Hey Matt Z!

I found the community through the podcast and wanted to say thank you for creating and posting them! I’m thoroughly enjoying binging through them.

I am a beginner (3 months) trader currently day trading the Micro ES.

I was curious as to your thoughts on how to approach the idea of switching from the Micro to the Mini and how you would suggest to analyze a trader’s “mental readiness” to step up “10x” by switching between these markets.

Do you feel that it would be a good approach to slowly scale up contract size in the Micro with 10 contracts, then once consistent and comfortable at that level; transition to the Mini with 1 contract? Therefore keeping risk/reward even for the transition…

Looking forward to your thoughts,

Jakob

1 Like

Hi Jakob,

Thank you for your question, and welcome to the Optimus Community. So here is my perspective in general, every Futures trader should develop their risk tolerance which reflects in the number of contracts you trade. So you don’t always need to feel that you must increase the number of contracts to gain in the marketplace. You have to find what is ideal for you.

In that regard, you have to see over time whether you need to move from the Micro Futures to the larger Emini.

A good approach would be to scale up slowly and see how the leverage and size affect your behavior. Then, as you add, you should, in my opinion, trade that size for quite some time to experience all volatility types or as much as possible. You may discover that you can trade as much as 10 Micro Futures or not. Wherever you land, it’s ok, because it fits you.

It is better to be consistent than increase contracts that entail more considerable risk.

The last variable to consider is scaling, where you can use a smaller number of contracts to scale in and out where one larger Emini may not allow you to do it.

Consider using a trading journal like the one we use with our platform here.

Thanks,

Matt Zimberg

Optimus Futures

There is a substantial risk of loss in futures trading. Past performance is not indicative of future results.

1 Like

MattZ,

Thank you for your reply. That makes complete sense as I had not considered how scaling might effect a trader’s behavior combined with/or in place of increasing contract size on entering a trade.

I hear a lot of traders talk about different market conditions and you mentioned “all volatility types.” I would like to learn more about this. Would you be able to recommend any books or other reference material that talks about identifying and/or understanding what kind of markets there have been in the past, where we are now, and possibly some speculation on the future. It would be interesting to know what, as you said, “quite some time” might be and how to identify any change/shift in market condition so that I may note as to how my strategy does in the different conditions, or at least to know that there is a condition that may be coming that I haven’t experienced yet. I hope that makes sense.

Thanks again,

Jakob

Markets can go up or down, but how they do that is what every trader, investor, and financial analyst is trying to cope with. For example, think of these situations:

- Narrow range of trading that is slow

- Narrow range that that fluctuates between the ranges slowly

- High range that is slow

- High range that is fast (like we saw in Covid March 20/20)

The number of combinations is high, and depending on the volatility, you have to adjust or decide whether you want to trade through it.

“Volatility,” in my opinion, is just a vague term unless you quantify it, and many traders/analysts use it without giving it context.

Do not feel you need to trade through each volatility phase, and over time you need to decide which market type is optimal for your performance. Unfortunately, I do not think a book can teach you to cope with every situation (consider that the market changes each year and we patterns we may not have seen in the years before). So again, I go back to the size factor. Trading small for a few years can provide the feedback and edge you may require to see how you handle wins and losses in different environments. So don’t rush to go bigger from micro futures to the large lots and try to experience all you can with smaller sizes.

Best,

Matt Z

Optimus Futures

There is a substantial risk of loss in futures trading. Past performance is not indicative of future results.

Happy New Year Matt,

Thank you for your reply and the given information. I have still been rifling through the podcasts and appreciate your seemingly unbiased opinions and ‘tell it like it is’ demeanor on the multiple topics.

Back to the market cycles, I had a feeling you were going to say it isn’t something a book may help with. That’s cool, just part of the challenge. I did stumble upon a blog post by Brett Steenbarger providing some descriptions that might help others.

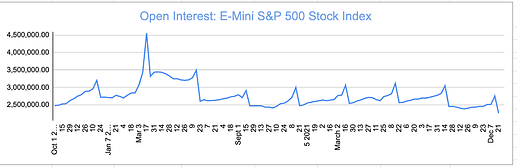

Also, in seeing the lower volume over this past week, I became curious as to if this was an annual occurrence and a time in which I should consider to not trade in the future. I plotted the weekly open interest from OCT 2019 to Present Day; data from the CFTC COT reports for the E-mini. What is up with the quarterly spike and decrease? Is it the ‘big boys’ making portfolio adjustments for their earnings reports? Just curious if you had noticed this and what your thoughts are on it. (Neglecting the spike Covid time period of course.)

Might make a decent podcast topic for you as well… The varying influence of # of retail traders vs. # of institutional traders in the markets.

Best regards,

Jakob C

Hi Jakob,

Happy New Year to you as well, and lots of prosperity.

The equities (S&P) market goes through cycles, and there is a varying level of liquidity throughout the year, but I am not sure how to advise people to trade through each cycle and how to use this data practically with any given method. In my opinion, the focus should be on the volume, and as long as it is liquid then you can decide when to enter.

Volume and open interest are two key technical measures of liquidity. Volume is the number of contracts traded in a given period, and open interest is the number of contracts that are active, or not settled

If you find that you found a correlation between your method and open interest, you can use it as a reference. If not, then drop it. Again, just my opinion.

Remember your goal is to become a trader, not to know everything about the market.

Those who want to find every single correlation and understand all the mechanics may find themselves overwhelmed with facts that do not always help to trade.

Keep things simple, and ask whether the information helps you make better decisions.

Best,

Matt Z

Optimus Futures

There is a substantial risk of loss in futures trading. Past performance is not indicative of future results.