Hey fellow traders, I’m relatively new to the world of futures trading and have been trying to comprehend the concept of Depth of Market (DOM). I’ve been researching it and watching tutorials, but I still have some questions that I hope you can help me with.

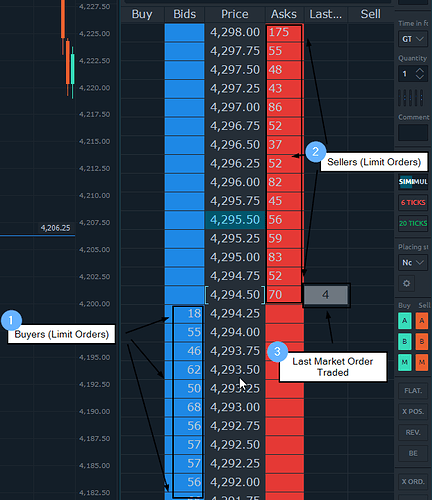

From my understanding, DOM essentially displays the number of buy and sell orders at varying price levels. It’s like a real-time snapshot of market liquidity, which assists traders in assessing the supply and demand dynamics at play. But how exactly do experienced traders utilize this information to make informed trading decisions?

For example, when I observe a significant number of buy orders stacked at a specific price level, does that indicate strong support and the likelihood of the price bouncing off that level? Conversely, if there are more sell orders at a certain price, should I interpret it as resistance, and that the price might struggle to break through?

Also, I’m unsure about which side represents buyers and which side represents sellers in the DOM. Is it the left side for buyers and the right side for sellers, or vice versa? Or does it vary depending on the platform being used?

Moreover, what about the speed at which these orders are being filled? Can I use this data to gauge market sentiment and predict short-term price movements? I’ve heard some traders mention “order flow” and “trade flow” analysis – how do these techniques relate to DOM, and are they worth learning for someone like me?

Lastly, do you have any suggestions on how to incorporate DOM data into my existing trading strategy? I’m currently using technical indicators like moving averages and RSI, but I feel like adding DOM to the mix could give me an additional edge.

I know that’s a lot of questions, but I’m genuinely eager to learn and enhance my trading skills. Any insights, advice, or resources you could share would be immensely appreciated! Thanks in advance!