Hello @Alan, Well the right answer is any perfect arbitrage like CL calendar spread are impossible to execute by a retail trader. @Digital_Jester gave this answer here and this is loaded with correct information.

Blockquote

as I explained above there are some spreads that are defined by arbitrage-able conditions and 6E M/U as illustrated is a prime example of that. You can put out some quotes in that spread and you may get some odd lot fills. I have tried this and have generally found that an Algo will automatically tick you until your close enough to value that your not going to make enough money to make it worth your while.

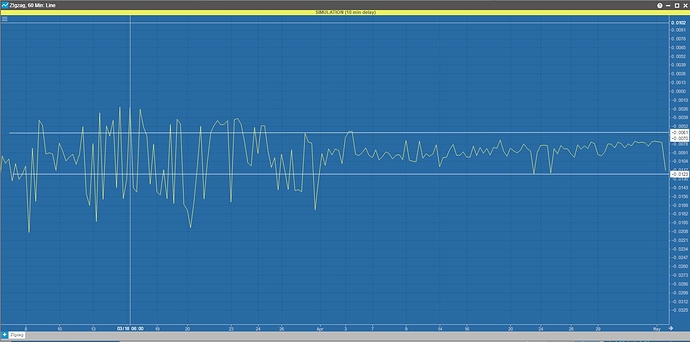

When trying to plot any spread you can plot one of two things. You can plot last print to last print which can be wildly inaccurate because the print in the less liquid contract could be stale by minutes or even hours, especially if your talking about ES or 6E. Or you can plot the actual trades in the actual exchange listed spread. If your plotting CL M/N this will work nicely but if you plot ES M/U or CL Z24/Z25 the spread trades so rarely the chart is meaningless. Of course if there is no exchange listed spread your left with last print to last print which is unrepresentative at best. You can also print/analyze settlement prices but even they can be a little, ‘screwy’ for lack of a better word and probably doesn’t have the granularity you are looking for but could be more suited for more medium term trading.

Quoting an email I received this morning

Sadly, beginner traders fall prey to these soothing ideas pretty often. In the real world there are only two ways you can make money trading the markets:

Taking on risk that others won’t

Exploiting market inefficiencies

The beauty of spread trading is it can often combine both.

As for stationary series, you are definitely thinking correctly but you need to get out of the box that everybody else is thinking in. Try coming up with two, three, four or more instruments that when combined are stationary but stay away from the obvious especially the financials, I would recommend the very to semi-liquid commodities. In your original post you mentioned CL spreads and Brent/CL spreads so how about trying a combination of say CL and BRN/BZ maybe even RB & HO or even GAS. The more legs and the more deferred the contracts the more likely it will be stationary. You may want to convert to similar units, but since ratios are not always constant that may not be the case. (My choice would be to convert and then try different rations of the converted prices/units). What you find is not going to trade 100 times a day but if you can trade it two or three times a day and make say one or two ticks on each (after slippage and commissions) that quickly adds up. Two trades times two ticks is $40/day which 250 days a year is $10k. If that doesn’t sound like enough, then find a second and then a third and it eventually does become enough. This is what prop traders do. They sit around all day long, day after day, collecting the ticks that nobody else wants! One of most consistent trades I have (which isn’t necessarily the same as most profitable) is a 5 legged Energy Spread which even has different quantities on the legs.

Let me be clear. I am not trying to paint the picture this is easy. It’s actually very hard. Even if you find the right relationship the execution of it could make it un-viable. It involves hard work, an understanding of what could work and why, you need to understand the markets involved, the math, the software, how the matching engines work and what could go wrong. If it was easy everybody would do it. There’s a reason very few even try. But if you can get it to work…

Blockquote

Anything that can be executed as arbitrage by retail traders gets into a trend, means you do not know when it is coming back to zero. As @Digital_Jester explained above look for more than two legged basket to trade. Another tip would be that any prime brokerage would want to keep exchange margin. Meaning a couple of thousands dollars to open a two legged spread let alone 4 or 5 legged ones, and if you end up making 10$ or you need to do it 100s of times before you can double your bet. So my suggestion is that depending on the amount you have start with the smaller offshore forex brokers like Icmarkets and once you have gained enough capital you can move on to bigger brokers for real trading. The advantage of that is these brokers provide humongous leverage and very very accurate pricing and execution. Plus on the platform like MT5 you can make custom algos to plot it with Bid or Ask price or both… or better yet Use these brokers (although they have limited products but you will find quite a lot still) use them for charting and use proper brokers for execution. There are sooo many ways it can be answered but i am gonna leave it here for now.