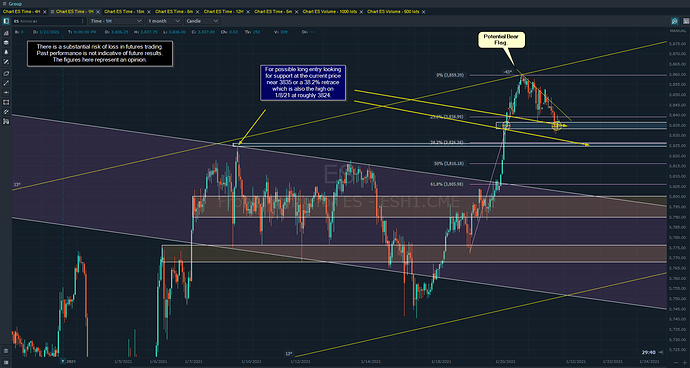

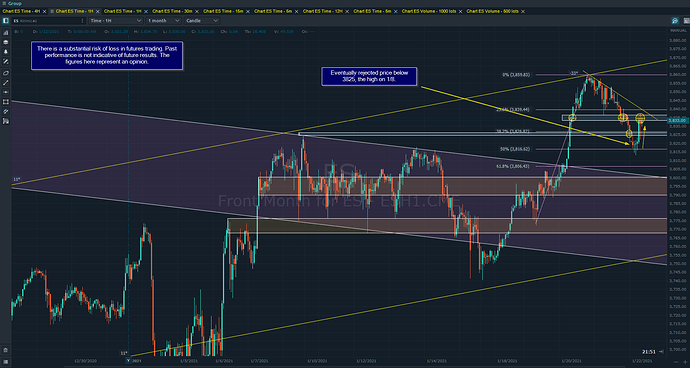

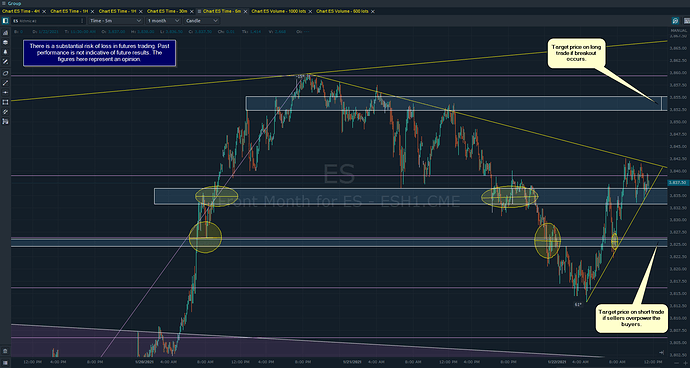

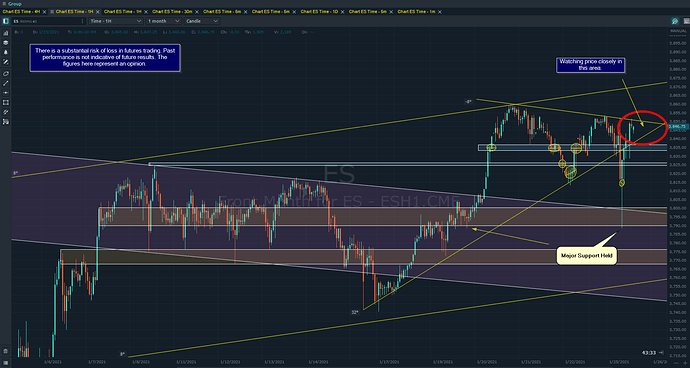

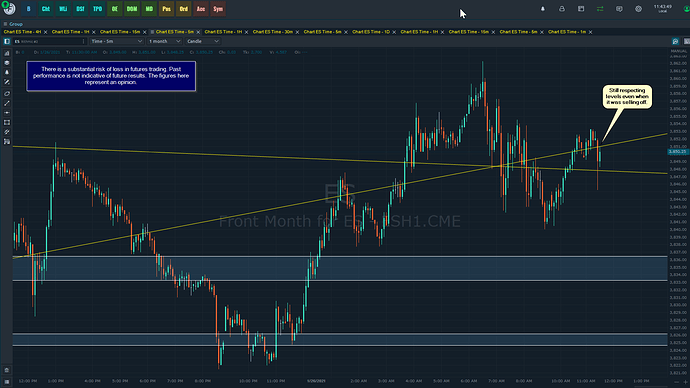

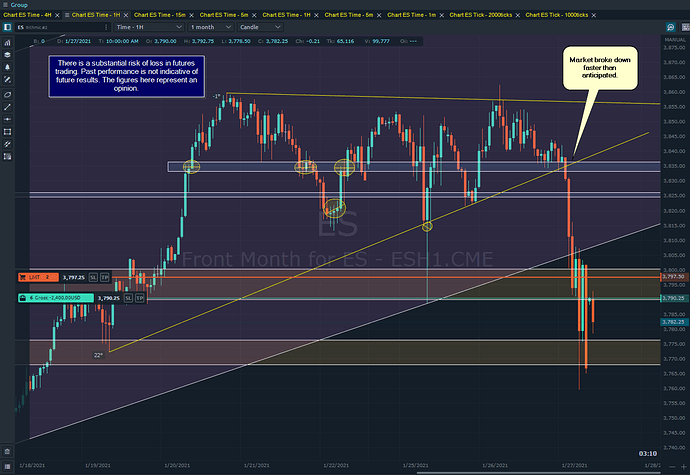

Update from previous post regarding fib retracement:

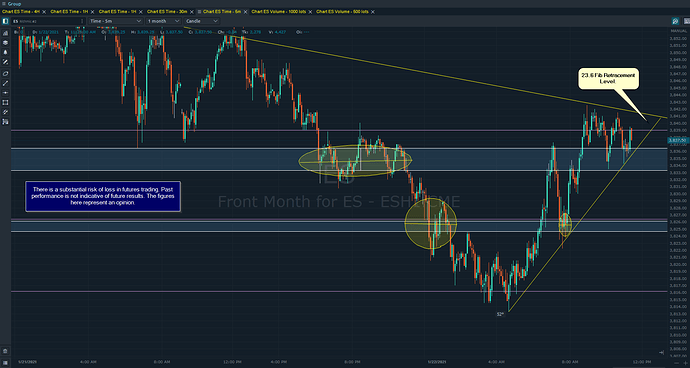

As mentioned I drew a fib retrace on the last chart knowing that may not be the top. I also correctly the bottom of the fib to represent the low of the recent move:

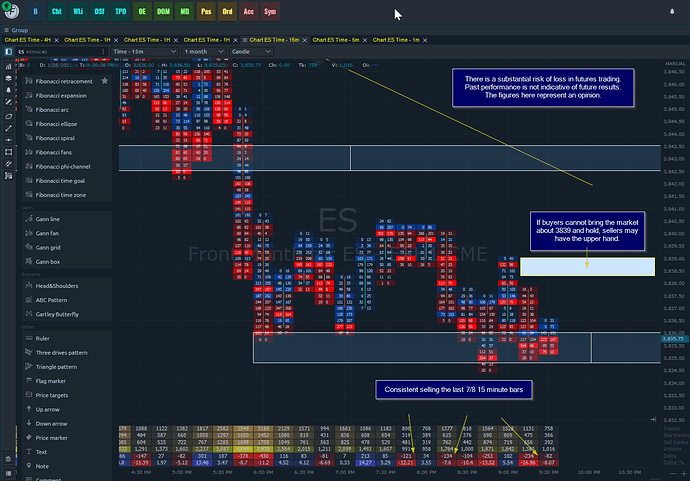

Some important things to note:

-

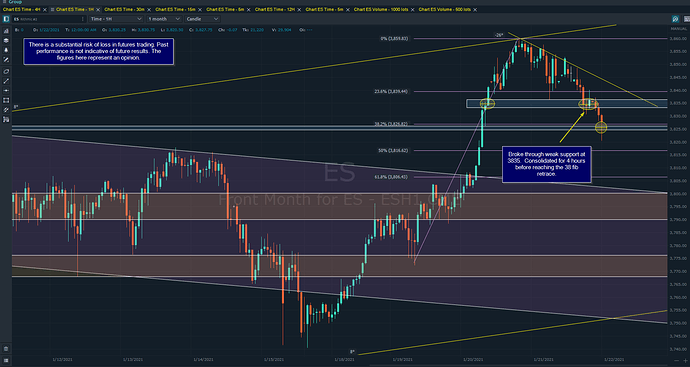

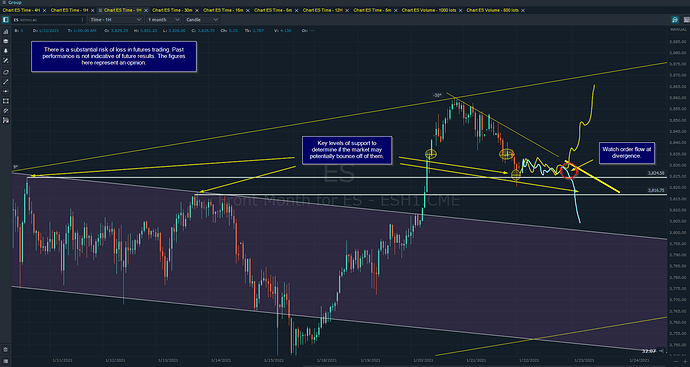

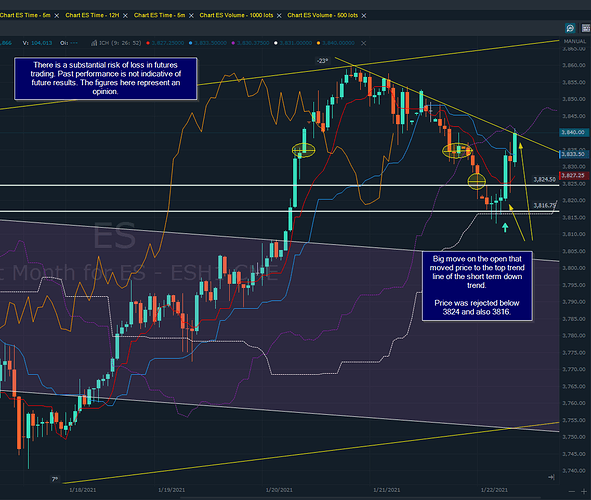

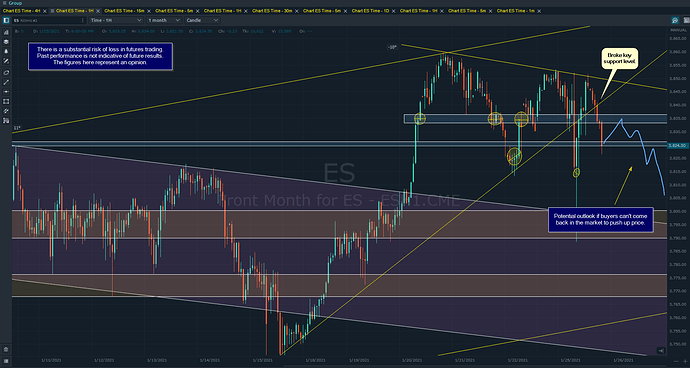

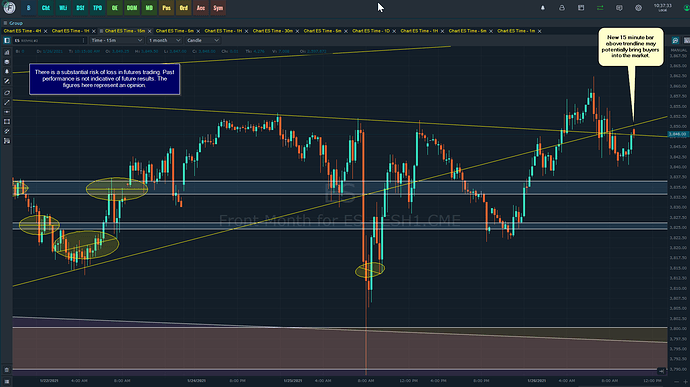

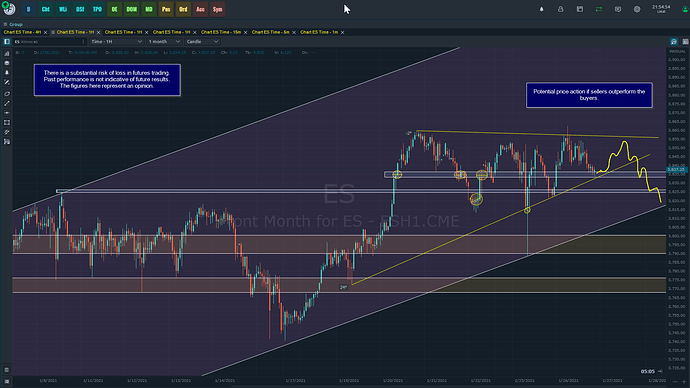

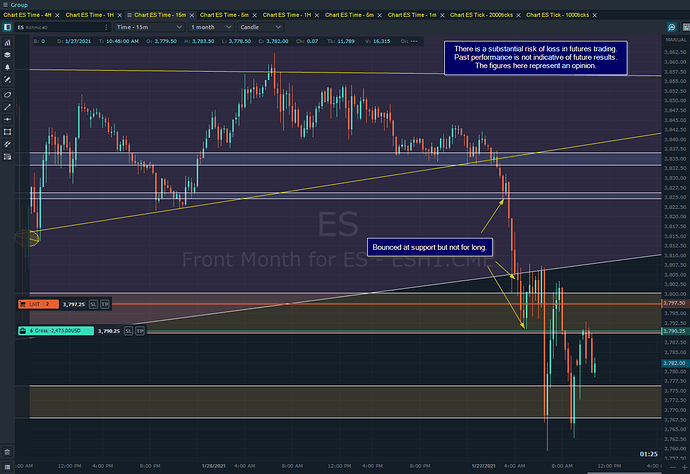

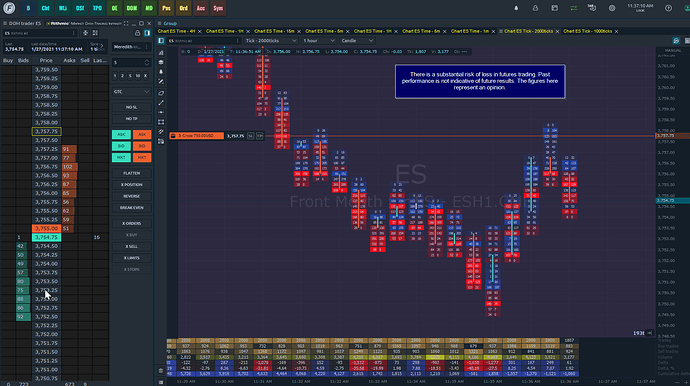

Now that the price has hit the high trend line and retraced, it is starting to look like a potential bull flag. However, it seems that an aggressive entry is a bit premature. You can see that the potential flag is high up in the trend channel and just started forming.

-

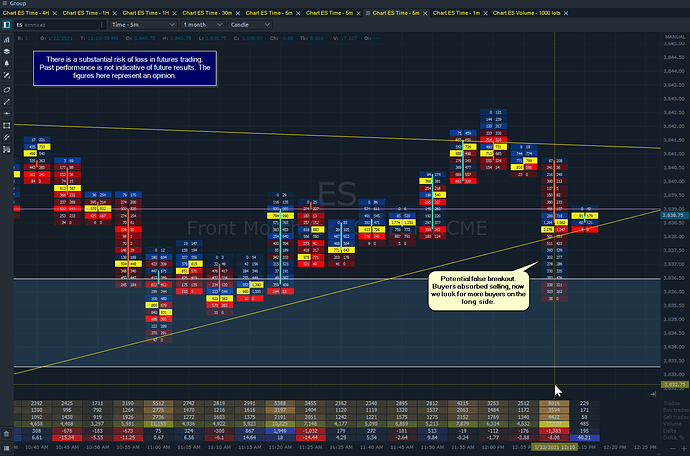

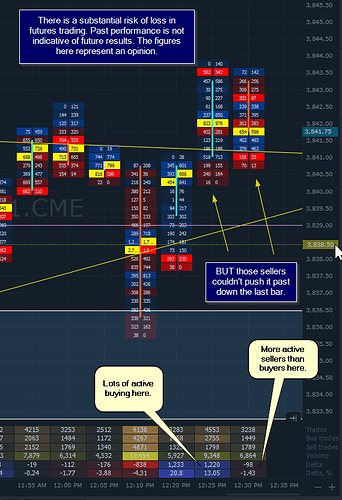

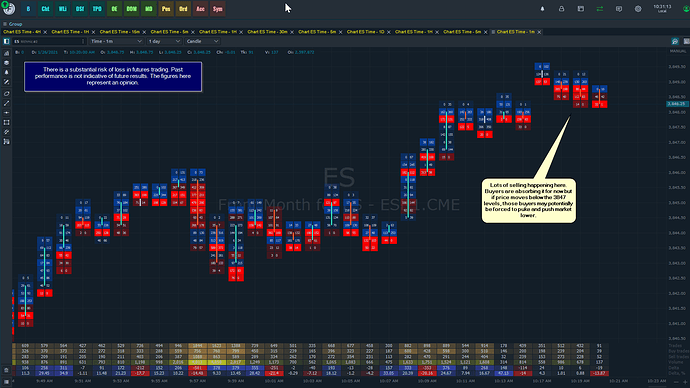

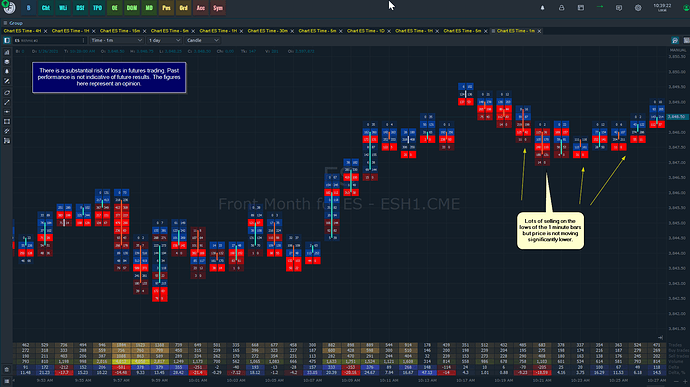

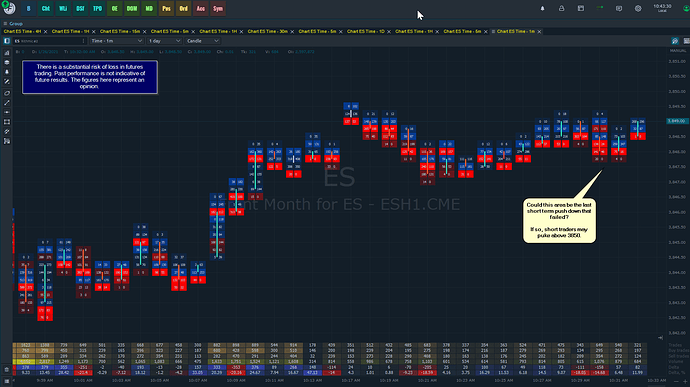

Despite hesitation to join the buyers this high in the channel, the buyers are still winning and have not let the market take a strong foothold on the short side.

-

High on 1/8 is directly under the 38 fib retrace.

-

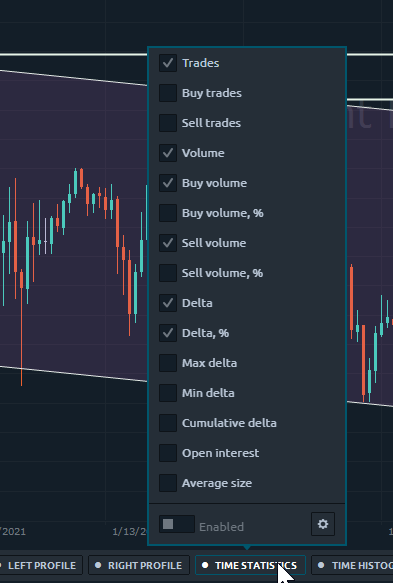

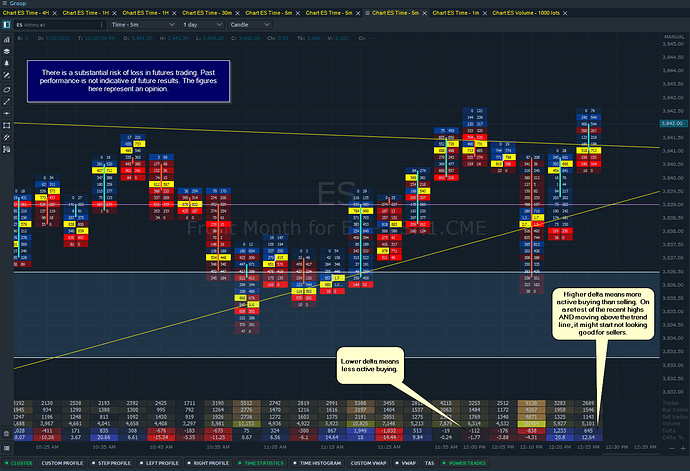

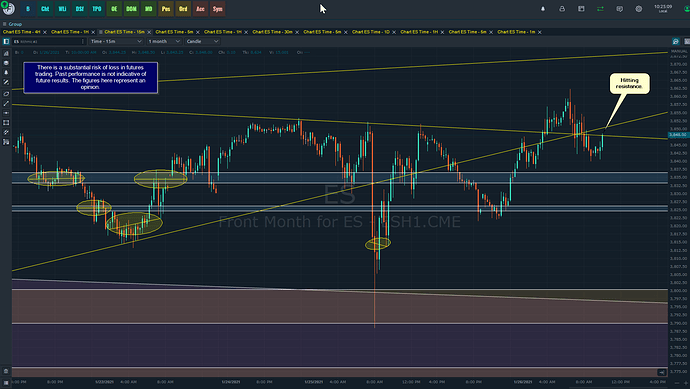

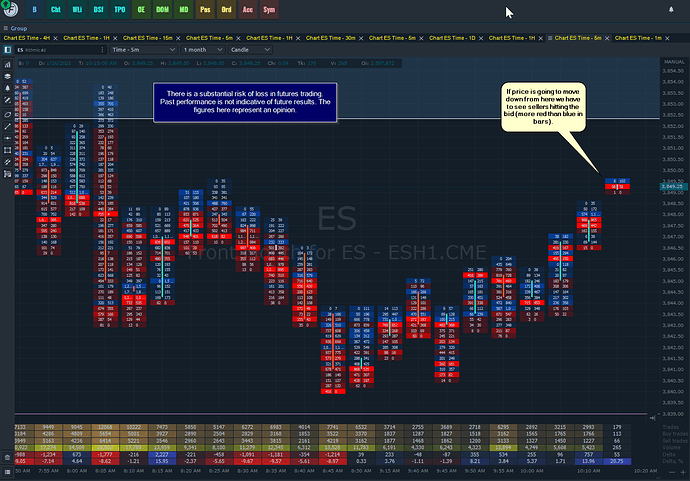

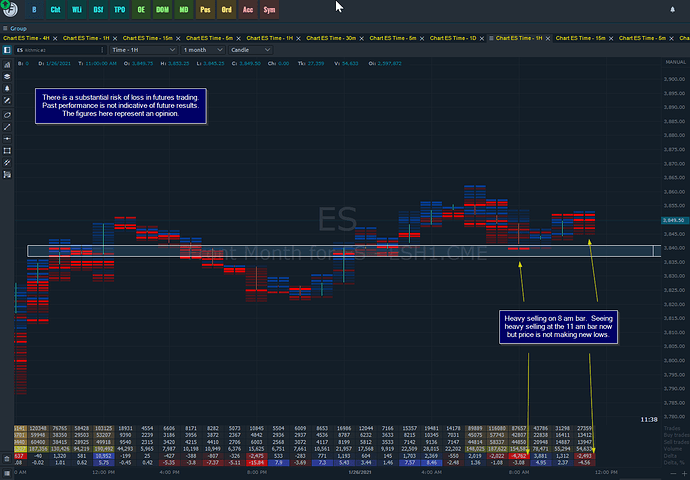

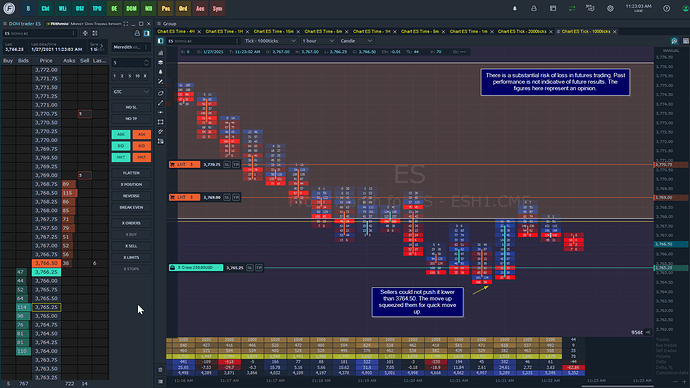

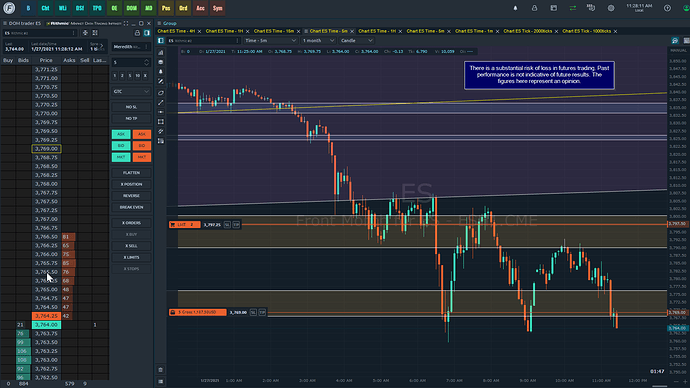

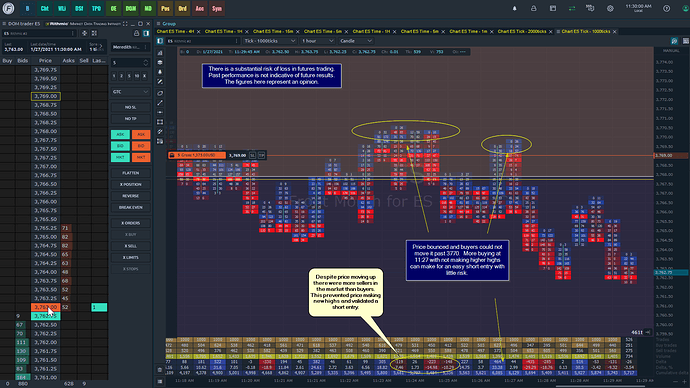

Any entry should consider order flow and market delta bars.

Ideally the setup or lack there of will start to develop earlier rather than later.

Ideally. But we all know the markets lol.

Trade well!

There is a substantial risk of loss in futures trading. Past performance is not indicative of future results. The figures here represent an opinion. The placement of contingent orders by you or broker, or trading advisor, such as a “stop-loss” or “stop-limit” order, will not necessarily limit your losses to the intended amounts, since market conditions may make it impossible to execute such orders. Please conduct your own due diligence if Futures are an appropriate instrument for you.