to take care of the technical side as much as I can. Thanks!

I’ll try to shed some light on these different order types. First, here is the basics of how price moves.

Bid (price people are willing to pay) -------------- Market Price -------------- Ask (price people are willing to sell)

Lower price ------------------------------- (spread) ----------------------------- Higher price

The spread is the range between the bid and the ask, in active markets with higher volume, the spread will be very close sometimes as low as one pip or price point. Less active markets will have higher spreads, sometimes which are extreme.

When you place a market buy order, you will be filled at the best ask price which will be the difference in spread between the bid and the ask. So rule of thumb is that every market order you will start at a loss equivalent to the spread. Same goes with selling market, you will get the best possible bid again, putting you at a loss of the spread.

Joining the bid will put you at the highest bid price, which is similar to placing a limit order at that same price. The pro is that you will get the price you want without the spread, but the price may not be reached or will be delayed as the bid/ask keeps changing. The inverse is true with joining the ask when going short.

As for the explanation of the order button themselves:

You have Bid/Ask(Offer) is the state of the price. If you want to buy at the Ask Price, which is really MKT(market order) then you press the Buy Ask button. to Join the Ask means you want to SELL at the Ask Price and not the Bid Price. it means you have to wait until the Bid is raised to the Ask Price.

On the other hand when you want to sell or go short, you hit the Sell Bid, if you want to BUY at the Bid Price, you click Join Bid.

Matt

Thank you Matt. very good explanation and a bit more detailed than expected.

Is there a way to isolate the DOM outside of the platform and make it “float” outside the platform?

As far as I know you can’t detach any of the DOM on on the chart trader, but there is a DOM which is part of the “Order Book” that you can find under “File”. On that DOM you will find “Detach Window” which will give you the option to have a floating DOM.

Thank you. I did what you explained and it worked.

Its easy to execute from one screen and see the charts on the other.