What’s New? | Release Notes | Current Version: 1.52.22

Attention Optimus Futures community members and Optimus Flow users,

This weekend we will be launching our first update since our official launch, Version 1.52.22. This is a minor update focused around a few minor bug fixes and quality of life features.

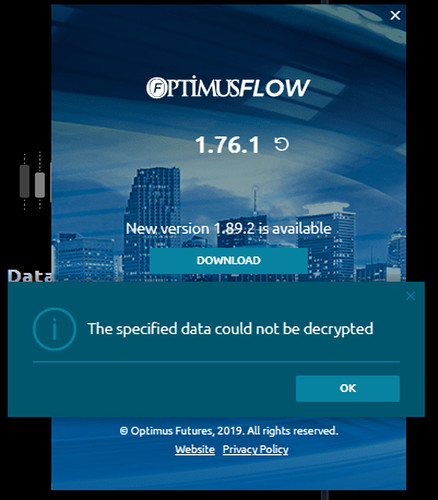

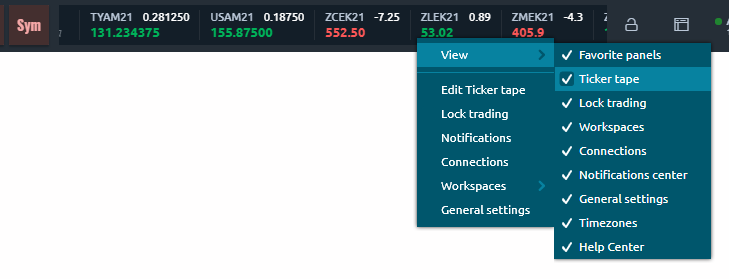

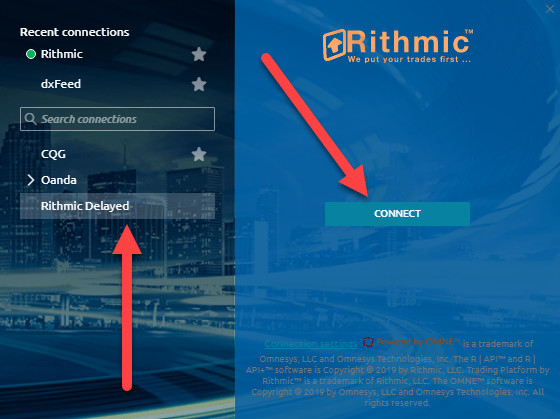

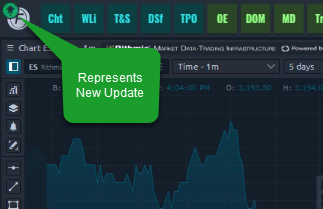

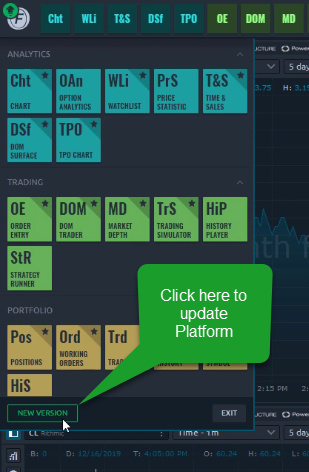

For those of you that aren’t familiar, when we send out an update of Optimus Flow a green “update logo” will appear hovering above the Optimus Flow main menu button as shown below:

After you open the main menu, navigate to the bottom and click on New Version to prompt the update of the latest version.

Once updated, your platform will contain the newest features and improvements created by our developers.

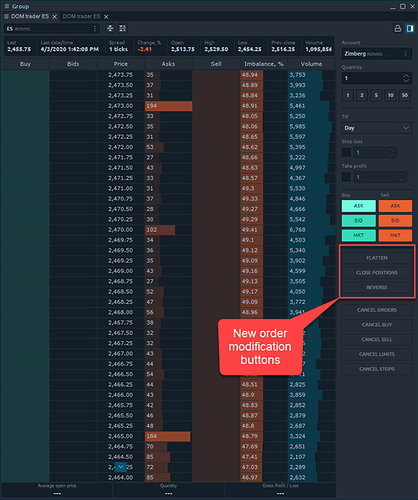

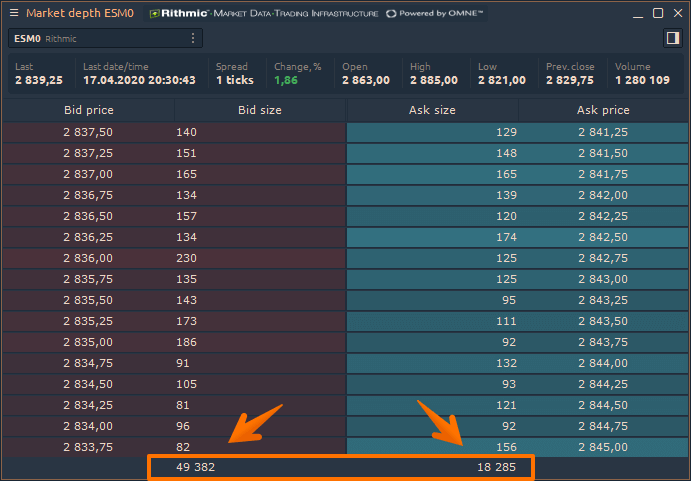

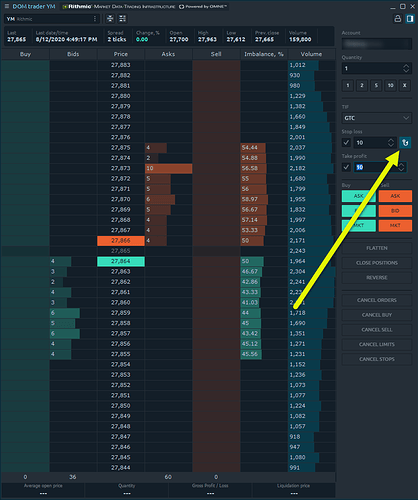

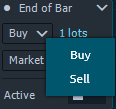

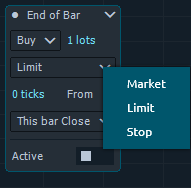

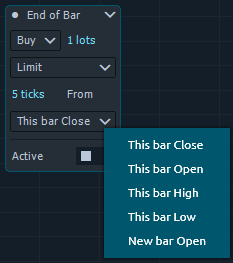

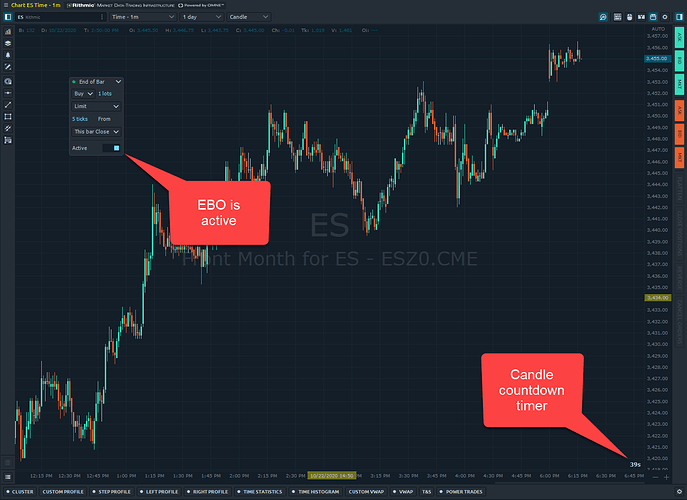

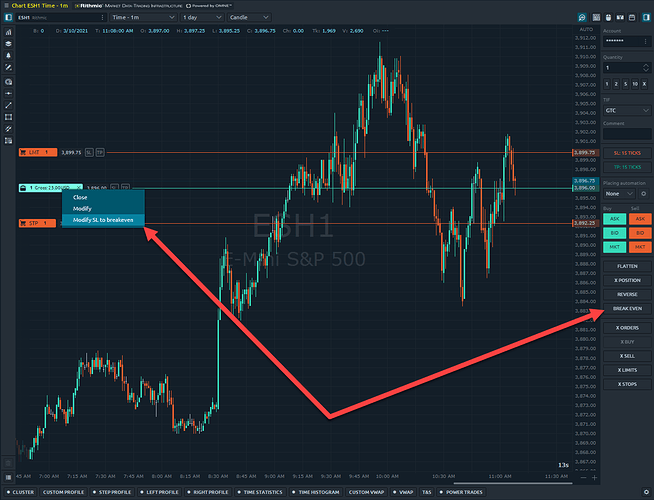

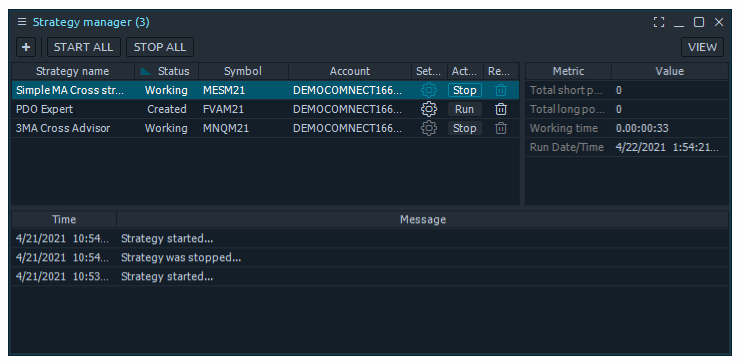

As mentioned before, this is a minor update, but the new version is still focused around two very important features. The first change you can expect are three new order modification buttons within various order entry panels found throughout the platform. You will find these new changes on your DOM, Markt Depth, Chart - Trading Panel, and the DOM Surface.

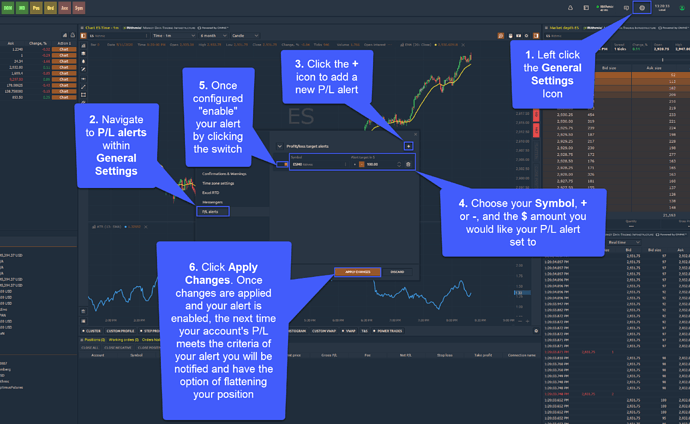

The new order modification buttons have had their logic reconfigured and simplified from previous versions. The three buttons you will find are Flatten, Close Position, and Reverse.

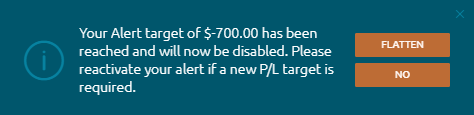

- Flatten – Cancels all working orders and flatten all positions.

- Close Position – Flattens your positions ONLY . All working orders will remain active. If you have placed a bracket order and use this button, the legs of your bracket order will remain while your active positions will close.

- Reverse – Reverses your position to the opposite side. If you have a long order and click reverse, you will flatten your current position and then enter a new order on the sell-side.

The preexisting buttons such as Cancel Orders, Cancel Buy, Cancel Sell, Cancel Limits, and Cancel Stops will remain the same.

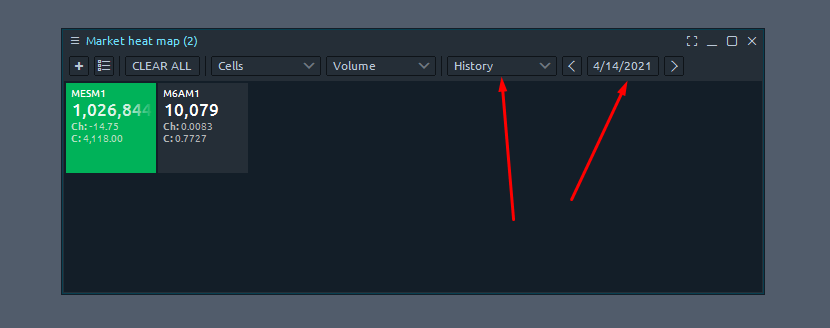

Our next feature is a quality of life update. This feature will look to improve the symbol search function. Previously and by default, only a few preset contracts would load within the symbol search bar. It was possible and still is possible to access any symbol found held on the exchange within Optimus Flow, but symbols were not added until manually searched for.

For ease of access and to save time for our users, we have implemented a larger list of default symbols that will appear for all users. If you do not see a symbol you are looking for in these sections, you can still manually search for a symbol. For example, you can search PL and find platinum.

The symbols are:

Stock Indices

-

ES Emini SP

-

NQ Emini NASDAQ

-

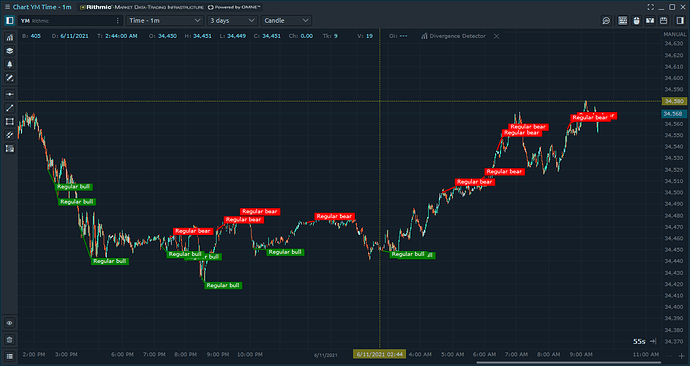

YM Dow Jones

-

RTY Emini Russell

-

MES Micro ES

-

MNQ Micro NQ

-

MYM Micro Dow

-

M2K Micro Russell

Currencies CME

-

6A Australian Dollar

-

6B British Pound

-

6C Canadian Dollar

-

6E Euro Currency

-

6N New Zealand Dollar

-

6S Swiss Franc

Mini Currency

-

E7 Micro Euro Currency

-

J7 Micro Japanese Yen

Micro Currency

-

M6A Micro Australian Dollar

-

M6B Micro British Pound

-

MCD Micro British Pound

-

M6E Micro Euro Currency

-

MJY Micro Japanese Yen

Energy

-

CL Crude Oil

-

QM EMini Crude Oil

-

HO Heating Oil

-

NG Natural Gas

-

QG Emini Natural Gas

-

RB RBOB Unleaded Gas

Metals

-

GC Gold

-

MGC MIcro Gold

-

YG Emini Gold

-

SI Silver

-

YI Micro Silver

-

HG Copper

-

QC Mini Copper

Grains

-

ZC Corm

-

O Oats

-

RR Rice

-

ZL Bean Oil

-

ZS Soybean

-

ZW Wheat

Interest Rates

-

ED Euro Dollars

-

ZN 10 Year Note

-

FV 5 Year Note

-

ZT 2 Year Note

-

ZB 30 Year Bonds

-

UB Ultra T Bonds

-

ZQ Fed Funds

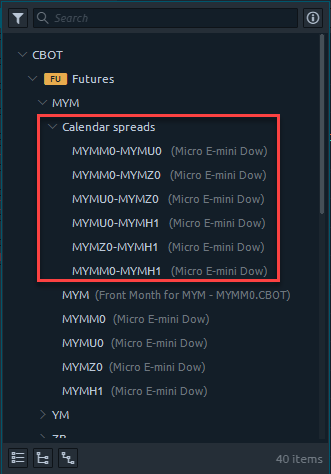

Our next update, 1.53, will separate spreads from these symbols and place them in their own, dedicated section, like Options currently.

Let us know if you have any questions on Optimus Flow version Version 1.52.22. If you have any feedback on Optimus Flow, feel free to reply below or let us know in a new thread. We will continue to update this thread weekly with new updates and features.

Thanks for your time,

Jake

Optimus Futures