A quick look at the POC & VPOC.

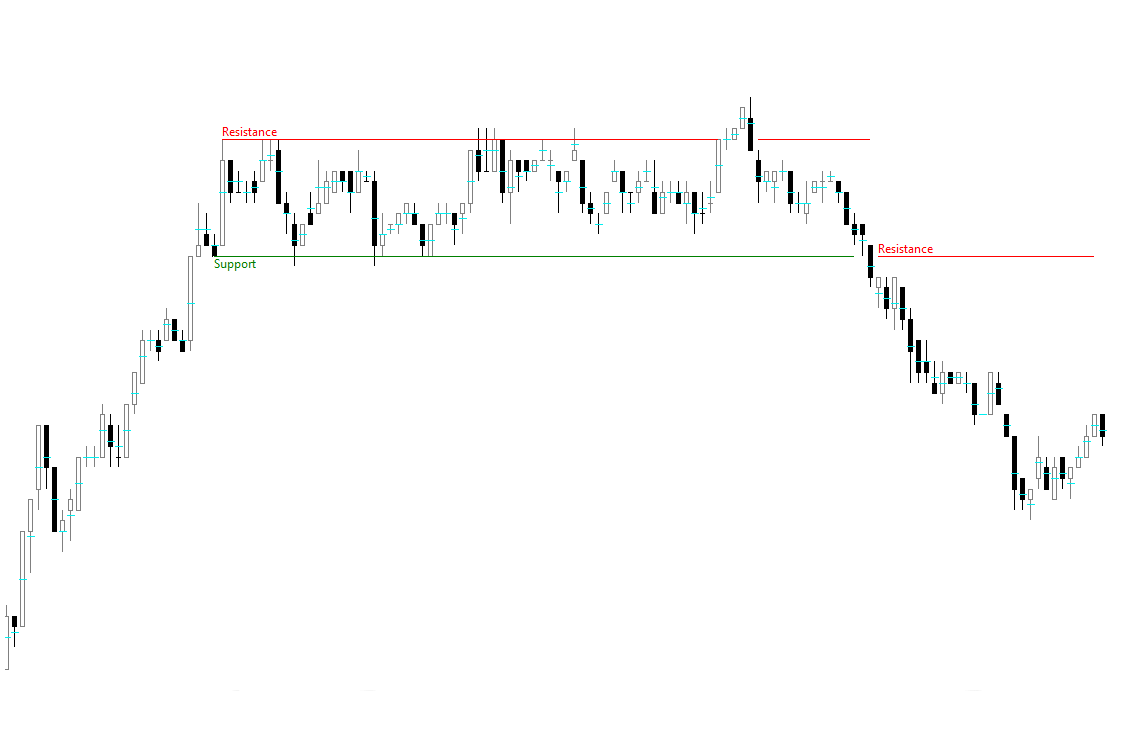

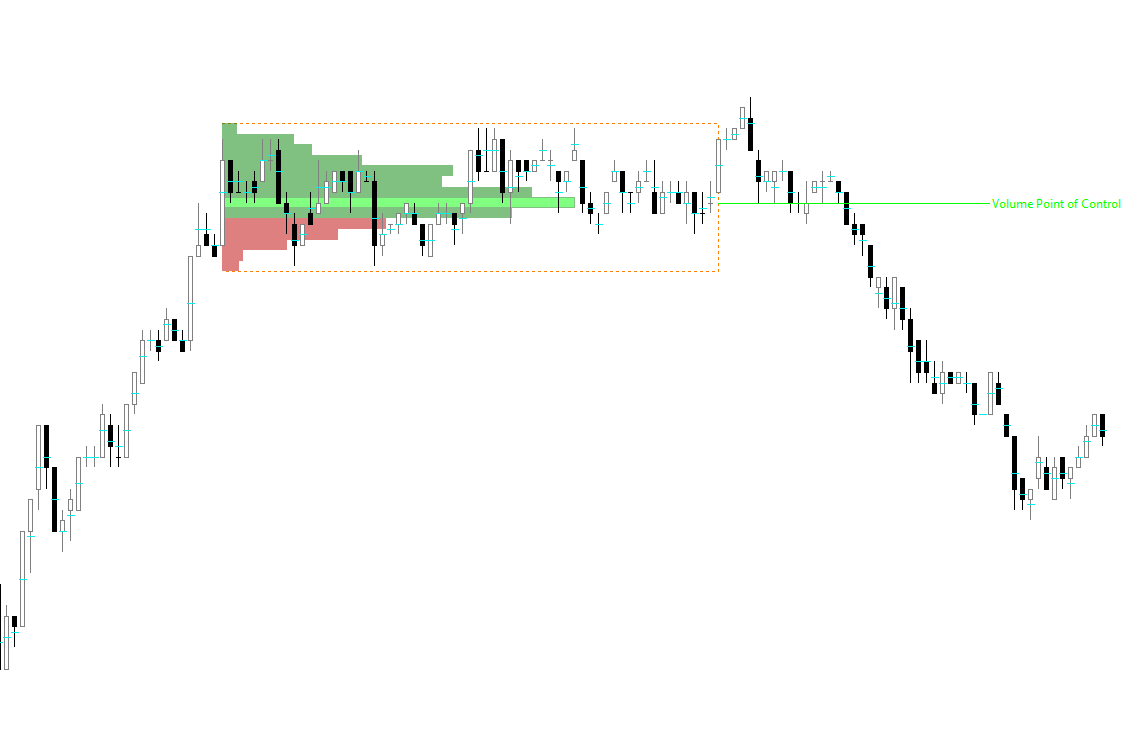

POC (Point of Control) is defined as “the price level at which the heaviest volumes were traded.” By placing volume on a price axis, we can see where the most contracts traded during a specified time frame.

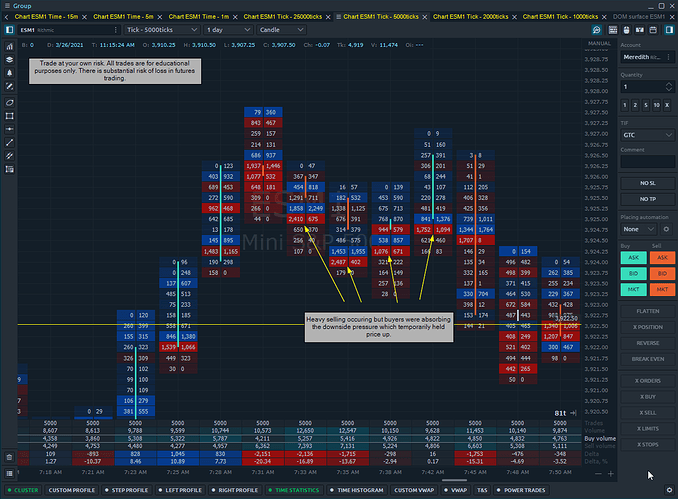

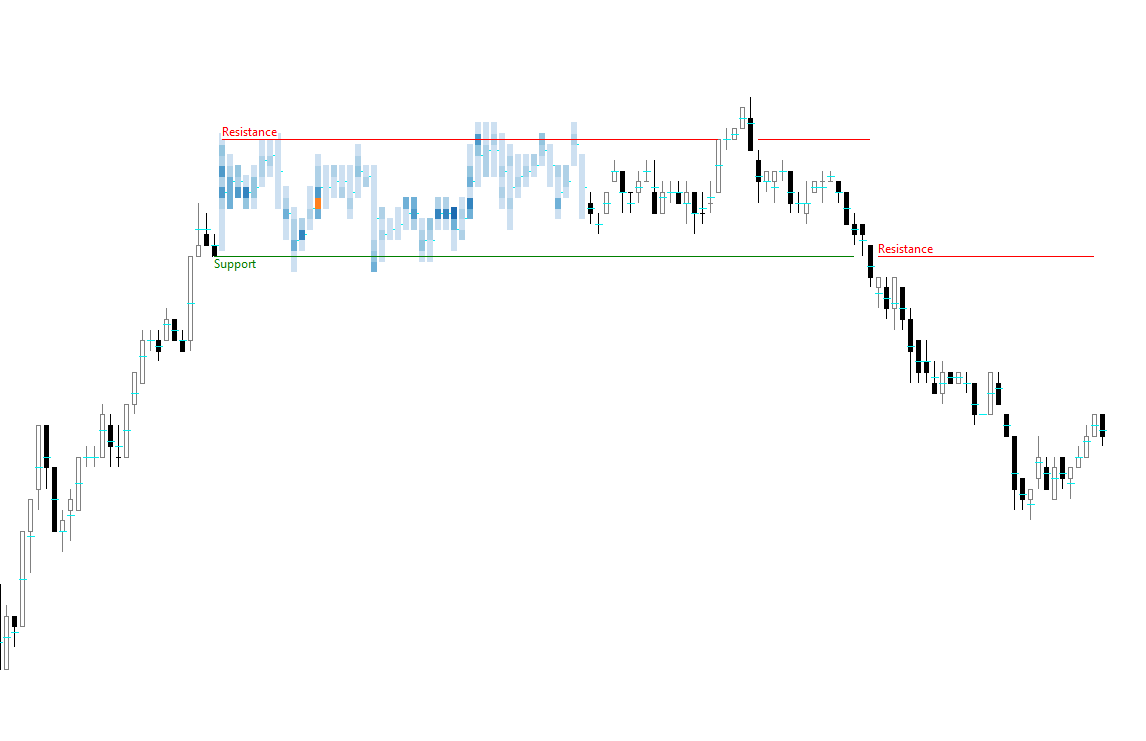

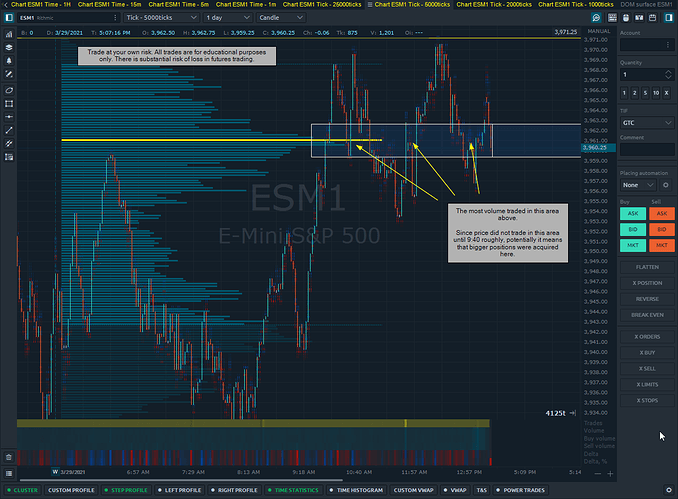

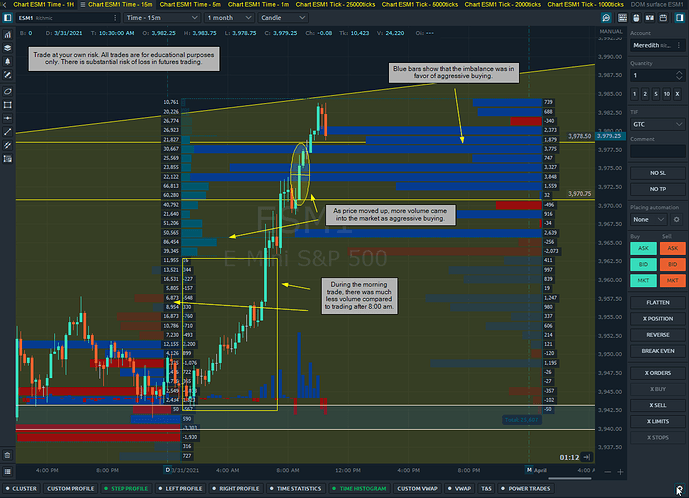

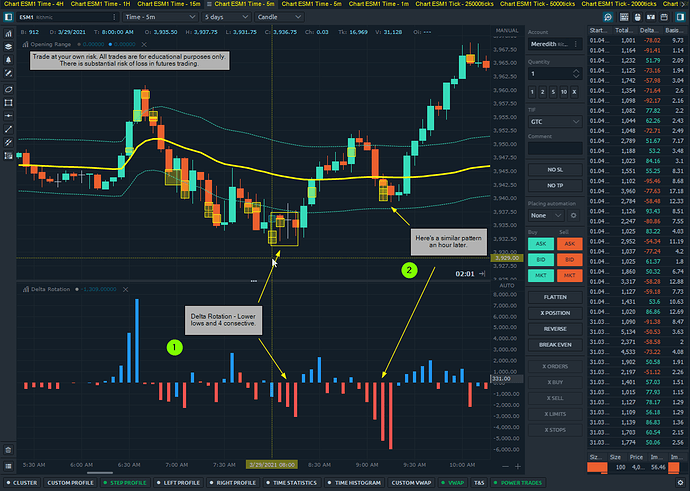

In the below chart, we are looking at 5-minute candles with a daily POC.

The daily range is highlighted here:

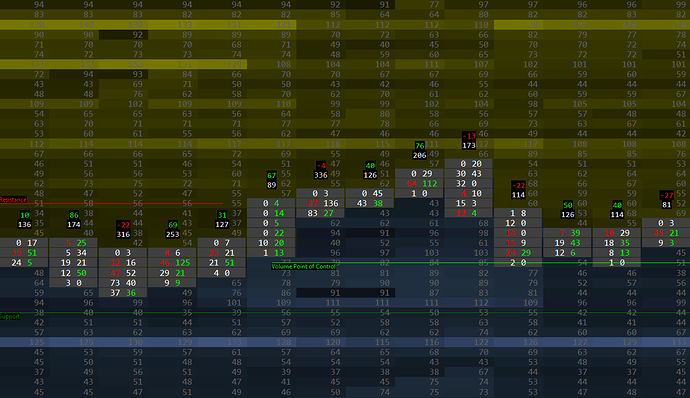

The horizontal volume bars are a measure of how many contracts traded at that price during that time-frame.

Normally, we are custom to seeing volume on a time-scale rather than a price-scale. What we can do with this information is see what prices had the most liquidity.

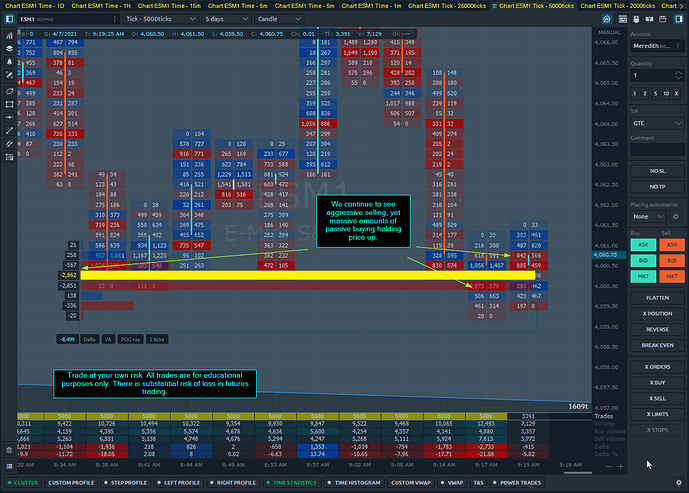

By identifying this we can then look at our Footprint chart to see if there was a bias towards sellers or buyers.

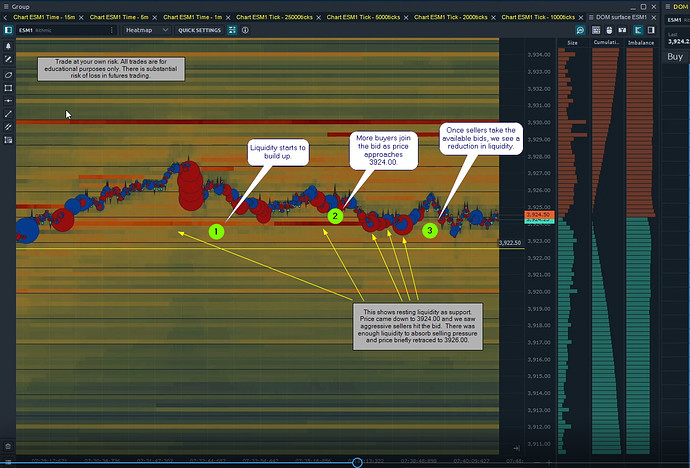

I’m particularly interested in the POC for today. Since volume is recorded on a price-scale, we can determine where the majority of the contracts traded during the day based on price.

The market opened and traded to the lows, then after 9:40 AM, moved up toward the POC. I’ve highlighted the price range I’m interested in.

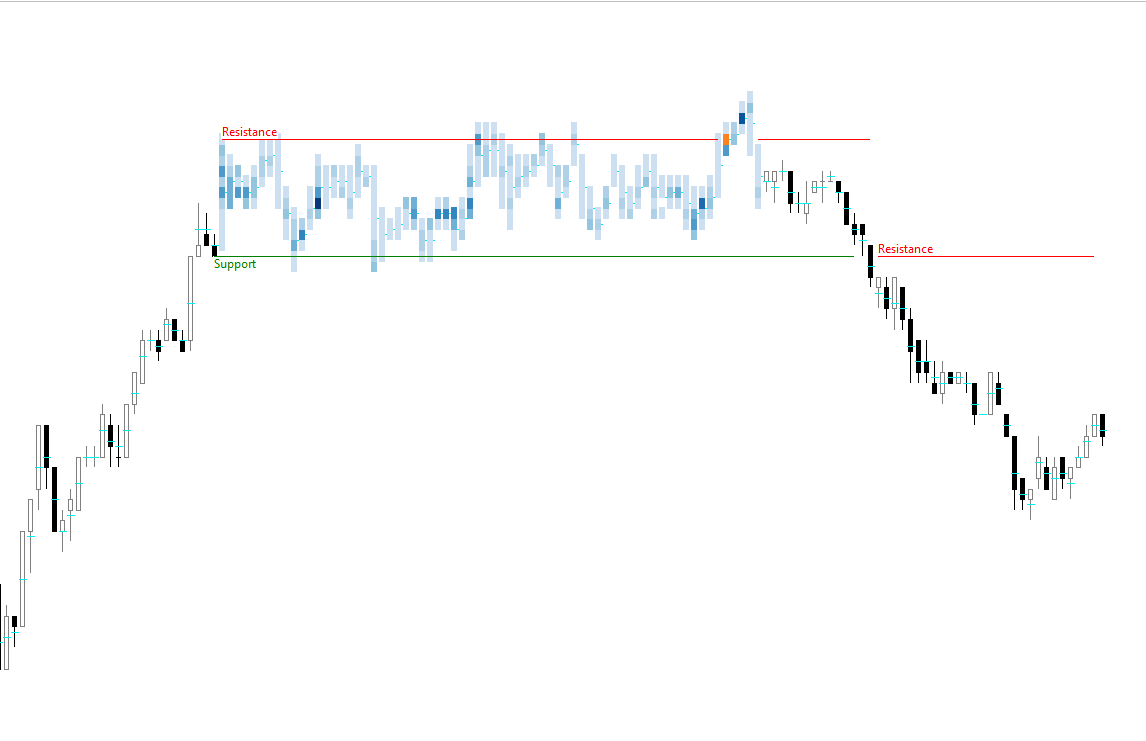

This means that there were no volume bars printed in this area as price hadn’t traded there yet. Therefore, the majority of the volume today traded at 3961.25.

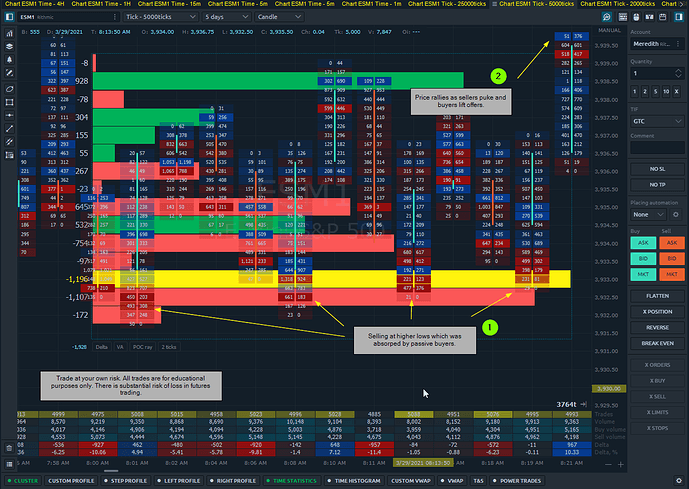

Now that we have where the majority of the volume traded in reference to price, we want to look at the imbalance between buyers and sellers in that area.

Let’s find this data on the same chart to quickly find if there was an imbalance there.

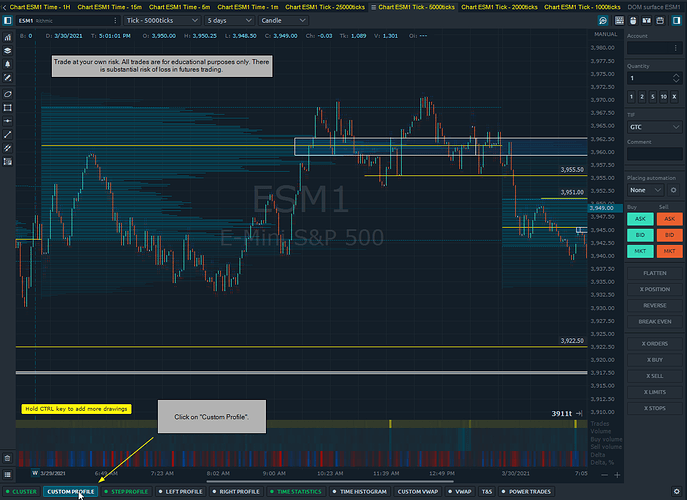

Click on “Custom Profile” on the volume analysis toolbar:

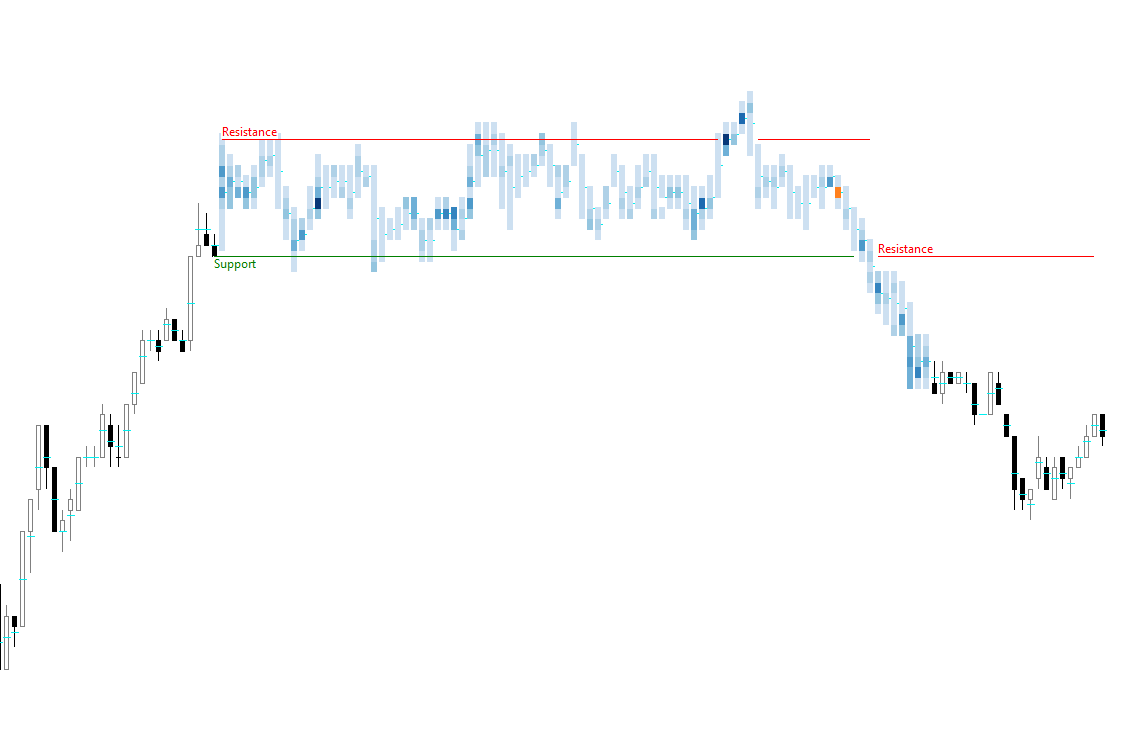

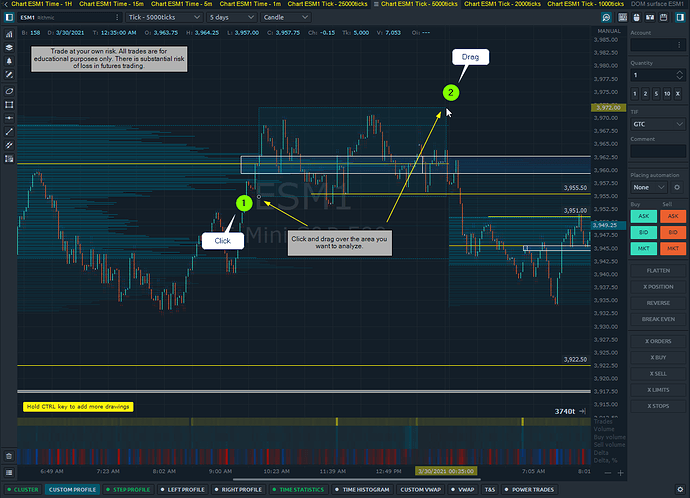

Click and drag over the area you want to analyze:

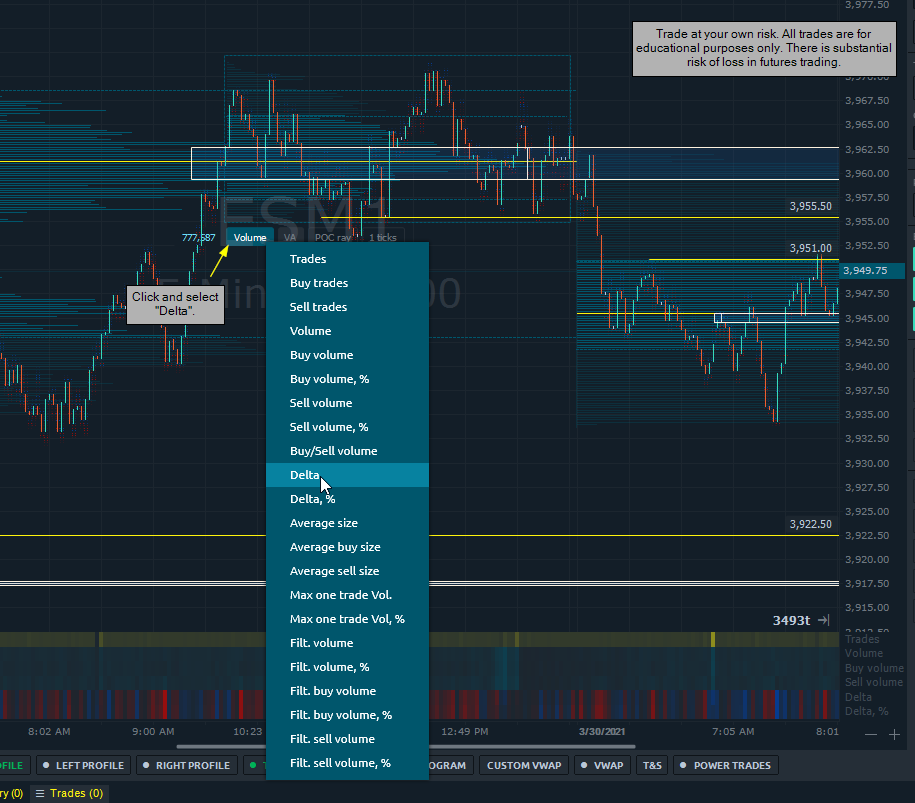

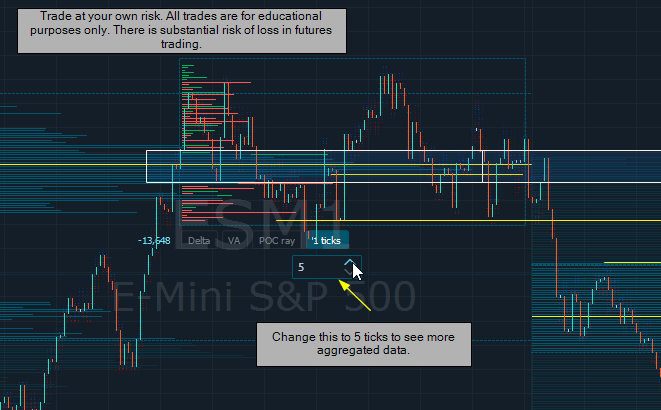

Click where it says “Volume” then change the selection to “Delta”.

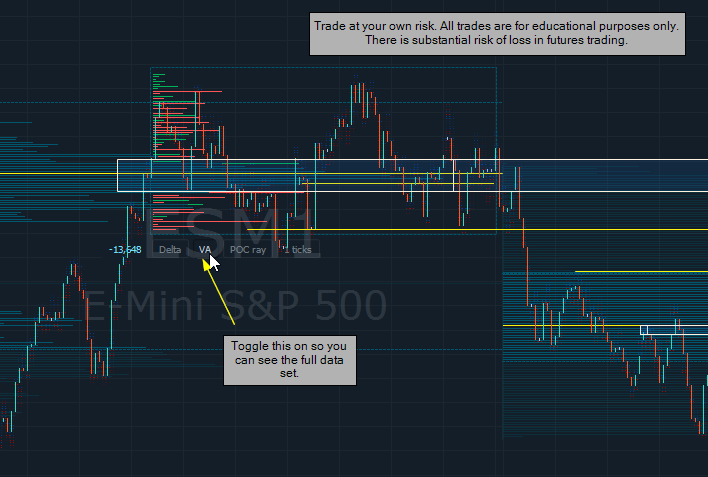

Click on “VA”.

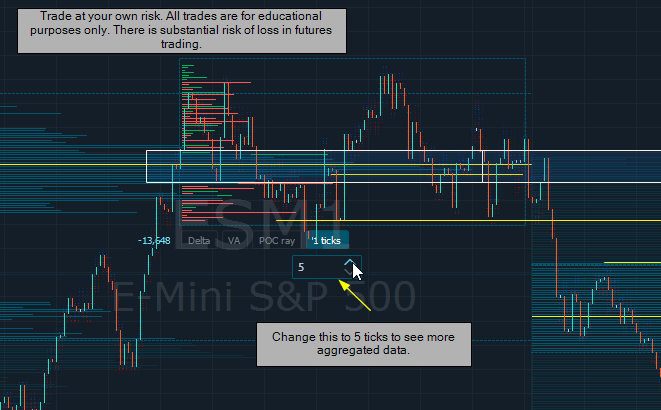

Change to 5 ticks.

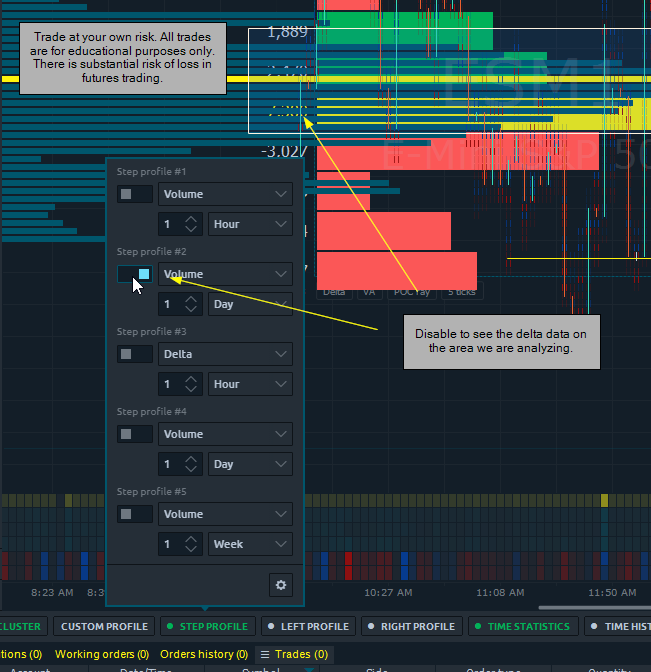

If you have the Step Profile volume enabled, you will have to disable that briefly to fully see the delta volume profile we just created.

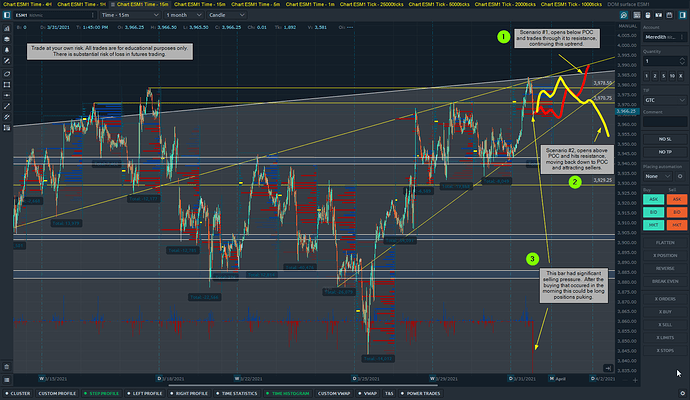

Now we can see that there is a delta number assigned to the horizontal bars. This means that for the time range in our area (roughly 9:50 am to 10:00 pm), there were 7,320 more aggressive sellers than aggressive buyers. Specifically between the prices of 3959.50 and 3960.50.

To circle back, the reason I want to narrow down my data is that I know this is the area that traded the most contracts for that trading day. We got this from finding the POC above.

This is important to know as it provides us with a look into the bias of the majority of traders.

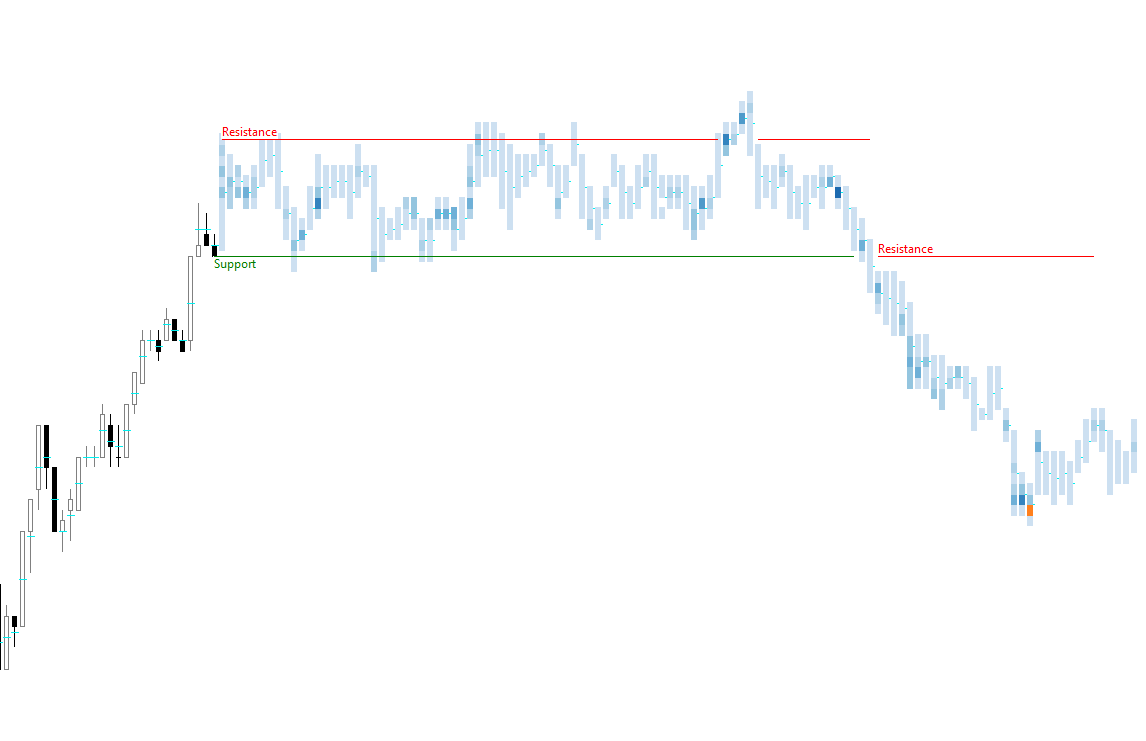

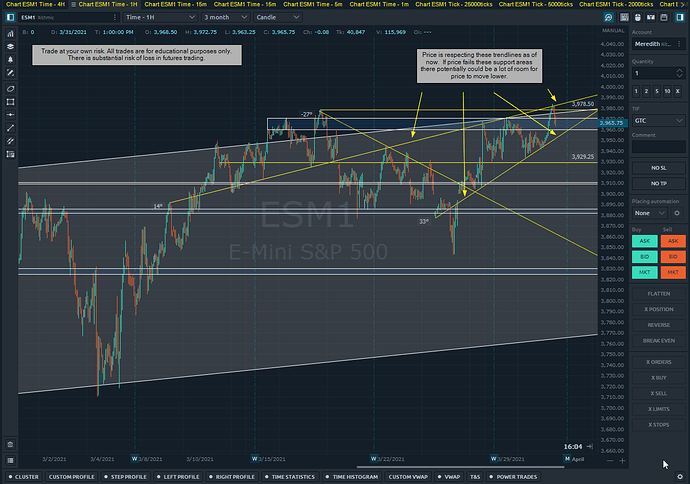

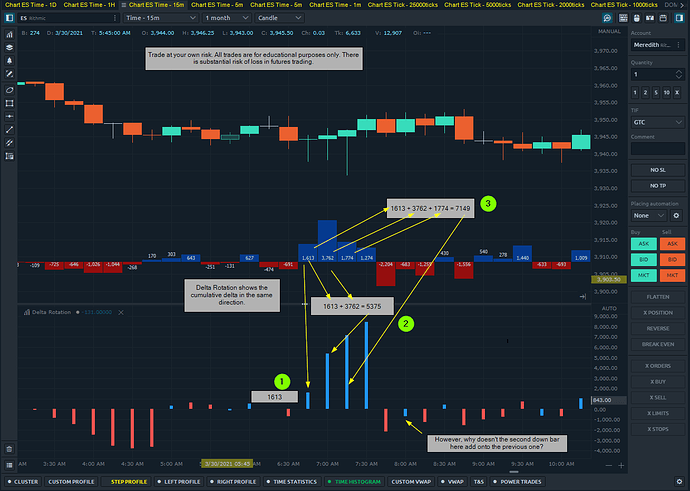

We can add this to our candlestick charts as well. I’m going to use my 15 min chart for this.

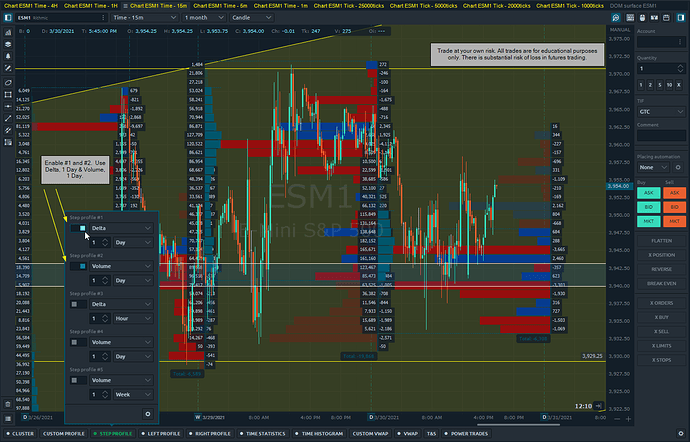

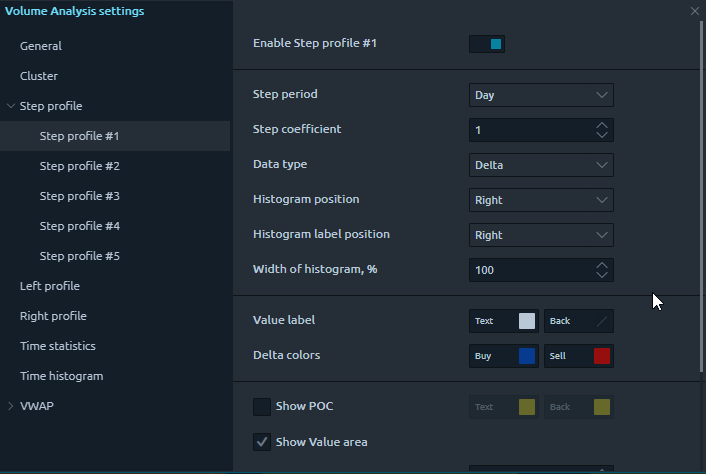

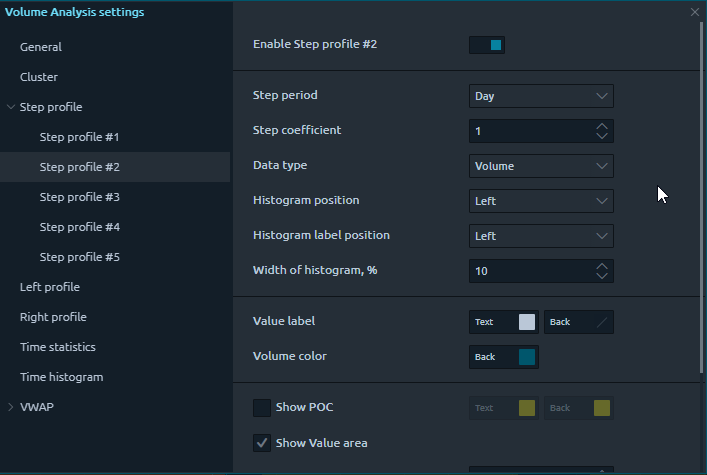

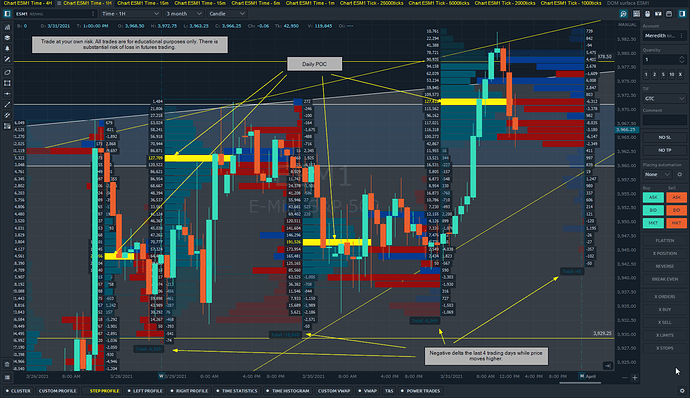

Click on “Step Profile” on the volume analytics toolbar.

Then click on the gear icon and refer to these settings to adjust accordingly:

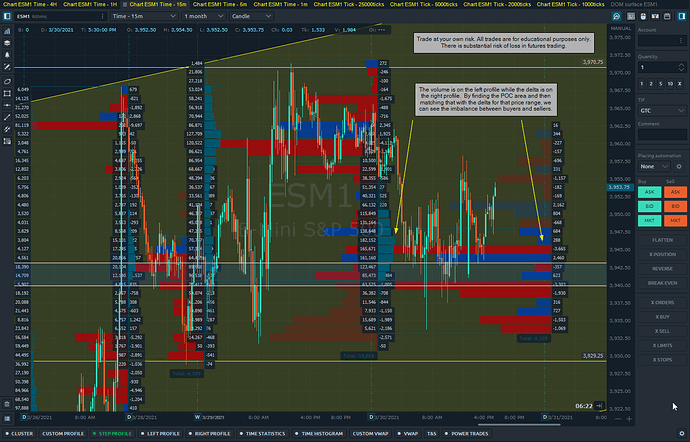

Now we can see the chart with price, delta, and volume. Sorted by time (intra-day) as well as price.

Look at the totals of the delta for each day, these have been negative the last 3 sessions for the ES mini futures. This is relevant information because it tells us what the overall sentiment is.

There is a substantial risk of loss in futures trading. Past performance is not indicative of future results. The figures here represent an opinion. The placement of contingent orders by you or broker, or trading advisor, such as a “stop-loss” or “stop-limit” order, will not necessarily limit your losses to the intended amounts, since market conditions may make it impossible to execute such orders. Please conduct your own due diligence if Futures are an appropriate instrument for you.