Hello,

Pardon my lack of knowledge but I am trained on the Metatrader and forex brokers where Feed platform and brokerage service all comes from one source. But now i am moving on to futures, and i saw that Optimus futures has the wide range of selection with the platform which is exactly what i need.

Question:

If I sign up for the optimus futures, will get the platform with it and the data feed also? how does it work overall?

Hello @Arman_shah, and welcome to the Optimus Community.

In reality, MetaTrader is a platform that is broker agnostic, which means you get the FX pricing from the brokerage you have signed up with. in The Futures world, you can choose your broker (for service), and the technology platform with some data feeds.

Some platforms are broker and data feed agnostic, and some come with their own data feeds.

Just remember that all the data feeds, at the end of the day, connect to regulated Futures exchanges.

If you look at our platform, Optimus Flow, you will see that we are the brokers for it.

We use Rithmic to steam the data and execution.

If you give me a specific example of software you were looking at, I would tell you what technology it could use to execute it.

Thanks,

Matt Z

Optimus Futures

Hey Matt,

Thanks for your reply. Mainly I am looking for complex spread trading. Meaning use my own formulas to make a spread which could be more than 4 pairs at a time. So I am looking for a platform that allows me to do it. Tradingview seems the best candidate. However their historical data is significantly different from IB i am not sure about the other brokers.

So, Tradingview is what i am looking at but do you think that the historical data is reliable on that and it would be the best fit for the job?

Thank you

Could you give an idea of a spread trade you are looking at?

Matt

For example( (0.5clM20-clN20)-(0.5clX20-clZ20) ) this is a very very basic one, but that’s the basic idea. If i can use up to at least four pairs with different weights with all four operators that will be ideal.

Ok, so you are looking at Crude Oil spreads. If you use TradingView it would be driven by the CQG data feed. They do have spread symbols and you can execute them with one click, but as your mentioned, I am to sure how far back their historical data goes. CQG also has their own web based desktop that you can examine for your spreads: CQG Desktop Free Demo | Futures Trading Platform | Optimus Futures

Matt Z

Optimus Futures

Ah thank you Matt. But I am not necessarily talking about exchange listed spread but it can also be synthetic or even multi product synthetic. But it seems like its capable of anything so far.

Also if you can answer one more question please, is there any products limitations like other brokers? Or I can trade each and everything listed on a particular exchange? (like CME Nymex etc)

I still believe that what you showed above could be traded as one price, but you could be right, it may be a synthetic. What is 0.5? Curious.

The product limitations could exist if you trade contracts that are too far out (risk managers may have a problem with this). This means that one of the months is way out where we could have liquidity issues, and it is not recommended for small accounts.

As for your question:

Most firms would allow you to trade the near liquid contracts, ES, MES, GC, MNQ, CL, QM, ZB, ZN, etc. But, I could tell you that just because the exchange lists a particular product, it does not mean that the clearing firms would you to trade it. The considerations are liquidity, the volatility of those markets, and your account size.

Matt Z

Optimus Futures

Really? I have heard of calendar spreads which is CLNXX-CLMXX. Besides Calender spread like this do not have opportunity for the retail traders. It stays in a very tight range not even making it out of the BID and ASK spread zone expect for these exceptional times. (please tell me if I am wrong here).

My Idea of trading is, as i described above to start with very very tight range. Usually untradeable, and then start replacing the products and play around the size to make it oscillate enough to be profitable without high frequency equipments. So that’s what that 0.5 is. Its the weight reduction applied to one of the Sub-legs of each of the Legs. Downside is to find a broker that fulfills all these requirements. Products, Charting and to-the-cent accurate historical data.

So even with the account size of 7 figures, some limited products are listed on those FCMs website. Is there anyway to bypass this limitations?

Give me an example of a product you want to trade that you think requires seven figures?

As to questions above, I invited a colleague who may help with the energy products.

I hope he can comment.

Thanks,

Matt Z

Optimus Futures

I am sorry I cant reveal the exact instrument and the combination publically as they are the trade secret. But If I can get some exchange listed spreads, Like BK at CME . The WIT and Brent Spread. And some other interest spread that would be great.

We can trade exchange-traded spreads. But, we’ll determine what to provide once you have an established account and we know the level of capital. The risk in spread trading is not less than trading outright instruments, and since you will carry positons overnight, we have to see what months you want to carry, and the level of risk it entails.

This is a discussion outside the forum of course.

It seems you like TradingView, and we will hook you via CQG (as mentioned above).

That would not be an issue.

With all due respect, the “secret” to every method is the risk management of the trader behind the strategy, not the ratio.

Thanks,

Matt Z

Optimus Futures

New here, so don’t know how 'Quoting Posts" works so one large reply.

I do not know of any spread combination that would require 7 figure accounts at least in the energy space. The most volatile spread currently is probably CLM/N and margin requirements for that are only $3500/lot I think. Obviously if your strategy was long 12 CLM and short 1 each of CLN/Q/U/V/X/Z/F/G/H/K+M then the margin requirement of that would be higher but it would still be less than 12* the margin requirement of CL K/M.

With regards to creating ‘custom spreads’ the 800lb Gorilla in this space is ‘Trading Technologies’ with CQG probably second most popular and BTS and Cunningham the other known spreaders. Trading Technologies XTrader was ‘THE’ professional trading software for most of the last 20 years. Their success was built heaving on MD Trader which they developed and patented, which most people call a DOM trader. They also built the first commercial spreader. XTrader was both expensive to use ($1500/month) and really required you to have colocated servers in order to be effective. Trading Technologies have been fading out XTrader for the last couple of years in favor of their new product that they just call ‘TT’ but many call ‘New TT’ or ‘Could TT’. This product is both cheaper and also no longer requires co-location. Anything non-latency dependent is held in the cloud while all live orders, spreaders, algo’s etc are all run on their co-located servers at the exchanges. I think their autospreader allows upto 50 different instruments to be configured in a single ‘spreader’.

Info on autospreader

https://library.tradingtechnologies.com/trade/as-introduction-to-autospreader.html

Info on TT through Optimus

Long time energy trader, and long time TT user so let me know if anybody has any specific questions I may be able to answer on either.

Oh wow, that is the most amazing and to the point answer i have ever seen. So is there any fees for the use of the TT?

Side question: Do you think latency dependent and High frequency opportunity still exist for retail traders? Like Tri-arb or SPY-IVV or exchange arb.

What I meant with 7 figures was that if having bigger account would open more products to trade (verity wise). But i guess the answer is no.

There is a FCM of optimus futures. I have some questions about the margin. Who Do i ask? Directly to Gain capital or here is fine?

I just downloaded and used the Trial… i am beyond impress with this. Finally something that uses common sense and address a huge profit potential of spread trading. Clearly best of all. Thank you again.

Yes they have a pure subscription plan with unlimited trades, and a cheaper subscription plan which has an additional per lot charge. The Standard and Pro software have different fees. You would need Pro for the Autospreader. I will let @Mod-MattZ elaborate on fees.

Depends what you mean. I’m an energy trader so can’t comment on SPY-IVV. TT is fast. Really Really Fast. But it’s not HFT fast. Nothing other than custom C++ code and dedicated FPGA cards will get you that fast. If you try to arb CME-CL / ICE-WTI or CME-NG / ICE-Henry you will find that a) margins are under a tick and if your paying full exchange fees you will lose money and b) your errors will probably eat any profits you do make. Saying that there maybe relationships out there that are too small for the big firms to focus on that you could make money or aribing/providing liquidity.

Arbing cross exchange requires capital as you have to post margin on both exchanges. Obviously the more capital you have the greater the position you can take before forced to go the other way. Additionally brokers will look at bigger accounts differently than they do smaller accounts. Somebody with a million in their trading account probably has other assets. Somebody with $10k in their account, who knows?

Question for @Mod-MattZ not me

Glad I could help. Let me know if you have any other questions.

PSST. Take a look at TTs ADL!

One more thing on the account size issue. Most (all?) exchanges have some form of ‘messaging rules’. How it is implemented changes based upon the exchange but in it’s simplest form they take the number of messages you send (a new order, order change, order cancel and a fill are all messages) and divide it by the number of lots you transacted. If this ratio exceeds a pre-defined level they fine you. I think it’s unlikely you would encounter this problem but as you can imagine the larger the number of fills you have (the larger the account you have?), the greater the number of messages you can send.

Yeahhh HFT its painful spot for me. The fastest i was able to go was 300 microsecond with my own hardware. (No FPGA).

Man where does the restrictions and expenses end in the big brokerage world. I miss my retail trading days with forex brokers… Free up to date data, free platform Mt4/5, unlimited demo time, Hugeee leverages. But product limitations.

TT is pretty expensive. Since I am transitioning to the futures world there is still alot of trails and testing to go. Once the system is built and ready i do not mind paying. Is there any way to get more exchanges and more products even with delayed data to TT? The List is pretty limited to far.

I think the exchanges make more money from the data now than they do the actual trading! As a professional I have to pay $135/month per exchange to CME and CME/CBOT/COMEX/NYMEX count as 4 exchanges. ICE works similarly with ICE US (DX & Softs) & ICE Europe (Brent) separate and at a similar price. Then there’s their S2F North America Natural Gas which is $650/month. Quickly adds up $1000s a month just for data.

Ah ok, Well I guess trying on real account will give much more reliable results. And sorry to bother you but if you can answer just one more question about TT.

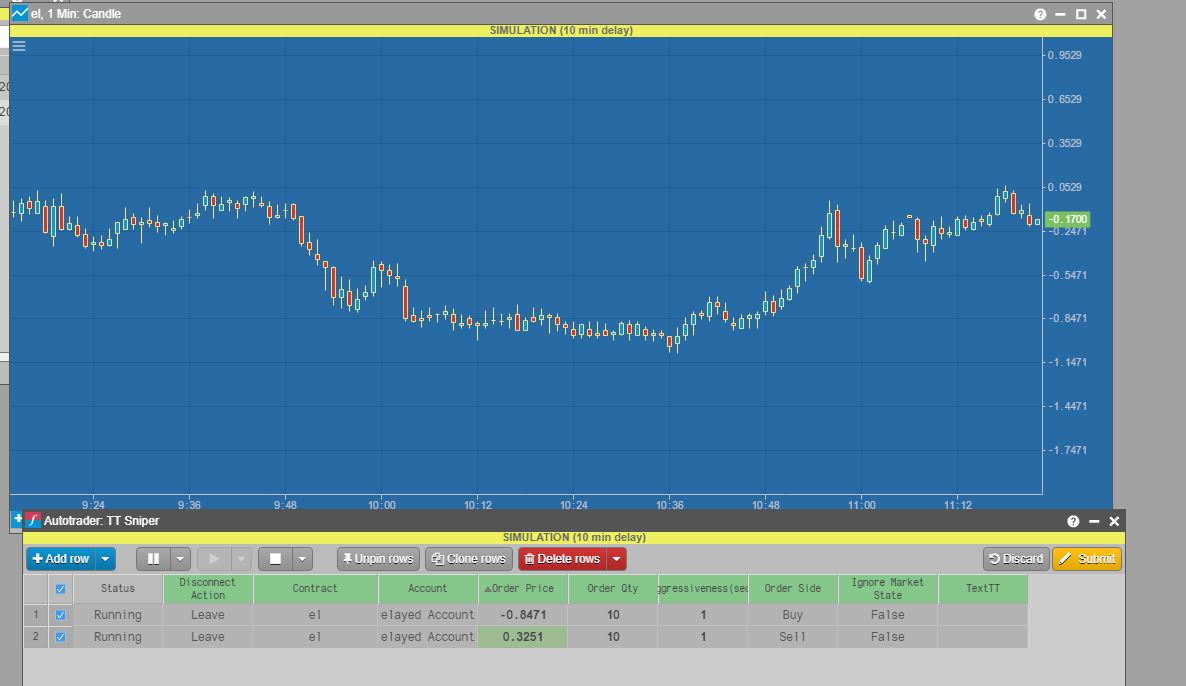

I am trying to get this test order triggered on the combo i made on TT. Before it was actually showing the line of “10 Lmt” on buy and sell level and the price crossed it so many times but nothing was triggered. In the picture you can see that TT SNP has two orders sitting on each side. But i do not see the LMT line and i am sure it wont trigger too. What am i doing wrong here? Thanks again