Hi @colosean!

I love this question so thanks for posting it. It is a question that is asked a lot because it’s normal to cross check other methods and indicators to stay in the loop. At the same time it makes us question “Is my method the best for me?”

To add to this here’s a quick read:

Vic Braden has a special talent, and it’s driving him nuts. Braden, a well-known tennis coach, can tell when a player is about to double-fault before the tennis racket even meets the ball. He doesn’t know how; it just comes to him in a flash. One year he watched the tournament at Indian Wells and called 16 out of 17 double faults before they happened. This freaks him out. “What did I see?” Braden wonders. “I would lie in bed thinking, ‘How did I do this? I don’t know.’ It drove me crazy.”

I came across this in Blink by Malcolm Gladwell. An entire book dedicated to the topic of split second decision making.

In last week’s webinar, Matt said that it’s extremely difficult for a trader to verbally express his trades to someone. Just like Vic who couldn’t verbalize what he was seeing about the serve that allowed him to predict a double fault.

While this isn’t the exact case in trading because we can better describe what led us to our decision as a result of the data we have available to us.

To answer this for yourself, the first step I’d recommend is always download your trade history and data.

Note - I’m working with support to properly extract this data with P and L to see if there is a solution where I can show how to sort your trades to identify challenges and opportunities.

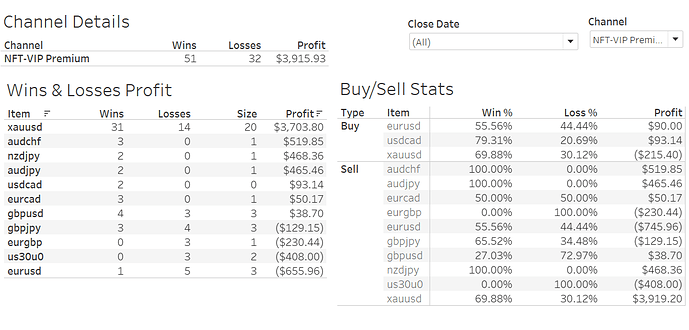

Here’s an example from a test I was doing with Forex trading and signal providers:

This is a more visually appealing way to see your trades that can help someone understand their behaviors and patterns.

For instance, you mentioned “I’m just not consistent enough.”

When we breakdown trading data like this it can show where the inconsistencies are. On this example, it shows that the best trades were in gold on the short side.

Worst accuracy was EURUSD specifically on the short side. That tells me that those losing trades were held longer they probably should have been.

Again, I know this isn’t helpful without a solution so I’m actively working on that and will reply here when I have something.

This is an overall best practice for any trader that will really show you behind the scenes of your trades. Ideally, when I can properly export all the data we will be able to identify if someone trades best during certain times and volumes, or during high volatility or low volatility trading.

As far as what does everyone else use or do, taking bits and pieces of someone’s methods is great and should always be collaborated. However, the most successful traders I’ve worked with are the ones that came into the market knowing nothing.

No moving averages or indicators. They stared at the market all day for months before they were just break-even traders. Then they saw what worked for them and scaled up.

Imagine if every person who wanted to trade wasn’t allowed to educate themselves on the market or read strategies from other traders. They would essentially have to just watch until it started making sense to them. Like a toddler learning something new, they can’t research or collaborate, they just observe then try. Make a mistake, then try again instinctively trying to avoid pain from the previous attempt.

The strategy is so unique to each individual. When Matt asked something about how many times do you trade in a day, or what time frame you trade on, I laughed because that day I probably did 100 round turns. Not to mention that was in an hour and a half lol.

But that is my style, I am super active in the market because it helps me get a feel for it and get involved. For many, that’s WAY too much trading. For some maybe not enough.

I’d recommend analyzing what trades are working and what ones aren’t. Be really detailed in your notes and face the losers head on and note your emotions, feelings, if you were up or down, what the market was doing, etc.

I’ll keep working on the data side to get a solution.

My style is analyzing charts from top down, then observing the market, getting in with small size to get a feel then start identifying areas to trade from.

I typically always join the bid or offer. This does a few things for me:

-

Forces me to trade on the fringe and be super picky about my spots. If I don’t get filled I wasn’t fast enough or didn’t see it. That’s OK.

-

It makes me watch order flow with more focus. I like to see a price flip a few times and try to find the waves of the buyers and sellers moving the price back and forth.

-

It significantly reduces my risk assuming I follow my exit plan accordingly. Sometimes I’ll get filled on a price and the market won’t go against my position at all. I’m risking 2 ticks to make 6.

I firmly believe that the market is changing at all times and could go any direction without notice, therefore I’m in and out of the market more often. Sometimes I’ll see something and get long only to reverse at the same price for a 2 tick win then reverse again.

Sometimes I’m in trades for 20 minutes because I can see it’s going in my direction and it’s just taking more time to develop.

I’ll send a polished video of cluster charts and how to identify entry spots tomorrow.

There is a substantial risk of loss in futures trading. Past performance is not indicative of future results. The figures here represent an opinion. The placement of contingent orders by you or broker, or trading advisor, such as a “stop-loss” or “stop-limit” order, will not necessarily limit your losses to the intended amounts, since market conditions may make it impossible to execute such orders. Please conduct your own due diligence if Futures are an appropriate instrument for you.

Over the past year, I’ve watched WAY too many YouTube videos and I got the concept from a guy named Micheal Chin - who may have gotten it from Mack. I could understand the strategy and it resonated with me. It worked out really well when I was paper trading but fell apart for me in real-world application. But I will check it out further and see if I can expand my knowledge - thanks!

Over the past year, I’ve watched WAY too many YouTube videos and I got the concept from a guy named Micheal Chin - who may have gotten it from Mack. I could understand the strategy and it resonated with me. It worked out really well when I was paper trading but fell apart for me in real-world application. But I will check it out further and see if I can expand my knowledge - thanks!