*’ll kick this off with a little about me, then get into my trials and tribulations. I may even keep this going as a personal blog to track my progress.

My journey into futures trading begins in November of 2020. In the late 90’s I was an investor and then a day trader in the stock markets. I did well in both but after things crashed in 2000 I stopped trading and investing until 2007 where I only invested in physical metals. Gold and silver. In 2008 I pretty much retired from main stream society. Sold my home and business in an expensive state and moved to a less expensive state in the midwest out in the middle of nowhere. I paid cash for my house and land and for the most part live a self sufficient lifestyle. I mention all of this because I find the simple life is much more rewarding and enjoyable than the stress filled rat race that our society has become. The perspective I offer comes from someone without a formal education past high school and then into 4 years of military. Out of the military I was self taught in construction, cabinet making and then went into management in a couple of different industries as well as having my own businesses. Thats a brief synopsis of my background.

So onto trading. I basically have no expenses so am not trading to pay the monthly bills. The capital I put at risk in trading is money assigned to the high risk category. My house, land, and metals portfolio is a hedge against inflation. I also started investing in stocks again since inflation just eats into the purchasing power of cash. Trading is or is supposed to be just another way for me to stay ahead of inflation. So far it hasn’t gone well. I’m breaking this down into 2 categories basically. One is the technology and the other is just trading mistakes/challenges.

Lets start with the trading challenges first. I’ll share real numbers here as well. I opened my account with 4500 dollars. Not a ton of money but enough to be able to trade and test the waters. No sense throwing large sums of money at something when I don’t know or understand the market fully. Using practice accounts at first it as obvious that I could take 100k and turn that into 30k in very short order. I could also take 100k and turn it into 160k in 1 day. Not without massive swings though and No way I could do that with real money.

So staring with 4500 my goal was 1-1.5% a day. About 60-70 bucks. My first day trading, up over 500… Big confidence builder. I think I finished my 1st week at a little over 5100. Of course my thinking at the time was, this is going to be easy!

Then the real lessons began. Week one was like a false sense of security. I didn’t use any stop limits and even on days where I started out losing I could trade my way back to even or even profitability.

Week 2 the real lessons began and I proceeded to have losing weeks until my account was down to a little over 600.00. On every single large losing day I lost because of not having my stop losses in place. I get into a trade, it starts out positive then goes negative and my mind set is it will turn around and come back in a minute. Of course it doesn’t. Next thing you know I’m down 200-500 and make the decision that that is a big enough loss for the day.

Looking back at that it obviously would have been better to have the stop losses in place, stop out of the position and wait for a better entry. So then I started using stop losses. Got stopped out lots of times only to have things turn around. It feels like I can buy the exact top in a move, buy it only to have it turn around immediately, move down, hit my stop and then turn around again. it then proceeds to move back up to where I would have had a profitable trade had I not been stopped out. So then I move stops lower or eliminate them altogether. It is or was a very frustrating process. All of this eats into the account value.

As a new trader these things are very frustrating. Looking back now I realize I was buying in on extended moves or just trying to trade or scalp any move anywhere on the charts. Going with gut feelings and intuition instead of looking at the charts and waiting for the right time…I’ll discuss this in more detail with charts later on.

First, here are my issues with the technology. These issues have probably cost me 20% or more of my accounts value so the losses are substantial on a percentage basis.

I’d also like to start by saying that Jake and Optimus have been great to work with. As a Mac user it’s not so easy to find a platform that I can work with. Jake was great in helping me to find and practice with different platforms before I decided on motive wave. I really like the platform but hate the customer service. If you have an issue on Tuesday they will get back to you by end of day on Wednesday. Then they will ask for more information and by end of the day on Thursday tell you they don’t see anything wrong or ask you to keep trading and make a video. Bottom line is your on your own if you decide to use their platform.

So 1st issue was what I call ghost trades. From my trade history you could clearly see I was trading 5 contracts of the MNQ. I was fine for a little while. Opening and closing trades with no problem. Then I closed a trade and within a few seconds a trade reopened for an odd number of contracts. 1-3. My trading log clearly showed that I had closed the trade without issue before the odd sized trades began. Thats when things got crazy. I felt like I was playing whack a mole trying to close trades over and over again and they just kept popping back up with new positions for odd sizes. They have a flatten all button that I also used and that would also close the trade but then reopen another… Anyway, that day I went from having a good profitable start to the day to getting killed just in commissions alone trying to close everything out.

The 2nd issue I had was when motive wave or the DOM within motive wave just stopped. Locked up the platform so I couldn’t do anything. At first I figured it was my slow connection speed but minimizing motive wave and opening other things on my computer to test them. My connection with everything else was fine. Complained to tech support at motive wave but it was useless as always. Neither of the issues was ever resolved but strangely enough haven’t happened again either.

A 3rd issue I had was entering a trade and knowing that my position filled but never getting a confirmation for 20 or more seconds. As someone who mostly scalps, thats a long time to go not knowing where exactly I am at. I do figure this is an issue with my connection speed and the volume was very heavy that morning.

My connection speed is an issue. Jake and I had discussed this before I even opened an account so I was well aware of the risks. My way around that is to not trade the open and close each day and only trade during periods of lower volume. I do feel like it’s a satisfactory work around. I feel like the connection speed is only an issue about 10% of the time, even during heavy volume periods. And again, none of these issues are related to Optimus.

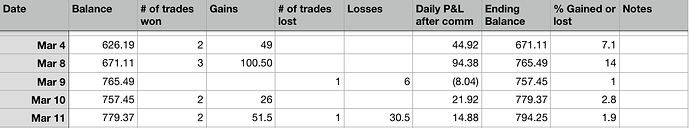

With all of the issues are out of the way, on to where I am at now. In the last 2 weeks, my account is back up around 800. I would say that since the beginning of Feb I am profitable between 70 and 80% of the time. The only time I blow those profits is when I don’t use proper risk management. Now I enter a trade and set my stop loss right away or keep a mental stop loss and just close the position on my own. It’s real easy to recover from 5 points. Not so easy to recover from 35 or more points.

Reflecting back to the start, I am thankful for the way Optimus set me up. The website says 700.00 margins per contract for the NQ… They set me at a much higher level right from the start and because of that, probably saved me from blowing up my account in 2 weeks. Also, as a new trader, I had no business trading the NQ at 20 dollars a point. If I knew then what I know now I would have traded 1 or 2 MNQ contracts. 2-6 dollars a point and there is plenty of movement during the day to make decent money.

I’d also say I am a much more calm trader now. I enter a trade and am not so eager to get out unless there is a big move right away. I have a better feel for how the market works, and am picking entry points much better than I was at first. In the beginning I was trading 40-60 contracts a day. Now I don’t do that many in a week. My goal is still 1.5% a day. One day last week I had a 15% day. I also don’t feel like I have to trade everyday. If I am watching the market and I don’t see any set ups I like, I just close it down and go do something else.

At one point I almost quit. I also almost reloaded the account to start over. I’ve now decided that if I want to be a trader I can trade my way out of this hole. Using proper risk management and better set ups I feel like I am on the right track.

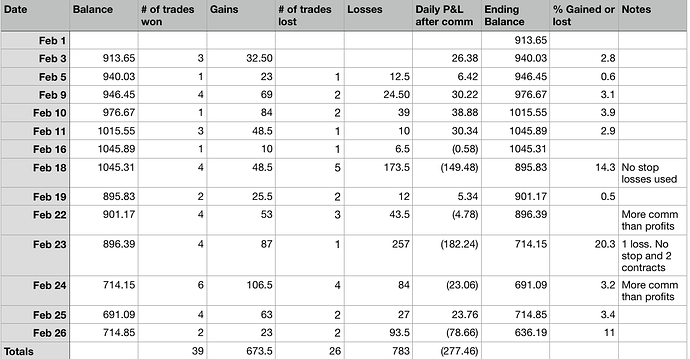

In my next post I will go through my win loss rate from the beginning of Feb. I think it’s important to analyze where I am really at with that. In my mind I am winning 70-80% of the time. With that kind of win rate it’s all about risk management and making sure my losing trades don’t destroy a weeks worth of gains.

I tend to be long winded sometimes so I’ll wrap this up by saying I have watched a lot of Matts videos. He really does offer good advice and for new traders they are well worth the watch. Take notes because he really isn’t doing this to try and sell anything. I really feel like he wants to help others become successful traders. I’ve learned a lot in the few short months I have been trading futures and am very thankful to Matt and Jake for helping me along in this learning Journey.

As I said, next post will be on my trading improvements since Feb 1 and I’ll try and post some charts with notes on what I am looking for in a set up. It will be a week or 2 before I get to it since I am currently switching platforms and have some learning to do with the new platform.