Thank you trader. Glad you enjoyed the post. Looking back to the beginning, if there is one thing I wish I had done right, it would be risk management. Cant stress that enough… I think most can overcome anything in trading as long as the proper risk management is in place. If I had used proper risk management from the start I would probably be a profitable trader already.

Futures trading is also vastly different than trading stocks. Stocks move up or down 2-10% at most on most days… Futures you can be up or down that much in seconds LOL.

Good point. A losing trade does not mean you did not follow your plan, and again, some beginners struggle with that. They think that a winning trade must occur if a trader followed his plan. It’s all about the consistency of the execution.

I used to rank my trades by scoring them from 1-10 based on how closely I followed my plan. It was not related to+ or - results; rather, the focus was on setup, follow-through, and execution. There were times I gave myself a score of 1 on a winning trade because it was either impulsive, or worse, a double down, or some other knee-jerk fear and greed motivation. After scoring your trades, you see a pattern that luck does not exist for a long time, bad execution of a plan leads to losses, and the trades you follow through with complete rules such as the one I bolded below, show much more promising stats.

Matt Z

Optimus Futures

Excellent post, it reminds me of a video that an Olympic gold medalist rifle shooter made about being process-oriented and putting in the correct level of mental effort:

Similar to you, he talked about scoring himself on his quality of execution rather than focusing on the outcome and the impact that doing so had on his performance.

@Trader thank you for the tip! That goes back to not getting sucked into the short term effects of price action and order flow.

I need to sit back and look at the bigger picture.

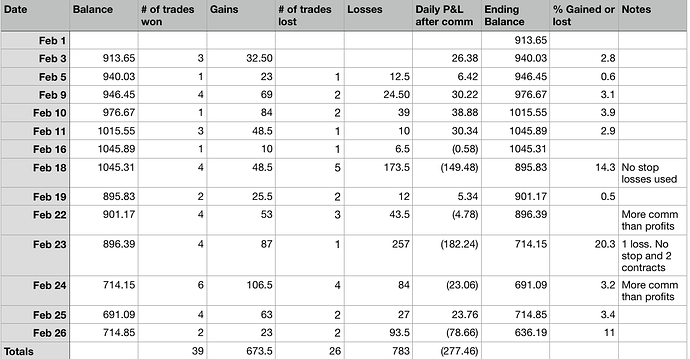

I spent some time last night and today putting together a spreadsheet with my trades from Feb and March. I know Matt had suggested analyzing our trades and after putting this together I can see why. It has been very helpful to do this exercise and I will definitely continue this. I now also know why he started the thread asking us to keep trac of how we felt when we made a trade… As I went through some of my trades I was like WTF was I thinking. LOL. If I had kept notes I would know exactly what I was thinking at the time.

ok so 1st I just want to say that for me, this isn’t about the size of my account. The purpose of all of this is to use this experience to become a trader. I want to get rid of the bad habits and establish good habits. That doesn’t happen in one session or even one month. It takes time. For me anyway.

So lets look at Feb. I can see the in the beginning of the months I was really trying to use my stop to limit losses. It was working well. Getting stopped out at 6-12 dollar losses was fine and I was able to make money in every session. Anywhere from 1/2 a percent up to about 4 percent per day.

On Feb 10th I know exactly what happened. I started out with a great trade. up 42 points and feeling on top of the world… Next 2 trades I traded without a stop for almost a 10 point loss per trade. If I had limited those losses to 10 or 12 dollars (5 or 6 points) The day would have looked even better on paper…

Lets look at Feb 18th. 4 winning trades and 5 losing trades… No stop losses and I really let this losers run… I did it again on the 23rd. Feeling very confident I went for 2 contracts and really let them run… How different would that day look with 1 loss of 2 contracts with a 6 point stop loss? The loss then becomes 25 dollars instead of 257.

Soo did I learn my lesson yet? Well, if we go to the 26th we will see that I did not. 2 losses on the day for 93 dollars instead of 20-25… What should have been a break even day tuns into an 11% loss on the account because of poor risk management. Without those 2 large losses for the month my account looks way different at the end of the month. About 30% different in fact.

Ok so for the month we have 6 days of losses. Of those 6, 3 of them are actually wins but commissions exceeded my profits. Since the P&L shows them as losses, that how I will treat them… So for the month 42% of my days were losers and 57% were winners. 39 winning trades and 26 losing. On a percentage basis 60% of my trades were wins and 40% losses for Feb.

So my takeaway for feb is that up until the 16th my trading looks pretty good. stop losses are in place and losses kept to a minimum. If we don’t look at commissions and just look at trading gains I actually gained 11 out of 14 days for a win rate of 78%… So, having just 3 bad days turns my account from a profit for the month to a loss… Easily avoidable with proper risk management.

Will I learn my lesson going forward? LOL. It’s going to be embarrassing to kill my March by doing the same thing.

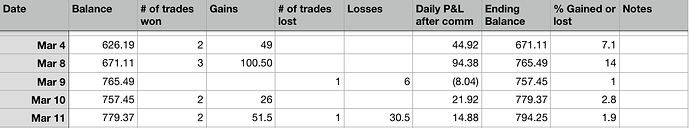

So, lets look at March thus far. So far looking pretty good. 4 out of 5 trading days are wins and the one loss I was stopped out with a 6 dollar loss. That was 1 of my 2 traing losses for the month so far. The other being on the 11th. 1 losing trade for a 30 dollar loss. I still hit my goals for the day but again, that should have been a 6-12 dollar loss max. Just as in poker, every mistake is a leak. Same goes for trading. Every mistake, no matter how small is a mistake that lowers the value of your account.

I didn’t trade last week so looking at the few days I did trade. I booked a decent profit and just quit for the day. 2-7% on the day is ahead of my goal of 1.5%. Feeling good bout the month so far.

I do want to talk about March 8th. On paper it looks awesome. 14% gain. Biggest gain in the last 2 months. 3 winning trades. 1st one for more than 25 points. Last one was only for 5 points to get me over 100 dollar win for the day.

So, as I said, it looks good on paper. Let me explain how that day really went. It was early in the session. Everything seemed to be running smooth so I took a trade. market was moving fast to the upside so I felt a quick scalp was in order. Entered the trade but no trade confirmation. I’m thinking it must have went through. It was a limit order and the market come down below the order and then moved back up. Still, no tone when you get the trade confirmation… Market moves up then turns around and starts moving down. I can’t remember for sure but about 20-40 seconds later I get the tone that the trade went through. (Yea this is one of those glitch days) On the platform I was using the P&L for the trade is also right there in a column in the DOM. So I see now I am down 120 dollars or so… Then 160 and 182 So I set a stop loss at minus 200. Almost 1/3rd of my account… I figure it’s early in the day. It’s only 200 dollars and the market moves fast in both directions this early in the day. I’m trading the 5 minute bar and all of a sudden the last minute in the bar it decides to run up… 10-15 seconds left in the bar and I am only down 10.00. I almost sold right there but then said WTH, I was willing to lose 200, lets see if this thing runs the other direction when the next bar starts. So the next bar starts and it’s stalled right around my break even point. Could go either way but only thing to do is wait and see. Then it starts moving up slowly at first and by 2 minutes into the next bar I am up over 25 points. I book my profits and count my blessings. :). However, when I closed that trade the trade confirmation also doesn’t show up… Did it miss my trade or blow through it? Trading down now so profits are dwindling so I hit the sell side again. I then get 2 confirmations. One is my 1st trade did in fact go though and I booked my profit. the 2nd is now a short position also in the money right now so I close that and book that 30 dollar + profit as well. Now I am up 89 dollars so I just sit and wait and make sure there is nothing else open for a couple minutes… All is well so I close out, happy that I survived another glitch but this time to the upside. Later in the day I log back in looking for a quick scalp to top the 100 dollar mark. I got it and finished the day.

So, that 100 profit looks so easy on paper but the story behind it is much different. LOL.

There’s not much else to say about march so far… My goal for the rest of the month is to just get back about 900. That will get me back up to where my account was at the beginning of Feb.

On Friday Jake help me get set up with Optimus flow so I am very excited to start trading with that next week. So far I really like the platform. Very intuitive and very easy to use.

So I have to ask, is it helpful for me to put these spreadsheets in? Is there any interest in seeing my progress in this and keeping this going as a running blog? I figure I will only post the spreadsheets once a month at the beginning of the month…

I don’t know if this is helpful to new traders or if it is even the correct way to be looking at things. I think it is helpful to me because, although I knew my main leak with not using stop losses, I didn’t know exactly how much it affected my account… I do now.

Also if there is anything else I should be lookin at in regards to the spreadsheet, let me know and I can add other columns going forward.

I hope everyone has a great weekend.

Keeping track and having accountability is vital. A few things that may help you:

- Put a “Trade” in your excel as the number of decision-making you make. Yes, one trade is long and short, but it has two sides of buy and sell. In essence, it is two trades, entry and exit. This would help you understand the frequency of the trades you do.

- Just like in your first post, you are focused on $$ and less on the process. You keeping talking about where you want the account to be, you made X and Y on specific trades, and how you reacted to these amounts. It would be best if you stopped focusing on each trade’s micro and your reaction to it and having more of an aerial and topographical view of your trades.

We have zero control over where our balance would be at the end of the month. It is not a goal. It is Greed.

Saying I want X dollars at the end of the month will not help you get further; in fact, it will discourage you if you don’t achieve it. By the way, many traders have a problem with the word greed as if it’s a sin. Greed is when you decide how much you want to earn on a given day, month, and year. Not your choice. Greed is also a subtle feeling because we are humans, not because we are bad people. The market is not a machine you can set financial goals with unless you want to receive a certain amount like dividends. But, that is a different asset class. I digress.

Focus in your journal on Trigger, Setup, and Follow through. You see the signal forming, you get the setup, and you execute—that way, you are building structure.

If you stray from the structure, you decrease the odds of success, increase the odds of making a mistake, and increase emotional response chances.

Following that, you can build a statistical performance that is 100% rule-based. If the results are not according to plan, you can start tweaking one small change at a time.

I hope the trade journal we are building will help you as well.

Keep tracking, digging, and sharing.

Matt Z

Optimus Futures

Ps. Thank for switching to Optimus Flow. Feel free to ask about features and provide feedback here:

Great advice. As I was doing this spreadsheet I was thinking I need to make a journal with more information on each trade… Then I come onto the forum looking for ideas and I see your developing a journal which I will be very interested in. :).

Ok I think I understand what you mean here. I know as I was putting together this spreadsheet, except for a few trades, I had no idea why I entered a trade or why I got out. Since many of those were just scalps I just assume I was watching the DOM and saw an opportunity… I also realize I see a lot of set up I don’t take. I watch them to see if they would work and most of the time they would. However, I really need to note those in a journal as well so that I can have confidence in taking them. I look at this all as the progression of hopefully becoming a trader one day. :).

So for example if I am going long in a trade put a 1 and if short put a 2? Should I also put time stamps and price entered and exited? I had thought about doing that just so I can see where I went right or wrong on the charts. I could really analyze each trade a lot more by having that information.

Yes, make two trades when for each entry and exit. It is not wrong to do 1 for a trade, but ding two helps to conceptualize the number of times you click. Again, this is a personal preference and helps me because small details can make a difference in my decision-making in general.

Timestampscould is a good addition. The idea is to measure your P&L in terms of time, from setup to exit. Sometimes traders would stay in a trade longer than they should while market conditions have completely changed. The price does not have to hit your profit or loss to exit; sometimes, it is time. For example, if you trade a 15 min chart, you should not be in a trade for three hours. This is my opinion. I discussed that in one of the webinars that you could do a 1:3 ratio for your trades: for example, a 15-minute chart would let you be in a trade for 45 minutes max, a 5-minute chart for 15 min, etc. If you stay in a trade longer than you should, you start to hope instead of looking for new setups.

Leveraged trading is a different state of mind and, above all, different management of trades. It is not an investment. In investing time may work in your favor; in leveraged trading, it is not.

The only time you practice is waiting patiently for your setups.

You have to trust that you will develop your own set of tools to measure and evaluate your trades with time. Above all, use the KISS process so you don’t go from trade analysis to trade paralysis.

Matt Z

Optimus Futures

Thank you, I find your webinars extremely helpful with nuggets of information like this. It seem so obvious once pointed out, yet easy to be blind to something so obvious until pointed out.

The challenge in anything that involves psychology is to create awareness of our conscious and always automated (due to DNA) decisions. I believe that this is also part of the challenge in trading.

As individuals, we work opposite to crowd behavior and that is also the challenge of trading.

You are trading against a group, and you must be aware of your actions. If you are not, you will act against your own best interests.

The good news is that the minute you are aware, you change, well, at least I hope that some will change.

Let me use an example: Let’s talk about a common mistake that beginner traders do and it’s adding $$ to losing positions. Now, let’s say you tell a beginner “You will be inclined to add money to losing positions, but don’t. Here is why: It is proven statistically that 87% of the time, most prices will continue against you if you act in such manner” Now you made a fact conscious and that may alter the behavior of the trader. This is of course one example out of many that we need to be aware and my goal through this forum and discussion to bring to light as many perspectives and thoughts as possible.

It’s a world of difference when you know the facts that affect our behavior.

Matt Z

Optimus Futures

So today was my first day on the Optimus platform. I’m not sure how the platform came about. If it was an off th shelf platform or if Matt had developers make I but I have to say it’s a pretty nice platform. Intuitive, easy to use and set up… 1st trade today was a test in very early trading where I seldom visit. Heavy volume. Market order entered and filled immediately and confirmation posted immediately. At first I wondered where to enter my SL… The I looked at the order on the chart and saw SL and TP on it. I just smiled and said it can’t be that easy… but yes, yes it was that easy… Click and drag and SL and the TP entered… Beautiful. Stopped out for 5 points but it was just a test. No locking up. No ghost orders, just worked perfectly and continued to do so until I turned it ogg. So Kudos to the developers of this program. Well done.

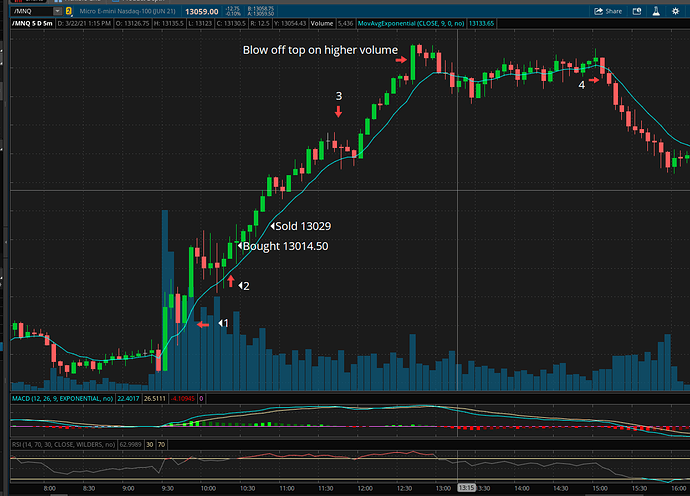

Ok, so , I only trade the NQ and since before I opened my account here I have looked at the NQ charts and noticed certain patterns develop on some days… Not everyday but usually fairly often. Todays chart was a perfect example of what I am talking about and it has the set up both long and short so I decided to screen shot it, make some notes and talk about it this evening.

Ok so first of all that blue line you see is the EMA. This past weekend I realized I really don’t have a concrete trading strategy other than an idea in my head. So in order to put th strategy together I need to see a decent chart of what II am looking for and what my goals would be. Today presented that chart.

So the goal is to get as much of the move as possible from about Point #2 to the blow off top… Then again on the short side from point #4 on down… The long side has about 125-150 points of movement in it and the short side from point#4 had about 60-70 points of movement. Timing perfect entries and exits on a chart like this, for me, would probably never happen… I would be happy with 1/2 of the move in any direction.

So that being said lets look at this chart and the different points I make reference to.

Point#1 is the first 4 bars or 20 minutes of the day. (This is a 5 minute chart) I see this as a danger zone to me. Market is moving very fast in both directions. Great for a quick scalp but not what I am looking for to enter a longer term trade. The one thing I do notice is that almost immediately the EMA line is holding. Although it looks like today that would have been a good entry point. It isn’t always the case at that time of the morning.

I really look for my set up at between 10:15 and 10:45. The early morning turmoil as I like to call it, has settled down and the market is giving us a clearer indication of what it wants to do. (Again, not always but these ar the times that seem to work best for me.)

You can see at point #2 I have an arrow pointing straight up. Thats the bar where I really felt my set up developing this morning. We just had a run up and then things took a breather and a bit of a shakeout even. Last 2 bars the ema pretty much held.

The next bar (The Doji bar) moved back down to the EMA which acted as support again. Thats my buy point… However with the new system I missed the fact buy and got in about 8-10 points later. Still, not.a bad entry and my strategy is confirmed when the EMA held once again anyway… Now I am in the trade and confident that I have it correct. My SL is just below the EMA and my TP is at 31.50. The really nice thing about this set up is that is you get in right at th bounce of the EMA, you can set your stop just below it and it probably won’t ever trigger. As you can see, the entire move up until point #3 the EMA line was never broken.

ok so lets address why I sold at 29… Market was moving up but seemed to be stalling at 27, 28 and pulling back to 24 or so then running up and pulling back… Just didn’t feel like a strong enough push t get us up to my 31.50 level. About 20 seconds before the end of the bar I moved my TP down to 29 and just as right before the next bar started it hit 29 then the next bar came and ran up to 34.50 or so LOL… I just laughed. Not going to care to much about 2 points. I recovered my loss plus posted a profit for the day after covering commissions… It was a good trade. In and out in about 13 minutes I think and was calm the entire time.

I also wanted to note that I had things going on at the house this morning so didn’t want to trade all morning. Thats the only reason I was even looking for an exit at this point.

So as you can see, between where I sold and up to point 3 it is pretty smooth sailing. Little bit of a pause for a couple bars here and there but nothing major going on. Certainly nothing that says sell.

Then we get to point #3. 4 red candles. the one right before those 4 is a Doji. The Doji and the next one have topping tails. After that we have the one that really breaks down and for the first time since the move started, moved below the EMA. Put a piece of paper over everything to the right of that candle. I’m not sure I haven’t sold in this area if I was in the trade. Can anyone offer up an explanation as to why I should still be holding on there? Thats a really hard spot for me…

The next 2 red candles do hold and then the upward move continues right on to the blow off top on higher volume. So, even if I sold at around point #3, by the 2nd green bar it’s obvious that the ema is still holding and the upward trend is still intact. So again, not looking to get the entire mov but definitely has some possibilities for a nice 2nd or even 3rd trade of the day in there.

Then we get to the afternoon doldrums until we get to point#4. We get the 1st red bar breaking the EMA and the 2nd one confirming the move down. That total move is 60-70 points so there is definitely a trade to be had in there. Also notice that once the EMA was broken it never traded back above it for the entire move. Thats why this chart was so perfect to post and talk about. The set up are not always this easy to spot but today was just a picture perfect day on the charts. Wish I didn’t have so many other things going on. Unfortunately trading is not something you can just do in the background. It really requires my full attention. Maybe someone out there has written a program to take advantage of this kind of action.

Anyway, posting this for discussion. If my line of thinking is completely wrong please let me know. I do see these set up quite often. Many times they run 50-300 points. These are the types of set ups I really want to take advantage of in the future.

Glad Optimus Flow is working for you! Thank you for the lengthy posts, I appreciate the effort.

Matt Z

Optimus Futures

@Jeff I think your way of thinking is exactly in line and very methodical. Nicely done. Whatever the trade is the most important aspect is identifying why you made it, what you were feeling and doing at the time, and why you exited.

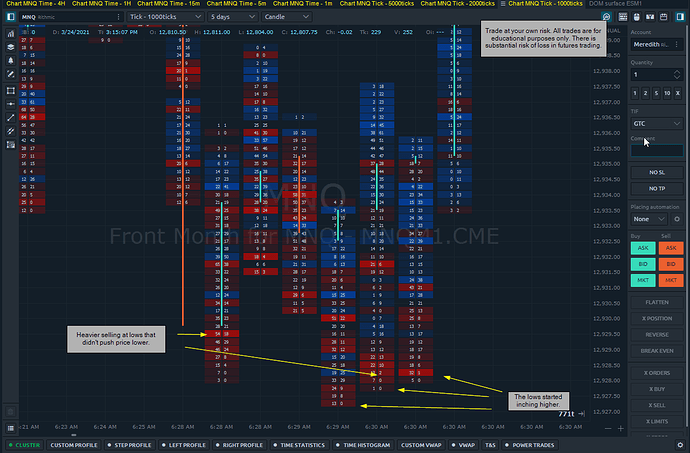

I wanted to see how the order flow looked during that time so here is a snapshot of the open:

I cannot read the order flow on these thinner markets, but it’s still very relevant. We can see the sellers trying to sell the lows without being able to push price lower, it caught them on the short side and immediately turned up with the buyers dominating.

Do you look at anything when entering these trades to validate order flow?

There is a substantial risk of loss in futures trading. Past performance is not indicative of future results. The figures here represent an opinion. The placement of contingent orders by you or broker, or trading advisor, such as a “stop-loss” or “stop-limit” order, will not necessarily limit your losses to the intended amounts, since market conditions may make it impossible to execute such orders. Please conduct your own due diligence if Futures are an appropriate instrument for you.

Thanks for commenting Ben… It’s nice to know that my thought process is at least going in the right direction.

I don’t currently look at any order flow tools. I did like your webinar the other day and have read through your post on it. I think there’s a lot I need to learn about that before I try to implement it. I have to admit I smiled when you came in and posted your info here. I was thinking I would love to see a breakdown of how things looked in the order flow stuff, as I was taking the trad. I can definitely see where there would be a small edge to at least get in just at the right time. If done properly I could also see where I could tighten up my stop as well.

The more I learn the more I realize I still have a long way to go before I become a trader. This month has been a huge month for me. Although profitable I am not referring to the gains in my account. More in terms of getting my head right in the journey to become a trader. Really thinking about what I am doing wrong, right and getting it all down on paper so that I can develop the good habits I need and get rid of the bad ones.

I will start looking at the order flow stuff as time permits… What I would really like to see is how the order flow stuff works in relation to the EMA line I use now. So for instance, if there is a pullback to the EMA line but it holds, what exactly is going on there at that moment in time on order flow.

Proud of you! Your thought process is in the right direction, and I am happy you came here so we can point you in the right direction. The idea is right, not to focus on the $$ but the process, be conscious of your decision-making and risk management. Again, I am glad that you are not arrogant and thinking you “solved” trading because you had a good week. You recognize the challenge, and you won it as a trader. Keep focusing as you have so far.

Now, this is important as well: Once you have the process to the point that you feel comfortable, don’t make the second mistake that traders make. They think if they add more elements to their trades, in other words, more method. It does nothing to improve or sometimes worse, takes them backward.

Recognize and ask: “Is this going to help me become a better decision maker? In another method will help me confirm my trades better?”

Do you see where I am going with this?! Simplicity is key. There is a significant demand for Profile Trading and Volume Analysis, but it is also microdata, not for everyone. So, all I am saying is master what you do now and slowly see other things.

@Ben will keep writing and breaking down the elements necessary to understand the market profile and volume analysis. Once you learn the method’s core fundaments, you can decide whether it will help or not. I am sure others will contribute over time to the Market Profile Forum, where you and others can show the elements that help them analyze volume analysis.

Matt Z

Optimus Futures

There is a substantial risk of loss in futures trading. Past performance is not indicative of future results.

@Mod-MattZ This falls perfectly in line not getting your charts to clunky, but more importantly, mastering one thing at a time. If you get good at a lot of stuff that’s awesome, but the one time you need something to use from that toolbelt, you may not have it. Then that leads into “I knew so much about different methods, why did I miss this?”

That’s a hard one to take because it feels like you’re defeated on the loss, then also invalidating all your hard work studying.

A common question that comes up here is, “don’t I need to be super smart and know all my chart to be a good trader?” Maybe, if that’s what you really need. But myself, I was forced to learn JUST watching order flow.

When we got a feel for that we introduced charts, very basic levels and trends.

Then came historical data to reflect on and how to formulate that alongside our plan for the day.

It was very simple to learn, executing and meta-awareness was another story. More difficult to obtain objectivity and removing emotional reactions to winning or losing trades, bad days altogether, etc.

I’m going to @ a few people who have, thankfully, shared some of their strategy and start a thread to go over specific problems traders are struggling with. I’ll add the link when it’s complete!

[Link Coming]

There is a substantial risk of loss in futures trading. Past performance is not indicative of future results. The figures here represent an opinion. The placement of contingent orders by you or broker, or trading advisor, such as a “stop-loss” or “stop-limit” order, will not necessarily limit your losses to the intended amounts, since market conditions may make it impossible to execute such orders. Please conduct your own due diligence if Futures are an appropriate instrument for you.

@Jeff thanks for sharing that your “progress” has been a lot of personal reflection, observing your mentality in trading, etc.

It is really shocking how those things play such a big part in trading yet many people are not aware of it. Matt has set the stage very well in terms of acknowledging the mental process with trading while combining that with systems and procedures.

Trading, for me, has and always will be a journey. Not a journey of financial freedom, but mental freedom and reflection. Hopefully making me a better human and appreciating what we have in this life.

Thank you for the kind words Matt

Breaking down my trades, wins and losses is really helping a lot. One thing that clicked for me over the last couple days is my entry points on trades. When I enter at the right point, put my stop and take profit in place, I just sit back relax and wait for it to happen. Today I made 2 perfect trades IMO… I bought at the right time, set my stop at a 10 point loss and my TP at a 20 point gain. It’s a great feeling when the market moves as you expected based on chart formations and action. It hits your TP and you book your profit. The both trades executed perfectly and I hit TP on the first… The 2nd I set tp at 21 points figuring I would cover the commission on that trade and book a full 20 points… LOL. I bought at the right time, set my SL and the market moved up 20 .25 points. LOL. Missed my TP by .75 points and went back down and stopped me out. I almost closed the position at the top anyway but it was almost at the end of the 5 minute candle so I thought it would move up to tp on the next one… It didn’t. Going for that 1 extra point cost me 30. :). 20 in TP and the 10 point loss.

Anyway, I still felt like both were good trades. I made some other trades as well. 9 in all. 6 wins 3 losses. 1 of the losses was the 1 above. Another one I was up 15 points at the time and just had a feeling it wasn’t going to make it to TP. The 3rd loss was right at the end of the day. 10 minutes before the close where I always do terrible. I had already booked a nice profit for the day. up 9% on my little micro account that I have left. That inner voice said close out now, take your profit, tomorrow is another day. Not only did I not listen I broke all the rules on the last trade and booked a 1 point profit for the day instead of 36.

I know exactly where you are going with this and understand completely. Thats why I am asking the questions of Ben that I do. What I really need to understand before I dive into the flow stuff is , well, can I make better decisions with it. I don’t trade everyday and have decided on days that I don’t trade , that I will spend some time trying to learn the order flow stuff. I do feel like the way I look at the market is successful for me and the way I trade. This month I have traded 9 days so far. Booked profits on 8 of them and took one loss of 8 dollars on a day when I made 1 trade. That brings me to the biggest issue I have. Not putting my stop loss in place.

I can’t really say why I put it in place sometimes and others I don’t. What I have noticed though is that when I buy at the right time, which for me is close to the EMA or SMA, that I can put my stop in place and won’t get stopped out unless I am completely wrong on the trade. When I buy into a candle that is already extended above the EMA is when I don’t use a SL. I figure I will just ride it down to the EMA and it will bounce. Today I did that but did use a SL set a couple points below the EMA… Of course it went down, stopped me out and turned around.

Bottom ine is I think I have my basic strategy which I am working on getting on paper. I just need to work on my discipline, buy at the right times and use my SL.

I know I share a lot of information and for most experienced traders it’s probably not helpful. Hopefully the people that come in with 5k or less to start accounts can learn from this. I know it’s been incredibly helpful to me to write about it. Eventually I will just keep a private journal but for now I can share my newbie experience with others. :).

The mental aspect is similar in poker. I know when I am running well and my mental state is way different than when I take bad beat after bad beat. When I go on tilt, or fell myself getting to that point I just walk away. No one can make good decisions when on tilt.

I think we are on similar journeys.