Hey onetrader,

I think this might be the youtube channel for BOOKMAP. Maybe of use to you… https://www.youtube.com/channel/UC3HKlZ_7gxRgef9SCxu54Lw

A sweep of the book occurs when an aggressive trader buys at the market with more contracts than the best offer. Thus price sweeps through that levels and begins trading one tick higher. If that aggressive trader wants to buy even more than the next level, the price will also sweep through that level and trade on the next tick higher. It’s the opposite for the sell side. Please see the attached image from our HTF Guide.

Pulling of liquidity occurs when limit orders in the lit book are pulled out of the book. They no longer want to trade at those specific price levels. Analogous to an auction where a bidder no longer bids – he is not interested. In Bookmap this can easily be seen with the gray scale heatmap. It might be bright, and then it turns darker gray. The context of this liquidity shift leads to a much deeper discussion regarding the intent of the liquidity providers.

Hi,

At turning points at areas with liquidity often heavy sell volume if often actually buy volume as professsionals is selling

into strenght and vice versa. Is there a way to better determine what is what. I often see buy volume at the top and then it

turn around up there. Guess it it not just to invert the colors.

Best regards

Stefan

hi bruce/matt

could you please explain why “rapid fire” algos either attracts or repels price on the bookmap platform.

thx

dave

Is there a way to backtest the strategies you illustrated during the webinar?

I think it has a function called Iceberg detection.

Tracking velocity at the bid/ask reveals quite a bit.

Otherwise, Ferran Font Ramentol has some good Bookmap videos on Youtube where he talks about this; you might find those useful.

Can you discuss algo strategies that bookmap can identify?

Bookmap displays the market data in a very object manner. It simply displays the traded volume, and where when and how much traded. It also displays the current and historical depth of market – where buyers and sellers line up to provide liquidity in the market.

Although this is very objective data, Bookmap sheds light on areas that identify algorithmic activity. You may see spoofing type of action. You can also see the individual players that provide that liquidity and then move their large orders a tick higher or lower severla times, trying to skew the limit order book.

On top of that, Bookmap offers add-on indicators that spot large players in the current limit order book, as well as Iceberg orders.

Bruce Pringle

Risk Disclaimer:

There is a substantial risk of loss in futures trading. Past performance is not indicative of future results.

Keep it simple with the order flow, look at your levels of interest, then start to integrate some of the aspects I covered in the webinar like: understanding the current config of the book, how the book behaves as prices near the level, and what the traded volume tells you. This shouldn’t take too long – it’s not complex. Make sure to record your data, and then use Bookmap’s robust replay mode to review the action at a sped up rate. This is a powerful learning tool. It is how I was able to learn quickly about order flow – I just kept using replay mode. After seeing several instances, I started to anticipate certain behave at these levels. I also started marking up images, pointing out that specific behavior. This also helped. I did this on my own for a number of months and sent Bookmap some images. Then I had an opportunity to join the team. More and more details and subtlety in the order flow started making sense. I’ve been with the team 2 years now. Most learning took place within the first year. Start simple, integrate it into your trading methods, and use replay mode. You’ll start anticipating behavior.

Bruce Pringle

Risk Disclaimer:

There is a substantial risk of loss in futures trading. Past performance is not indicative of future results

no extra costs involved – you can zoom into microsecond and nanosecond levels as part of the basic subscription. If you want to trade from the Bookmap chart or have access to a few of our add-on indicators, then there is an advanced subscription which costs extra.

Bruce Pringle

Risk Disclaimer:

There is a substantial risk of loss in futures trading. Past performance is not indicative of future results

The dots are traded volume, according to aggressor classification. Although Bookmap displays every discreet market event, down to billionths of seconds, we still display the overall delta of the traded volume when you zoom out. Therefore you’re really getting the best of both worlds. The volume data columns (red and green bars) display volume either split out or in volume profile. The COB (current order book) column is the depth of market, which displays the limit orders and liquidity provided by buyers and sellers who want to deal at those specific price levels.

Bruce Pringle

Risk Disclaimer:

There is a substantial risk of loss in futures trading. Past performance is not indicative of future results

First off… thank you to Matt for bring the webinar.

Second… I’ve been in demo mode for a few days (Bookmap), and there is much that I see that I like. I must admit to a bit of “sensory overload” the first day in demo. I eventually removed the “volume dots” and tempered down the “heat map”, and found a place that I could live with (a few suggestions though)…

-

The “pulsing” feature of the vertical lines and time display… there needs to be a way to turn that off. Just joking, but it may set off epileptic fits in some folks (I found it to be an irritation).

-

It would be sweet to see connecting lines between trade entries and exits. As it is, one must go searching for those tiny dots when reviewing the trading session (not readily easy to find).

And… a couple of questions?

-

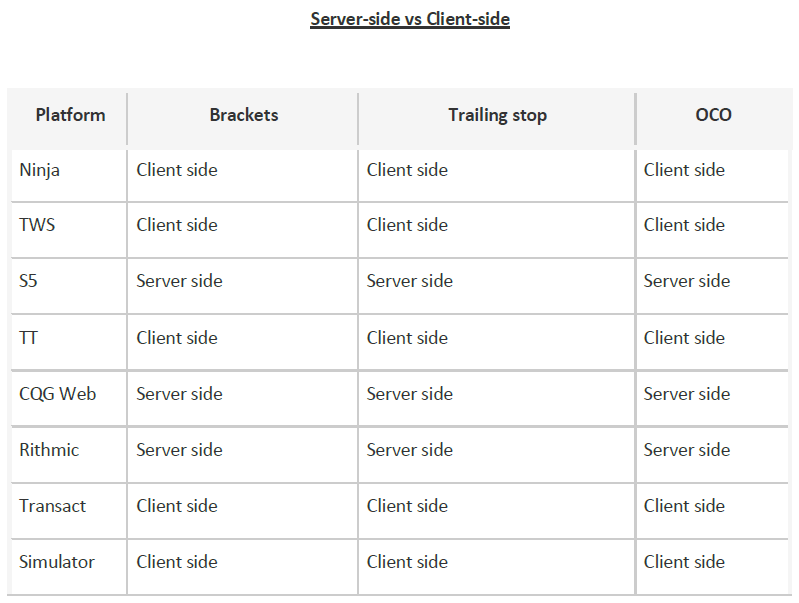

Are OCO orders supported as “server side” or “platform side”?

-

Please offer a comparison of what is offered in the “basic” and “advanced” platform descriptions? It will take months of review before I could commit to the Bookmap platform, and currently I just need the minimal experience to make that decision.

Hello @uncleppennybags Thank you for your question. I will let Bruce answer the Bookmap questions.

As far as server-side, you can use the Rithmic data feed for Bookmap and then place your orders on Rithmic Trader (R Trader). Once you place your order on R Trader, your orders will be Bracket Server Side OCO.

Matt,

Thanks for the reply, but my question was placed in the aspect of using BookMap as a stand-alone platform. Until a couple of years ago Sierra Chart had the same issue. The OCO brackets were held “platform side” which represented a huge risk in the case of a connection interruption (or some type of system failure).

I understand your concern. Bookmap does provide Server Side OCO as a platform. You can use the CQG Web API, Rithmic API, and Gain Capital API. The demo, however, is on the client side: Bookmap | Futures Trading Platform | Optimus Futures

Matt

Hi, Bookmap is a platform. Different data providers handle this “client side” vs “server side” issue in different manners. Please see attached image from the Bookmap User Guide.

Bruce

Risk Disclaimer: There is a substantial risk of loss in futures trading. Past performance is not necessarily indicative of future results. Trading futures and options involves substantial risk of loss and is not suitable for all investors. Past performance is not necessarily indicative of future results.

| Platform | Brackets | Trailing Stop | OCO |

|---|---|---|---|

| Gain Capital](GAIN Trader Market Data Speed and Accuracy) | Server Side | Server Side | Server Side |

| Trading Technologies](TT Market Datafeed | Access 40 Exchanges | Optimus Futures) | Client Side | Client Side | Client Side |

| CQG Web | Server Side | Server Side | Server Side |

| Rithmic](Rithmic Market Data - Streaming real time quotes and historical market data | Futures Broker) | Server Side | Server Side | Server Side |

I have been evaluating the platform along with a few other platforms in the markets. Could you provide a short point form that lists your advantage over other order flow platforms.

Does Bookmap have alerts?