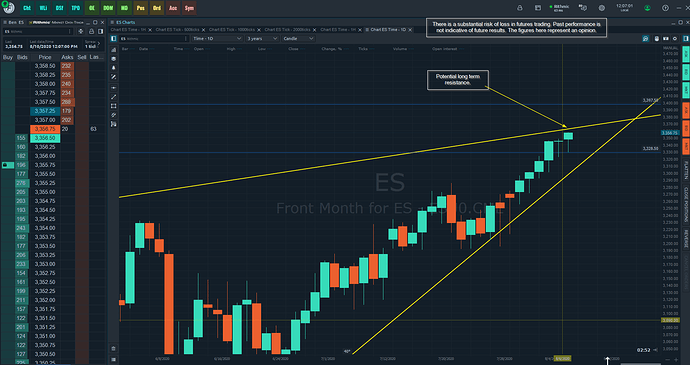

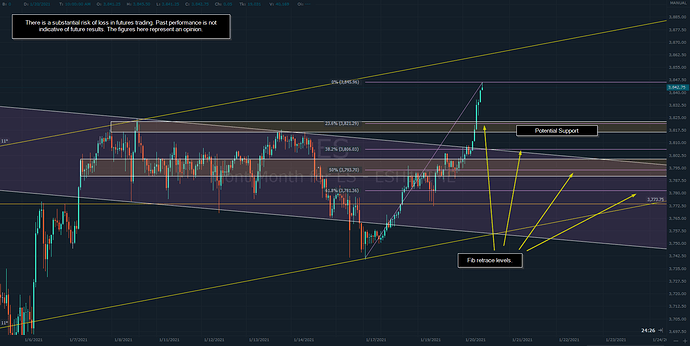

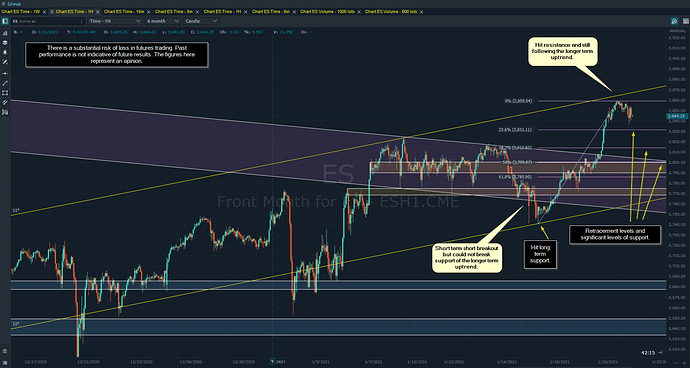

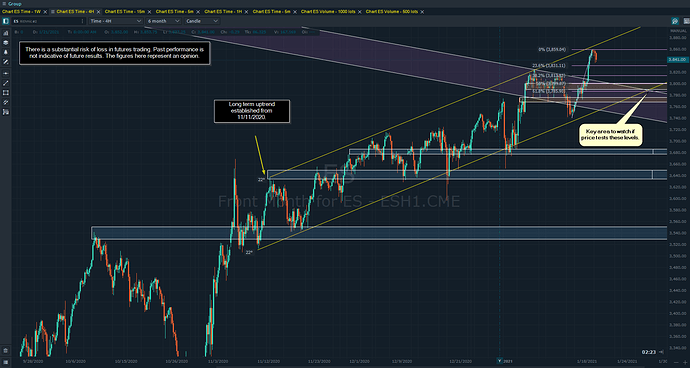

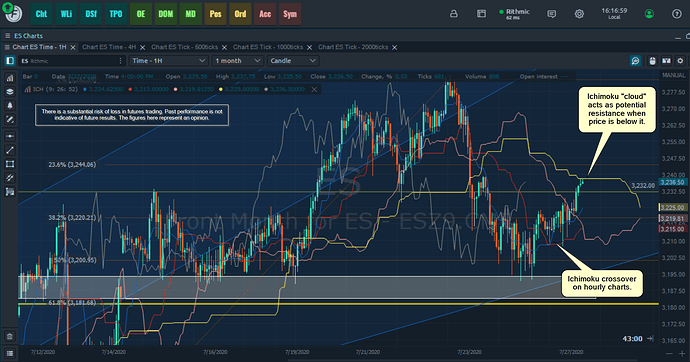

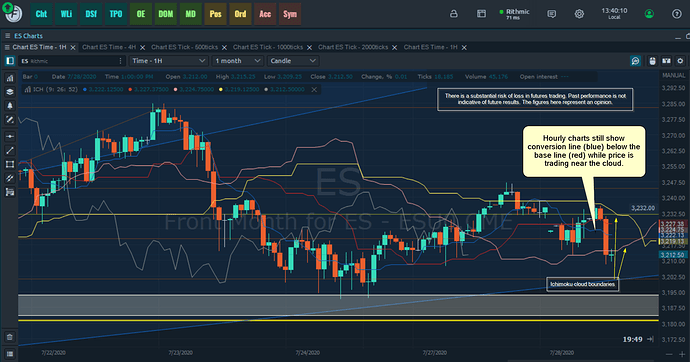

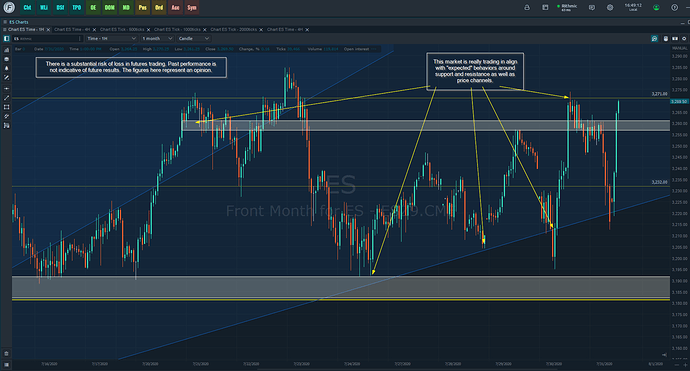

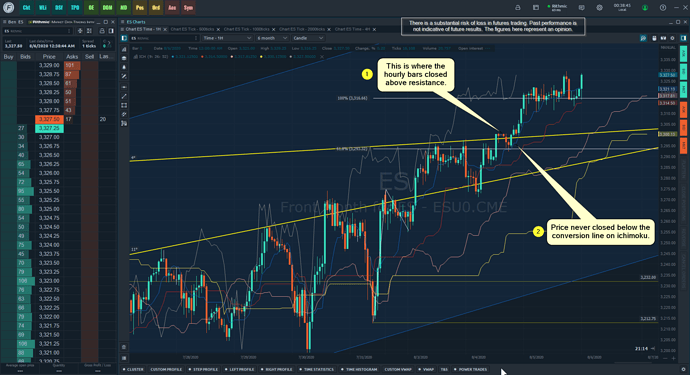

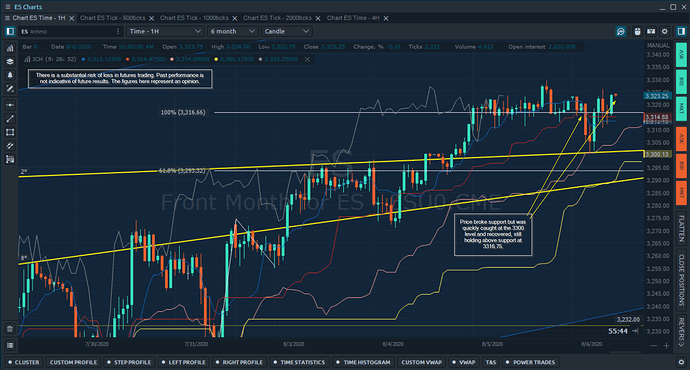

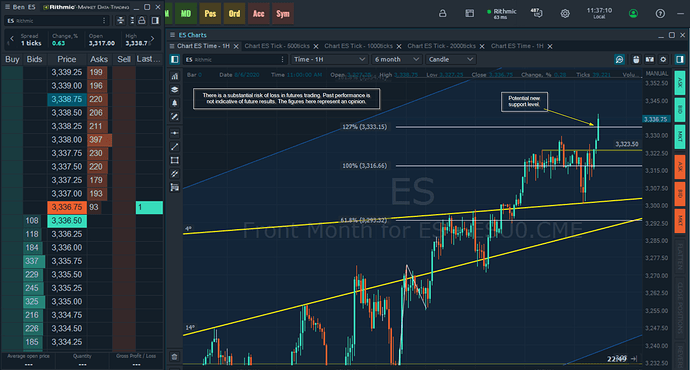

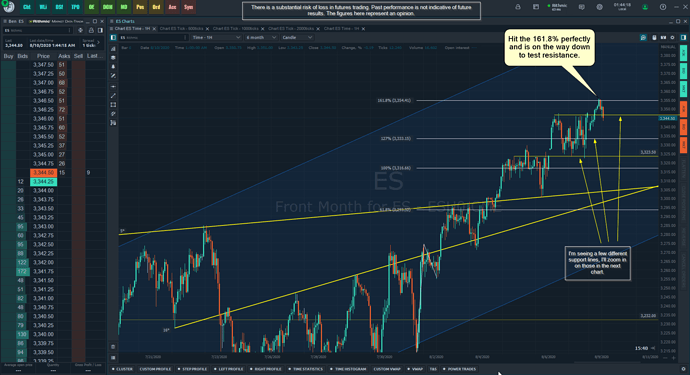

So what are the ES Minis going to do? It has surprised me a few times over the last week (not to mention Gold, which is suitable for another post), but overall it seems to be respecting already identified areas that may potentially indicate continued uptrend.

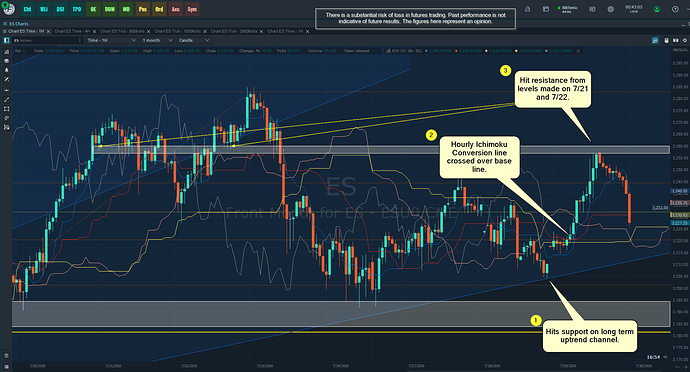

Here’s the first few observations of the moves:

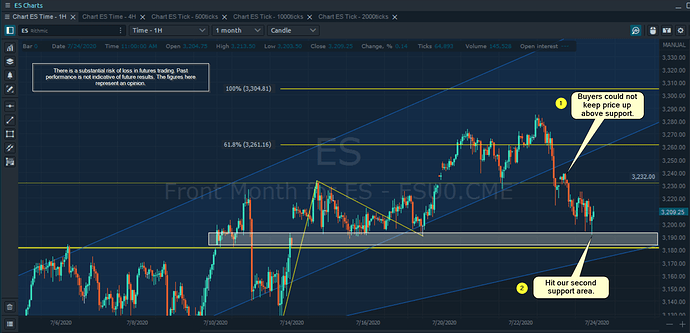

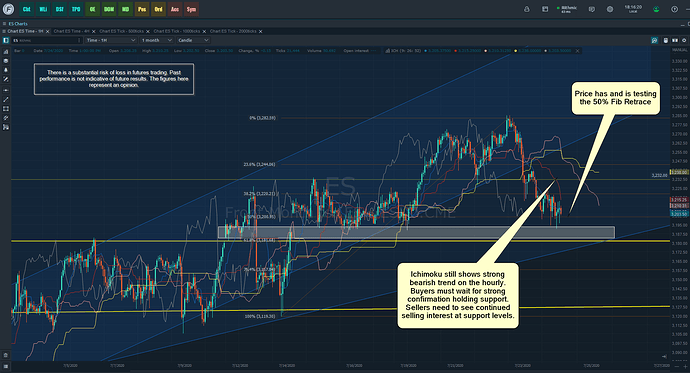

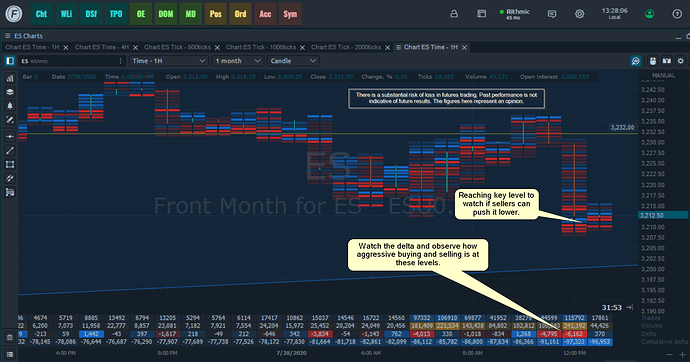

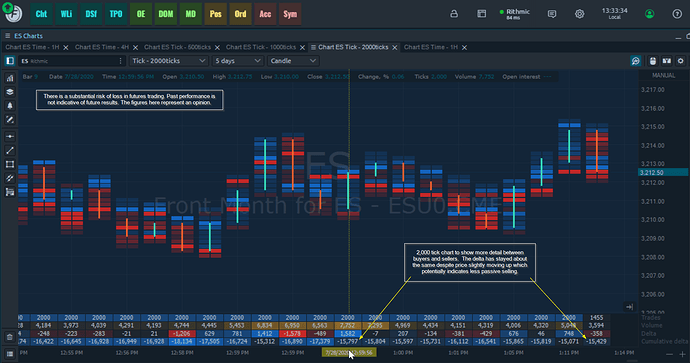

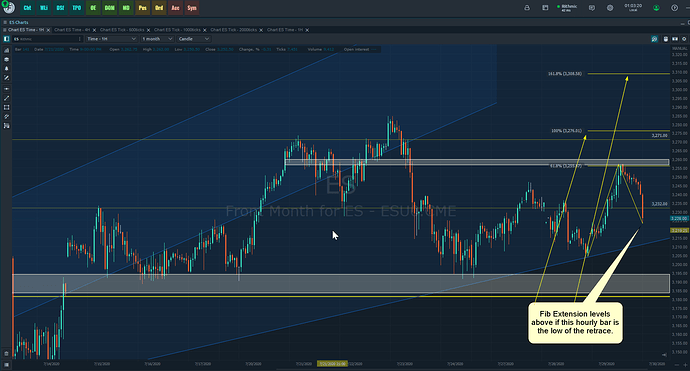

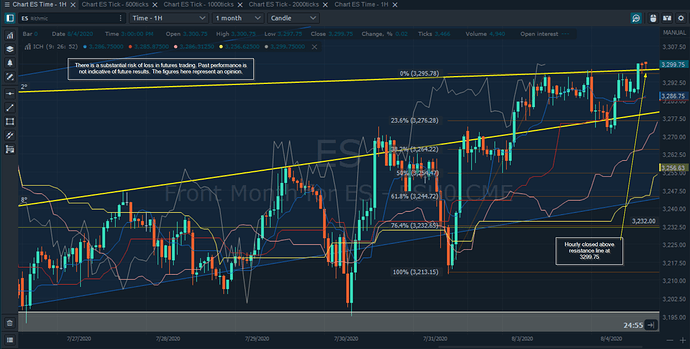

For the move starting at 3204.25 on the 28th to the high 3257.00 on the 29th, here are the Fib Retrace levels. It just wicked the 61.8% level.

If this HAPPENS to be the low of the retrace, here’s the Fib Extension levels to look out for:

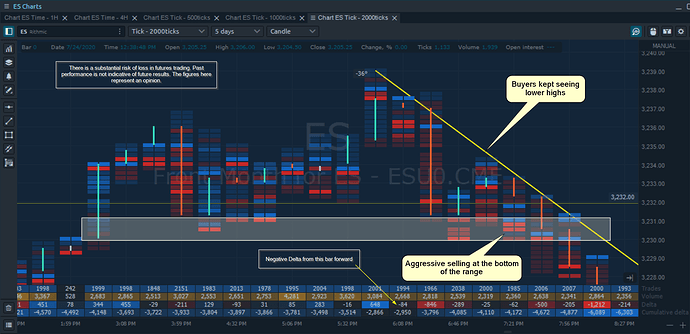

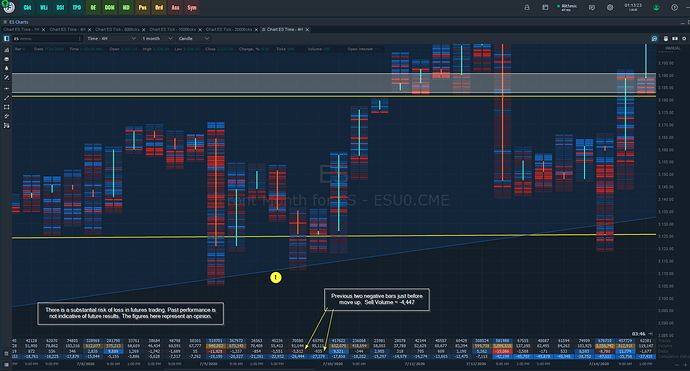

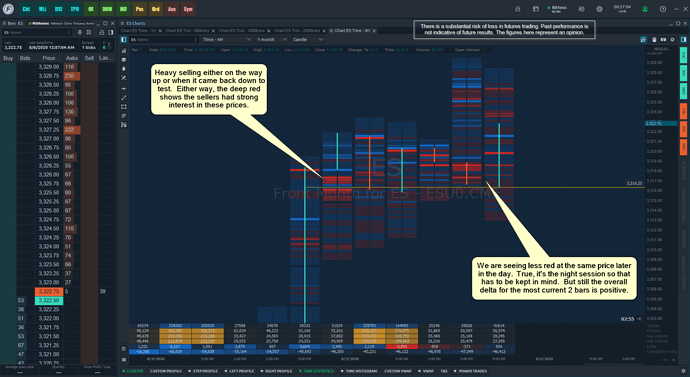

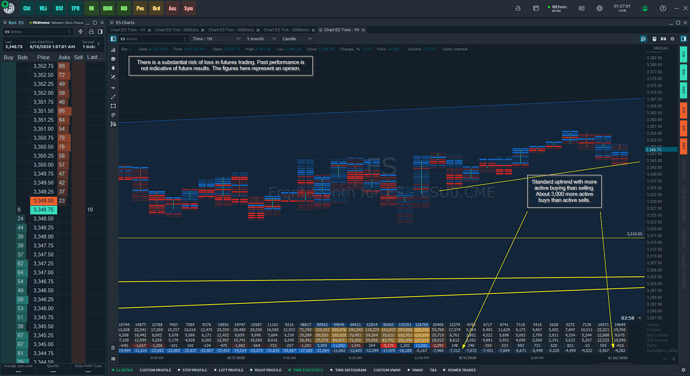

“Ok, I get it move on”. Yes you’re right, time for the delta analysis.

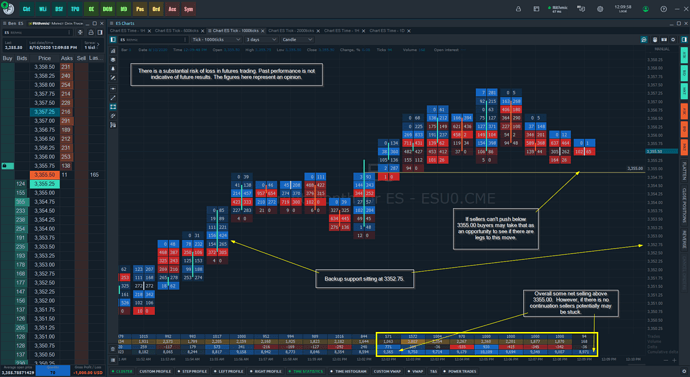

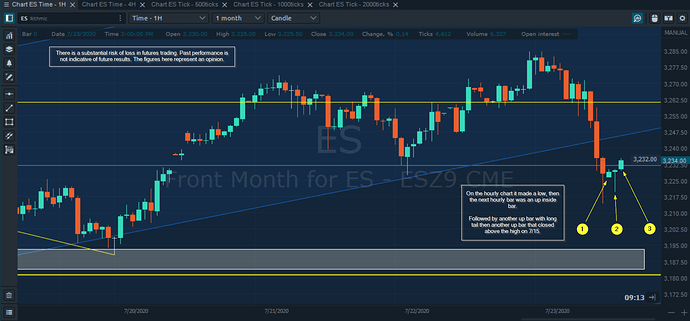

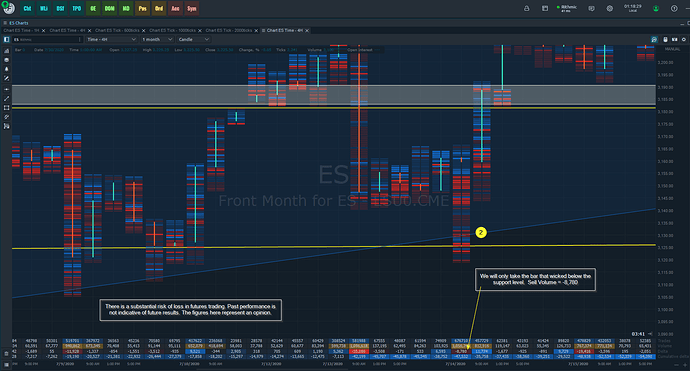

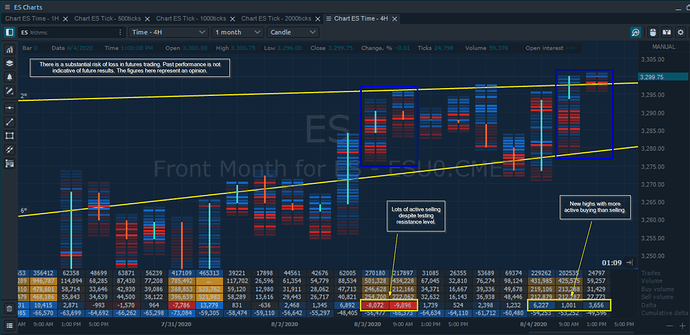

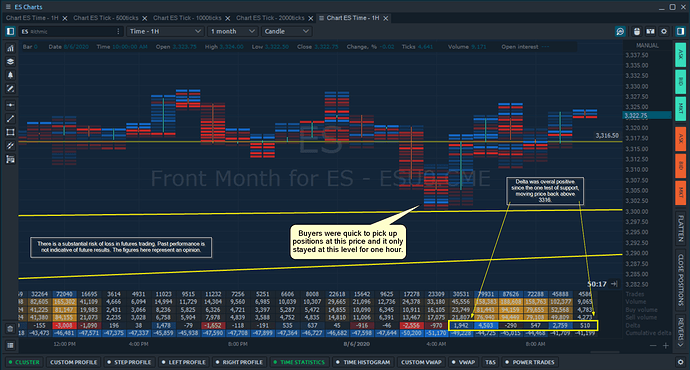

So, for the first significant test of support on the long term uptrend happened on 7/9:

I’m taking the two closest negative bars before the move up out of the range to calculate the amount of active selling contracts hit the bid.

Spot 1 = -4,447 Delta.

Second test was a few days later on 7/14:

Spot 2 = -8,780 Delta.

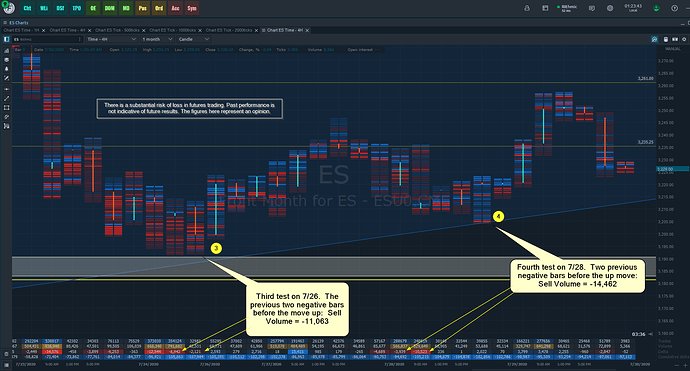

Third and fourth test:

Spot 3 = -11,063 Delta.

Spot 4 = -14,462 Delta.

So we have price moving higher while the support tests are attracting more active sellers.

To recap:

Spot 1 = -4,447 Delta. Price = 3113.75

Spot 2 = -8,780 Delta. Price = 3129.75

Spot 3 = -11,063 Delta. Price 3188.00

Spot 4 = -14,462 Delta. Price = 3201.25

So we are seeing more selling at the support levels at HIGHER prices.

In fact, we saw a TON more active selling throughout the entire move from 3113.75 to 3201.25.

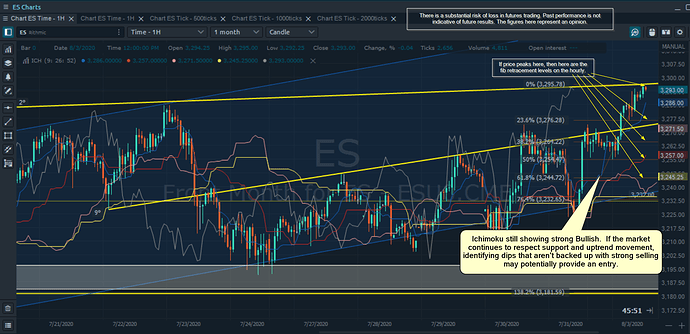

The Cumulative Deta started at -19,190 at Spot 1 and ended at Spot 4 at -102,856.

So a total of 83,666 ACTIVE sell contracts in a move up of 87.50 points.

With price moving up despite the massive amount of selling on Cumulative Delta, this means that on price moves up it didn’t require a lot of active buying because there weren’t as many sellers offering.

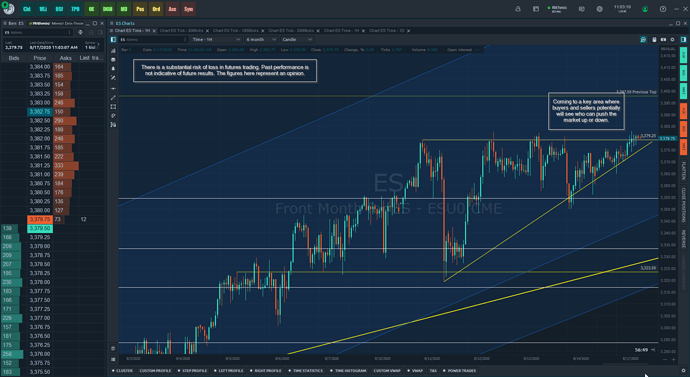

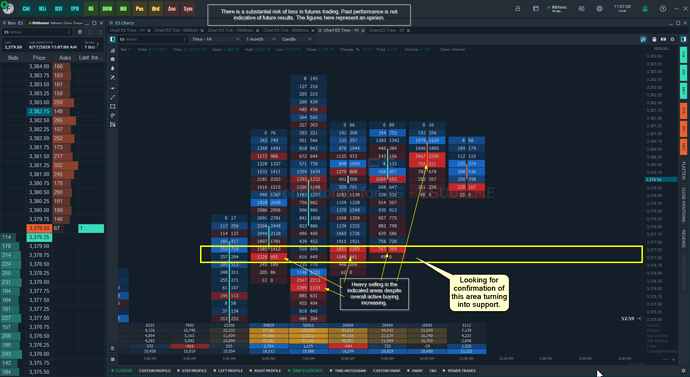

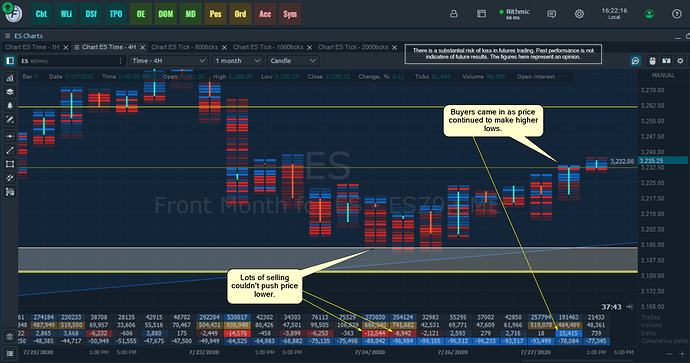

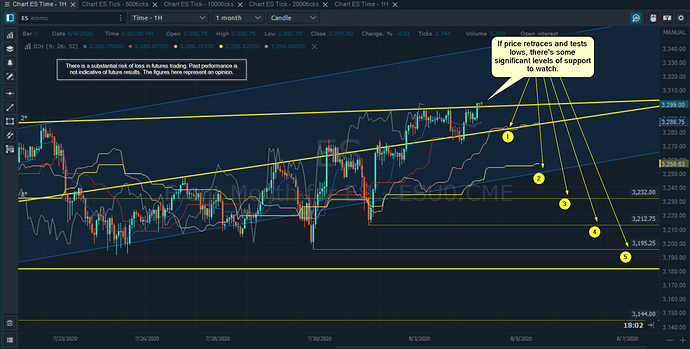

I have two questions here because I do think the market may potentially come to a pivotal point with a significant move ensuing:

-

Are banks and big players selling the dips that are being absorbed by optimistic retail traders?

-

Or are the banks and big players on the bid passively getting long, which would support why we are seeing aggressive selling into the lows and it fails to break below support?

What are your thoughts?

Charts Courtesy of Optimus Flow

There is a substantial risk of loss in futures trading. Past performance is not indicative of future results. The figures here represent an opinion. The placement of contingent orders by you or broker, or trading advisor, such as a “stop-loss” or “stop-limit” order, will not necessarily limit your losses to the intended amounts, since market conditions may make it impossible to execute such orders. Please conduct your own due diligence if Futures are an appropriate instrument for you.

. That’s OK, it’s a new week and now more information than we had before.

. That’s OK, it’s a new week and now more information than we had before.