Great question, and can be a very frustrating one.

Your hunch that it can be contradictory is accurate, that’s because it depends on the situation.

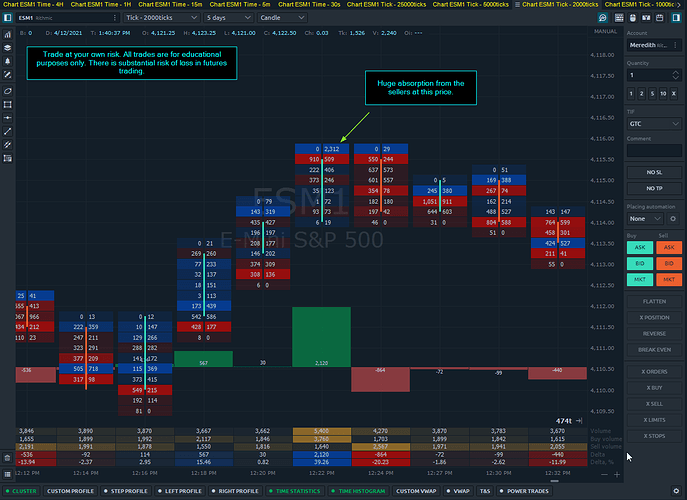

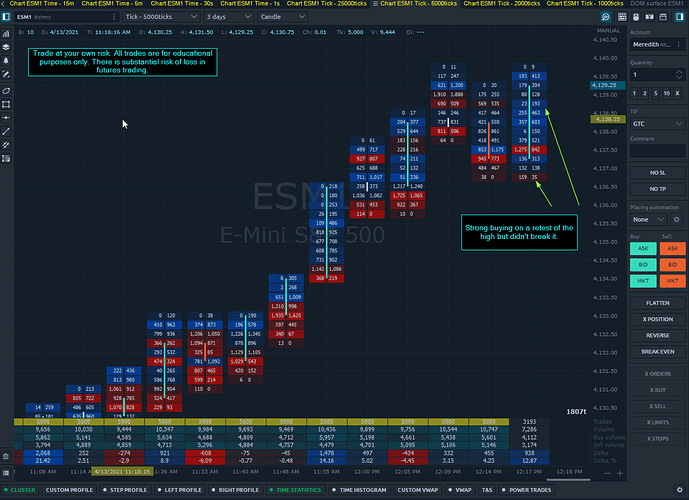

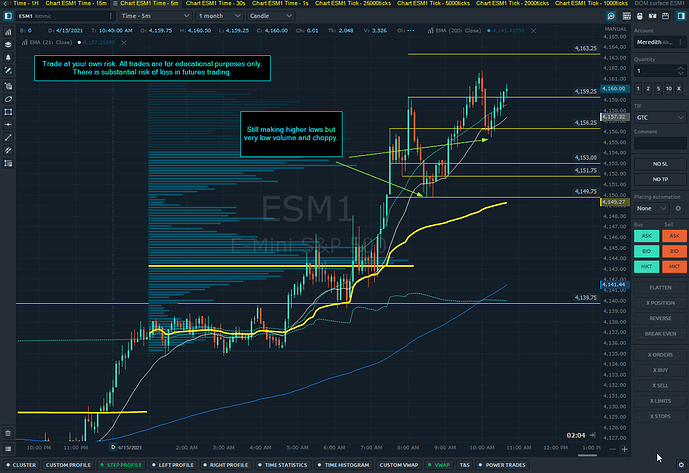

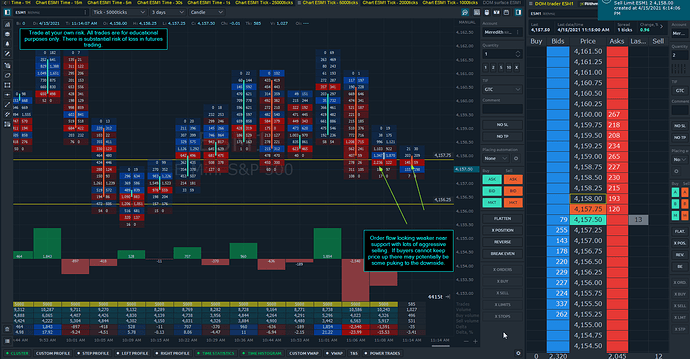

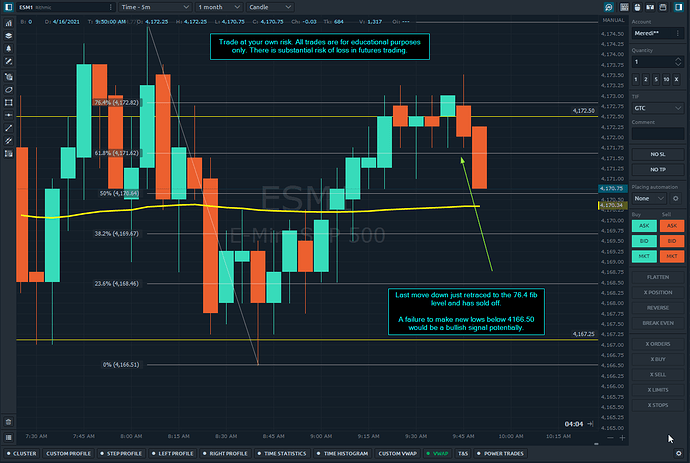

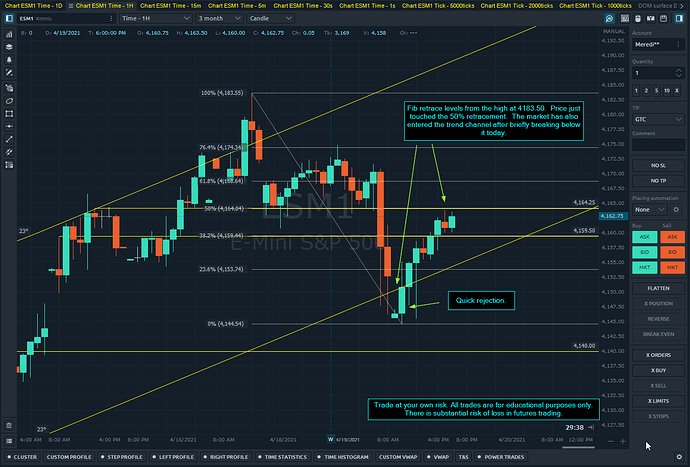

Here’s the 2000 tick chart from 12:22 today. Price came up to 4115.75 and stopped due to heavy absorption from the offer.

This was an iceberg order that just kept on filling up, moving price down 8 ticks before continuing up.

There are probably many opinions on what this is. We don’t necessarily want to determine what it is or isn’t, but how to use the information to make better decisions for trades.

To do that we need to look at what the market is/was doing.

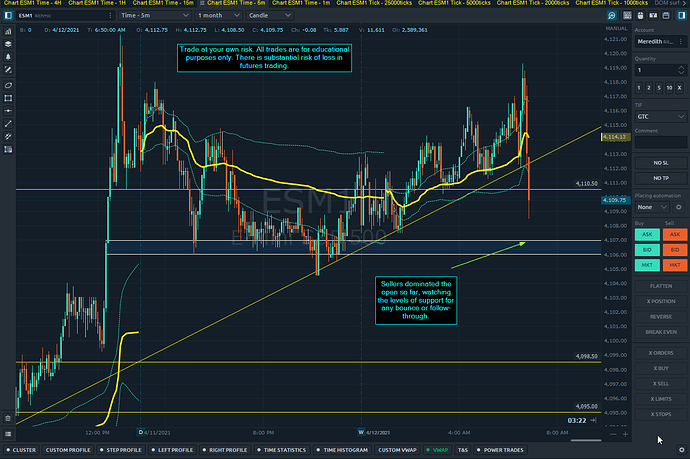

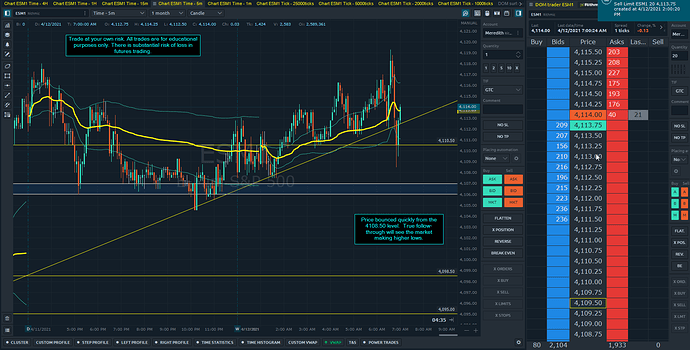

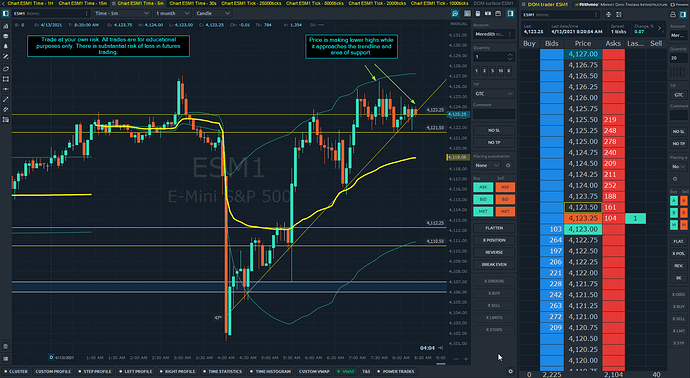

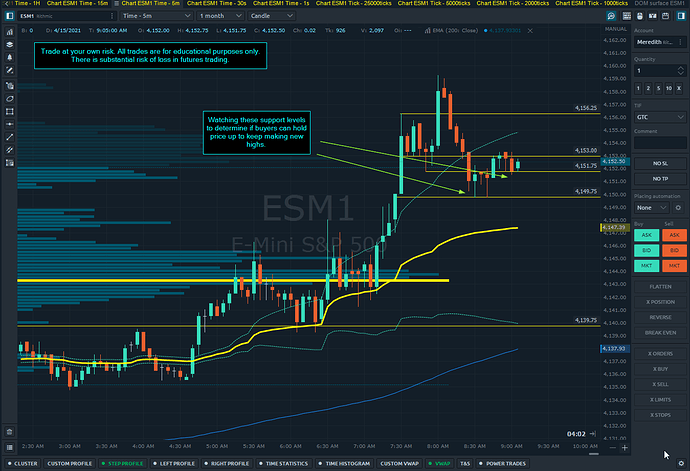

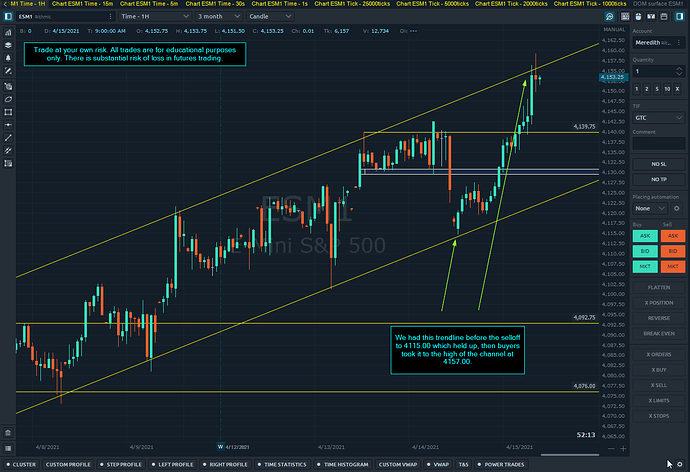

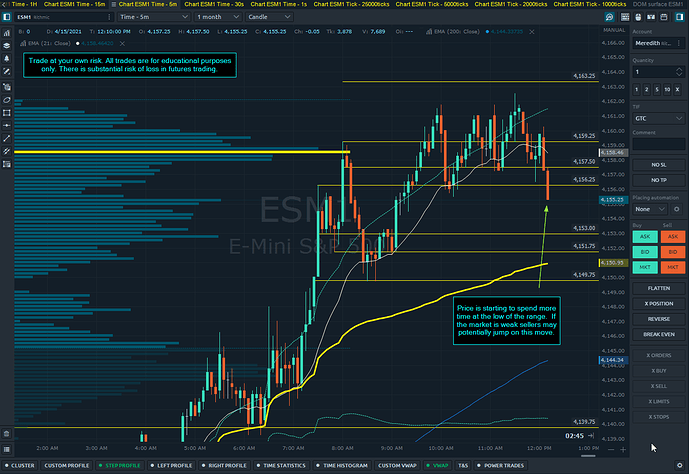

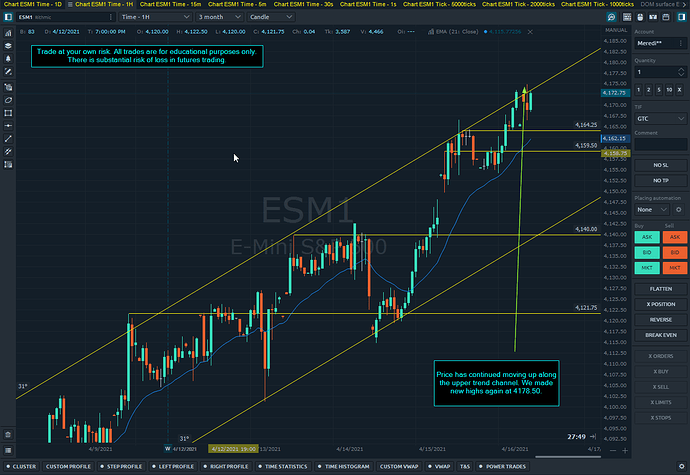

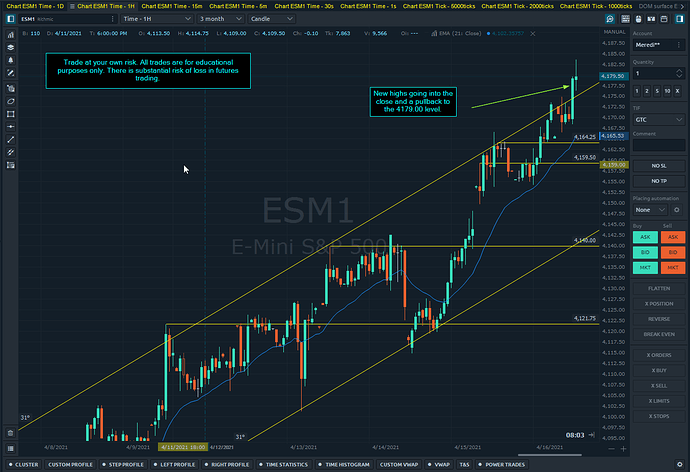

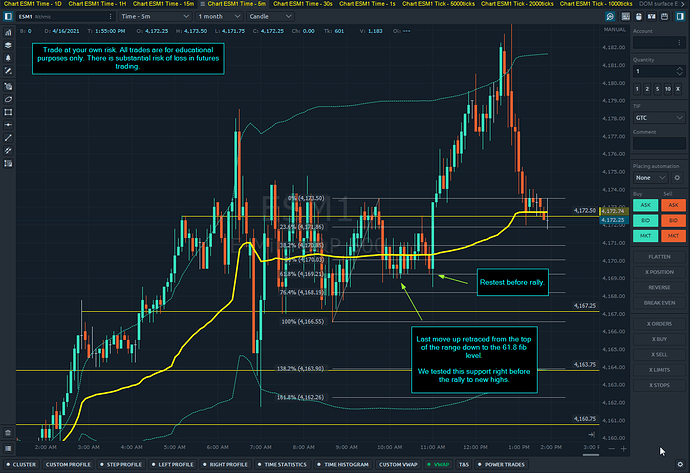

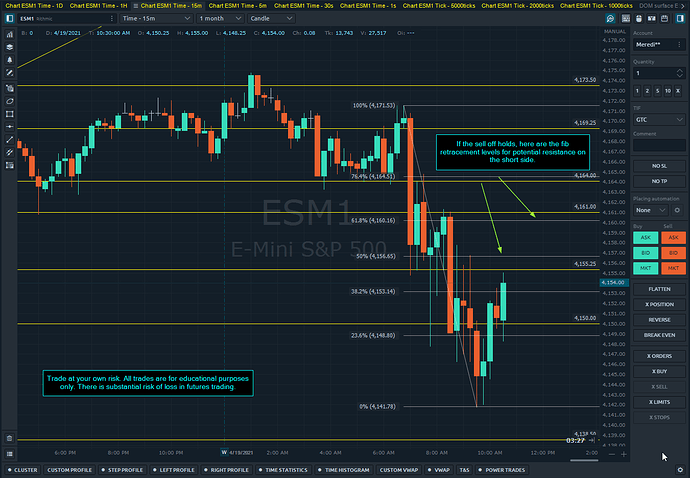

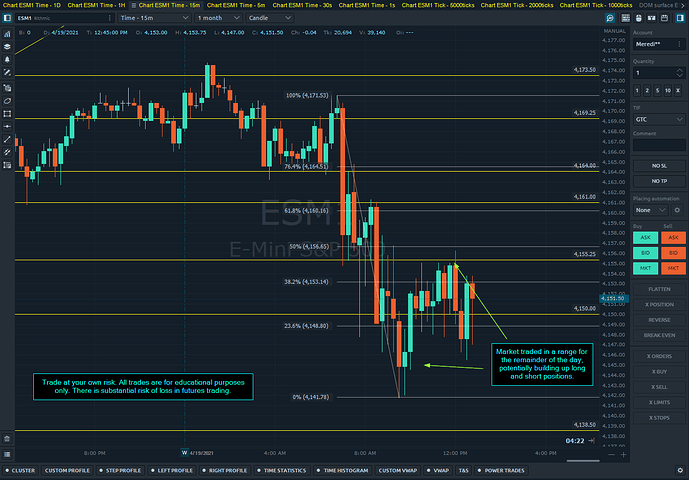

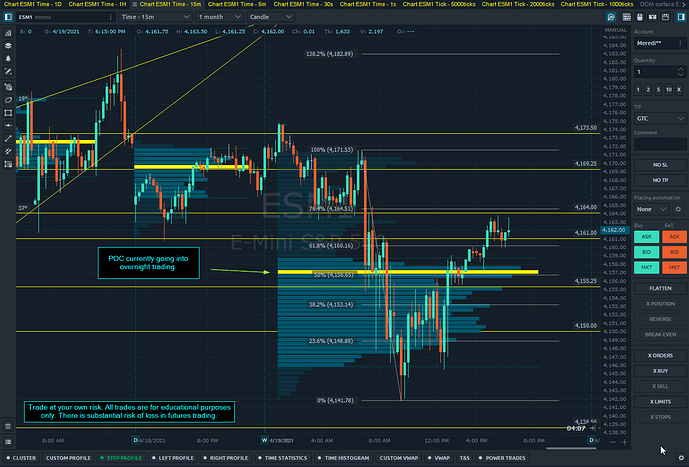

Price had sold off to form a range, it looked like it was going to make lower lows but then rallied to the top of the range a few ticks through it (4115.75 area), then stopped here with that order.

Maybe it is longs getting out of their trade, or a big short position. We will never know. However, if we are seeing the sentiment change in the market where buyers started dominating we could use this to our advantage. Something like:

I see a lot of selling here, passive selling. I’m still biased to be long, so I’m going to wait for a retest of the range or bottom of the range to enter and watch this level if price reaches it again.

At that point, I may exit or ride a rally with potentially added volume from short traders covering.

That’s about the best we can do!

There is a substantial risk of loss in futures trading. Past performance is not indicative of future results. The figures here represent an opinion. The placement of contingent orders by you or broker, or trading advisor, such as a “stop-loss” or “stop-limit” order, will not necessarily limit your losses to the intended amounts, since market conditions may make it impossible to execute such orders. Please conduct your own due diligence if Futures are an appropriate instrument for you.