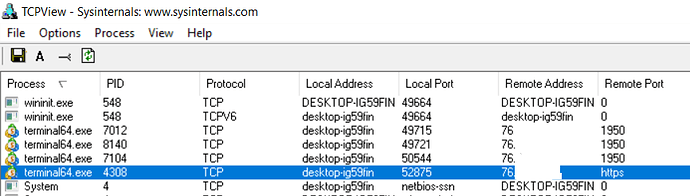

I have a buy limit order at ASK. After AMP received the order and cleared it, it held the order for 241 ms before it sent the order to CQG. From step 3 to 4, it took 241 ms. See line 4 of the image.

Is it AMP’s fault or CQG? After I sent the order, there is nothing else I could do, but wait.

Why would they hold my BUY limit order (at ASKing price)? That is basically a market limit order.

Btw, I have more of these trades. I am just showing one example here.

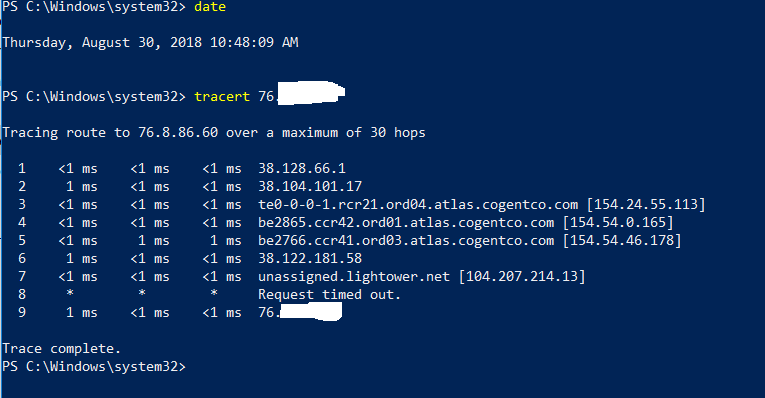

I have a colocated server in Chicago with <1ms ping with AMP Futures Metatrader server.

I also used the command OrderSendAsync to send the order.

Here is what the help file says about OrderSendAsync.

> The OrderSendAsync() function is used for conducting asynchronous trade operations without waiting for the trade server's response to a sent request. The function is designed for high-frequency trading, when under the terms of the trading algorithm it is unacceptable to waste time waiting for a response from the server.

Just so you know, I am just doing scalping and not HFT. Metatrader is not the right platform for HFT. I started looking into R|API to speed things up. Metatrader may not be good for scalping. If only there is another broker with a better implementation of metatrader, I do not have to give up my metatrader programs.