Trading plan 3/24/21 Wednesday.

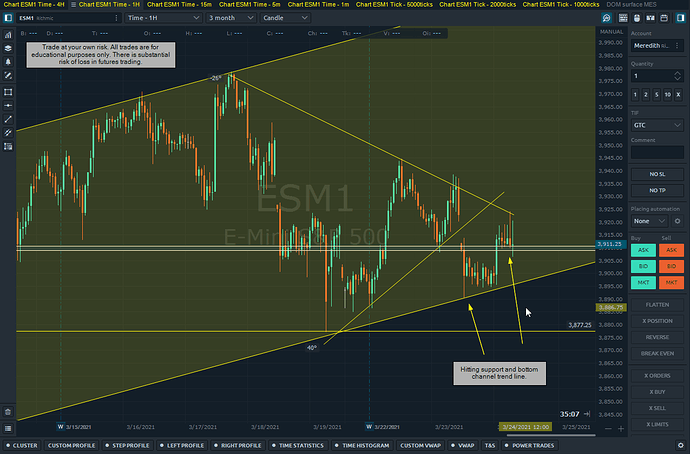

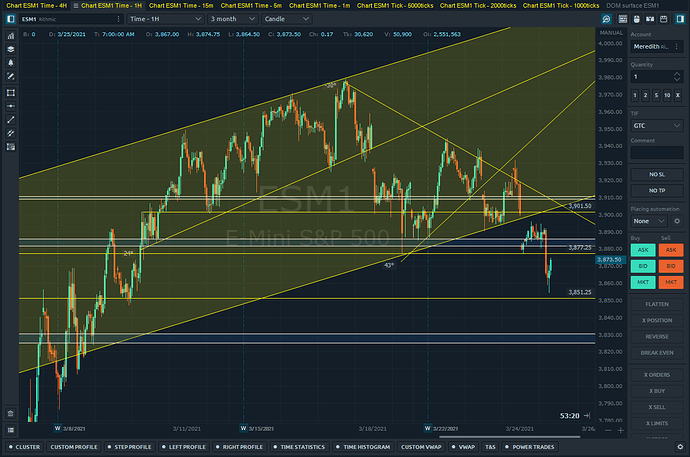

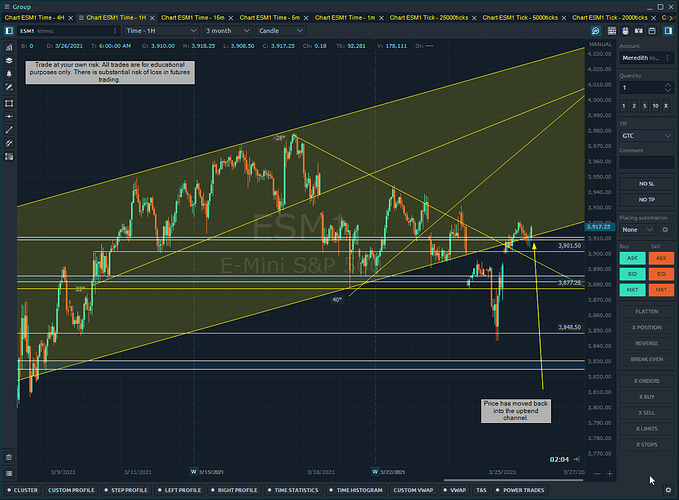

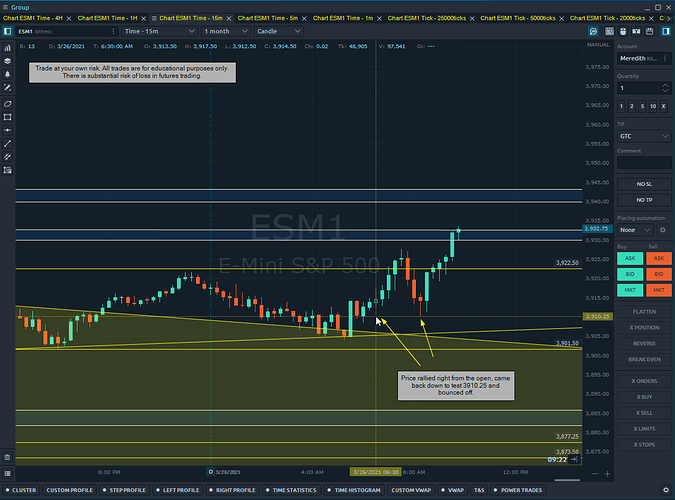

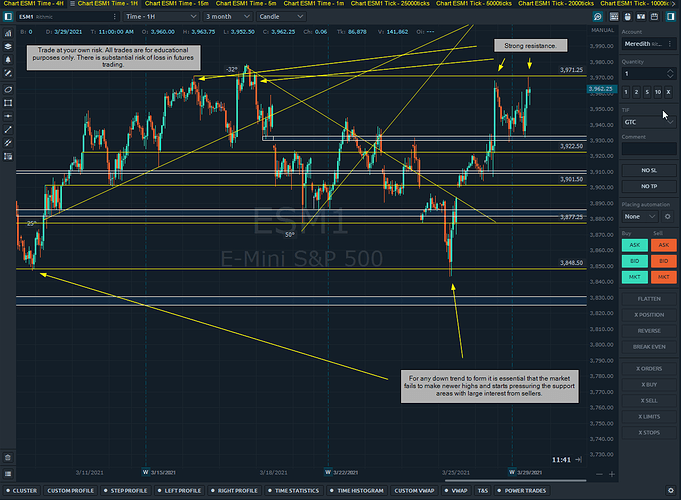

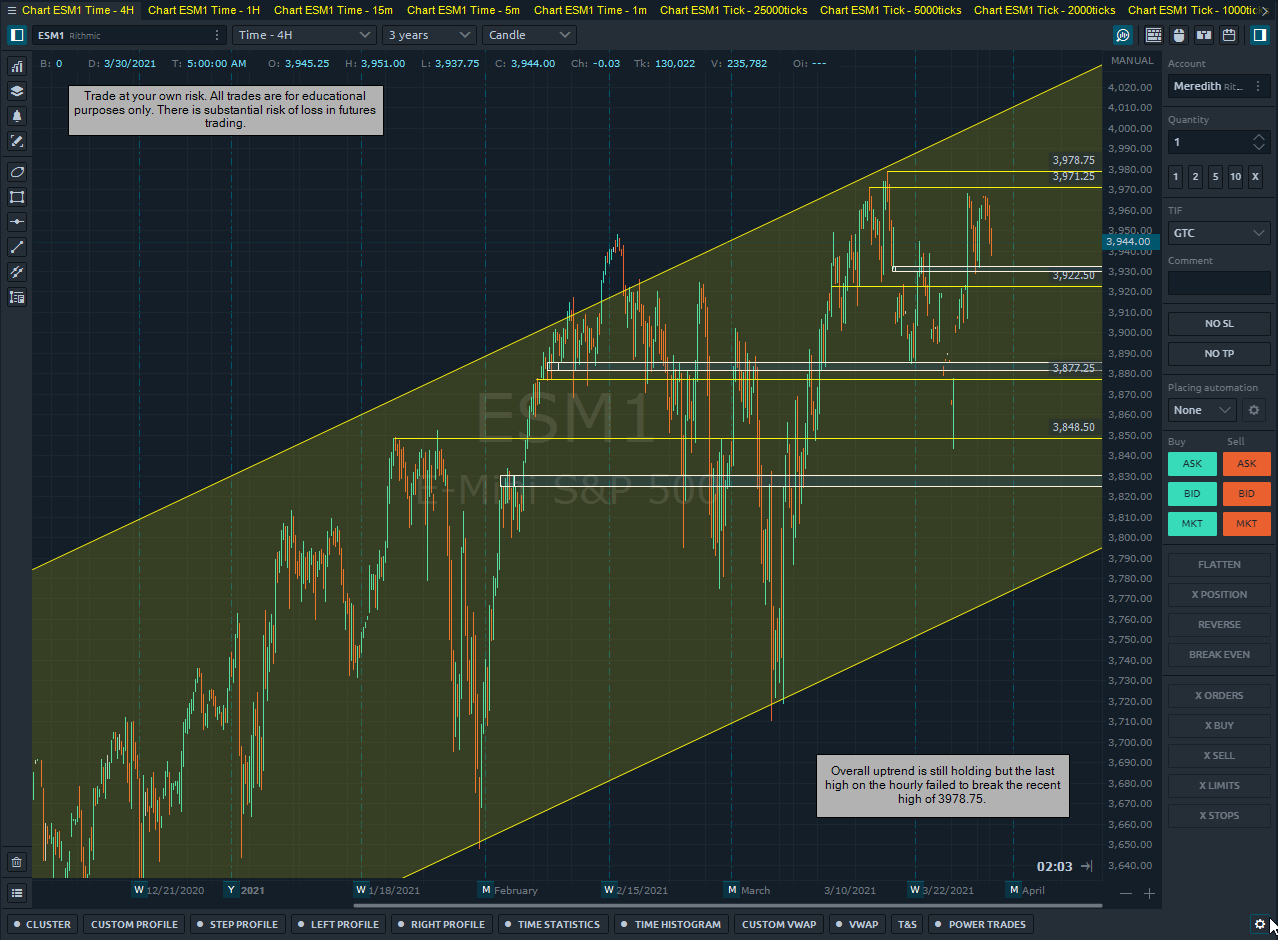

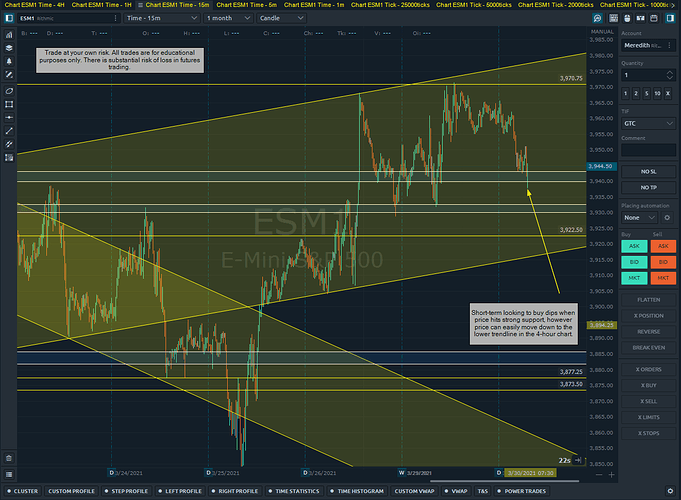

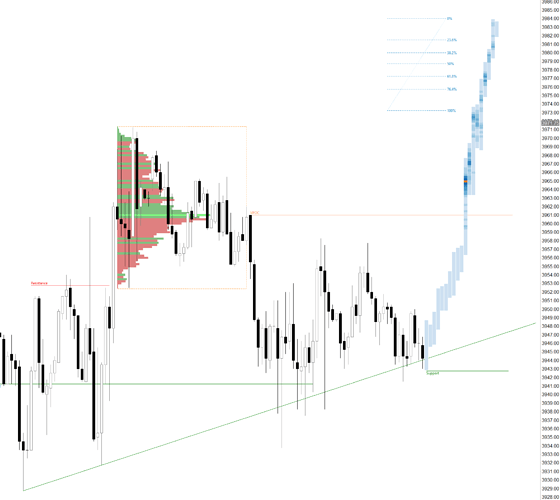

Price has moved lower in the channel and I’ll still be looking for areas to buy dips. Any short term breakout to the downside I’ll watch out for to see if it can be caught as well.

Mental Prep:

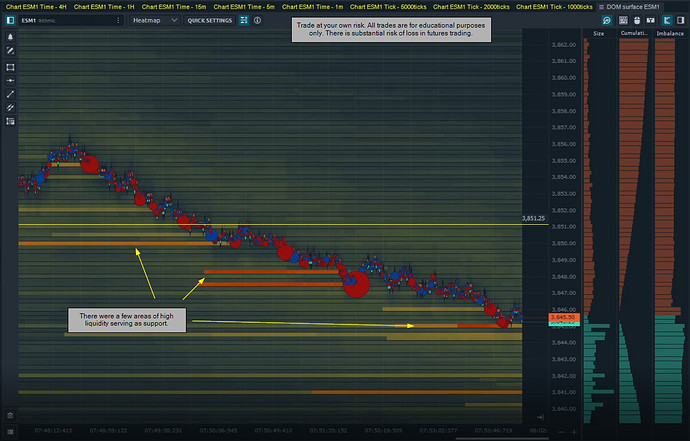

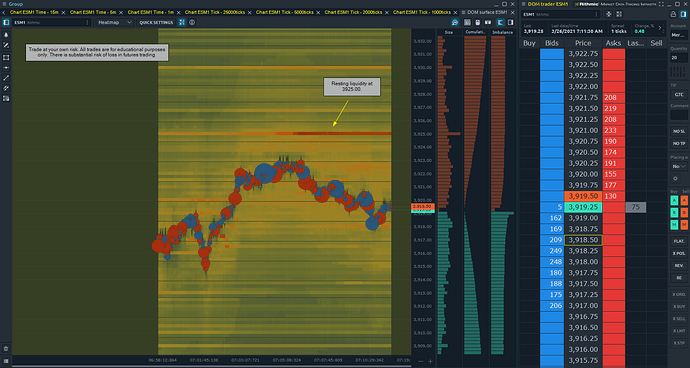

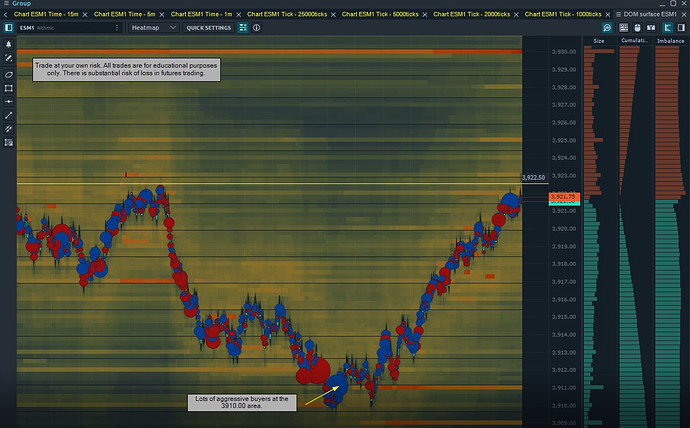

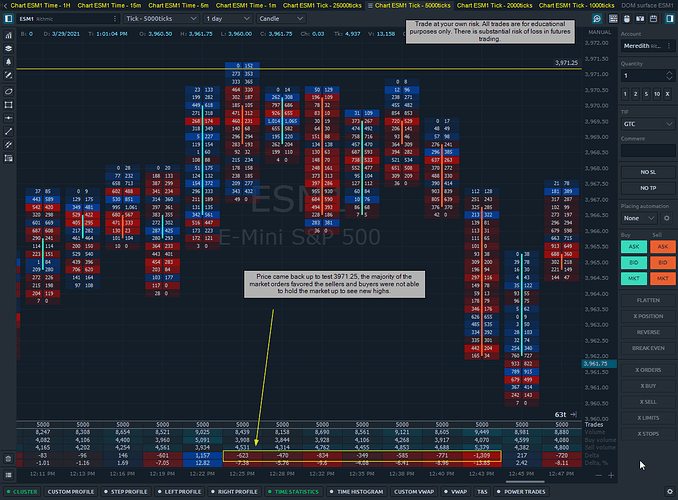

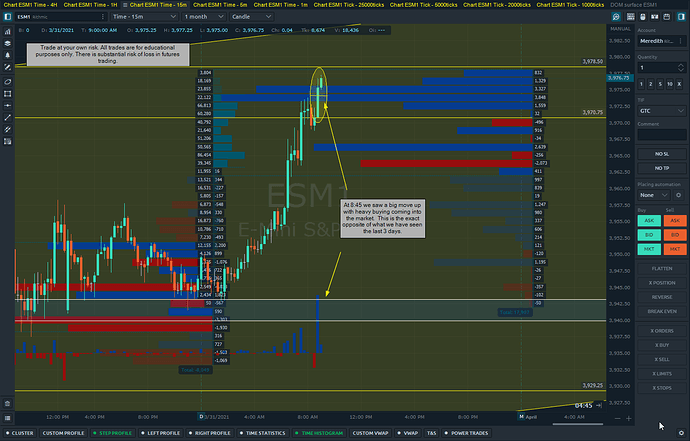

More tired today but still mentally clear and ready. I have a better picture of my plan today and I know I can find the right spots to enter the market. I’ll be watching the DOM surface as well to ensure I’m entering at key levels with liquidity.

Market and self-assessment:

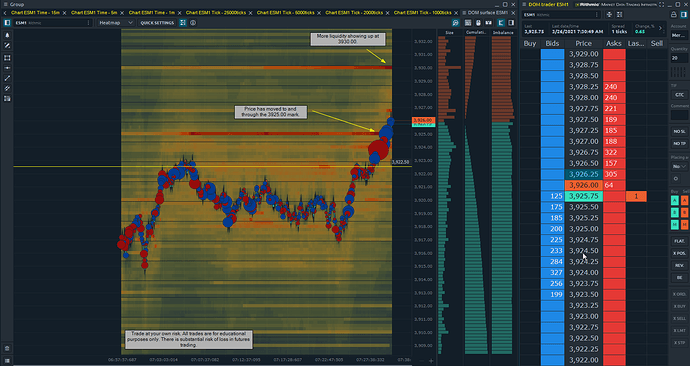

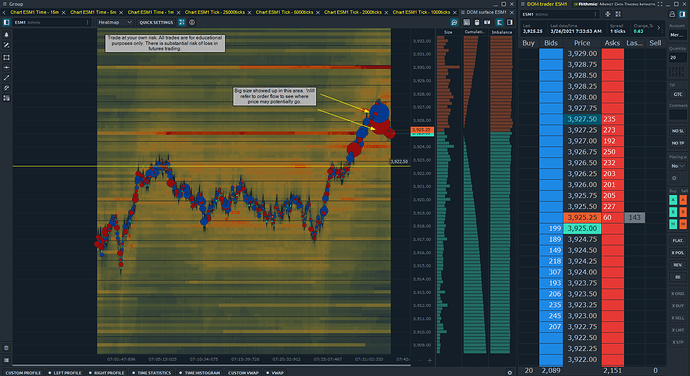

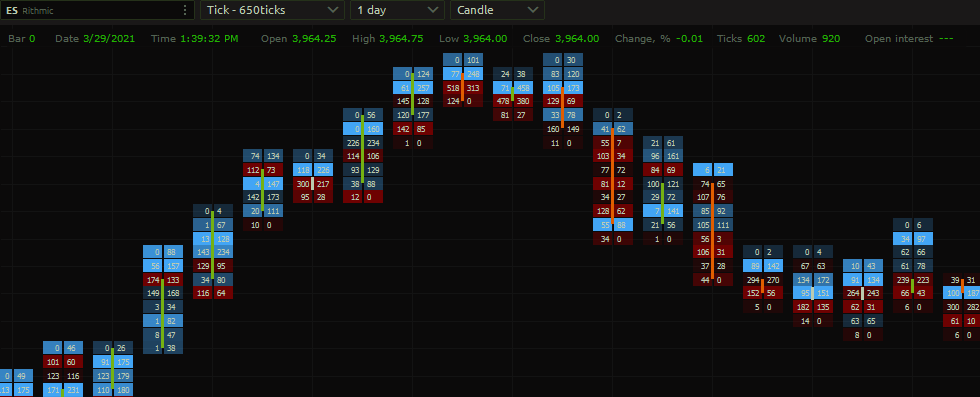

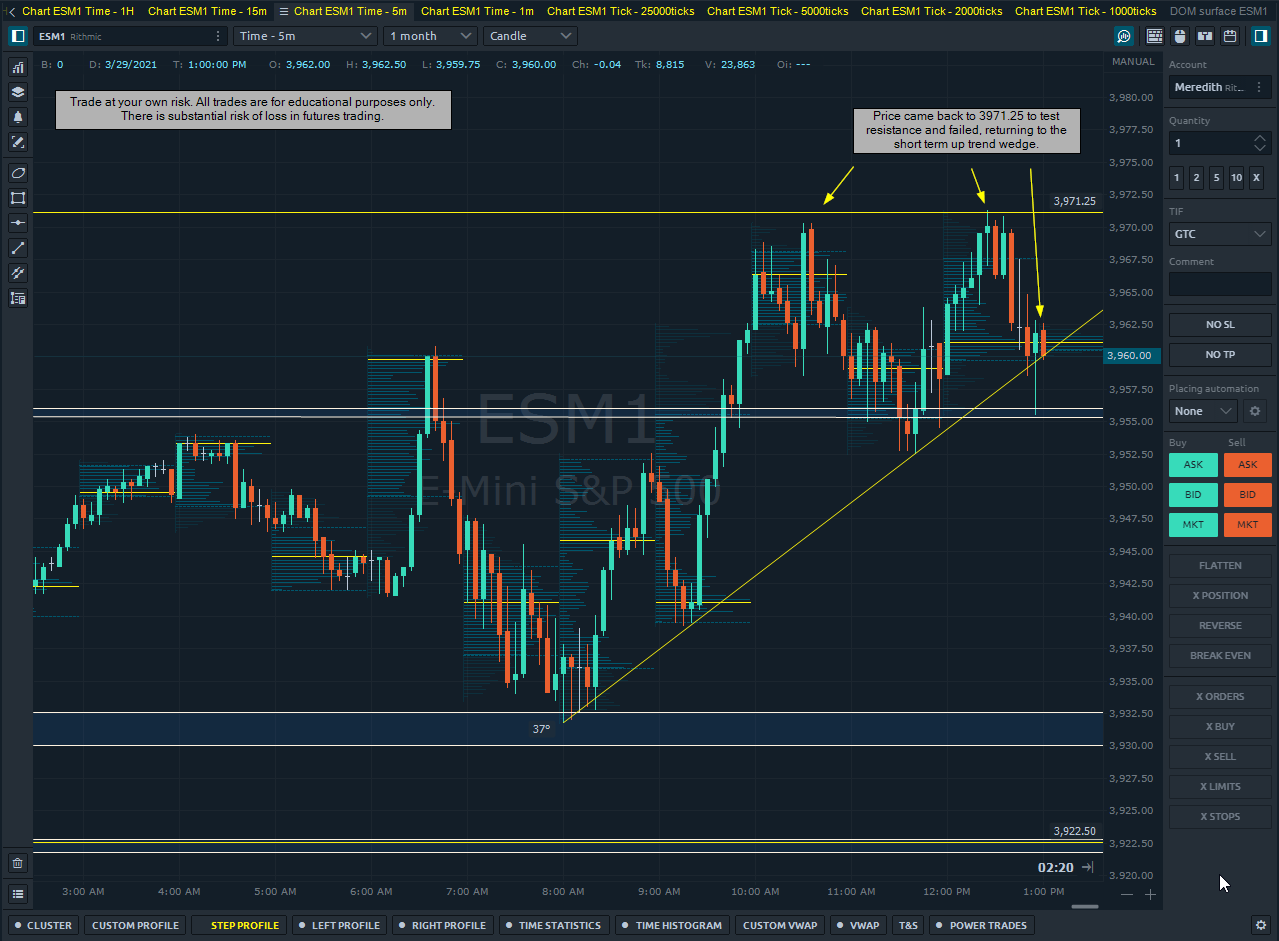

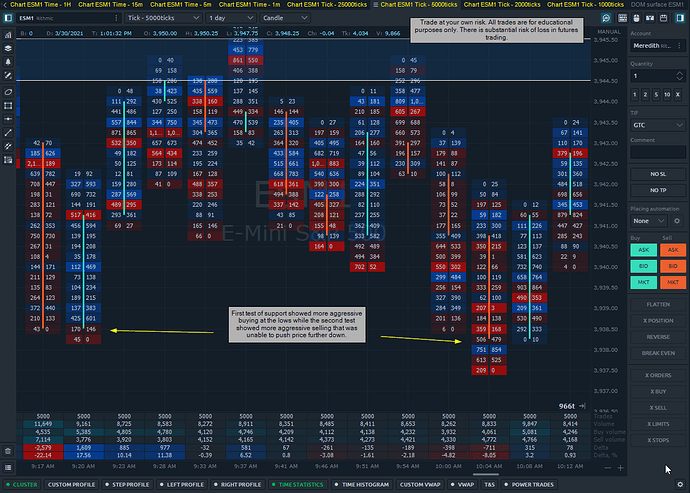

Price is currently on some support that could potentially hold. I’m watching order flow to time my entry and validate anything.

Price came down to an area that formed support. Watch the video below to see where I entered and what price action was doing.

Today, I’m going to follow my gut and stop trading. I’ve been very selective about my process and I’m going to focus the rest of the day on research, posting topics and replies and planning for tomorrow.

A good mental break is always helpful, especially rewarding after a positive day.

There is a substantial risk of loss in futures trading. Past performance is not indicative of future results. The figures here represent an opinion. The placement of contingent orders by you or broker, or trading advisor, such as a “stop-loss” or “stop-limit” order, will not necessarily limit your losses to the intended amounts, since market conditions may make it impossible to execute such orders. Please conduct your own due diligence if Futures are an appropriate instrument for you.