Trading Plan 4/7/21 Wednesday.

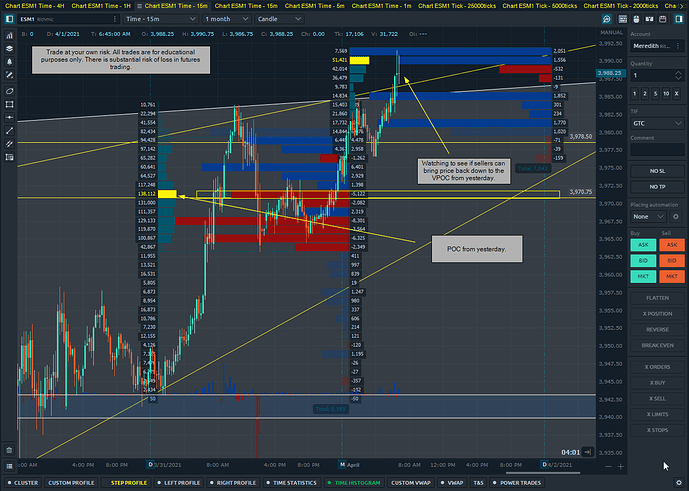

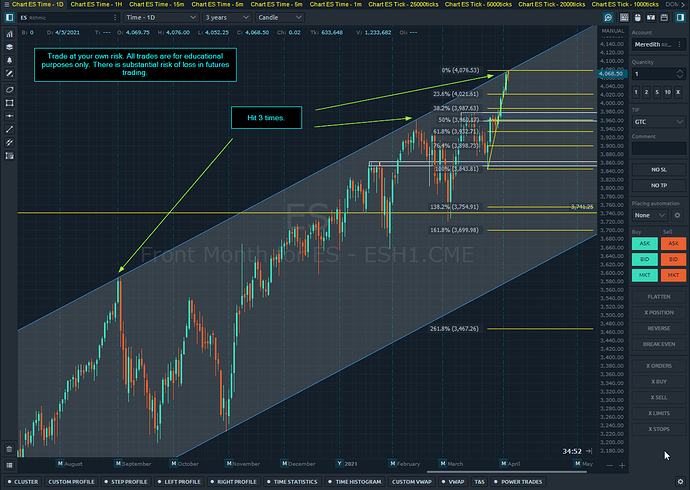

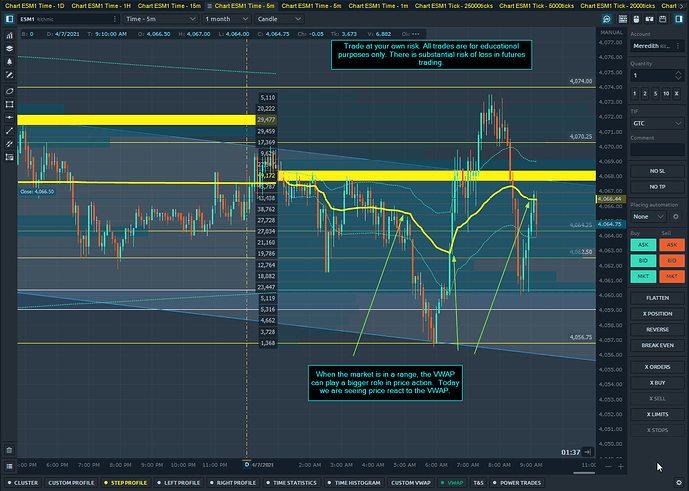

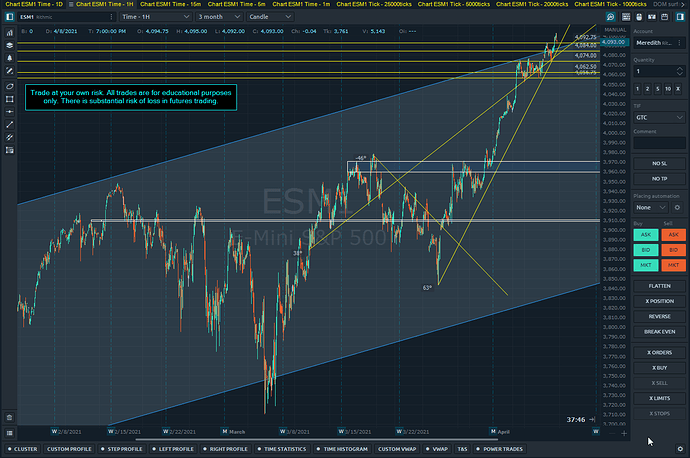

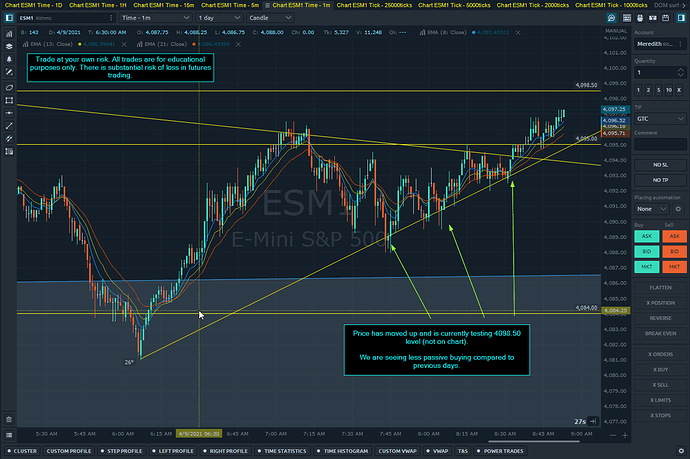

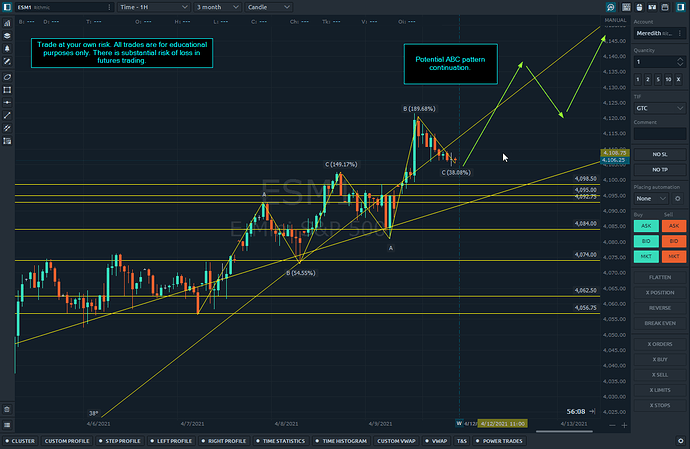

The daily charts for es mini futures have just hit an important trendline on the top of a channel.

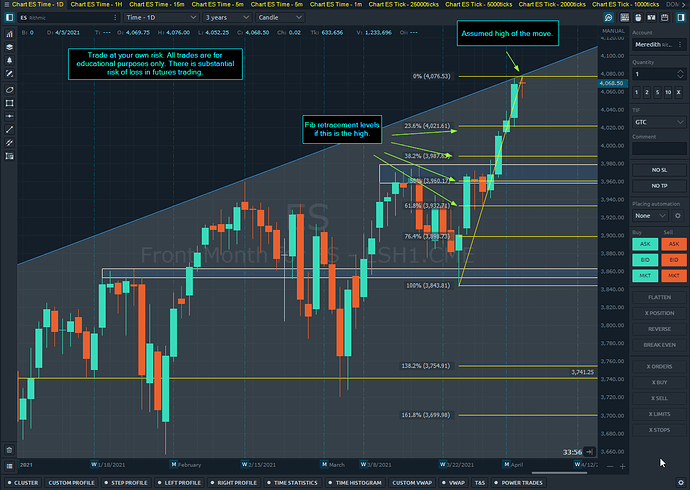

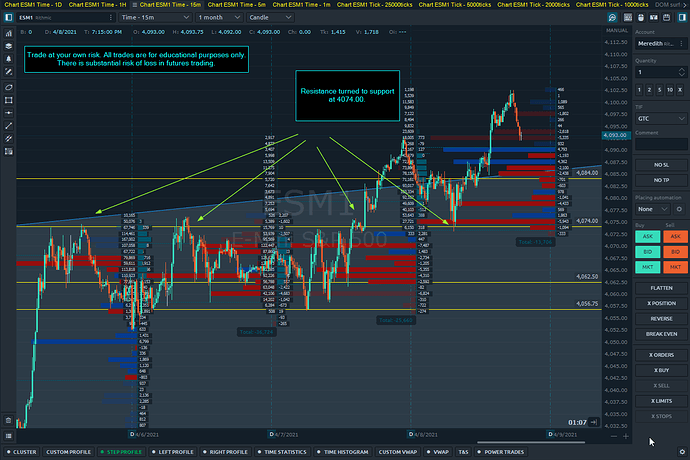

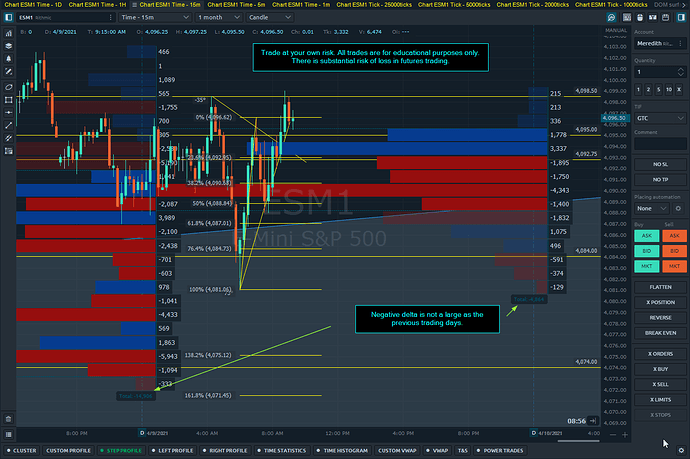

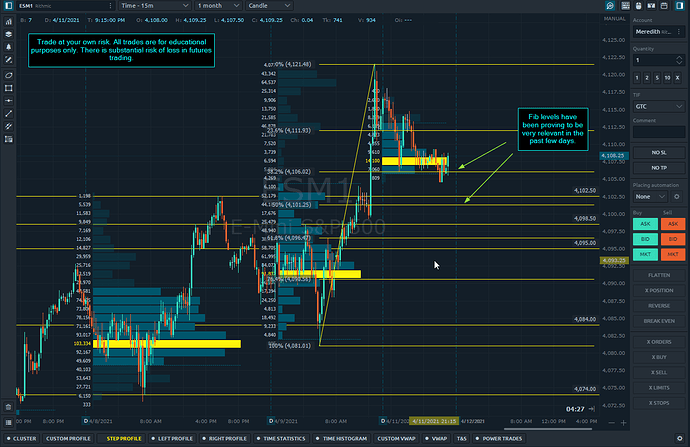

Taking a closer look here are the fib retracement levels if the recent high is the top of the move.

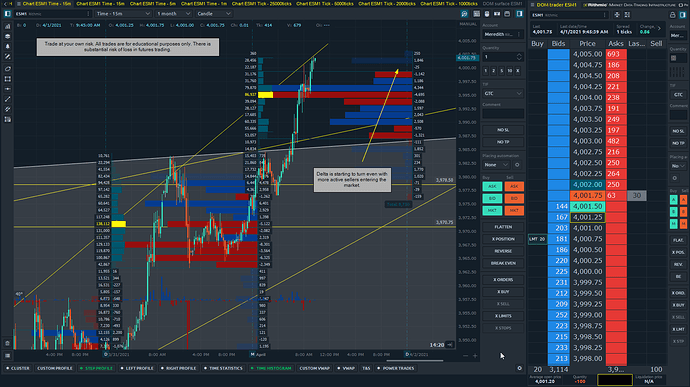

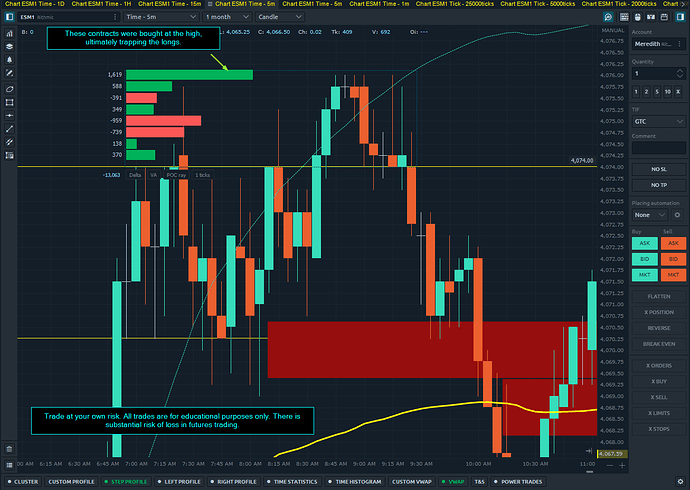

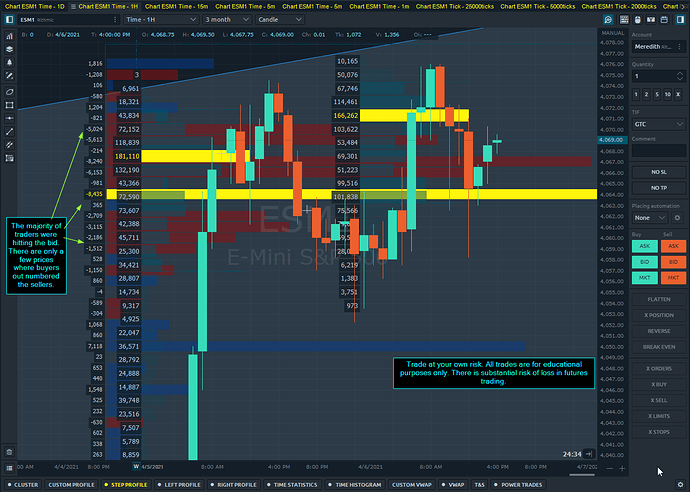

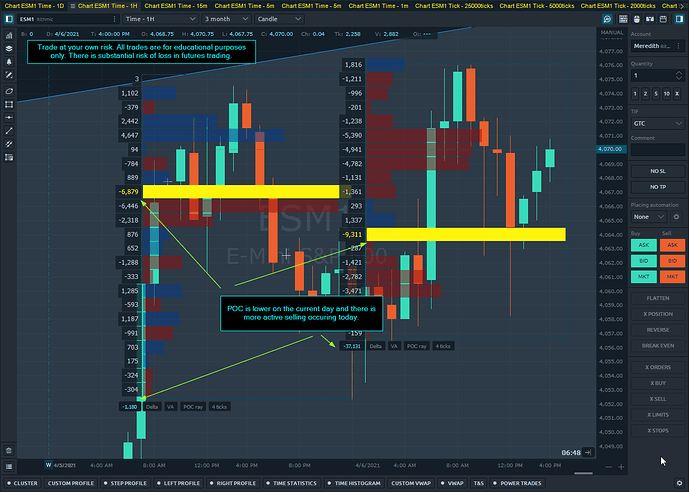

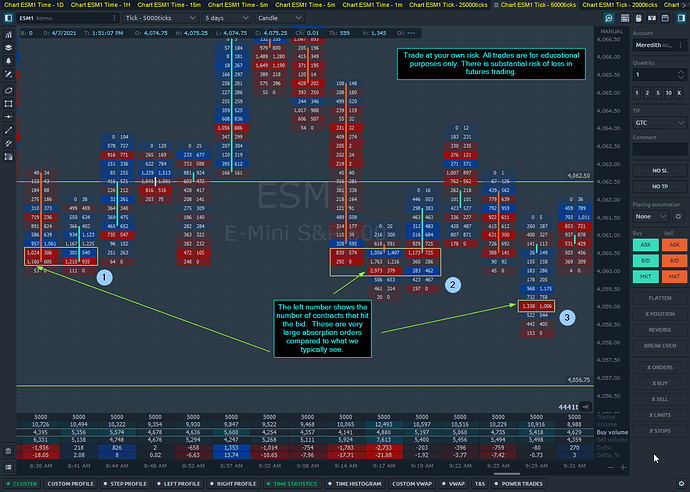

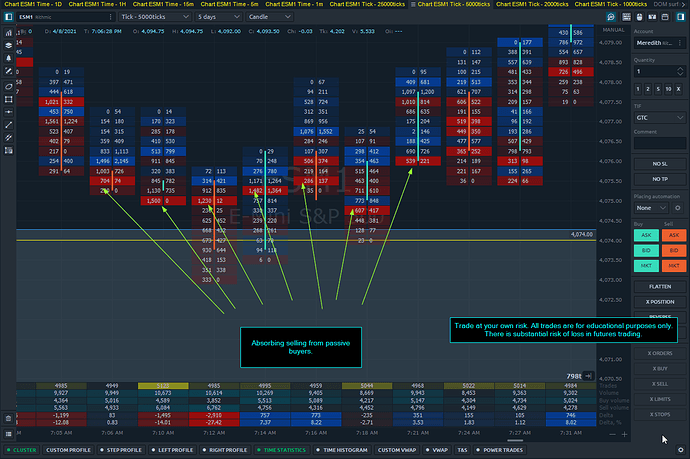

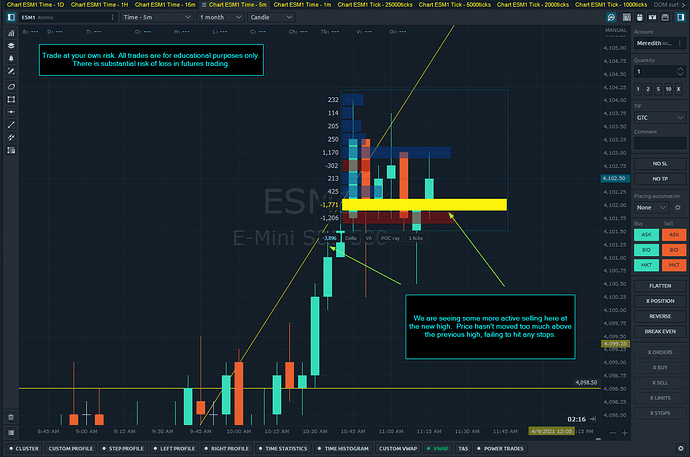

Now let’s look at the delta in relation to price in order to see how the market was behaving at these prices.

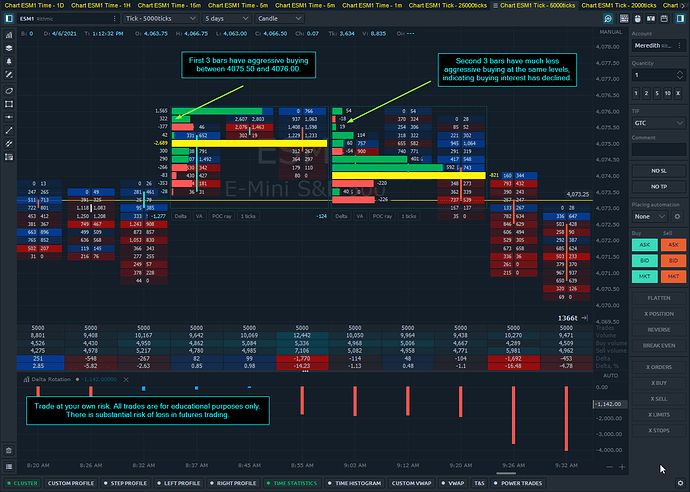

This chart shows the delta at each price level, in this case, the data is broken up in groups of 4 ticks. We can look at more aggregated data by increasing the tick size on the custom profile or make it more granular.

The POC of the custom profile is set at 4064.00. For the time we have specified and the price range, the majority of the contracts traded at that price. That bar also has a negative delta of 8,435. The adjacent bars also have mostly negative showing us that sellers were hitting the bid more than buyers were lifting the offer.

While this doesn’t tell us the positions of those traders, it does tell us something important about the mentality of the market.

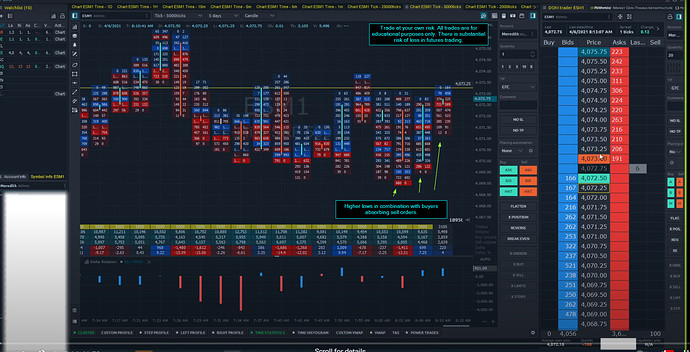

There were substantially more passive buyers in the market resulting in mass absorption of the aggressive selling. Despite the noticeable imbalance between the sellers and buyers, price still managed to make new highs.

Let’s recap.

What we know so far:

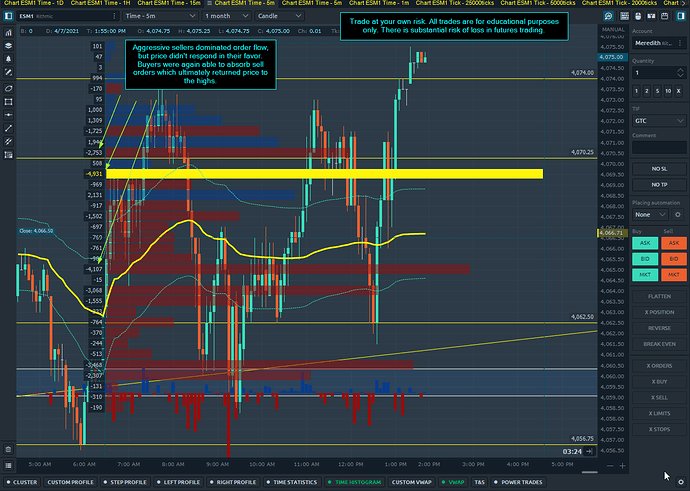

- Price is on the top of an uptrend channel.

- Price moved up despite there being more active sellers in the market than active buyers.

- This move was fueled mainly by passive buyers backing up the smaller group of active buyers.

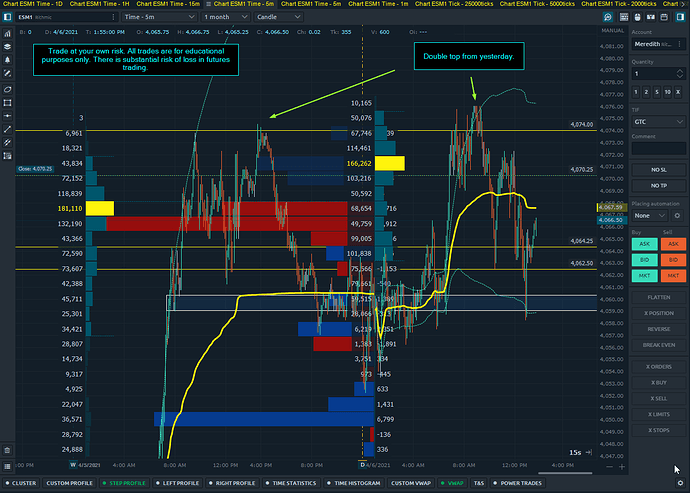

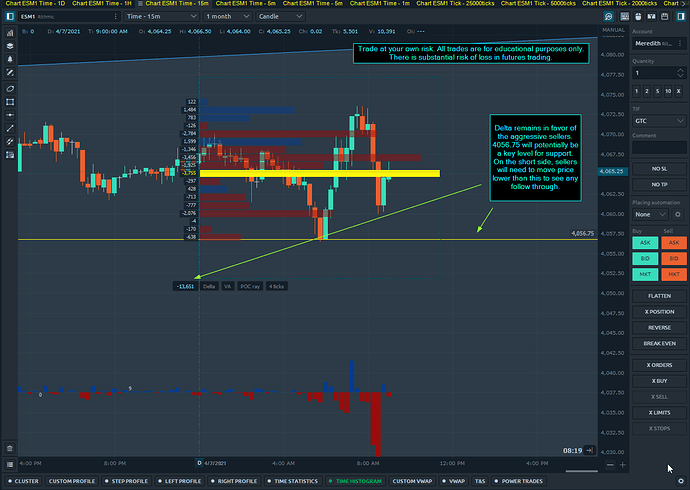

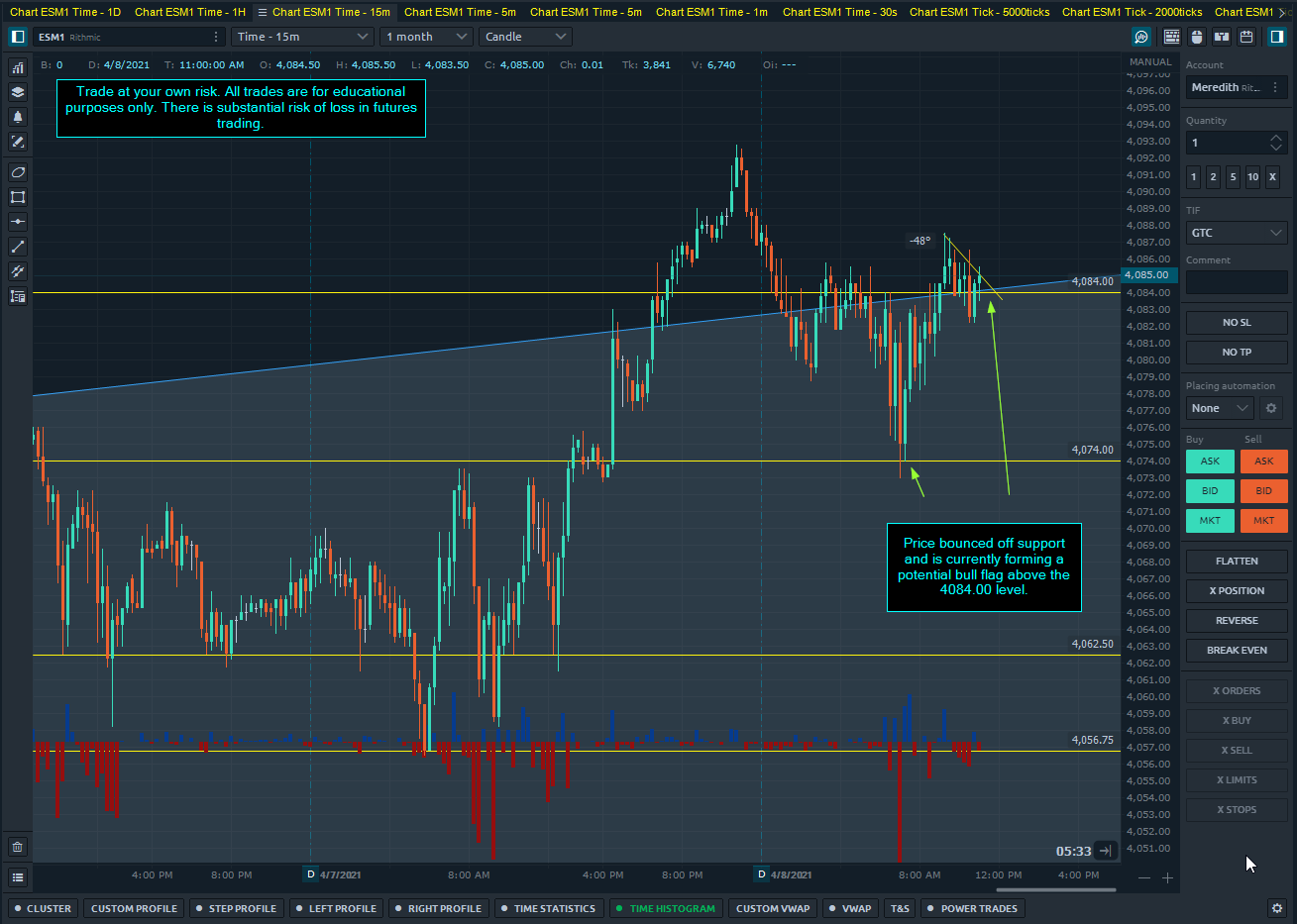

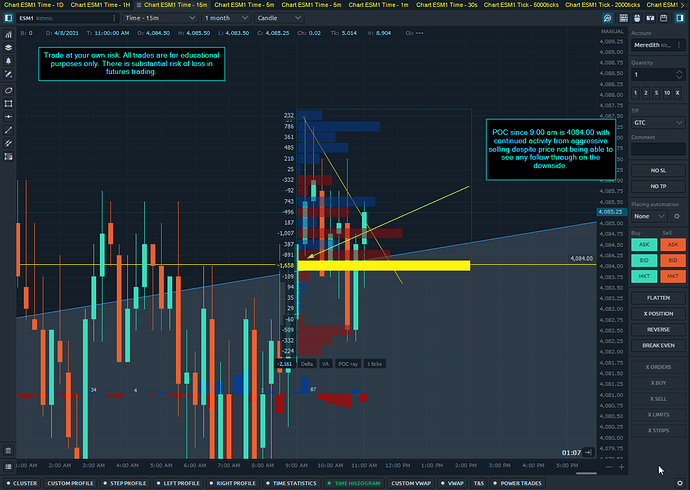

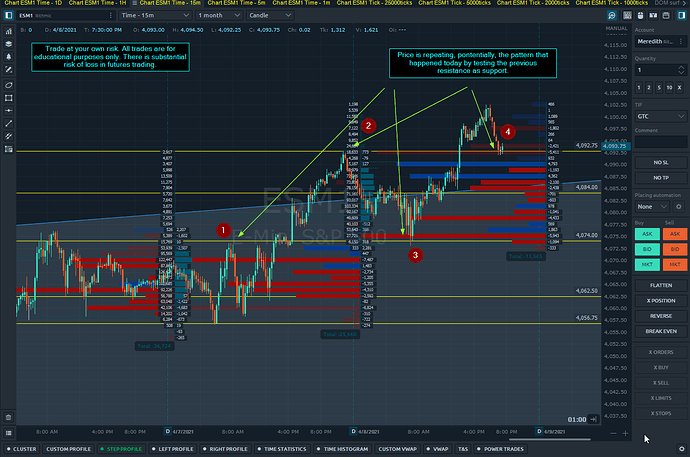

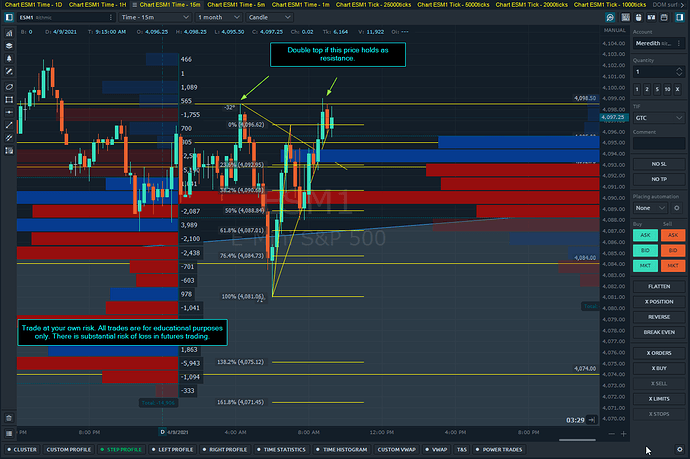

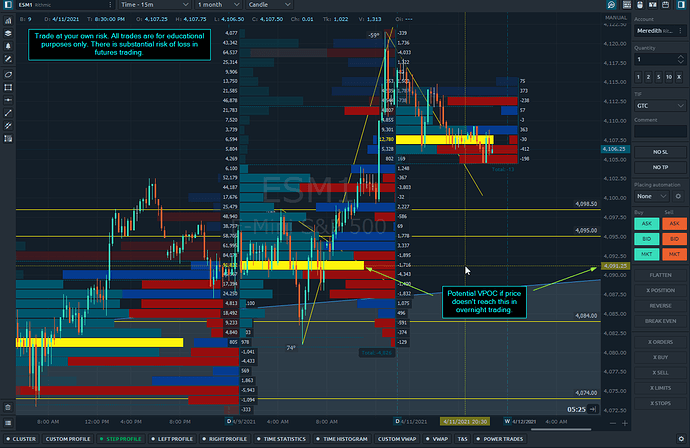

To find if there is a difference in market behavior between the two highs on Monday and Tuesday, we need to add another custom profile and edit the one we currently have.

We will take the 17 hours before midnight Tuesday, and 15 hours after midnight Tuesday to analyze separately. These numbers are not apples to apples, we are just trying to find the behavior in the order flow.

Disregarding the difference in hours of trading, the most notable differences are:

- The POC is 3 points lower today.

- The delta is much more negative today (that is expected as today includes the open while we didn’t include the open in yesterday’s data).

- The behavior at the price levels between 4068.00 and 4074.00 has changed. Today there is more active selling today in that area as compared to yesterday where that was generally more active buying.

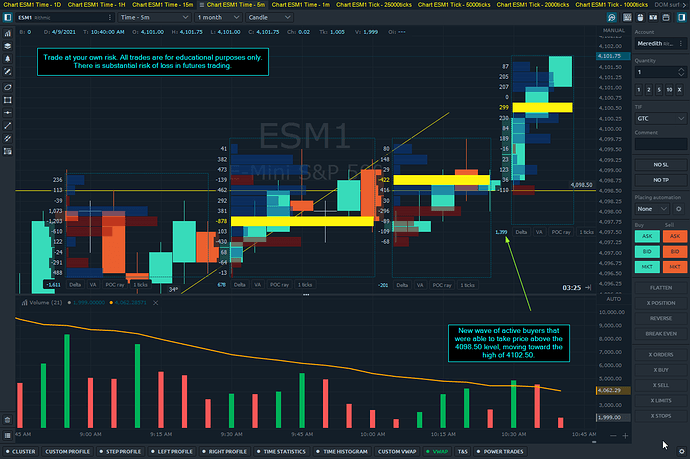

Now let’s ask some questions to see if we can formulate a plan for tomorrow.

Knowing that from yesterday until today, we saw more sellers hitting the bid at prices above 4058.00, what scenarios can we develop from that information?

Potential Scenarios:

-

A lot of retail traders took short positions in this area with potential stops above the previous high and above the top channel. If so, price movement at and above the stops could fuel a rally. This could then be used as liquidity for large institutions taking large short positions, driving price down (refer to fib levels above).

-

Mix of Algo trading, scalpers, and retail traders selling into liquidity from big buyers. This is why we saw the large imbalance in favor of the active sellers, yet the price continued to climb. If the market doesn’t necessarily have a bias toward either long or short positions, price may potentially retrace to test past resistance.

And of course, the possibility that the market will do exactly what the market does and we can interpret it then. However, breaking down the data allows us to develop a reasonable trading hypothesis to watch for in real-time as we trade.

We will take a look at the rest of the overnight trade before the open to adjust or polish our plan.

There is a substantial risk of loss in futures trading. Past performance is not indicative of future results. The figures here represent an opinion. The placement of contingent orders by you or broker, or trading advisor, such as a “stop-loss” or “stop-limit” order, will not necessarily limit your losses to the intended amounts, since market conditions may make it impossible to execute such orders. Please conduct your own due diligence if Futures are an appropriate instrument for you.