I saw this post on another forum, so I wanted to add my two $.02 about Sierra.

For the longest time, I used DTN, while executing with Interactive Brokers. When I heard of Optimus, and their ability help with better execution, and support, I transferred my account. The first feed I was on was Rithmic, it was good, and Matt along with his team helped me configure Sierrachart and Rithmic Trader that allowed me to flatten out positions if there was a glitch by Sierra. As clearly stated by Sierra’s support, they are not fans of Rithmic, but this solution has worked for me. I do not know why Sierra does not like it, but the guys at Optimus Futures just made it work.

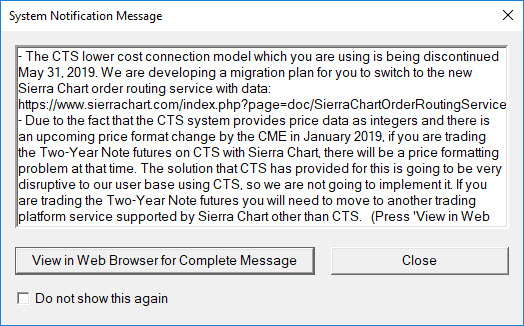

A few months while working on Rithmic, Sierra came with the CTS solution. So the “ideal solution” was getting the data from Sierrachart(white label of Barchart) and executing on CTS-T4. Ok, so I did it. What a mess of a configuration, and going back and forth between Sierra, and CTS-T4 support while trying to configure CTS without historicals so we can get the cheaper version. Sorry, there was nothing cheap about it because the frustration and lack of trading was the expensive part. About a month ago, Rithmic decided to drop the connection to ICE, and since I trade Brent Oil, I needed a new connection.

Matt hooked me up with CQG within minutes, and all worked well and still working well. I see no difference between CTS, Rithmic and CQG execution what so ever. Maybe (?) Rithmic was a bit better for CME, but I assume that is because it has servers in Aurora(?). I also switched to the Sierra data for historicals, and it is a good solution.

Now we have TT. Sorry, not going again for that one unless there is something I am truly missing. I would love to hear about the TT execution and order routing experience from those who have implemented it. Maybe it is a great solution, and if it works, I could be missing out. But I assume that as long as the data is driven by Sierra, they(Sierra) should not care what and who I use for execution.

Matt, Thank you for all the support and patience. Great Team!

Cathrine